This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Since 2016 THIS stock has been beating the S&P 500.

Unstoppable hackers keep stealing billions in crypto.

100,000 die yearly from THIS... AI cracked a cure.

If you hate ads, get ready to pay more.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 📈 Underdog Beating S&P 500

While the tech world chases the next disruptive app, a quiet force in the insurance arena is turning everyday premiums into a river of capital… Kinsale Capital Group…

Kinsale collects insurance premiums first, pays claims later. In 2015, they had around $200M in premiums before any claims were paid. By 2024, that grew to ~$2B. ~30% growth each year. Here's the sweet part… this money doesn't cost them a penny in interest. They invest it, earn extra profit, and keep the gains.

Here’s why we’re paying close attention…

They don't insure just anything. In 5 years, they’ve paid out only ~$0.76 cents per dollar in claims and costs. That’s sharp underwriting. It keeps profits high and cash stacked, even when markets wobble.

Operate exclusively in the excess & surplus (E&S) market, covering complex risks like construction, energy, and entertainment. This avoids price wars in standard markets.

Since going public in 2016, Kinsale's stock has grown about ~35% per year. That’s better than the S&P 500 and even outperforming larger, more established insurance companies.

They invests its cash in a mix of corporate and municipal bonds. This helps them grow their money efficiently while keeping risk low.

Kinsale leverages advanced data and automation to assess risk faster and more accurately than competitors still using outdated systems.

Pitfalls…

The Excess & Surplus (E&S) market is profitable, which means more players might jump in. Kinsale has to stay sharp, choosing the right risks to keep profits rolling.

Rising interest rates can lower the value of their holdings and reduce potential profits.

2. 🤯 Stealing Billions in Crypto Since 2017

Crypto is supposed to be secure. Unbreakable. Immutable. But hackers don’t break the code—they break people… North Korean hackers stole $1.5B in Ethereum from Bybit, a major crypto exchange. Not by hacking the blockchain, but by tricking the humans running it…

Bybit’s cold wallet—crypto’s Fort Knox—got breached by deception. Hackers tricked employees into approving fake withdrawals.

Hot vs. Cold wallets… what’s the difference?

Hot wallets = for daily transactions, always online, easier to attack.

Cold wallets = offline, multi-signature approvals, supposed to be rock solid… until they aren’t… the Lazarus Group (what they call themselves) made it look like a normal transaction. Employees signed off. Boom—Ethereum gone.

Not their first rodeo, since 2017 they’ve hacked and stolen over $6B in crypto.

Crypto transactions are irreversible—once it's gone, it's gone. No chargebacks. No fraud protection. No FDIC safety net… even the safest storage isn’t safe if humans can be tricked.

Crypto was built for trustless security. But trust is still the weak spot. Encryption means nothing if someone can just talk you into handing over the keys.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

4. 💉 100,000 Die Yearly From THIS… AI Cracked a Cure

Snakebites kill over 100,000 people a year. The problem? Antivenom hasn't changed in 100+ years—it’s expensive, region-specific, and requires refrigeration. A dealbreaker in the rural areas that need it most... but now, AI is rewriting the rules.

Researchers from the University of Washington and the Technical University of Denmark used AI to create artificial proteins that can stop snake venom.

The research behind this is wild…

AI designed 10,000+ potential proteins to block venom’s deadly effects.

Lab tests showed 1,000x better binding than traditional antivenom.

In mice:

100% survival when given venom + AI proteins.

80-100% survival even when treated 30 minutes later.

Stable at room temperature for weeks (no cold storage!).

Works across multiple snake species.

Human trials are expected in 2-3 years.

The company behind this research… Archon Biosciences…

Private company, but the founder David Baker, has partnered with big pharma before (Novartis & Eli Lilly)—expect similar moves here… so far he’s raised $20M in seed funding.

This isn’t just about fighting venom—it’s a glimpse into the future of drug design.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 The Economy Rocket, simplifies investing for busy professionals with data-driven, long-term strategies that cut out the daily market noise. Delivering a fundamentals-based stock list each day, making investing hassle-free.

👉 Magnelibra Markets, where decades of professional trading and research come together to give you the mental cues required to be a successful trader and where they breakdown the most important topics driving today's financial markets environment.

👉 Indieniche, featuring tips and stories from successful self-made founders. They share insights on building great products, growing your business, and showcasing essential tools to help you build and scale better.

👉 Nivaldo Puldon Ibarzabal, when it comes to trade advice, nothing beats relying on nearly 40 years of trading experience. This finance-focused newsletter condenses that experience for the benefit of fellow traders!

