As previously stated, this has been a tough couple of weeks to trade since we have not had much help from the markets, and momentum has dried up. As a result, we encouraged everyone to be more aggressive in booking profits, and if we still like the idea, we can get back in next week if conditions improve.

Subscribe for a 7-day free trial and leverage our expertise in navigating these markets.

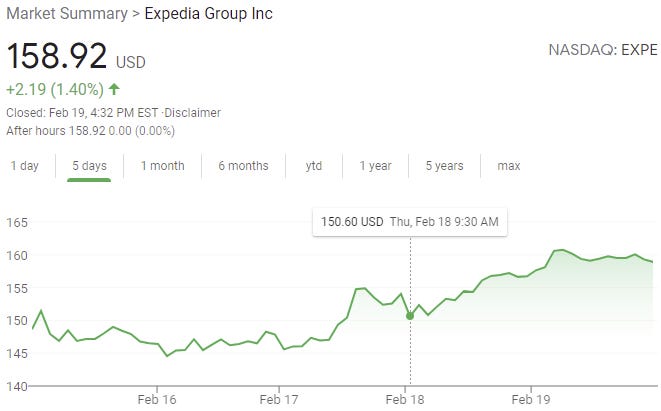

#5 EXPE

Expedia Group was featured in yesterday’s newsletter, where we purchased the open and sold this morning into momentum for a two-day return of 6.9%.

#4 DDD

3D Systems was featured in this morning’s newsletter. We got a strong open and a solid push higher shortly after, where we sold into momentum for a one-day return of 7.1%.

#3 SE

In last Monday’s newsletter, Sea Limited was featured where we gave a $280 price target for the trade. We purchased the stock on the open and sold it this Tuesday at our price target for a six-day return of 8.3%.

#2 AMAT

Applied Materials was featured in last Friday’s newsletter. We purchased the stock, and it shot up quick that day only to pull back almost to our entry point this week and then gapped up today on earnings where we decided to exit. This was a wild ride for a five-day return of 8.9%.

#1 ZM

This week’s top trade was ZM, which was featured in last Monday’s newsletter. The stock was doing great, just as planned, but with overall weakness in the markets, it lost its momentum and started to move against us. Since we anticipated less than perfect conditions, we did not give back too much profit and sold it this Tuesday for a six-day return of 9.3%.