Today we’re featuring Celeritas Capital.

Celeritas Capital does what most market newsletters don’t: It gets to the point.

No recycled takes. Just honest, curious thinking about macro trends, biotech, and fixed income—without pretending to have all the answers.

It’s written by someone who’s in the game, learning in real time, and open to being wrong. That’s rare. And valuable.

If you like thoughtful, no-BS takes on markets, give it a read. You’ll walk away smarter.

I’ll let Celeritas Capital take over from here…

An in depth look at inflation, growth, labor markets, credit conditions. And how investors should view all of this.

I thought it would be a good idea to take a look at the current macro landscape in this post. Why is the macro landscape so important? It is a pivotal time to evaluate the macroeconomic landscape because we are at the intersection of multiple transformative forces that are reshaping the global economy in real time. After years of unprecedented fiscal and monetary stimulus, the world is transitioning out of a period defined by zero interest rates, supply chain shocks, and pandemic-driven distortions. Central banks are recalibrating policies in response to inflation that has proven more persistent than initially expected, while markets are grappling with the lagged effects of rapid tightening cycles.

At the same time, structural shifts—including labor market realignments, deglobalization trends, technological disruptions like AI, and geopolitical fragmentation—are altering the underlying drivers of productivity, trade, and capital allocation. With that being said lets get into the meat of the post.

This post is long containing many charts. Your e-mail might cut out a part of it. To ensure you can read the whole post, read it through the substack app.

Inflation:

Inflation Dynamics-

Inflation has cooled a meaningful amount from its post-pandemic high. In the latest print the inflation rate lowered to at 2.3% YoY, lower than the previous print of 2.4% YoY. Core inflation is currently 2.8% a bit higher than the non-core inflation and both are still above the FED target of 2%. Core PCE which is the FEDs preferred metric currently hovers around 2.6% YoY. However inflation has not gone anywhere. In my view inflation is likely to stay sticky and remain above 2%. Shelter inflation, a lagging but weighty CPI component, has proven persistent. Medical services have proven to be p problematic for inflation. Hospital services increased 0.6% in April, physicians' services rose 0.3% over the month. The price of prescription drugs rose 0.4% in April as well. There is some more nuance to the inflation picture. Which is how service inflation remains sticky and important than ever. My friend

can say it better than I can so I'll just quote him. Make sure to read his article I attached below.

Part of the miscalculation by consensus is that the services part of the economy has increased in its size since the 1950s, which means that services inflation has become more and more important.-

The dichotomy between goods disinflation and services inflation persistence remains central. The post-pandemic normalization of supply chains has driven durable goods prices into outright deflation. Used car prices, for example, declined by 0.5% in April, while furniture and electronics categories show similar softness. In contrast, core services, particularly those tied to labor and housing, continue to exhibit sticky price dynamics. This one reason I don’t see inflation getting below 2% with the next 3-6 months.

With that being said I’m slightly worried the new tariffs particularly the retaliatory tariffs. I think there’s a chance that the tariffs could lead to inflation increasing. I have two reasons for believing this. 1. Tariffs are likely to exert upward pressure on input costs. (Input costs represent the expenditures a firm undertakes to secure the inputs required for production, including raw materials, labor, capital equipment, and ancillary services.) This will likely increase the cost for items adding pressure to inflation. 2. Tariffs also tend to reduce competition as domestic firms are shielded from foreign competition. This can lead to domestic firms losing the incentive to keep prices low or innovate. So the on going tariff is certainly important to watch in relation to inflation.

Expectations: Anchored, But Watch the Tails-

Market-based inflation expectations (e.g., 5Y5Y forward breakevens) remain broadly anchored around 2.3–2.5%. However, survey-based measures (e.g., University of Michigan's 5 Year Inflation Expectations) are showing signs of gradual upward drift, particularly in consumer segments.

This dichotomy raises the possibility of a fat-tailed risk distribution in inflation expectations:

On one hand, financial markets continue to price a Fed “soft landing” scenario, with disinflation and rate cuts.

On the other, tail risks of reacceleration—especially from energy shocks, geopolitical instability, or wage-price spirals—are being underpriced.

The information we have access to suggests that headline disinflation does not necessarily signal a return to the pre-pandemic low-inflation regime. Instead, we are witnessing a realignment of inflation drivers.

