😯 War Games Expose U.S. Weaknesses—THIS Defense Firm Steps Up Big

Plus: Ultimate Surveillance Flex, NEW $1.8 Trillion Industry, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

THIS Defense firm scores HUGE U.S. contract.

Ultimate surveillance flex—privacy under attack by governments.

NEW sector is set to explode, $1.8T by 2035. No, it’s not AI.

Wall Street's new darling dethrones Tesla and Apple.

And more. Let’s get to it!

Follow us on Instagram | Advertise to our 7K+ subscribers

But first…

Ready to get serious about investing?

Join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Become a premium subscribe today for just $9/month and receive market beating stocks. Picked by elite traders. In your inbox. Every Monday, before the market opens.

Top Insights of the Week

1. 😯 War Games Expose U.S. Weaknesses—THIS Defense Firm Steps Up Big

A few years back, the idea of China attacking the U.S. seemed impossible. Unfortunately, that's no longer the case. With rising tensions over Taiwan, a conflict between the U.S. and China is very real. And that’s a problem. Here’s why…

U.S. military is desperate to upgrade their weapons for 21st-century warfare. One defense firm in particular has been stepping up and recently scored a HUGE contract…L3Harris Technologies.

$871M contract with the U.S. Army to supply electronic time fuses.

$32B worth of contracts lined up for future work.

$714M in free cash flow in Q2 2024, tremendous financial stability.

Acquired Aerojet Rocketdyne for $4.7B, boosting its missile defense.

What makes them first class in defense technology?

Developed a virtual electronic shield to protect F-16 aircrafts.

Partnered with DARPA to develop hypersonic missiles.

Developed propulsion systems for missile defense and space launch missions.

Developed a portable weapon kit for vehicles to launch guided missiles.

Developed an autonomous vehicle for maritime surveillance and defense.

Defense industry market: ~$616B in 2023, projected $772B by 2028.

2. 👀 Ultimate Surveillance Flex

Telegram's CEO, Pavel Durov, landed his private jet in France, for unknown reasons. French authorities rushed in, out of nowhere, and now he’s facing…

Complicity in managing an online platform, this charge alone is max 10 years jail-time.

Refusal to provide necessary information.

Complicity in offenses.

Money laundering.

Provision of cryptology services.

Supply and importation of a cryptology tool.

What’s next? Telegram could easily be banned from France. Looks like they could beat the U.S. to it. Privacy is under attack. Governments are going to extremes to monitor communications.

Anti-TikTok law raises free speech and privacy concerns by letting the government label foreign enemies broadly.

NSA uses Google ads to sidestep “secure” apps.

U.S. is ramping up surveillance with laws like FISA.

Demand for decentralized platforms that protect privacy and resist government control is growing. Here are a few we’re watching.

Advanced VPNs with Zero Trust Architecture that fight surveillance.

Minds, a blockchain social network that protects privacy.

Oasis Labs, creates apps to keep data private and safe from surveillance.

ProtonMail, an email service with encryption, doesn't track IP addresses.

3. ☄️ NEW $1.8 Trillion Industry

There’s a particular sector that’s expected to have a ridiculous growth spurt by 2035, $1.8T to be exact…What is this sector? Space.

$3.3B in space tech investment in Q2 2024, 36% increase from Q2 2023.

Global space economy: ~$630B in 2023, projected $1.8T by 2035.

50% of global investment in space tech is captured by the Americas. Don’t be fooled. EMEA and APAC are not just going to sit idle. This will become a space arms race. The U.S. knows this. And got ahead of the ball by creating Space Force.

U.S. Space Force allocated $5.6B to ensure the U.S. has reliable access to space for critical national security payloads.

We have all heard of the usual suspects in this industry, SpaceX and BlueOrigin. But there are two low-profile companies in particular that have investor’s attention locked in…

AstroForge, recently raised $40M, aiming to mine asteroids for rare metals–could revolutionize how we obtain rare resources on Earth.

Varda Space, recently raised $90M, produces drugs in space to improve formulations, delivery, manufacturing, and storage. Another game changer. Could potentially produce drugs that are more effective, with fewer side effects, and cheaper.

*Sponsored

MktContext*

Weekly tips and strategies to time the stock market and achieve superior returns (yes, it's possible!).

Trusted by savvy investors, we share timely market analysis, trading signals, and economic updates from a seasoned professional managing $5 billion. Subscribe now to start beating the market.

Astute Investor’s Calculus*

Discover the strategy that's quietly building wealth for smart investors.

Astute Investor's Calculus isn't just another investment newsletter—it's your blueprint for navigating the market with precision.

