🧐 You missed something...

Top Market, Investing, and Business Insights for December

Here’s a recap of last month’s top market, investing, and business insights—from insiders and experts outside the mainstream media:

Featuring Offbeat Alpha’s most-opened newsletter and most-viewed content for December.

U.S. taxpayer dollars funded COVID-19.

Google is funding this German scientist to break Bitcoin’s encryption.

MIT calls THIS mineral the "key to feeding the world."

More people want to work

remotefrom the sea?!

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights for November

1. 😳 The Deep State Report Just Dropped

U.S. taxpayer dollars funded COVID-19… not long ago, if you said that out-loud you would be called crazy, cancelled, or lose your job… well, the House just dropped a 500 page report on how this is in fact true… some are calling it the Deep State Report and it pulls no punches…

Mask mandates? Ineffective.

6-foot distancing? Arbitrary.

Lockdowns? Caused economic and mental health disasters.

School closures? Caused a historic learning loss.

Earlier this year, we wrote about how Fauci proved the Deep State is real… not to toot our own horns but… toot.

President Obama paused manipulation of viruses (gain-of-function research). Fauci didn’t agree. He waited for Obama's term to end and reversed the pause.

Enter "Deep state"... just a buzzword for powerful, long-term, unelected

government officials. Dr. Fauci led the NIAID for 38 years.

EcoHealth Alliance, funded by NIAID, continued research at Wuhan but did not report the virus became more infectious.Officials lied about vaccine benefits, ignored natural immunity, and shut down debate… silver lining? Trump’s Operation Warp Speed… it was praised as a historic achievement in the report—speeding up vaccine development and saving lives.

2. 🫢 German Scientist Wants to Break Bitcoin

In 1947 Bell Labs dropped the transistor... a true game-changer. Without it, we would be in the stone age... no phones, no computers, no electronics… as they say, history doesn’t repeat itself but it sure as hell rhymes… Google just had its transistor moment...

They released Willow, a quantum chip that’s faster than the world’s most powerful supercomputer.

It solved a computational problem in under 5 minutes that would take the fastest supercomputers longer than the age of the universe to figure out.

THIS IS A BIG DEAL... the man behind it... German scientist Hartmut Neven. Google has been throwing money at him since 2012 to get to this exact moment.

He leads the Quantum AI Lab at Google.

Created the first face login for phones.

And now... he wants to crack encryption on all of the world’s browsers, servers, computers, and Bitcoin... in 2-5 years… just a chill guy.

Tech is racing to prepare for a world where quantum computers break today’s encryption…

Bitcoin estimates switching to quantum security could take over 305 days.

LGT Financial Services is testing new security to protect against future quantum hacks.

Apple is gearing up for future quantum hacks.

U.S. Cybersecurity and Infrastructure Security Agency (CISA) urges organizations to start upgrading to quantum-safe security.

Google is firing off on all cylinders... their $175B/year revenue from search is paying off... BIG…

Google’s AlphaFold 3 uses AI to accurately predict protein, DNA, and RNA structures. They control AlphaFold 3.0's IP, securing a major share of the biotech market.

Google's Gemini 2.0 AI can now handle tasks like online shopping or scheduling.

Waymo's robotaxis now run 24/7 in San Francisco, 300 cars, 10,000+ rides a week.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $90/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

MAKE MONEY or GET YOUR MONEY BACK GUARANTEE. If you subscribe today, use it actively for a year, and don't make money, we'll refund your payment and give you an extra year for free.

Get $13,890.80 worth of value for just $90/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

3. 🌎 MIT: THIS Mineral Is “Key to Feeding the World”

When MIT researchers say there's a mineral beneath the earth that is "key to feeding the world"… we hear cash registers. Turns out, this mineral has been quietly powering global farming for decades… it's called potash… and it plays a crucial role in crop growth by boosting plant health and resistance to disease.

Potash-based fertilizers grow 99% of the food you eat and demand is skyrocketing… but supply can’t keep up… By 2032, the potash market could reach ~$93B.

50 hedge funds, including Ken Griffin’s Citadel, are investing millions in potash-related companies… but there’s one company in particular that catches our eye… Brazil Potash.

Why we’re paying close attention…

Plans to connect to Brazil’s national power grid, cutting costs and emissions.

Strategically close to the Amazon River for cheaper shipping.

Targeting Brazil where 98% of the potash is imported.

Backed by Wall Street giants.

The global fertilizer market is set to surge, feeding 9 billion by 2050.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Unleash Your Potential Blogs, learn how to make money through marketing and sales—more than most schools can teach you in 12 years!

👉 AI DailyPost, join 1,000+ AI professionals with a concise weekly digest of the top 5 groundbreaking AI research papers.

👉 No Straight Lines Investments, provides readers with a unique combination of: i) analysis of key macro data ii) weekly flow and positioning nuggets iii) chart/technical insights, all used to support bottom up stock selections, in an easy to read format.

👉 The Contrarian Capitalist, Macroeconomics, geopolitics, energy, metals + freedom. Bringing TRUTH and a healthy dose of COMMON SENSE to the world. Providing solutions to life’s challenges (Plan B et al) and a contrarian way of thinking. Being the Yin to everyone else's Yang.

