🏠 Worse than 2008—But No Foreclosures

Plus: THIS Stocks 47% Crash is Your Gain, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Foreclosures vanished—but debt's worse than 2008.

THIS stock tanked 47% but the core business is still SOLID.

World’s first FDA approved longevity drug.

The fastest growing restaurant ever… thanks to China.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🏠 Worse than 2008—But No Foreclosures

Foreclosures are vanishing, even though more homeowners are drowning in debt than in 2008… that’s because the FHA has turned mortgage defaults into a DANGEROUS business model…

wtf is going on…

FHA is backing riskier loans than before the 2008 crash—64%!! of borrowers exceed the safe debt-to-income ratio.

Delinquencies are worse than 2008. 7.05% of FHA mortgages went 90+ days delinquent last year—higher than the subprime bubble’s peak (7.02%).

Foreclosures aren’t happening. Instead, the FHA covers missed payments and lowers monthly bills by paying loan servicers. Borrowers take on more debt, servicers get paid, and the cycle keeps going.

Our government has turned mortgage relief into a cash cow for loan servicers… lenders keep making risky loans, knowing the FHA will bail them out.

Slow train crash in motion…

If defaults spike, taxpayers will foot the bill.

Housing prices could take a hit if foreclosures finally happen in waves.

If rates keep rising, new buyers get priced out, and owners feel more pain.

2. 😳 THIS Stocks 47% Crash is Your Gain

Most businesses just skim the surface… but THIS company dives deep, uncovering the hidden patterns in digital behavior, but after a 47% drop, it’s now a deep-value play… SimilarWeb…

SimilarWeb tracks web traffic, app usage, and digital trends. It tanked 47% after an earnings miss… slower revenue revenue growth (15% YoY) and lower operating margins (4% vs 8% in 2023)… but that’s an overreaction, not real trouble.

Here’s why we’re paying close attention…

Large clients ($100k+/year) showed 112% retention (up from 107%), driving recurring revenue.

49% of revenue comes from multi-year contracts (up from 42%), securing stable, predictable income.

2025 digital ad market is $650B, growing to $1.48T by 2034… fueling demand for better online insights.

Potential rebound—if investors see digital market intelligence's long game.

Pitfalls…

Margins may shrink as spending on sales, R&D, and AI grows.

Crowded market. SimilarWeb must keep innovating—every tech company’s struggle.

The downturn still lingers, making it hard to see the long-term value of a data-first approach.

Bottom line…

SimilarWeb sits at the center of the digital shift, giving businesses a clear view of online behavior. Despite a 47% drop after an earnings hiccup, its core business is solid… and it’s right in our crosshairs.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 💊 World’s First FDA Approved Longevity Drug

Billionaires are pouring into longevity drugs, hoping to live longer. But the breakthrough might start with dogs…

A new drug from Loyal could become the first-ever FDA-approved longevity drug. It’s designed to help dogs live longer by mimicking the effects of calorie restriction—without dieting.

The research behind it…

Dogs slow down around age 10. Metabolism drops, diseases spike.

Study found that calorie-restricted dogs lived about two years longer.

Loyal’s pill offers those benefits without the strict diets. If approved, it'll launch by late 2025.

Dog owners spend billions on pet care, and the animal drug market could reach $78.9B by 2034. But the real breakthrough here…

If the FDA approves this drug for dogs, it opens the door for human longevity drugs too. It would be the first official stamp saying a drug can actually extend lifespan, marking a turning point in medicine.

