☢️ WTF Did China Just Pull Off?

Plus: The Next BIG AI Biotech Company?, Apple Moving in the Shadows, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

The world’s first nuclear reactor that doesn’t melt.

Is THIS company the next big AI Biotech? Nvidia thinks so.

Apple releases paper on a new tech that’s insanely good.

Disney is betting big on price hikes.

And more. Let’s get to it!

Follow us on Instagram | Advertise to our 7K+ subscribers

But first…

Ready to get serious about investing?

Join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Become a premium subscribe today for just $9/month and receive market beating stocks. Picked by elite traders. In your inbox. Every Monday, before the market opens.

Top Insights of the Week

1. ☢️ WTF Did China Just Pull Off?

It’s the world’s first nuclear reactor that doesn’t melt. And it’s in the hands of China. Gen4 Pebble Bed Reactors are melt-proof, smaller, and more efficient. What does this mean?

Accelerates China’s nuclear energy—projected to spend $440B.

China’s electricity will become cheaper. China pays 7-9 cents/kWh, U.S. pays 17-25 cents/kWh.

China will reach 8.7 terawatts of power, nearly tripling its supply. U.S. will only double to 2 terawatts.

This is a problem for the U.S.

Industries like AI will rely on power costs. China’s lead in nuclear tech gives them a major edge.

Investing in and deregulating U.S. nuclear tech is vital. Here are some major players that get it. Hopefully more join soon.

Jeff Bezos’s General Fusion, working on fusion energy technology, raised $300M.

Under Trump, U.S. nuclear energy production hit a record high.

Bill Gates invests over $1B in a Wyoming nuclear plant.

Sam Altman’s Oklo, develops small nuclear reactors, raised $306M. And Helion, building the world’s first fusion power plant, raised $500M.

2. 🤔 The Next BIG AI Biotech Company?

Drug discovery through AI is moving fast.

Google’s AlphaFold 3 can predict protein structures.

Ex-Meta researchers recently used an AI model, ESM3, to create a protein in record time.

And now, there’s another company raising eyebrows among big players...Recursion Pharmaceuticals.

Nvidia invested $50M and granted them access to its cloud for AI training.

ARK Investment holds 16.7M shares, $177M invested.

Bayer signed a $1.5B deal to develop drugs using their AI.

Merging with Exscientia, giving them a war chest of $850M.

Acquired two AI drug discovery companies, Cyclica and Valence, $87M.

What do these top players see in this company?

Recursion's unique 23-petabyte dataset and AI speed up drug discovery, saving time and billions of dollars.

AI drug discovery market: ~$1.5B in 2023, projected $9B by 2030.

3. 🤫 Apple Moving in the Shadows

It will transform their entire product lineup…Codenamed “MM1.”

This tech requires new Apple hardware. Older devices won’t handle it. Apple is betting this will trigger a wave of upgrades. Similar to early iPhone days.

Apple’s shift into AI has been aggressive. Acquiring 32 AI startups in 2023, more than any other tech giant.

Of the 32, WaveOne stands out, specializing in video compression to boost streaming and cut data use.

There’s another small company that could benefit from Apple's MM1 AI project by supplying key components. Currently flying under the radar…Ambarella Inc.

*Sponsored

William Lobb's Blog, Newsletter and General Tomfoolery

A landlocked pirate trying t survive 21st Century mediocrity. Join today for free.

PicAisso

The Art of AI: Subscribe for awesome AI art, design, video, and music content, delivered on a chill schedule. Join today for free.

