🧐 You missed something...

Top market, investing, and business insights from the past few weeks.

Here's a recap of the past few weeks' top market, investing, and business insights—from insiders and experts outside the mainstream—featuring Offbeat Alpha’s most-opened newsletter and most-viewed content.

The AI fear feels real—but what if it’s just good PR for control?

The next $26T wave is approaching.

THIS stock is a gas toll empire.

The quiet middle is starting to win BIG.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Past Few Weeks

1. 🤔 AI Panic Is the Point

You’ve heard the stories. AI will take your job. Then it’ll build weapons. Maybe even kill us all. Heavy stuff. It’s everywhere. It’s not just fear. It’s a strategy…

Let’s follow the story behind the story… Dario Amodei, CEO of Anthropic, says AI could wipe out 10–20% of jobs in the next few years. Mostly entry-level white-collar work—tech, law, finance, customer service. But look closer, and these headlines tend to pop up right before fundraising or regulation pushes. Coincidence?

There seems to be a pattern here…

A group called Effective Altruism (EA) is pumping $1.6B into AI safety panic. Their biggest backer? Dustin Moskovitz—Facebook co-founder. His org, Open Philanthropy, funds dozens of so-called “independent” AI watchdogs. But they’re not so independent. Same people. Same goals. Same playbook.

And it all ties back to Anthropic… Luke Muehlhauser, Open Philanthropy's senior program officer for AI governance and policy, serves on Anthropic's board.

Here’s their playbook… Regulate the industry. Then control who gets to build in it. They call it global compute governance. Translation? Control over:

Who gets access to chips

Who can build data centers

Who gets AI licenses

What values get coded into the models

The critics call it what it is: regulatory capture.

Because if you help write the rules… You stay in the game. Everyone else gets locked out.

Another twist… After pushing AI regulation in Washington, key Biden staffers now work at—surprise—Anthropic. They wrote the rules. Now they’re cashing in on them.

Bottom line… The real risk isn’t AI turning evil. It’s power being concentrated in the hands of a few people using fear to take control. What we need:

Open competition

Clear rules

Sunlight on the people writing them

Because when power and code mix behind closed doors… It’s not the machines we should be worried about. It’s the humans running them.

2. 🌊 Nothing Stops THIS $26 Trillion Wave

Marc Andreessen just made his boldest bet yet… on humanoid robots.

He says they’ll be bigger than the internet. A $26T industry.

With billions of robots doing real-world work—cleaning homes, building cars, helping doctors.

AI is getting a body… it’s stepping out of the browser and into the real world. Literally. Andreessen calls this “embodied AI.” But the U.S. must move—fast. Marc’s warning? If America doesn’t build these robots first, China will.

China’s already pouring billions into AI + robotics. Their “Made in China 2025” plan is no joke. It includes building millions of robots and controlling the global robot supply chain.

The fear? If the U.S. doesn’t act, we’ll be buying our robots—and our future—from someone else. Marc’s push is simple… Build “alien dreadnought” factories—fully automated production lines. Not old-school assembly. High-tech. Scalable. American-made.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. ⛽️ A Gas Toll Empire

Most energy companies gamble on oil prices. Cheniere (NYSE: LNG) doesn’t. They don’t drill. They don’t speculate. They ship liquefied natural gas (LNG) across oceans — and get paid like clockwork…

Cheniere runs the biggest LNG export terminals in the U.S. Think toll roads for gas. Every molecule that passes through? They clip the ticket.

And the best part? 90% of sales are locked in with long-term contracts — 15 to 20 years — with giants like BASF and Equinor. That means steady cash, even if prices swing.

LNG demand is soaring — up 26.8% a year through 2033. Asia and Europe can’t build fast enough. And 20% of U.S. exports? Cheniere handles them.

Big things are coming… Corpus Christi Stage 3 goes live soon… Sabine Pass expansion is next… That’s 30M+ tonnes of extra capacity.

$5.4B revenue (up 28%)

$1.9B EBITDA

$1.3B in free cash flow

$350M in buybacks

$0.50 dividend

Yes, there’s $27B in debt. But they’re managing it — paying it down and refinancing.

