Money’s complicated. Investing feels intimidating. And most finance advice? It’s dry, out of touch, or full of jargon.

The Finance Homie changes that. It’s real, relatable, and practical—finance through the eyes of a Black millennial who’s actually doing it. Building a six-figure stock portfolio, figuring out budgeting, saving, and investing—all shared in a way that makes sense.

If you want financial advice that feels like it’s coming from a friend, not a textbook, this is the newsletter to read.

I’ll let The Finance Homie take it from here…

I can’t remember the year, but I went to Miami with a friend one summer. I won’t go into the salacious details of the weekend, but I fell in love with South Beach. To save money, I flew into Fort Lauderdale because it was a bit cheaper. Call it poor planning or just partying too hard but I had no way of making it back to the airport. I was stranded. Eventually, I begged a metered cab to take me and made my flight with just an hour to spare.

As I was researching new stocks to buy back in 2021, I examined the companies that have disrupted the way we interact. Amazon, Google, Apple, Meta, Netflix…you get the picture. Enter Uber, one of the most disruptive companies in our lifetime. How could I not think of this as a Black guy trying to catch a cab in NYC? What started out as a “car company” has become a verb and staple in our everyday lives. It has grown to become a transportation logistics network that operates all over the world. Their motto, “Go Anywhere, Get Anything,” is beginning to reign true. Uber is building a “super app” right in front of our eyes. All of your travel essentials at the tap of a button.