Top 3 Charts of the Week

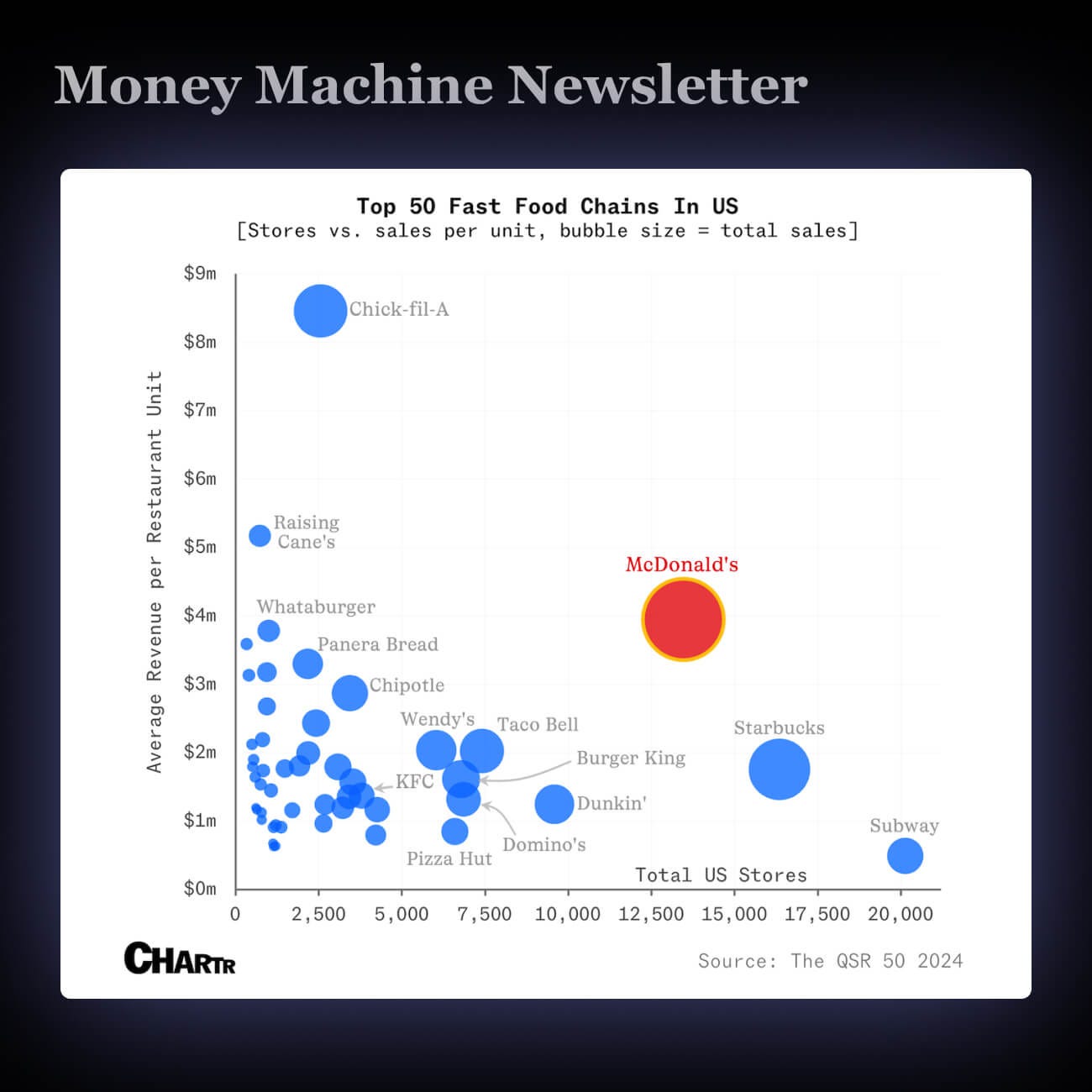

1. 🍟 McDonald's Remains America's #1 Fast Food

Fast food sales are slipping, even for giants like McDonald's, Pizza Hut, and KFC.

Americans still love McDonald’s, $53B in sales last year.

McDonald's is focusing on value to keep customers, Chick-fil-A on efficiency.