Risks…

Global supply glut

EPA regulation

Two megaprojects at once (Corpus Christi Stage 3 and Sabine Pass expansion)

Debt always needs watching

Top 3 Charts of the Past Few Weeks

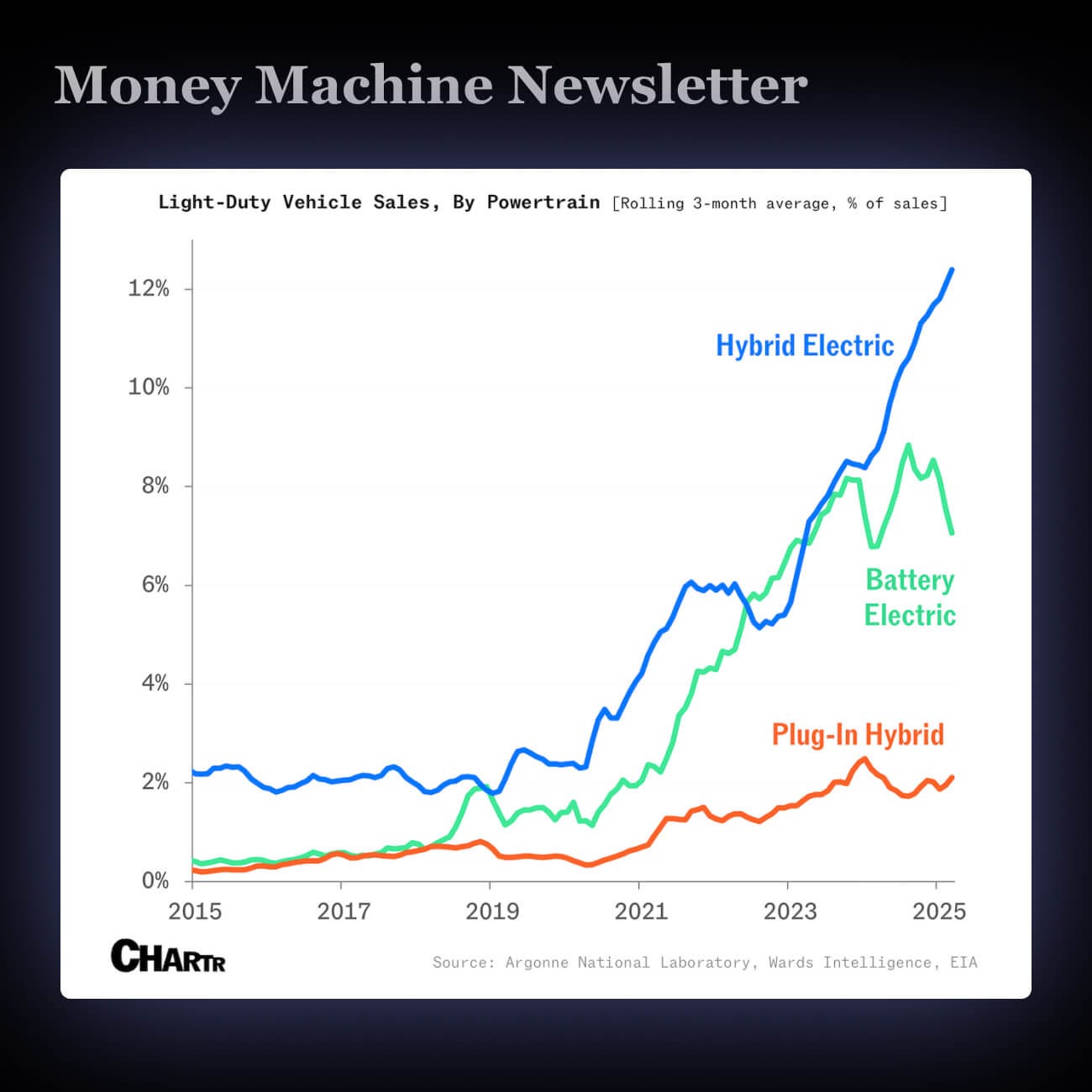

1. 😳 Hybrid Sales Hit New Highs

1 in 8 cars sold in the U.S. is now a hybrid. That’s more than full-electric cars, which are losing steam. Toyota’s bet on hybrids is paying off.

EV hype is cooling. Only 7.1% of new cars are fully electric. Hybrids are quietly winning — they’re cheaper, simpler, and fit how most people actually drive.

Gas cars still dominate in the U.S.—78% of all sales. Tesla is losing steam, with Q1 sales down 13% to 336,681 cars. Meanwhile, Toyota stays on top, selling 10.8M cars last year. Just 1% were fully electric, 40% were hybrids.