Growth and Labor Market:

Headline Growth Holds, But Beneath the Surface Lies Fragility-

Contrary to recession forecasts, U.S. GDP growth has been remarkably resilient, averaging above-trend at roughly 2.2% annualized in the past three quarters. With the GDP NOW forecast for Q2 is projecting a health GDP growth of 2.3%. (Figure 2) This performance is due in part to robust consumer spending, continued government expenditure, and the capital expenditure cycle in tech and renewables. This strength defies many recession calls and reflects a combination of robust consumer demand, inventory rebuilds, and a recovery in capex, particularly in technology and infrastructure-related sectors.

Yet headline figures may mask important divergences beneath the surface. The economy is transitioning from the post-pandemic stimulus era into a mature-cycle environment, marked by:

Slowing consumption in lower-income households

Increasing reliance on credit and wealth effects

Diverging sectoral performance (e.g., industrial softness vs. tech strength)

Early signs of labor market cooling

This implies that while technical recession risks remain low, the quality of growth is slowly eroding, and the sustainability of momentum is in question.

Consumer Spending: Buoyant but Bifurcated-

The U.S. consumer continues to be the engine of growth, but momentum is uneven across income cohorts:

High-income households, buoyed by stock market gains and real asset appreciation, continue to spend, particularly in discretionary services (travel, dining, leisure).

Low and middle-income households, by contrast, are increasingly relying on credit and have begun to draw down excess savings buffers accumulated during the pandemic. (Figure 3)

Credit card delinquencies and buy-now-pay-later (BNPL) usage are rising. An interesting aside this year 60% of ticket purchases for the music festival Coachella used BNPL. Is this a sign that the US consumer is finally against the ropes? Unlikely, its more probable that a bunch of kids who do not understand their own finances splurged on a concert ticket. I just thought it was an interesting albeit some what sad news story. Moreover, student loan repayments, which just started to be collected again within the past month. Along with rising insurance premiums are exerting pressure on Americans disposable income.

While nominal spending remains strong, real consumption is increasingly financed through leverage rather than income gains, raising concerns about forward sustainability. The path ahead for consumption and therefore the consumer is a precarious one but I have my money on the American consumer winning this one (next 3-6 months). The underlying US economy looks fairly strong and the most recent economic data prints have looked promising.

Labor Market Conditions-

The U.S. labor market has undergone a pronounced but measured normalization following the extraordinary tightness of the post-pandemic recovery. Headline indicators remain robust—the unemployment rate is holding near 4.2%, job growth continues at a moderate pace, and layoffs remain historically low—but momentum is clearly decelerating across a range of metrics.

This shift reflects a transition from an overheated labor market to a more balanced, late-cycle dynamic. The labor market is not in freefall, but signs of softening and asymmetry have become more apparent:

Job openings though still elevated, have been declining in recent monthly readings.

Quits rates have normalized, indicating reduced worker bargaining power.

Wage growth is slowing, especially in lower-wage services and logistics.

On job openings, the latest job openings report come in at 7.19 million. This is about inline with historical averages but is still a decrease of 4.16% from the December 2024 level. (Figure 4)

Wage Pressures: Cooling, But Sticky-

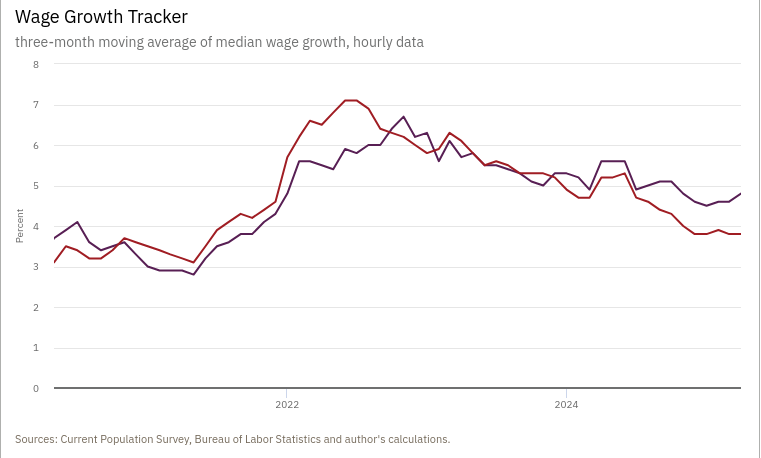

Wage inflation, a key concern for both investors and central bankers, is showing signs of deceleration, but remains above pre-pandemic norms. As of Q2 2025:

Average hourly earnings are rising at 3.7% YoY, down from a peak of 5.6% in early 2022.

The Atlanta Fed’s Wage Growth Tracker shows more pronounced moderation for job switchers, suggesting diminished labor market churn.

Unit labor costs have stabilized, but remain a tail risk for services inflation, particularly in healthcare, education, and hospitality.

