🧐 You missed something...

Top market, investing, and business insights from the past few weeks.

Here's a recap of the past few weeks' top market, investing, and business insights—from insiders and experts outside the mainstream—featuring Offbeat Alpha’s most-opened newsletter and most-viewed content.

Soil is dying, threatening food security, here’s an insane solution.

Hackers’ 1% edge on stocks and their toughest challenge.

THIS tiny company is creating a MASSIVE AI hedge investment.

There’s a record breaking CEO turnover… wtf is going on?

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights for November

1. 🌮 Food Security Threatened, Here's an Insane Solution...

A global soil crisis threatens food security... 40% of soils are degraded, rising to 90% by 2050... poor soil means lower yields, higher food prices, and more artificial fertilizers, worsening the problem… there is one insane possible solution gaining momentum… desert farming… and this particular company is leading the charge… Ohalo.

Most soil-saving strategies target farming methods, not crops. Ohalo’s Boosted Breeding flips the script... creating plants that can thrive in poor, dry soils... yes, even deserts… the potential is wild…

50-100% yield increases even in poor conditions.

A chance to turn unusable land into farmland.

Reduced reliance on harmful fertilizers.

Ohalo’s early trials show significant success in growing high-value crops like potatoes, a ~$120B market and the third-largest source of calories worldwide.

tldr; on the tech… it allows plants pass 100% of their genes to offspring, creating resilient crops that thrive in extreme conditions.

Although Ohalo's tech doesn’t fix soil on its own, when used with no-till farming and cover crops, it could make a huge impact on our soil problems… and ripple through industries we’re closely watching.

2. 😳 Hackers' 1% Edge on Stocks

Hackers can steal billions in bitcoin, breach a country’s defense system, and access millions of social security numbers... but they met their most difficult challenge... it has nothing to do with code... it’s being fooled by randomness...

Hackers breached press-release systems to trade stocks before the news went public, the catch?… sifting through the noise. Most press releases were useless. They threw out 99% of them… the 1% they kept?… merger announcements.

Their hit rate? 70%. Enough to make hundreds of millions before getting caught, insider trading at its finest… you know, what politicians do. But, let’s face it, we're not all Nancy Pelosi or hackers… but still, curious to know what happens if traders also had access to next day's news… that's what Victor Haghani (ex-Long-Term Capital Management partner) and James White (CEO of Elm Partners) tested, their findings…

Even with tomorrow’s news, traders were only right 51%… barely better than a coin toss.

Overconfidence destroyed portfolios… big bets on bad ideas wiped out 16% of participants.

Top traders improved to just 57% accuracy.

What separated winners from losers? strategy…

Top traders passed on 1 in 3 trades they weren’t sure about.

Small, smart bets beat big gambles EVERY TIME.

Over leveraging on “sure things” destroyed portfolios.

"He who lives by the crystal ball will die eating shattered glass." Ray Dalio out here spitting facts. Investing doesn’t require a crystal ball… it requires clear thinking, filtering out noise, and seizing small, consistent edges… you don’t need tomorrow’s news to win… you just need a better way to play.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $90/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

MAKE MONEY or GET YOUR MONEY BACK GUARANTEE. If you subscribe today, use it actively for a year, and don't make money, we'll refund your payment and give you an extra year for free.

TRY RISK FREE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $90/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

4. 🚀 THIS Tiny Company Could 10x (Here’s How You Could Profit)

Canal Flats in British Columbia, Canada; Prince George in British Columbia, Canada; and Childress County, Texas, all hold a powerful little secret... IREN (formerly Iris Energy)... a company quietly building the backbone for AI's next leap forward…

AI’s growth depends on energy-rich data centers… companies that own this infrastructure have MASSIVE leverage… IREN, born in Bitcoin mining, knows this—and it’s shifting from just Bitcoin to powering AI computing, transforming its business overnight.

The state of energy and data centers for AI…

AI’s energy demands are like nothing we’ve seen before—ChatGPT uses 17,000x the power of a U.S. home. U.S. data center construction spending jumped 60% last year to keep up.

Building new data centers takes years due to permits and logistics… the lack of ready facilities is becoming a major bottleneck.

All of which IREN is locked and loaded to help solve.

Here’s why we’re paying close attention…

Owns renewable-powered data centers, ready for AI giants to jump in… with ~$400M/year from Bitcoin, no debt, and positive cash flow, it’s primed for an AI pivot.

Builds data centers powered by 100% renewable energy, using cheap, excess hydro and solar power that would otherwise go unused.

Already locked in partnerships with Poolside AI and WEKA… if it could land more AI deals, its value could soar 10x.

It’s continuing to expand its Bitcoin mining operations while simultaneously growing its renewable-powered AI data centers.

Become a premium subscriber with Money Machine Newsletter to get our buy/sell setups.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Nuclear’s Substack, advanced option trading strategies based on the #1 Amazon bestseller The Nuclear Option.

👉 The Economy Rocket, simplifies investing for busy professionals with data-driven, long-term strategies that cut out the daily market noise. Delivering a fundamentals-based stock list each day, making investing hassle-free.

👉 Magnelibra Markets, where decades of professional trading and research come together to give you the mental cues required to be a successful trader and where they breakdown the most important topics driving today's financial markets environment.

👉 Finance Focus Newsletter, brings nearly 40 years of trading experience directly to you. When it comes to trade advice, nothing beats real-world expertise—and that's exactly what this newsletter delivers: decades of insights, condensed for the benefit of fellow traders!