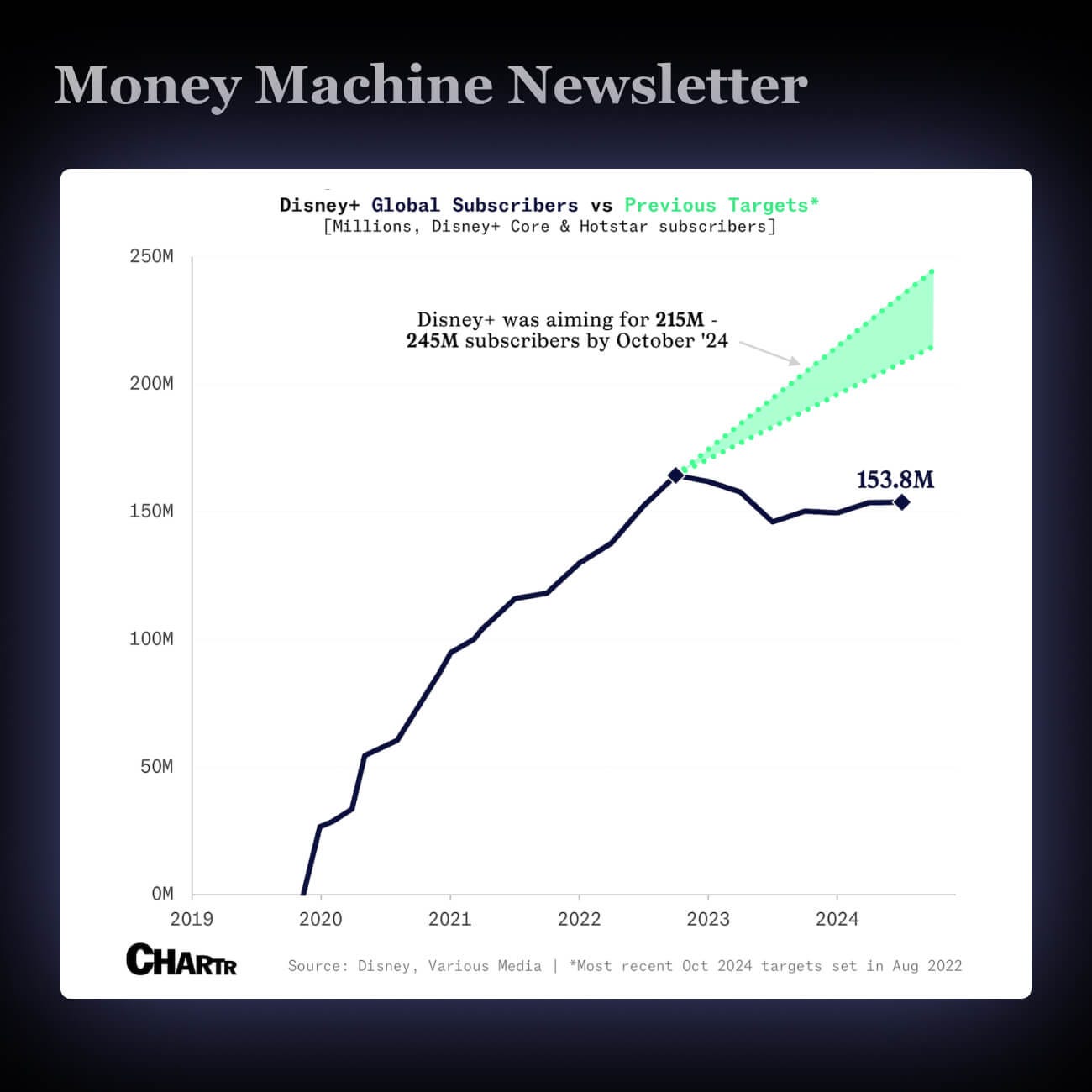

2. 🐭 Disney+'s 5-Year Plan Falls Short

Disney's streaming unit turned profitable, $47M after hiking prices.

Disney's focus has shifted from growing subscribers to boosting profits.

Rising costs may push consumers to reconsider their subscriptions.

