🧐 You missed something...

Top market, investing, and business insights from the past few weeks.

Here's a recap of the past few weeks' top market, investing, and business insights—from insiders and experts outside the mainstream—featuring Offbeat Alpha’s most-opened newsletter and most-viewed content.

Your electric bill pays for AI.

THIS stock dethroned banks.

America is about to get the credit card bill from hell.

THIS tiny tool has a wedge into 95% of Fortune 500 companies.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Past Few Weeks

1. 💵 Your Electric Bill Pays for AI

Big ideas need big power. And AI? It’s hungrier than we thought. Right now, utility companies are sprinting to catch up…

$212B — That’s how much U.S. utilities are spending in 2025 to keep the lights on.

4% → 9% — That’s how fast data centers will more than double their slice of the national power pie by 2030.

100,000 homes — That’s the energy one large AI data center eats. Some use 20x more.

And the surge isn’t slowing down… Amazon’s dropping $100B to expand its digital brain. Google: $75B. Microsoft: $80B. Meta: $65B.

The grid was built for homes and factories. Not for rows of server racks running 24/7. Now we’re seeing 7-year delays just to plug into power. And at current pace, it’ll take 80 years to build the lines we need in the next 10.

What’s the backup plan?

Nuclear is back (hello, small modular reactors).

Renewables are surging (tech companies are the biggest buyers).

Natural gas still fills in the gaps.

But while the industry scrambles for solutions, you’re already footing the bill…

PJM, the power grid that covers much of the Midwest and East Coast, saw bills jump $9.4B from data center demand alone.

So yes, your ChatGPT queries are running on borrowed volts. But the tab? It’s showing up on your utility bill.

2. 🏦 THIS Stock Dethroned Banks

Apollo Global Management (APO) is quietly building an empire in private credit. The kind of financial engineering that doesn't just make money... it prints it

While banks stepped back from lending, Apollo Global Management moved in. They're not just making loans—they built the entire machine.

The Athene merger was genius. It gives them $380B in stable insurance money that needs somewhere to go. That's the cheapest funding you can get.

Here's how it works: Apollo originates the loans, funds them through their insurance company Athene, then sells off the excess. They own every step. It's like controlling the factory, the supply chain, and the store.

And they're picky. Apollo moves $150B annually, mostly investment-grade stuff that's boring and safe. The kind of loans that pay well because banks can't make them anymore.

$729B in assets under management (up 10% year-over-year).

$1.37 adjusted EPS last quarter (beat expectations).

100-200 basis points of extra spread vs. public markets.

60% of their book is investment-grade (boring and profitable).

Risks…

When interest rates drop, the gap between safe and risky returns shrinks. Investors won't pay extra for risk they don't need to take.

Competition heating up (KKR, Blackstone aren't sleeping).

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 💰 America Is About to Pay a Hefty Price

Remember that feeling when your credit card bill shows up and it’s way more than you thought? Now imagine that—but for $11T…

The U.S. has to refinance $3T this summer. $11T over the next year. All that cheap money we borrowed in 2020-2021 when rates were basically zero. Now rates have doubled.

We're looking at hundreds of billions more in interest payments. Just to keep the lights on.

Trump wants the Fed to cut rates by 2.5%. Says it'll save tens of billions. He's also thinking about locking in long-term rates instead of rolling the dice every year.

The 10-year yield is dropping—from 4.6% in March to 4.2% today. Wall Street smells rate cuts coming. But if rates stay high, interest payments become our biggest expense...

Bigger than defense. Bigger than Social Security. That's money not going to roads, schools, or anything useful. It's going straight to bondholders.

This isn't just math. It's trust… When you keep borrowing like there's no tomorrow, people start asking: Can this last? What happens when it can't? Nobody knows. But we're about to find out.

