This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Trump may have found a backdoor to the Fed.

AI that doesn’t need prompts—it just gets to work.

The few holding up the economy are starting to step back.

One country is stick with rising prices. The other, falling.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🚪 Trump’s Side Door Solution

A policy pileup is brewing… For a while, we all thought interest rates were headed down. The Fed hinted. The market cheered. Now? Not so fast… They paused rate cuts — again. The “4 or 5 cuts this year” idea? Off the table. Maybe 2 cuts next year. Big maybe. So what’s the holdup?… major disconnect at the top…

The Fed and Treasury aren’t on the same page…

The Fed wants to stay put. The Treasury? Still borrowing trillions — mostly short-term — and rolling the dice on higher future costs. That’s bad timing… Nearly $10T in government debt needs refinancing — at today’s much higher rates. That’s like locking in a credit card at 25%… after missing the 0% window.

The Fed’s playing it cool…

They’re in “wait and see” mode. Why? Too much noise. Tariffs, spending cuts, rate pressures, immigration policy — it’s all hitting at once. No playbook. No clear signals.

Meanwhile, the bond market’s blinking yellow — rates have slid ~30 basis points in a month. That’s Wall Street whispering: “This could get ugly. Cut soon.”

Main street feels it first…

Shoppers are squeezed. Prices on fast fashion jumped 27%+. People can’t spend like they used to. Confidence is cracking. DOGE is also trying to cut $1T in spending by September. Less money flowing out = less money circulating in. That’s a classic recipe for… recession.

A proposed workaround?… local lending…

If the Fed won’t cut… Trump wants to deregulate small banks to free up credit. Local banks helping small businesses stay afloat. It’s a side door solution — but one that could matter a lot in a downturn.

2. 🤖 AI’s Workaholic

While everyone’s busy chatting with bots, this one just listens once—then works in silence until the job’s done…

A Chinese startup launched Manus—an AI that works on its own. You give it a goal, it gets to work, and keeps going even after you log off. 2M people are on the waitlist. Invite codes are going for over $1,000.

This is a different kind of intelligence…

It uses 29 integrated tools, from web browsers to code terminals.

It splits into sub-agents, each handling a piece of the task.

It works transparently—you can literally watch it go, via its virtual desktop.

Early users say the magic is in the hands-off part. You spend less time managing—and more time seeing results. They’ve used Manus to…

Plan vacations

Build websites from plain English

Analyze e-commerce trends

Compare insurance

Generate lessons for education

And they didn’t have to stay in the loop while it worked.

No back-and-forth. No prompt engineering. No "how do I ask this right?"

Alibaba’s AI team is backing it with infrastructure… and developers are building with it across consumer and enterprise use cases…

This feels like another BIG shift in how we use AI. The winners won’t just build smarter tools—they’ll build ones that don’t need you in the room.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 😳 An Economic Reboot Is Coming

The U.S. economy is dangerously top-heavy, and the few people propping it up are starting to step away…

We’ve heard the headline: “The economy’s strong.” But that’s just the surface.

The truth? It’s been running on the backs of the top 10%—and they’re getting tired.Over the last decade, the rich got richer and kept the economy afloat with their spending. They own the assets. They saw their wealth balloon. They shopped, traveled, invested—and that masked the pain for everyone else. That’s why Wall Street soared. That’s why the government kept saying “We’re fine.” But now the top 10% are pulling back too.

The cracks…

The top 10% now drive half of all spending in the U.S. That’s a record.

Even they’re cutting back—vacation plans at a 15-year low, airlines slashing forecasts, retail giants like Walmart and Costco lowering outlooks.

S&P 500 is wildly overvalued, trading at a P/E of 21 vs. a historical average of 16.

And the bottom 90%?

Mortgage payments: up nearly 100%.

Car insurance: +54%.

Egg prices: +15% in one month.

Inflation stole their spending power. Wages haven’t caught up.

And now even the “rich cushion” is wearing thin.

We’re heading into a reboot… not a crash—yet. A slow unraveling of the idea that the market can go up forever. We’ve hit the point where “pay later” turns into “pay now.” Buy-now-pay-later is literally delivering Taco Bell in four installments. That’s not innovation. That’s a red flag.

Don’t get caught in the illusion…

Markets may still rally in the short term. That’s what they do. But the writing’s on the wall. If you're invested, be cautious. If you're on the sidelines, look for signals. And if you're building something, build it on solid ground—not stimulus sugar.

The next story isn’t about “more growth.” It’s about who gets to grow from here on out. That’s the shift. And it's already started.