With actionable insights, proven techniques, and real portfolios that are generating returns today, this is the edge you've been looking for.

Don’t just invest—invest smarter. Subscribe FREE now and start making calculated moves that could transform your financial future.

The Weekend Investor*

Empower your financial journey in just 5 minutes a week. Learn to:

Build a future-proof portfolio

Boost your financial knowledge

Digest key market moves that matter to you

Tailored for busy young professionals. Free 5-min reads. Subscribe now for smarter finances.

Top 3 Charts of the Week

1. 📈 Nvidia Is Wall Street's Most Traded Stock

Nvidia's stock is up 159% this year.

Nvidia's results impact not just its stock but the entire AI sector.

Nvidia leads in trading volume, surpassing Tesla and Apple.

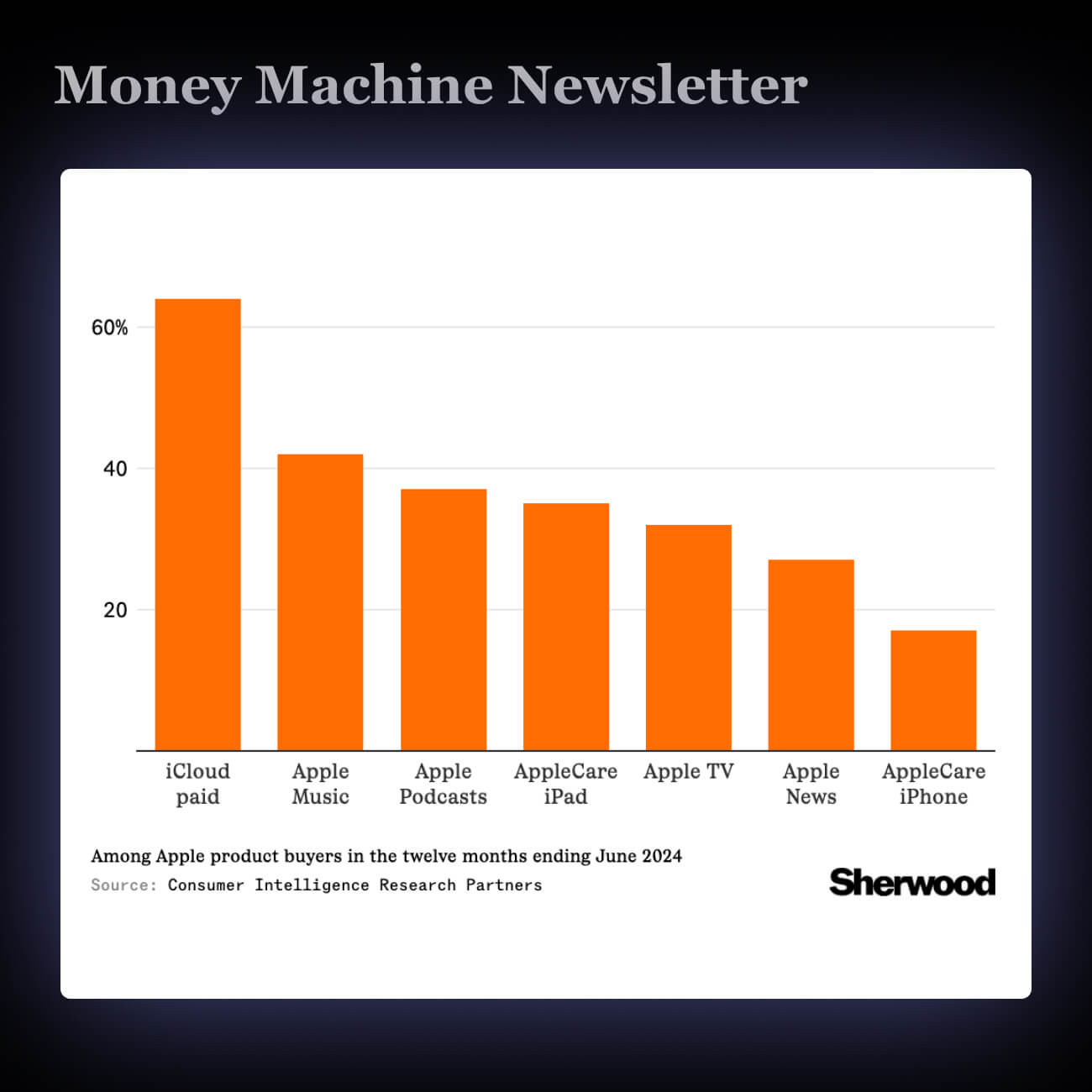

2. 🍎 Apple Customer Usage by Service

Apple's services, now 25% of revenue, face regulatory challenges that could cut profits.