Top 3 Charts of the Past Few Weeks

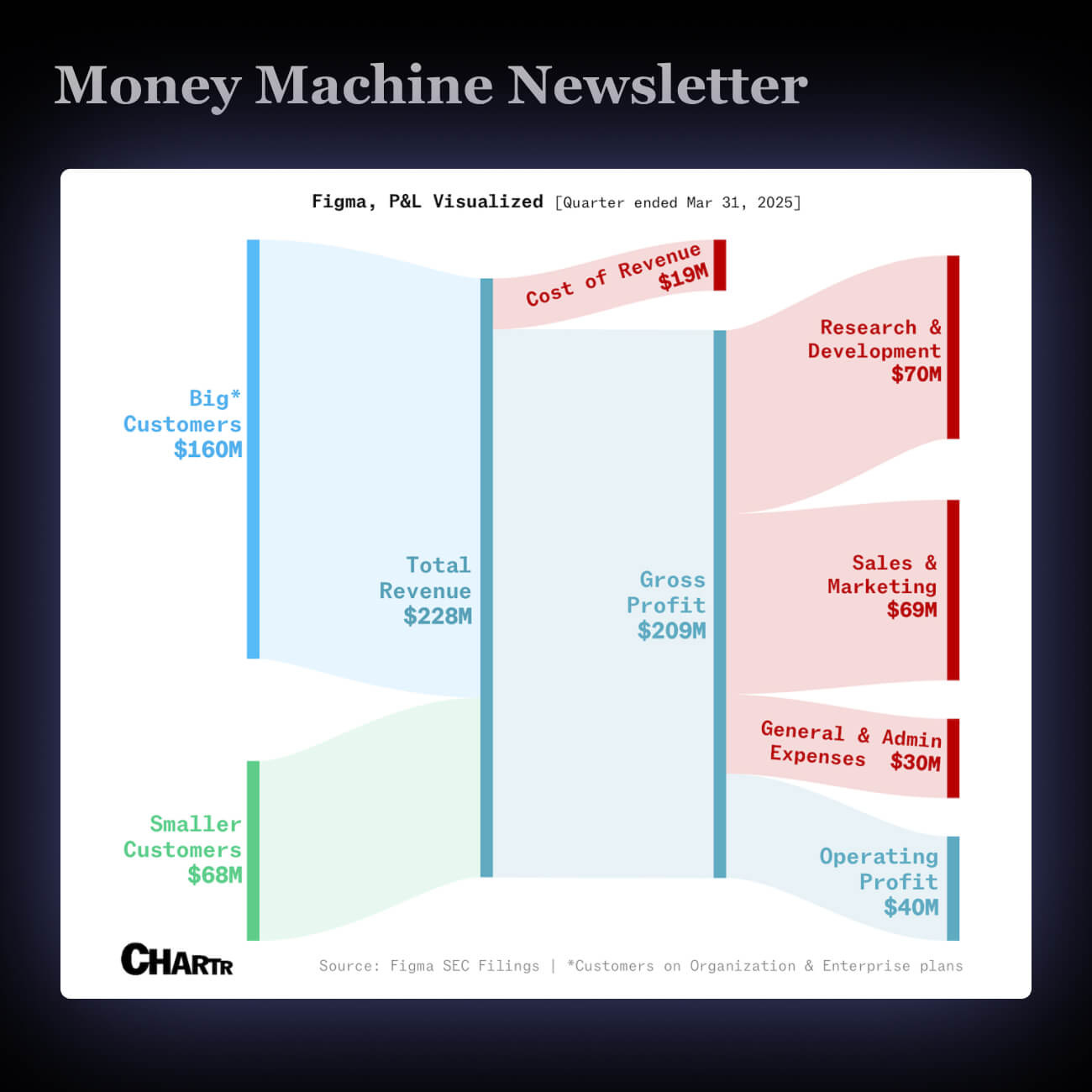

1. 🎨 Figma Files for IPO, Opens Its Books for the First Time

Figma just filed to go public. It made $228M last quarter, is profitable (17% margin), and 95% of Fortune 500 companies use it.

This isn’t just another flashy tech IPO. Figma is a real business, not just hype. Adobe once offered $20B for it. That says something.

Figma’s IPO could set the tone for other startups eyeing Wall Street—like Canva. If Figma flies, expect a parade of tech companies behind it.

2. 🐕 Datadog Is Now in the S&P 500. These Big Stocks Still Aren't.

Datadog just got into the S&P 500. Its stock jumped 15% on the news. It’s replacing Juniper Networks in the index.

Getting into the S&P 500 matters — big funds buy your stock automatically. Datadog now meets all the size, profit, and liquidity rules, with a $53.6B market cap.

Wall Street thinks Datadog has legs — Bank of America picked it as their top software stock for late 2025, betting on 20%+ growth thanks to AI demand.

3. 🔵 More Than 5 Billion Devices Will Ship With Bluetooth This Year, 31 Years Since Its Invention

Bitchat (build by Jack Dorsey) uses Bluetooth to create a private mesh network between nearby phones. No Wi-Fi, no cell service, no phone numbers. Messages hop from device to device until they reach their target.

Communication that can't be shut down, tracked, or controlled. When governments cut internet access or companies decide what you can say, this still works.

Bluetooth will hit ~8B devices by 2029. Dorsey just turned them into an unstoppable communication network that bypasses everything.

What did you think of today’s newsletter?

Enjoy this content? Follow us on Instagram, YoutTube, Linkedin

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.