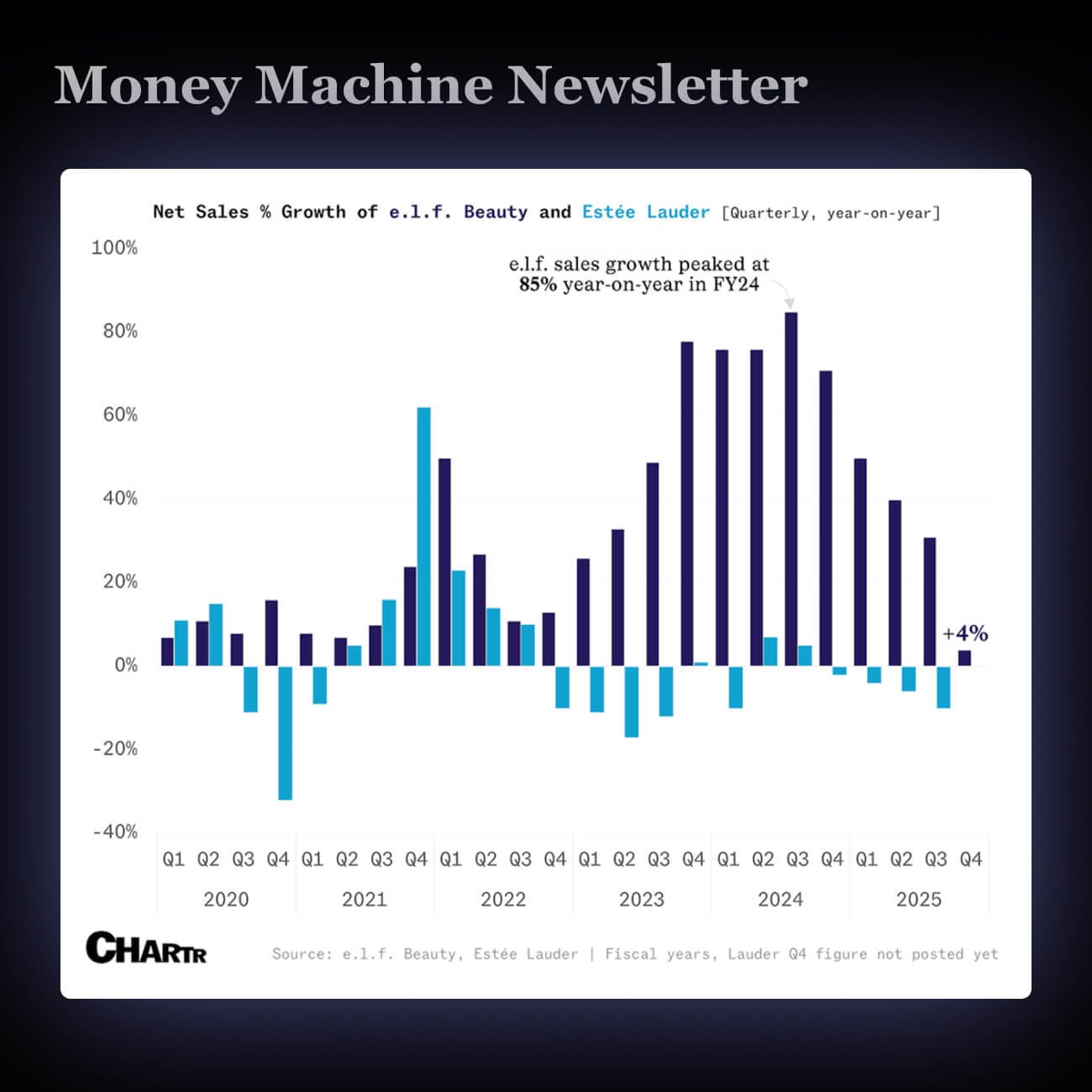

2. 💰 e.I.f. Sales Are Still Brushing Up, But Slowing Down

e.l.f. Beauty is buying Hailey Bieber’s skincare brand rhode for $1B. rhode doubled its customers and made $212M in sales over the past year.

e.l.f.’s sales growth is slowing (up only 4%), so it’s betting on rhode’s popularity—especially with Gen Z—to bring fresh energy and boost future growth.