👉 T&G’s Substack, earnings reports, market analysis & market predictions. Subscribe today for your daily recap of the market.

Top 3 Charts of the Week

1. 🛳️ Cruise Tourism Is Back and Here to Stay

Disney’s spending $12B to double its fleet. Virgin launched a $120K unlimited cruise pass.

Cruises are tapping into "work from sea" trends and longer onboard experiences, appealing to younger travelers.

Cruise market is booming again, targeting new demographics and reshaping how people combine travel and work.

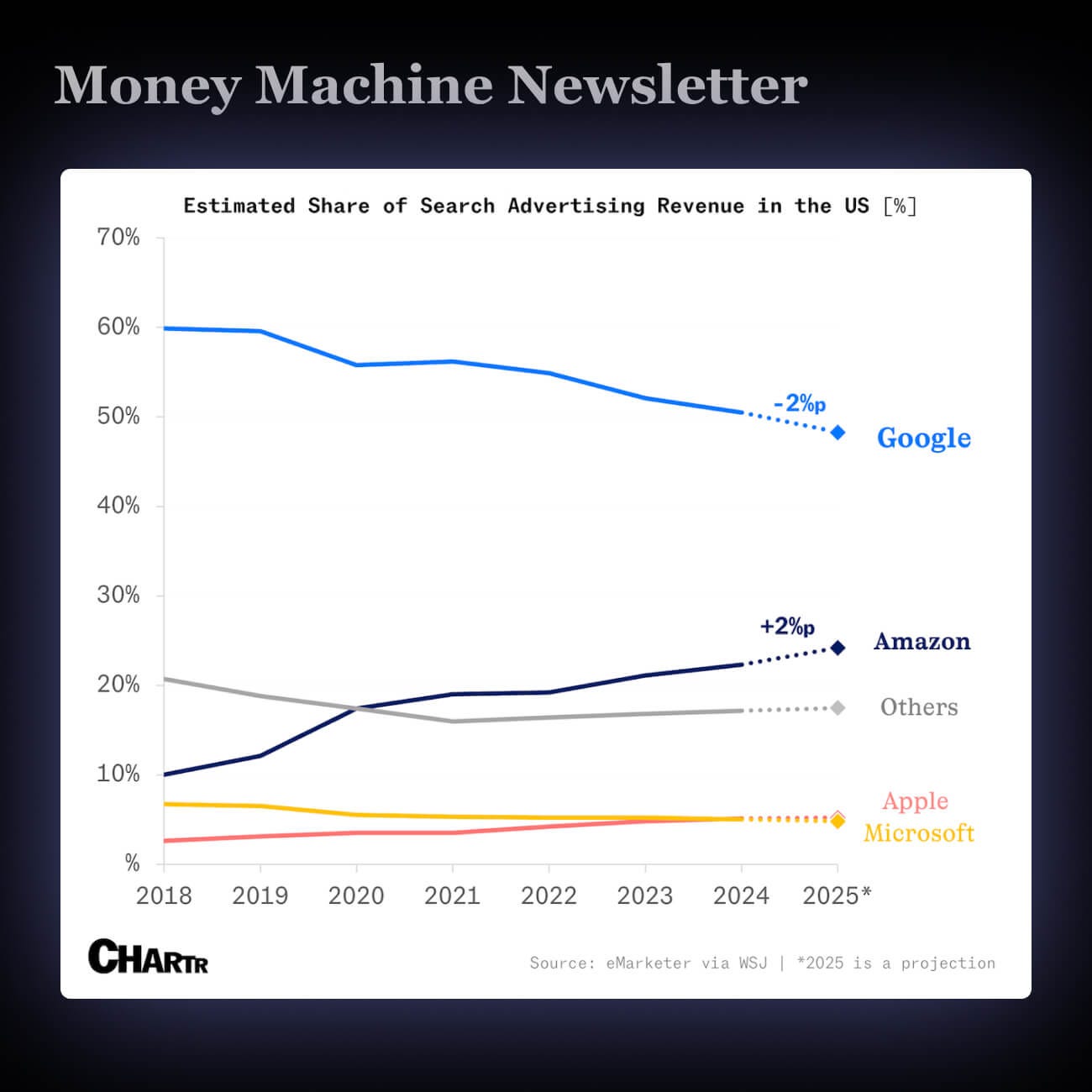

2. 📉 Google's Search Ad Dominance Is Slipping

Google's search ad dominance is slipping, forecasted to drop below 50%.

Fewer users are clicking Google ads. Ad dollars are shifting to Amazon and TikTok.

Search advertising is a $300B market. Google relies on it for $175B annually (57% of Alphabet’s revenue).

3. 🇨🇳 China Leads the World in Coal Production

China broke records, mining 428M tons of coal in November. It produces 55% of the world’s coal but aims for 60% of global renewable capacity by 2030.

China's coal use might have peaked, signaling a possible shift to cleaner energy.

What did you think of today’s newsletter?

Enjoy this content? Follow us on Instagram, YoutTube, Linkedin

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.