Top 3 Charts of the Week

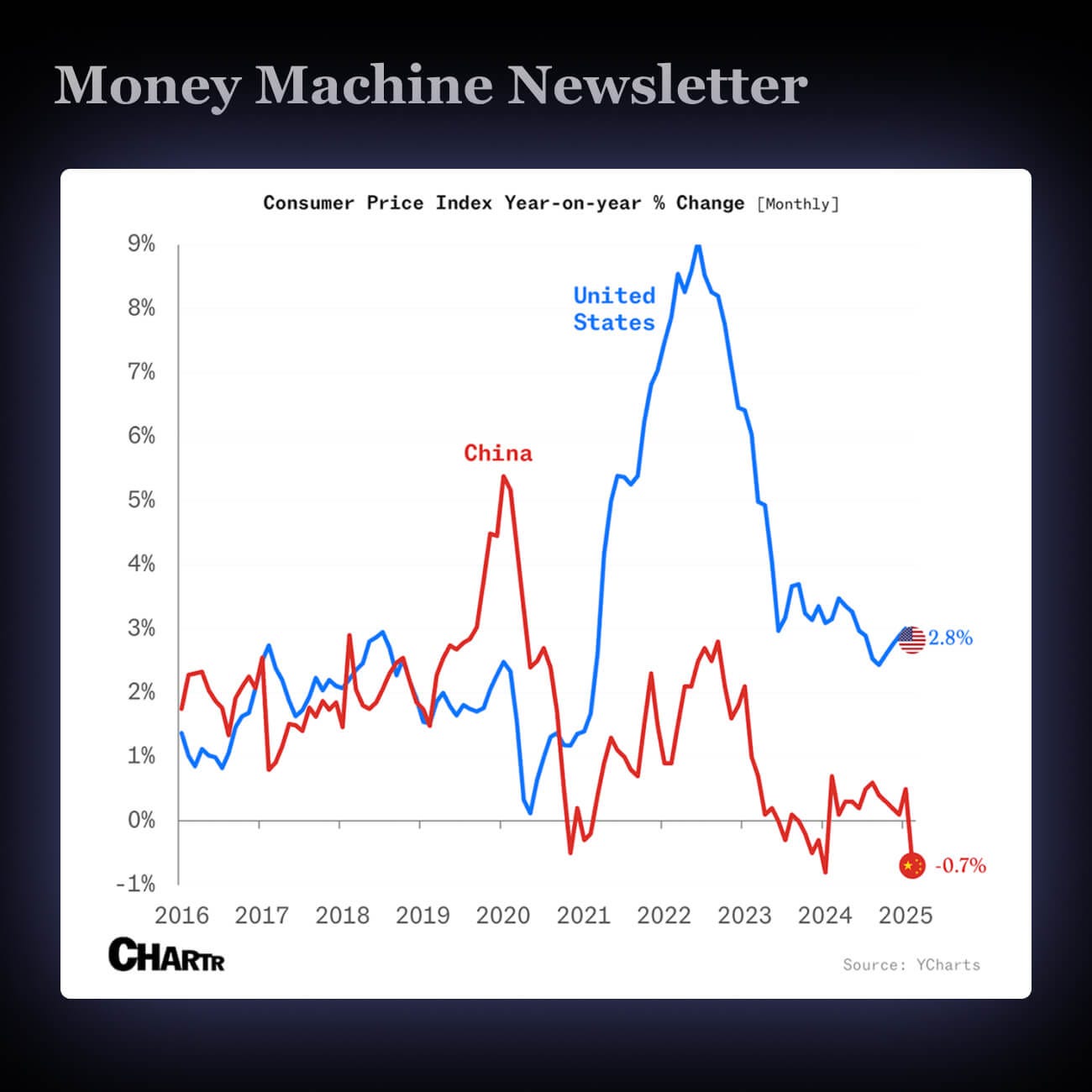

1. 🧐 US & China's Diverging Inflation Paths

U.S. has an inflation problem — prices are rising. China has the opposite — prices are falling. U.S. inflation hit 2.8%, while China’s dropped to -0.7%.

Rising prices hurt buyers (U.S.)… Falling prices (China) may sound great but… deflation makes people wait. Consumers hold off. Businesses pause. Why spend now if prices will drop tomorrow? The result? Less spending, more saving—

which leads to even lower prices. A vicious cycle. Both mess with the economy in different ways — one overheats, the other freezes.These are the world’s biggest economies. If either one stumbles, it shakes the global market. China just launched a 30-point plan to fight deflation. The Fed is still figuring things out.

2. 😬 New Apps Are Flopping Hard

Most new apps fail fast — 81% don’t even make $1,000/month after two years. Only the top 5% earn real money, about 400x more than the bottom 25%.

Subscriptions alone aren’t cutting it. Developers are now blending in other ways to make money — like one-time purchases — especially in gaming and lifestyle apps.