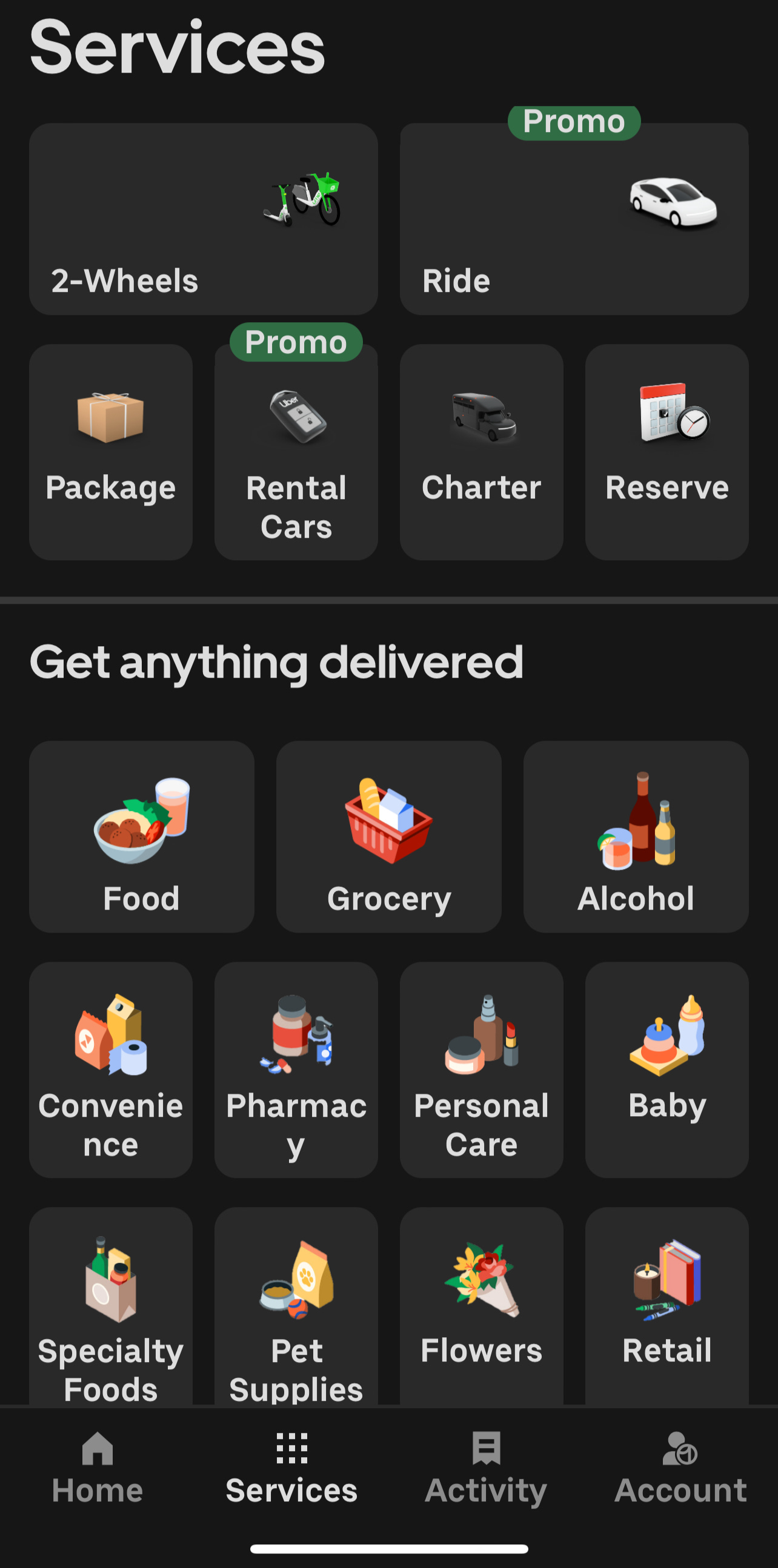

Whether you’re looking for a ride after a late night or craving sushi after work, you’ve probably opened your Uber/Eats app at least twice a week. I’m quite often surprised how many friends don’t recognize the many capabilities of using Uber. The app currently offers package delivery, alcohol, groceries, car rentals, car reservations, Uber for teens, scooter/bike rides, charter buses, airport shuttles, and more. There’s also Uber explore which I’ve used in New Jersey that allows you to make dinner reservations powered by Open-table. They also have a cargo freight division, Uber Boat in London, autonomous cars via a Waymo partnership (more on this later), and even hot air balloon rides in Turkey. I can envision even more use cases like booking flights, buses, trains, and flying taxis (which will be a reality with the Joby Partnership in the next couple of years).

This is why I’m excited about the company's future later in the decade. Its TAM continues to grow with rides/eats/freight and is still expanding in other countries with over 170 million monthly active users. The company that was burning cash has finally turned net positive under the guidance of superstar CEO Dara Khosrowshahi. Uber One also continues to add subscribers which allows you to get cash back on rides, free delivery on food and other benefits. I can easily see this becoming an Amazon Prime-like necessity for power users.

Autonomous Risk

I had the pleasure of taking my first autonomous Waymo ride in Phoenix and was stunned at its capabilities. The Google backed Waymo continues to expand into other cities and hit 200k paid riders per week. Add in the Tesla Cybercab threat which may launch this year, and it’s easy to see why so many people are concerned about Uber’s future if customers can get cheaper rides elsewhere. My thesis is that Uber is merely a platform, sort of a middle man connecting people-places-things. There will be more autonomous entrants and I don’t believe it’s a winner takes all market…yet. If we have 5 driverless car companies, most of them won’t decide to embark on their own. Do you really want 8 different taxi apps on your phone? Will they all service the same area? Scaling a fleet of cars to compete with Uber won’t be cheap either. Sure, Google can afford to burn cash, but still have to account for fleet management, maintenance, cleaning, charging, idle time, etc.

Here’s what I think the future looks like. There will be a hybrid of human/autonomous drivers both serving specific use-cases and areas. You’ll have the big players like Waymo and Tesla who may eventually decide to compete on their own. You’ll also have other entrants like Zoox, Wayve, WeRide, and BYD, with most opting to work with Uber’s platform of 170 million users. In the end, Uber can win because of its ubiquitous supply and demand. People want to get to their destination as quickly as possible. Whether that’s a human or robot, Tesla or Waymo, get me home! Whoever can supply by transportation needs the fastest will be rewarded. Right now, nobody offers an aggregation of options like Uber.

Uber remains one of my favorite companies and a stock I plan to hold for years to come. The growth story is just getting started and I can’t imagine a world where Uber isn’t necessary to travel. I don’t know where you’ll be vacationing next, but I know you’ll be using Uber.

Disclaimer: I am a shareholder of Uber. I am not a financial advisor and thoughts here are my own.