👉 Indieniche, featuring tips and stories from successful self-made founders. They share insights on building great products, growing your business, and showcasing essential tools to help you build and scale better.

Top 3 Charts of the Week

1. 👀 Record-Breaking CEO Turnover

Nearly 2,000 CEOs left their jobs in 2024, a record high since tracking began in 2002—a 60% jump from 2022. Public companies saw 327 CEO exits, up from 199 in 2022.

CEOs face pressure from AI markets, pandemic burnout, and complex challenges. Many are also retiring.

2. 📈 U.S. ETFs Hit Record Highs in 2024

Investors put over $1T into ETFs in 2024, hitting a record $10.6T. ETFs grew 30% in one year, fueled by the S&P 500’s 25% gain and Nasdaq’s 30% rise.

ETFs are booming because they're cheap, simple, and tax-friendly. They reflect a shift from expensive active investing to passive strategies. Most inflows went to U.S. stock ETFs, like S&P 500 and Nasdaq 100.

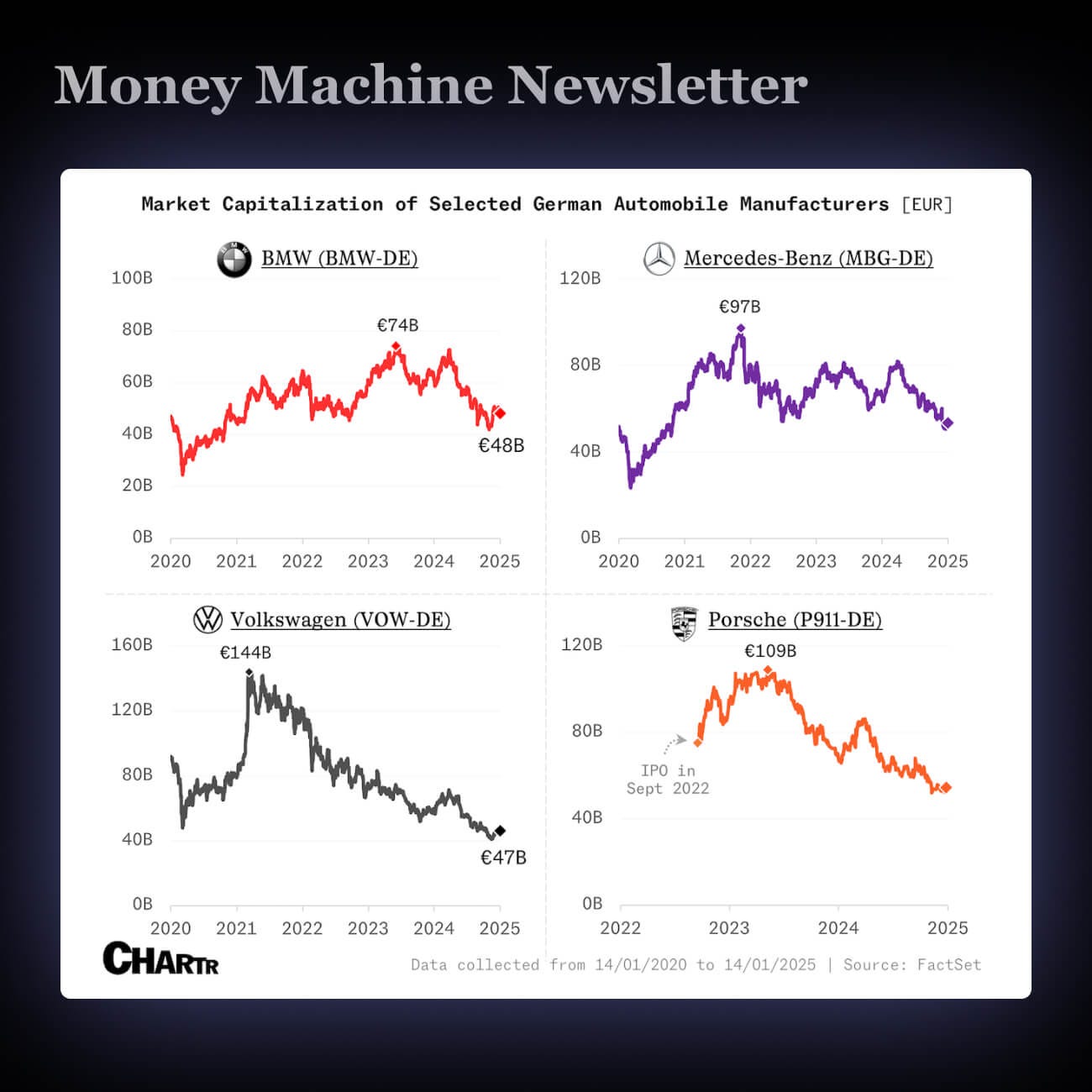

3. 🚗 Germany's Iconic Carmakers Are Losing Ground

Germany's economy shrank again as high energy costs, rising rates, and China’s cheaper EVs hit growth.

Volkswagen, BMW, and Mercedes-Benz saw global sales drop 2%-4% in 2024. In China, where local brands now dominate 70% of the market, their sales fell even more—up to 28%.

What did you think of today’s newsletter?

Enjoy this content? Follow us on Instagram, YoutTube, Linkedin

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.