Importantly, wage growth is becoming more asymmetric:

High-skilled sectors (tech, engineering, finance) continue to command elevated premiums due to talent scarcity.

Conversely, wage gains in lower-paid roles have plateaued, raising concerns about real income erosion for vulnerable cohorts.

The productivity outlook is a critical swing factor. If the diffusion of generative AI and other technologies boosts productivity meaningfully, the economy could sustain higher wage growth without reigniting inflation. This scenario would be bullish for equites because if companies can use AI to boost profit that will be a net positive for investors.

This divergence implies that while headline wage pressure may ease, underlying inflationary momentum—particularly in services—may prove persistent. Thus making it sticky.

Financial Markets and Credit Conditions:

Financial Market Resilience: Disinflation, Rate Path, and Positioning-

Risk assets have been notably resilient in the face of higher-for-longer policy guidance from the Federal Reserve. At the time of writing risk assets have made a mighty comeback from the low of “Liberation Day”) April 2nd. However much of these gains have been narrowly concentrated into Megacap tech and AI beneficiaries dominate index performance, while small caps and cyclical sectors lag.

The S&P 500 is up 0.82% year-to-date. BTC has had a very solid performance of 11.22% year-to-date. Lets not forget the NASDAQ which has returned 1.77% year-to-date. All indexes have been driven by AI-related growth. Along with resilient corporate earnings, and re-rated multiples in sectors leveraged to soft-landing narratives.

Bond markets have seen violent repricing’s. The 10-year Treasury yield has oscillated between 3.9% and 4.4% in recent months, reflecting a tug-of-war between inflation expectations and growth fears.

High yield and investment-grade credit spreads remain below long-run averages (~330 bps and ~110 bps, respectively), reflecting optimism around macro stability.

Volatility remains subdued, with the VIX hovering around 14–16, suggesting complacency despite geopolitical risks and macro crosscurrents.

However, much of this resilience is built on the expectation of a policy pivot, now tentatively priced for Q3/Q4 2025. While markets have adjusted to fewer cuts than anticipated earlier in the year, risk-on sentiment has been fueled by:

Moderating inflation (core PCE trending below 2.8%)

Cooling labor markets without sharp deterioration

Credit Environment-

While surface indicators of financial conditions—such as risk asset valuations and volatility measures—suggest a market narrative leaning toward soft landing or benign disinflation, underlying credit conditions tell a more complex and cautionary story. The U.S. credit system is currently characterized by tight lending standards and rising risk aversion among banks.

Credit markets remain orderly, but risk premia are compressed. Investment grade (IG) spreads are hovering near 55bps, while high yield (HY) spreads, though wider, are still within pre-pandemic norms. This pricing suggests minimal recession fear—potentially a mispricing.

Bank Credit Standards and Loan Growth: Credit Supply Remains Constrained-

According to the Federal Reserve’s Senior Loan Officer Opinion Survey (SLOOS) released in April 2025:

Lending standards tightened further for commercial and industrial (C&I) loans to firms of all sizes.

Demand for C&I loans declined, consistent with softening investment appetite among corporates.

Commercial real estate lending remains under acute pressure, with standards for construction and multifamily loans continuing to tighten aggressively.

“Banks most frequently cited a less favorable or more uncertain economic outlook, reduced tolerance for risk, and deterioration in collateral values as reasons for tightening.”

— Federal Reserve SLOOS, April 2025

Corporate Credit:

Investment-grade (IG) issuance has been robust, with refinancing demand increasing ahead of expected Fed cuts. Spreads remain tight, but duration risk is a concern.

High-yield (HY) issuance has picked up but remains below historical norms, as risk appetite is selective and market access is bifurcated between BB and CCC-rated credits.

Private credit continues to grow, with non-bank lenders filling the void left by retreating regional banks. Leverage levels and documentation terms in private markets remain a concern for forward-looking defaults.

Bank Lending:

Lending standards have tightened across the board, especially for:

Commercial real estate (CRE): Office sector remains under acute pressure; delinquencies are rising in central business districts with high vacancy rates.

Small and mid-sized enterprises (SMEs): These businesses are facing higher rejection rates and rising cost of capital.

Regional banks, still recovering from 2023 liquidity shocks, have reduced risk-weighted lending and are focusing on deposit retention. Regulatory scrutiny and unrealized losses on securities portfolios continue to constrain credit availability.

Consumer Credit:

Credit card and auto loan delinquencies have risen from post-pandemic lows, particularly among subprime borrowers.