👉 The Market's Compass, technical analysis of various financial instruments to aid both short-term and long-term investors in their investment decisions.

Top 3 Charts of the Week

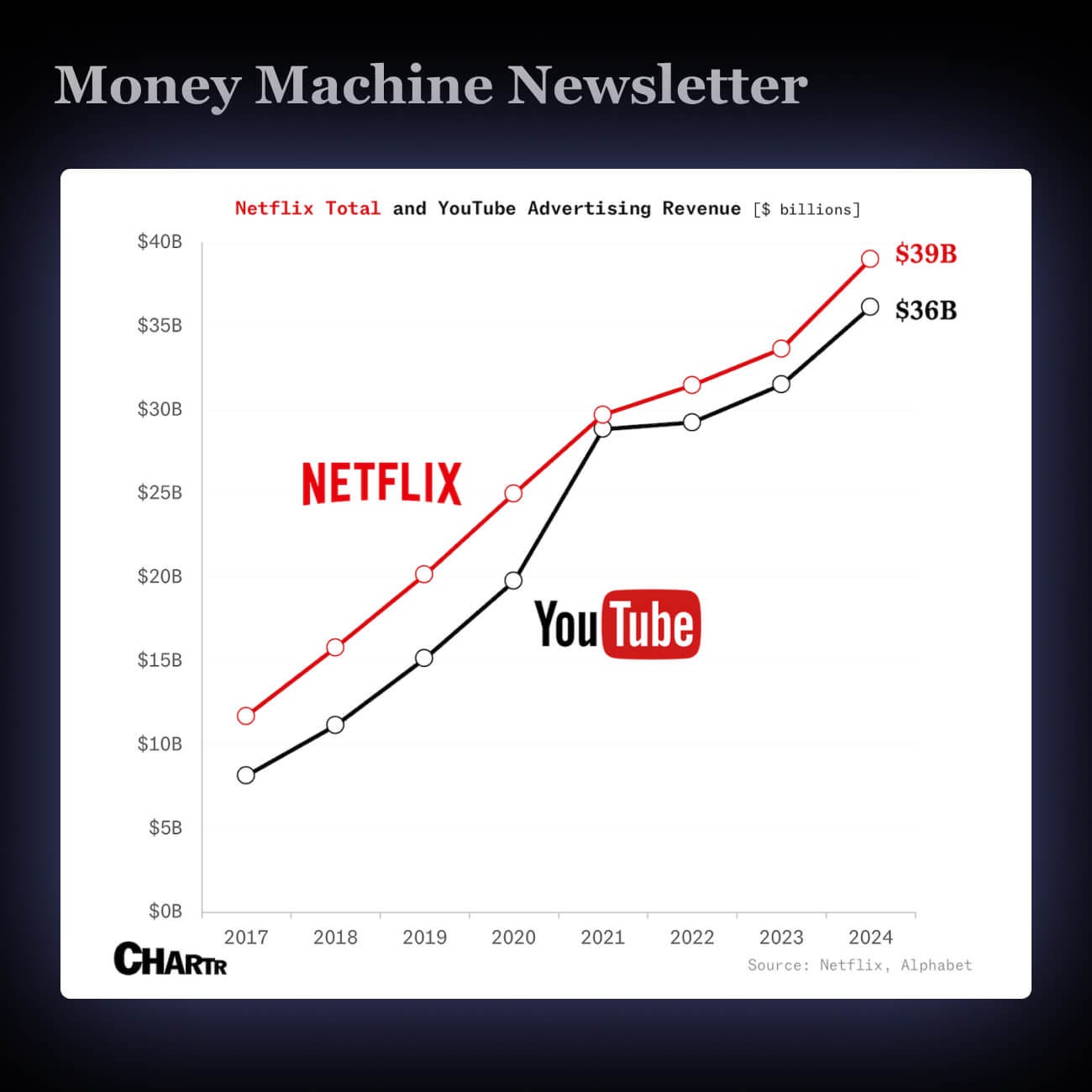

1.💰YouTube's Ad Biz Alone Is Almost Netflix-Size

YouTube is testing a cheaper ad-free plan, “Premium Lite.” Meanwhile, Netflix is all-in on ads. YouTube pulled in $36B just from ads in 2024—almost as much as Netflix’s total revenue of $39B.

YouTube chases subscribers. Netflix chases ads. YouTube makes 70% from ads, but TV viewership is up. Over 55% of new Netflix users pick ads.

If you hate ads, get ready to pay more. If you love cheap plans, expect more commercials.

2. 😳 Amazon Just Overtook Walmart in Sales

Amazon just beat Walmart in total sales for the first time—$187.8B vs. $180.6B last quarter.