Top 3 Charts of the Week

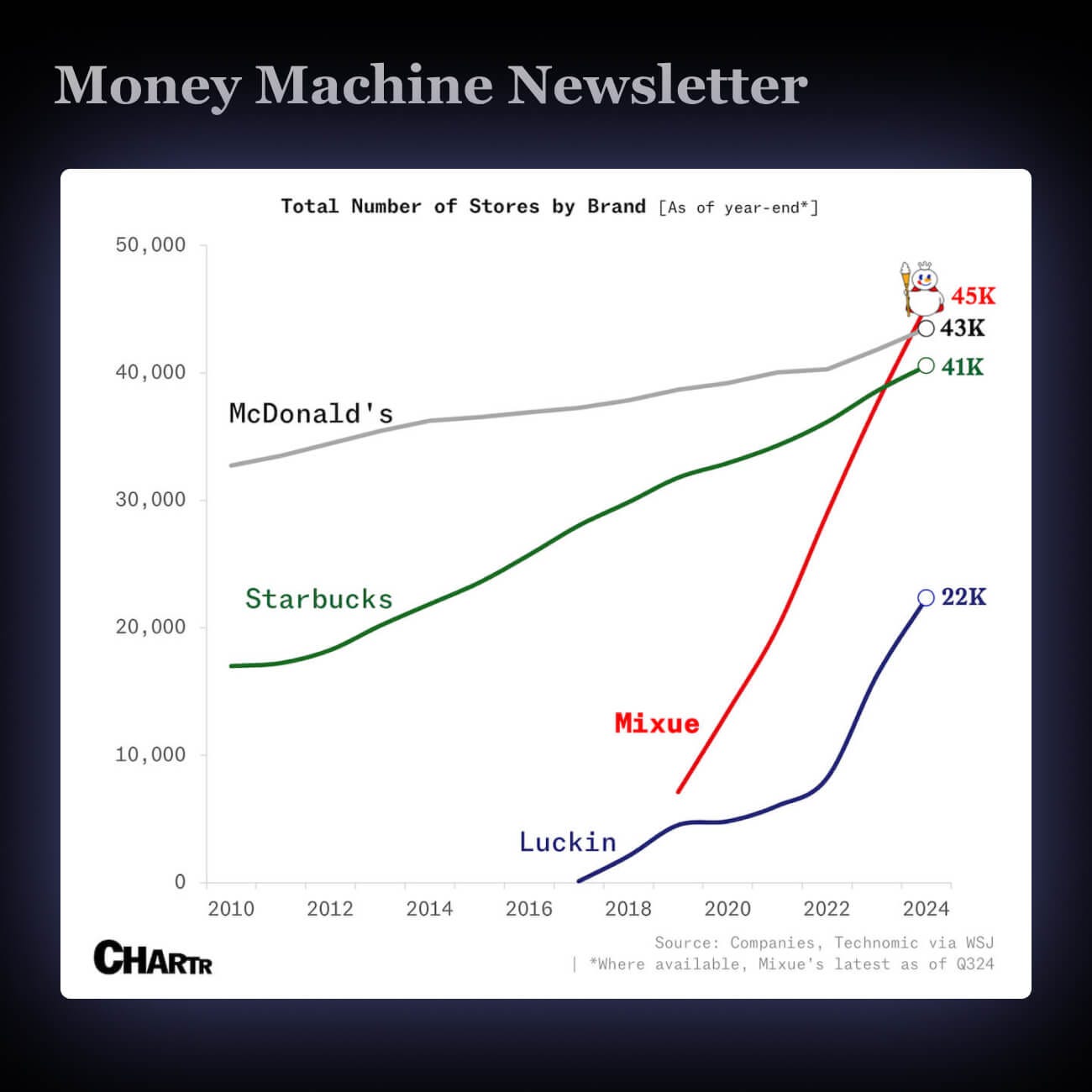

1. 🧋 Mixue Opens 45,000 Stores Faster Than Any Restaurant

Mixue, a bubble tea chain in China, opened 45,000 stores—faster than any other restaurant ever!… McDonald’s took ~70 years to reach 40,000 stores.

It's grown bigger than Starbucks by selling cheap drinks and supplies to franchisees.

Investors love it, pushing shares up 43% in one day.

2. 🚬 Cigar Sales Skyrocketed in the Pandemic

Philip Morris might sell its cigar business for $1B.

They're shifting to smoke-free products because fewer people smoke now.

Selling cigars helps them focus on new products like nicotine pouches, which could grow faster.