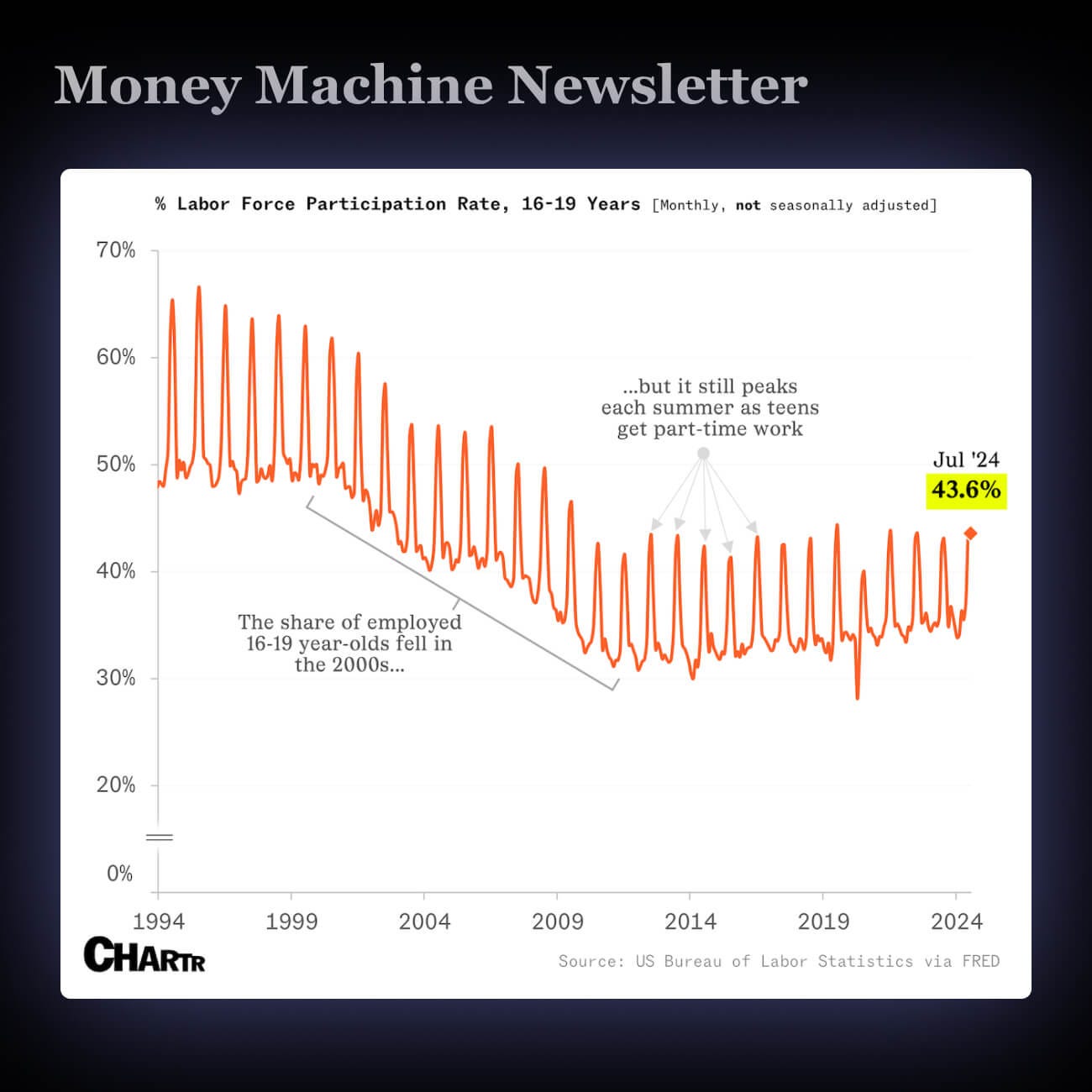

3. 😎 Teens Are Returning to Summer Jobs

Teen labor force hit a 14-year high, 43.6% of 16-19 year-olds working in July.

Rising wages, up 36%, are pulling more Gen Z teens into work.

Teens are earning more, reshaping the job market and driving economic shifts.

Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth.

Become a premium subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber 🚨

TOP 5 STOCK IDEAS, picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS throughout the week as we spot them.

Access to OUR COMMUNITY of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY of which ideas performed best.

NO GUESSWORK. You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS, discover opportunities and risks not highlighted elsewhere.

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.