The New York Fed’s Household Debt and Credit Report shows that total household debt has risen to over $17.5 trillion, with mortgage balances stable but revolving credit rising.

Loan loss provisions at major banks are trending higher, anticipating further normalization in consumer credit performance.

The growth rate of bank loans and leases has slowed significantly. Total loan growth across U.S. commercial banks is up just ~2.1% YoY, down from 6.7% YoY a year prior. This contraction in credit supply is being felt most acutely by small and mid-sized enterprises, which depend disproportionately on regional and community banks.

Investor Implications + Trades:

As the U.S. economy navigates a late-cycle environment characterized by decelerating growth, restrictive monetary policy, and asymmetrically sticky inflation—particularly in services—investors must recalibrate their frameworks. While the "soft landing" narrative continues to dominate consensus positioning, underlying fragilities in credit, consumption, and global trade dynamics warrant a more nuanced and tactical approach.

Repricing the Policy Path: Fade the Easing Optimism-

Despite market pricing for three rate cuts in 2025 (as of May), the Federal Reserve remains data-contingent and increasingly focused on underlying inflation persistence, particularly in core services ex-shelter. Terminal rate expectations have re-anchored higher, but cuts are neither imminent nor aggressive unless labor markets deteriorate rapidly.

Investor Implications:

Front-end yields (2Y–3Y USTs) are likely to remain volatile but anchored by sticky inflation and a cautious Fed.

The next FOMC meeting is unlikely have a cut.

Tactical Trades:

Short duration bias via SOFR futures or 2Y swap receivers in the front-end with tight stops.

Consider curve steepeners (e.g., 2s10s or 5s30s) as the Fed nears the end of its hiking cycle and growth slows.

Positioning for Slower Growth Without a Hard Landing-

With real GDP growth moderating toward the 1.5–2.0% range (down from 2.5% YoY in late 2024), but not collapsing, the U.S. economy appears to be entering a non-recessionary slowdown. Labor markets are softening at the margins, and the consumer is exhibiting signs of fatigue, particularly in discretionary and subprime segments.

Investor Implications:

Risk assets may remain supported in the short term, I think equites have a high chance of retesting all time highs.

Credit spreads are tight, but bifurcation within IG and HY opens opportunities for alpha via credit selection.

Equity volatility is underpricing macro tail risks, especially from geopolitics and late-cycle fragility.

Tactical Trades:

Long quality factor in equities (e.g., high ROIC, low leverage).

Overweight large-cap defensives, particularly in sectors with pricing power and resilient earnings (e.g., healthcare, staples, utilities).

Selective short positions in cyclical sectors tied to capex (industrials, materials) or subprime exposure (autos, consumer finance).

Credit Markets: Selectivity Over Beta-

Credit spreads remain tight despite tightening bank lending standards, rising delinquencies in consumer credit, and refinancing risk in CRE and leveraged loans. The disconnect between macro fundamentals and credit valuations argues against passive beta exposure and calls for active security selection and tail hedging.

Investor Implications:

Avoid broad HY beta—focus instead on BB-rated corporates with positive cash flow and strong liquidity.

Monitor refinancing risk in 2025–2026 maturity profiles, particularly in B-rated and private credit deals.

Tactical Trades:

Long short-duration IG corporates or bullet structures in utilities and telecoms.

HY CDS curve flatteners (buy 1Y protection, sell 5Y) to express credit tail-risk hedges.

Consider long volatility overlays via CDX HY options or dispersion trades to benefit from single-name credit bifurcation.

Tactical Equity Trades and Themes-

Longs:

High-quality growth with balance sheet strength, especially in AI, digital infrastructure, and select industrial software.

Dividend growers and low-volatility defensives in a slowing economy.

Healthcare (biotech, services) as a defensive play with optionality.

Shorts / Hedges:

Regional banks, particularly those with CRE exposure and funding cost imbalances.

Cyclicals tied to real asset inflation (e.g., housing materials, autos) under tighter financial conditions.

Consumer finance names exposed to deteriorating credit quality and wage stagnation.

Volatility / Macro Overlay:

If you’re worried that volatility is under priced or are afraid of a volatility blow out. I would look at going long VIX futures or leap calls of your preferred volatility index.

Use index put spreads (e.g., SPX or QQQ) to hedge equity beta in a top-heavy market.

Consider volatility curve steepeners as hedges against macro shocks.

Employ cross-asset correlation trades (e.g., equity vs. credit dispersion) to capitalize on asset mispricings.

Nothing in this email is intended to serve as financial advice. Do your own research.

Thanks for letting me share some of my work!