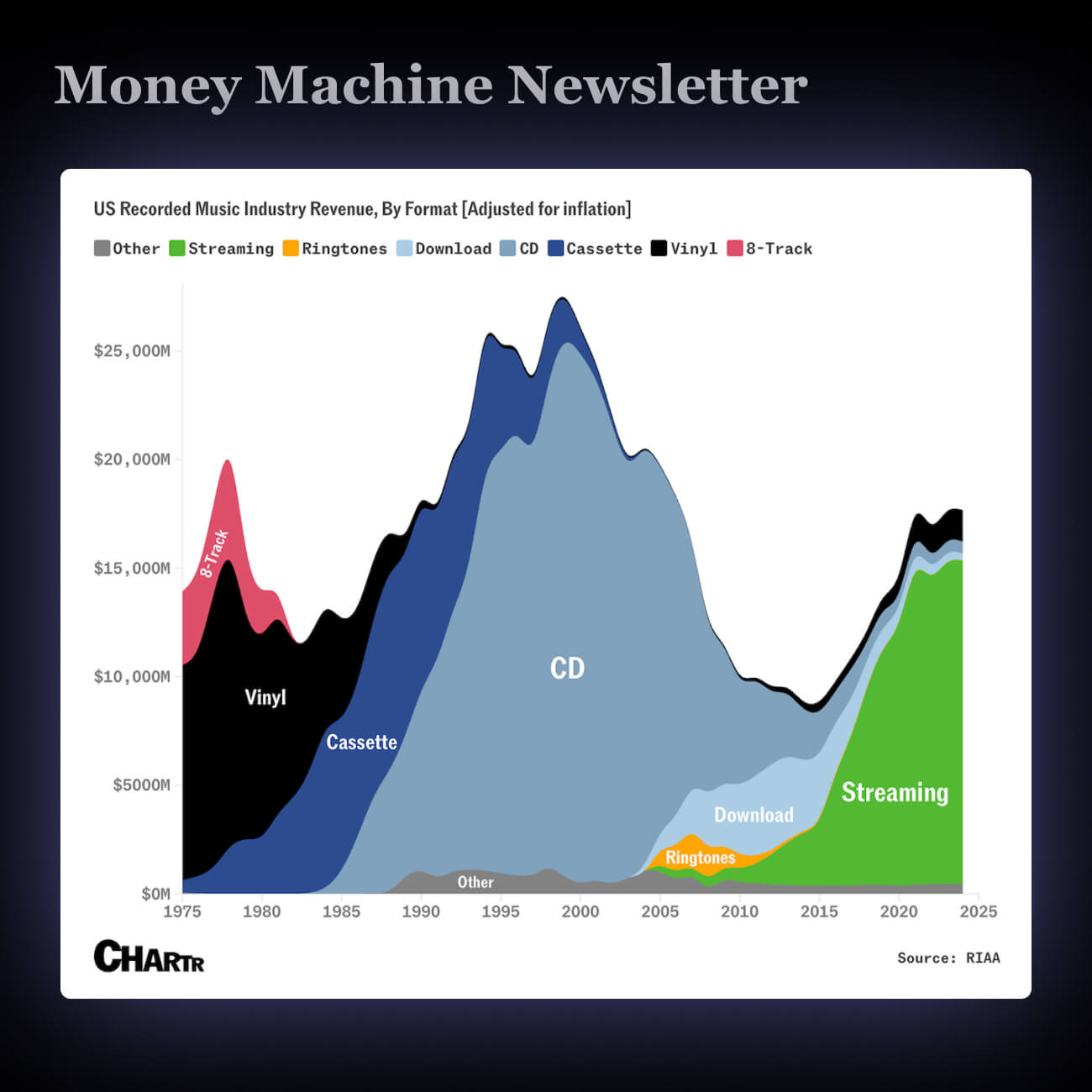

3. 🎶 A Brief History Of The Music Industry In America

100M Americans now pay for music subscriptions. Streaming made up 84% of the music industry's revenue last year, bringing in $14.9B. Spotify alone paid out $10 billion in 2024.

Streaming isn't just music's future — it’s the present. How you access it is shaping who gets paid, how much, and what gets made.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 EXPANSE STOCKS, knowledge base for quality & growth investing.

👉 Cryptofada Research, they share profitable and actionable early-stage crypto investment opportunities weekly via Airdrop|Testnets|Public Sales|Presales|ICO|IEO and Trading strategies.

👉 FluentInQuality, helps you invest in high-quality companies that turn investments into exceptional returns. These businesses generate reliable cash flows, operate under skilled management, and dominate their markets with monopolistic or duopoly advantages.

👉 Hidden Market Gems, A finance newsletter written by a straight-talking entrepreneur who gets straight to the point and uncovers high-potential hidden gems.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.