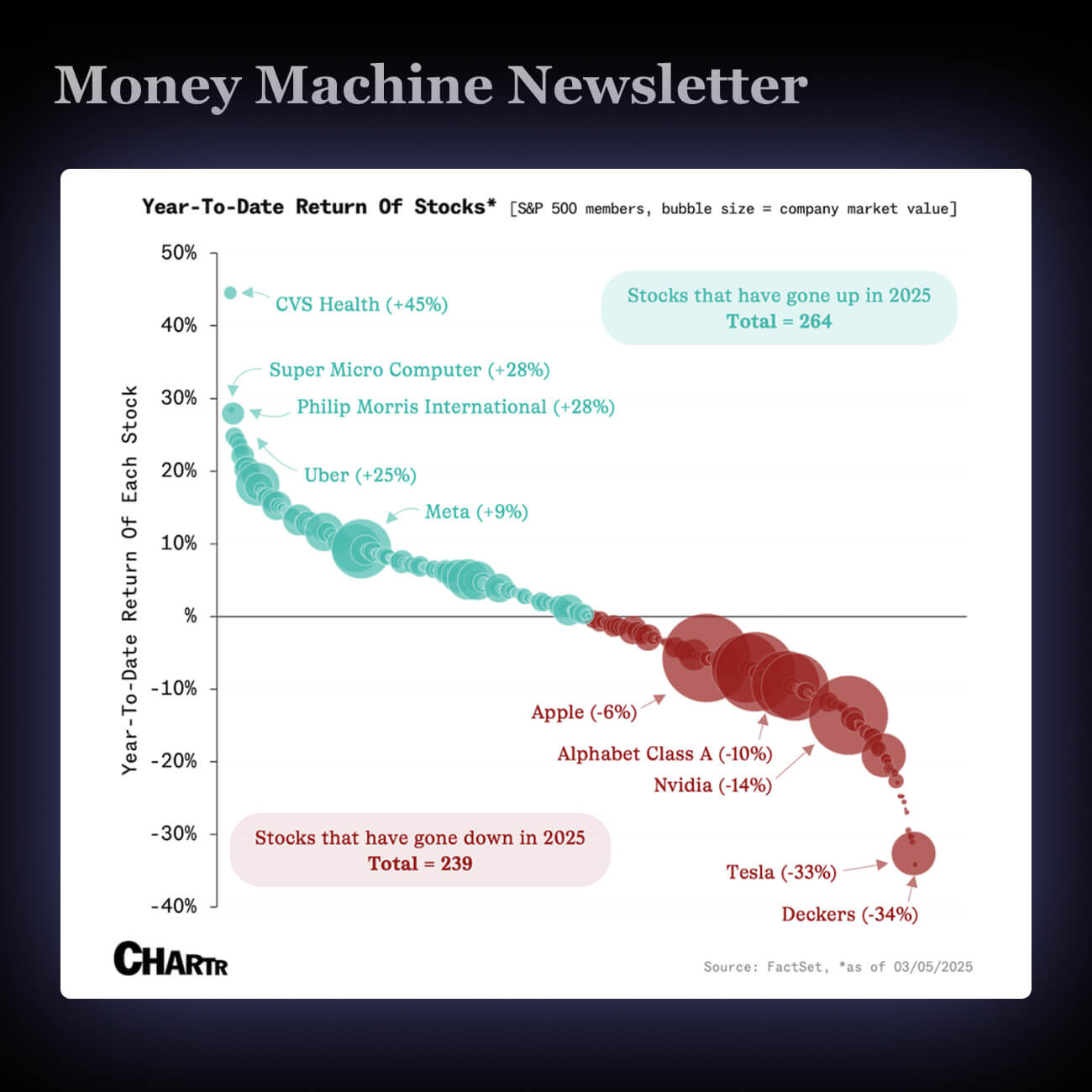

3. 🫠 2025 Stock Market Winners & Losers

Stocks dropped sharply this week due to new tariffs.

But more than half of stocks (52%) are still up this year.

Some big tech companies (Amazon, Tesla) are hurting badly, while others (Meta, Uber) are holding strong.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Give InvestorSnippets daily newsletter a try. It scours over dozens of sources to bring you the most interesting bite-sized stories on markets📈, stocks🏢, and ETFs💸 in under 3 minutes. It’s completely free and read by thousands of investors each day!

👉 Nivaldo Puldon Ibarzabal, when it comes to trade advice, nothing beats relying on nearly 40 years of trading experience. This finance-focused newsletter condenses that experience for the benefit of fellow traders!

👉 The Market's Compass, technical analysis of various financial instruments to aid both short-term and long-term investors in their investment decisions.

👉 The Experiment Zone, testing the Latest Trends in business, AI , productivity and everything in between for a better tomorrow.

👉 All Things Self Improvement, holistic self improvement newsletter for creative solopreneurs.

👉 Alex of Rome Capital, researches under-followed US/European special situation and small-and-mid cap growth stocks and publishes in-depth thesis in an amusing way.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.