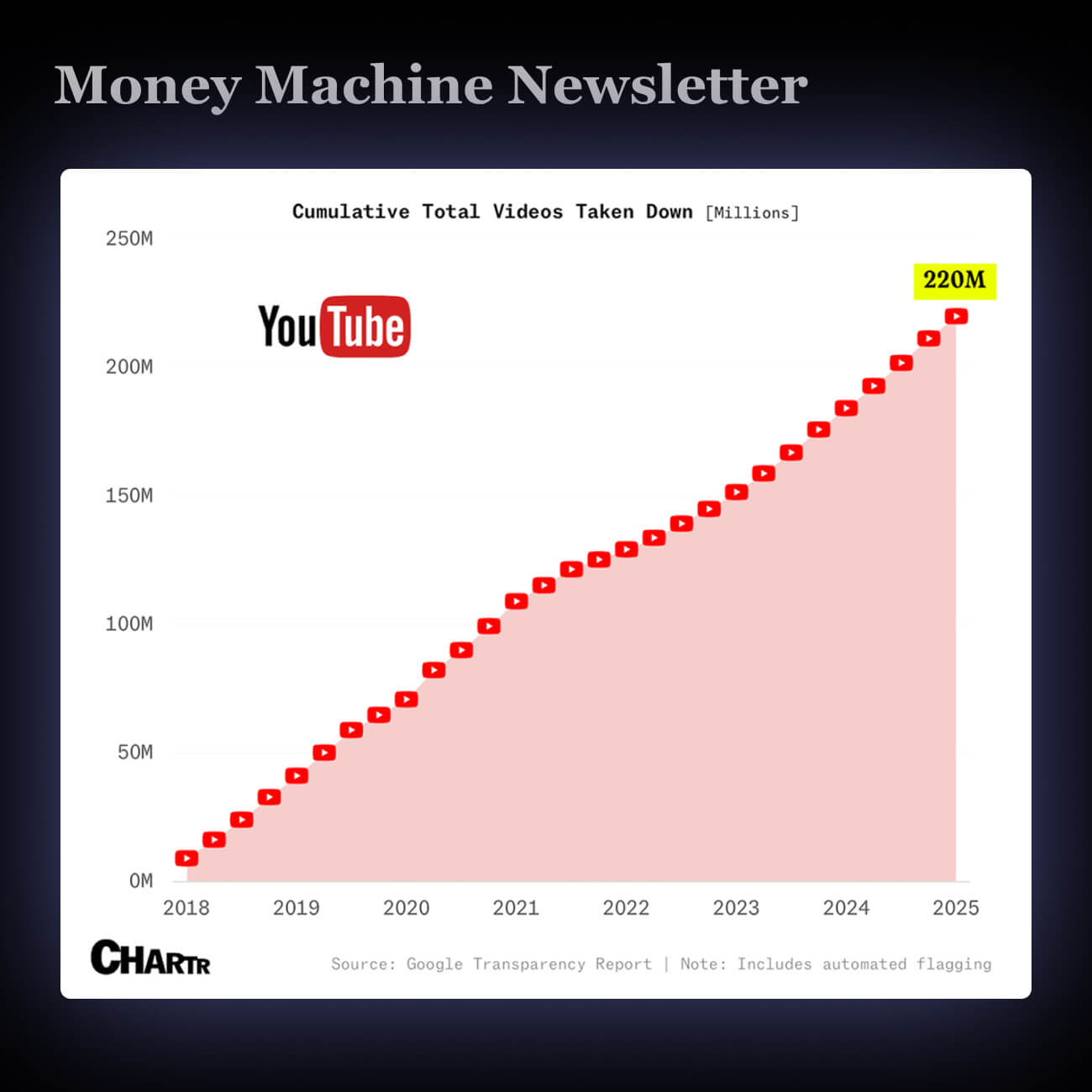

3. 😳 YouTube Deleted 220 Million Videos in 7 Years

YouTube changed the rules—quietly. Since late 2024, certain videos get more leeway. Especially if they cover hot-button topics like elections or gender.

Before, the algorithm took down anything that crossed the line. Now? Videos can break the rules—just a little—if YouTube says they’re “in the public interest.”

Since 2018, they’ve deleted 220M videos. Mostly flagged by AI, not humans. This new policy shifts the balance. More freedom of speech? Maybe. Either way, it affects what shows up in your feed. And what doesn’t.

What did you think of today’s newsletter?

Enjoy this content? Follow us on Instagram, YoutTube, Linkedin

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.