Losing Google's search deal could cost Apple billions.

Apple's growth now depends more on services like iCloud and Apple Music.

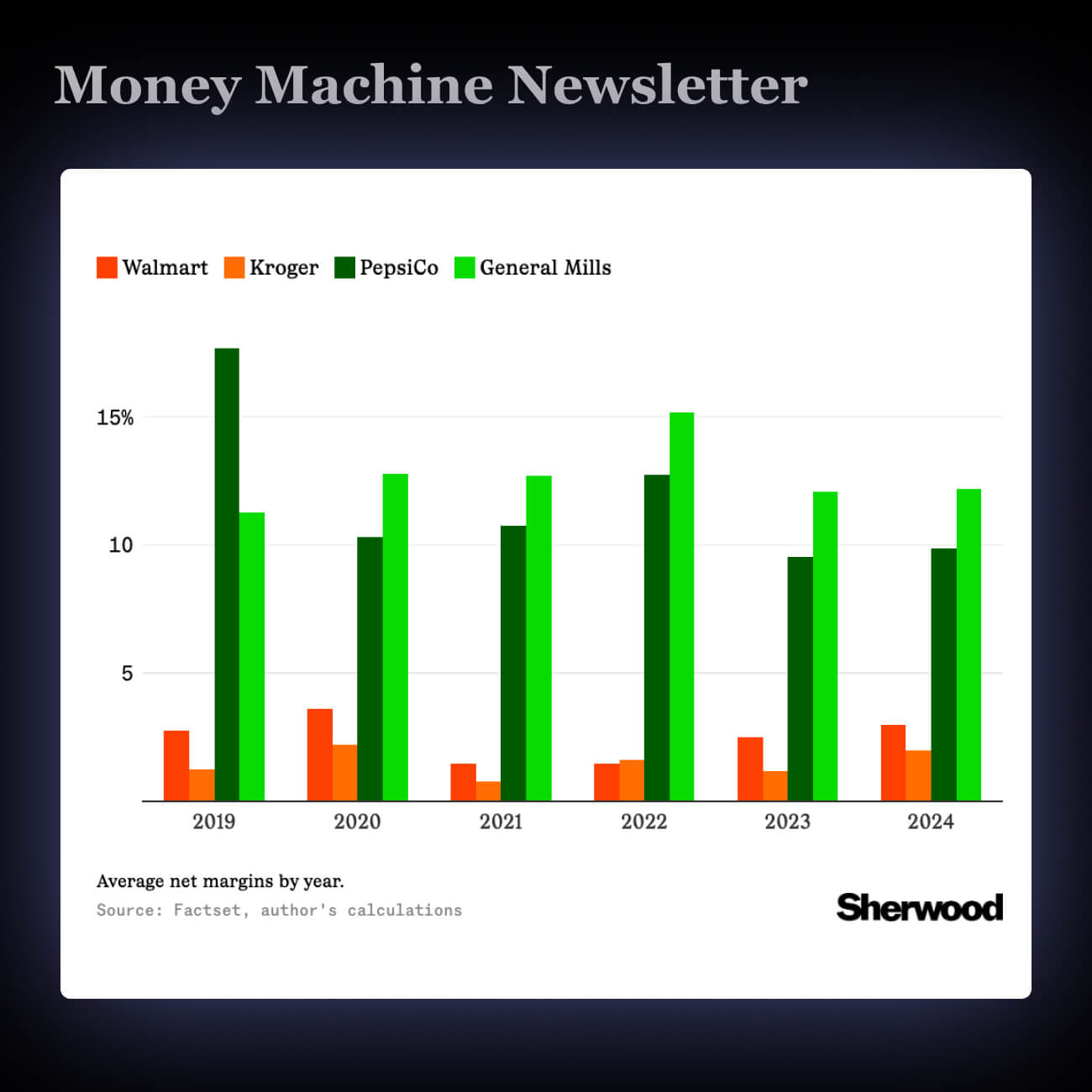

3. 🛒 Grocery Margins Lower Than Manufacturers

A price gouging ban on groceries is being proposed without clear targets.

Grocery stores with thin margins might face pressure.

Food prices up over 20% since the pandemic.

Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth.

Subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber 🚨

TOP 5 STOCK IDEAS, picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS throughout the week as we spot them.

Access to OUR COMMUNITY of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY of which ideas performed best.

NO GUESSWORK. You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS, discover opportunities and risks not highlighted elsewhere.

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.