Amazon isn’t just selling stuff. It’s cloud, ads, and subscriptions. Walmart? Still mostly groceries.

Amazon pulls in more revenue, but its profits come from different places. AWS drives most of the earnings, while Walmart scrapes by on thin retail margins.

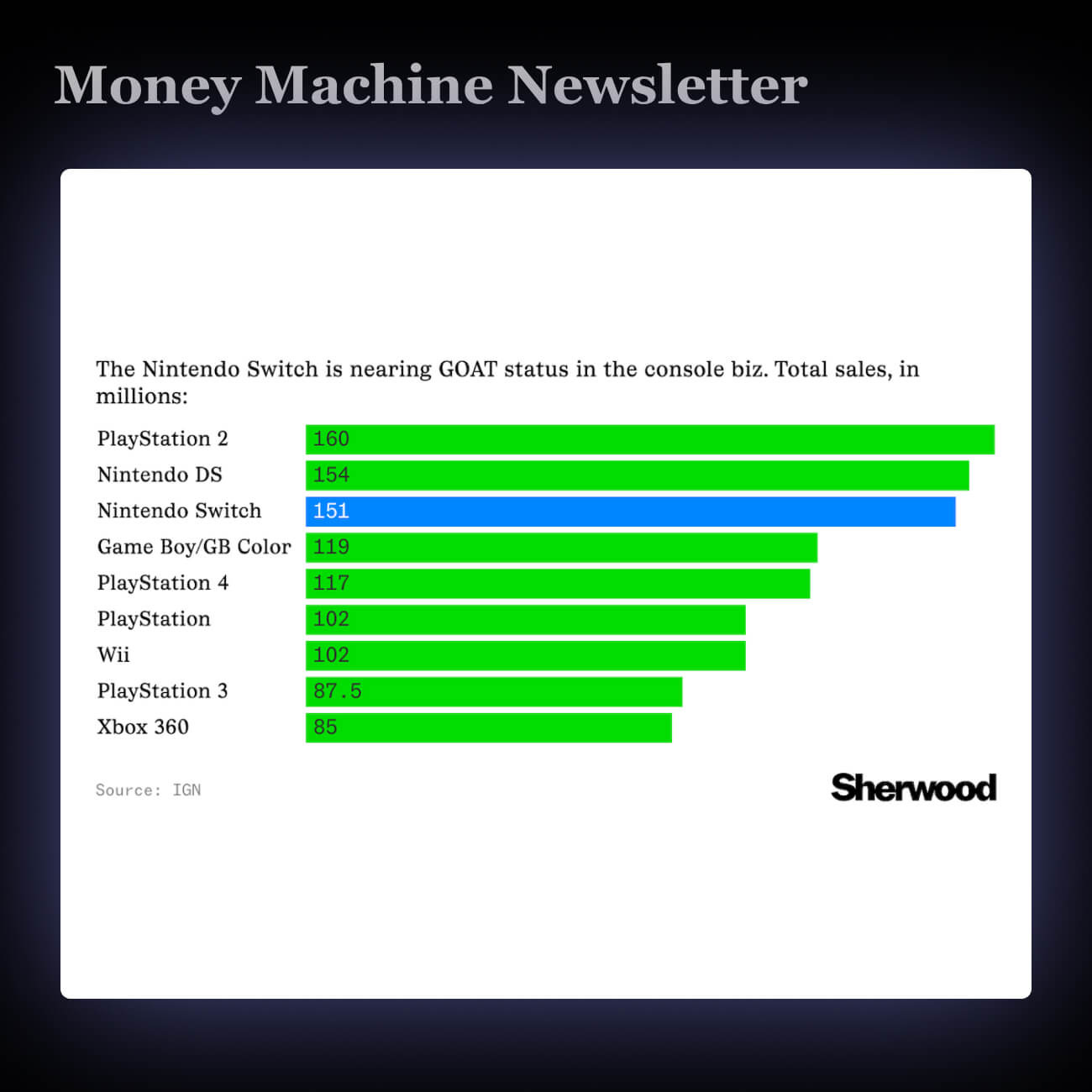

3. 🎮 Nintendo Switch Is Nearing GOAT Status

Nintendo’s Switch crushed it for eight years, but sales are slipping. Enter Switch 2. Launching this year. Investors are all in—Nintendo’s stock jumped ~38% after leaks dropped.

Switch 2 is a big test. The gaming market’s packed, and repeating past success won’t be easy. Nintendo leans on its own games to stay ahead, but that might not cut it this time.

Nintendo’s stock is riding high on hype—the real test is whether the Switch 2 can actually deliver.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.