❌ TikTok Isn’t the Only Ban Happening

Plus: Market Tells Powell 'Cool Story Bro...' (Not Good), and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Paying 30 years of home insurance to be left holding the bag.

THIS has happened only twice in the market since the ’80s.

Making BANK under Trump's presidency.

China out here cannibalizing the car industry.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. ❌ TikTok Isn’t the Only Ban Happening

You've been paying home insurance for 30 years... one day, you get a letter from your insurer saying arrivederci... they bail because it no longer makes businesses sense to cover you... weeks later, a disaster destroys your home, your life savings, gone... this is the reality in California right now... this madness needs to stop...

In July 2024, State Farm bounced from Pacific Palisades, dropping home insurance for more than 1,600 folks… months later, they’re hit with these savage wildfires… 0 insurance.

It’s a trend… natural disasters are getting worse… some home insurers are banning California and Florida… why? a combo of rising costs, old pricing models, and strict regulations…

Billion-dollar weather disasters in the U.S. are surging… in 2024, there were 27 events, just shy of 2023’s record of 28.

State laws keep insurance rates artificially low, but risks stay high. So, home insurers bounce from high-risk areas.

Until THIS MONTH, California had a ban on weather models to price policies more dynamically.

California's FAIR Plan is a joke... it's responsible for insuring ~$6B worth of homes in Pacific Palisades alone, but only has ~$200M set aside to pay for claims.

Free market solutions are the only solutions…

Let insurers price risk fairly. It encourages smarter building—fireproofing, weatherproofing—and rewards preparedness.

Artificial insurance markets boost property values short-term but risk a crash long-term.

Without smart reforms, taxpayers and homeowners will pay the price. Leaders need to ditch red tape and let markets do their job.

2. 🥱 Market Tells Powell 'Cool Story Bro...' (Not Good)

Revolutions don’t start in spreadsheets... right??? Well... long-term bond markets are rebelling against the Fed... NOT GOOD.

Since September 2024, the Fed cut rates by 1% to boost the economy… but the 10-year Treasury yield pretty much said, cool story bro… it called the Fed’s bluff… jumping from 3.6% to 4.77%... something that’s happened only twice since the 1980s… this rise in Treasury yields despite Fed cuts show the market disagrees with the Fed.

What’s going on?

Job growth remained strong in December, with 256K jobs added, and inflation rose from 2.7% to 2.9%... on top of that, some analysts now predict rate hikes, not cuts, in 2025.

Without the market’s trust, the Fed’s plans to boost borrowing and spending fall flat… risking more inflation and instability… in turn… businesses, consumers, and investors struggle… the real challenge?… rebuilding trust and regaining control.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $90/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

MAKE MONEY or GET YOUR MONEY BACK GUARANTEE. If you subscribe today, use it actively for a year, and don't make money, we'll refund your payment and give you an extra year for free.

Get $13,890.80 worth of value for just $90/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

4. 👀 Profiting Big in Trump’s Second Term

In 1981, Reagan took office, cut regulations, and sparked a massive economic boom—stocks soared, industries thrived, and investors made BANK… buckle-up because it’s happening again… with Trump's push for free-market principles, certain companies are primed for massive growth… there’s a lot of noise about “Trump bump” stocks... but it's just that, noise... we cut through the BS and found 3 stocks with real potential under this new administration… and we’re paying CLOSE attention…

1st stock is tied closely to Trump’s inner circle.

2nd stock figured out how to profit from gold without ever swinging a pickaxe.

3rd stock has a bitcoin lunatic behind the wheel… and we love it.

tldr on why we’re paying close attention to these...

Deregulation in healthcare, energy, and finance fuel innovation.

Economic uncertainty typically boosts demand for inflation hedges.

Let’s dig in…

$1.6T U.S. healthcare system needs change, and Trump’s privatization plans could create big opportunities for efficient players like Oscar Health...

Oscar grew from ~$500M to ~$8B in revenue in a few short years but is still undervalued compared to traditional insurers.

Privatized healthcare policies could drive explosive growth.

Close ties to the Trump family, co-founded by Jared Kushner's brother, Joshua Kushner.

Crypto adoption is speeding up, and Trump’s crypto-friendly stance could keep sparking Bitcoin booms, setting up MicroStrategy nicely…

MicroStrategy’s use of debt to buy Bitcoin makes its stock move ~3x more than Bitcoin’s price.

If Bitcoin continues to get institutional backing from Trump, MicroStrategy’s returns could outpace Bitcoin itself.

As the U.S. faces inflation and rising debt, gold still remains a safe haven. Franco-Nevada offers low-risk, high-margin exposure to gold…

Franco-Nevada brings in ~$1B in revenue with just 45 employees—an insane level of efficiency.

There's always a possibility that Trump’s policies might spark inflation, raising gold demand and boosting Franco-Nevada’s revenue.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Unleash Your Potential Blogs, learn how to make money through marketing and sales—more than most schools can teach you in 12 years!

👉 AI DailyPost, join 1,000+ AI professionals with a concise weekly digest of the top 5 groundbreaking AI research papers.

👉 No Straight Lines Investments, provides readers with a unique combination of: i) analysis of key macro data ii) weekly flow and positioning nuggets iii) chart/technical insights, all used to support bottom up stock selections, in an easy to read format.

👉 The Contrarian Capitalist, Macroeconomics, geopolitics, energy, metals + freedom. Bringing TRUTH and a healthy dose of COMMON SENSE to the world. Providing solutions to life’s challenges (Plan B et al) and a contrarian way of thinking. Being the Yin to everyone else's Yang.

👉 T&G’s Substack, earnings reports, market analysis & market predictions. Subscribe today for your daily recap of the market.

Top 3 Charts of the Week

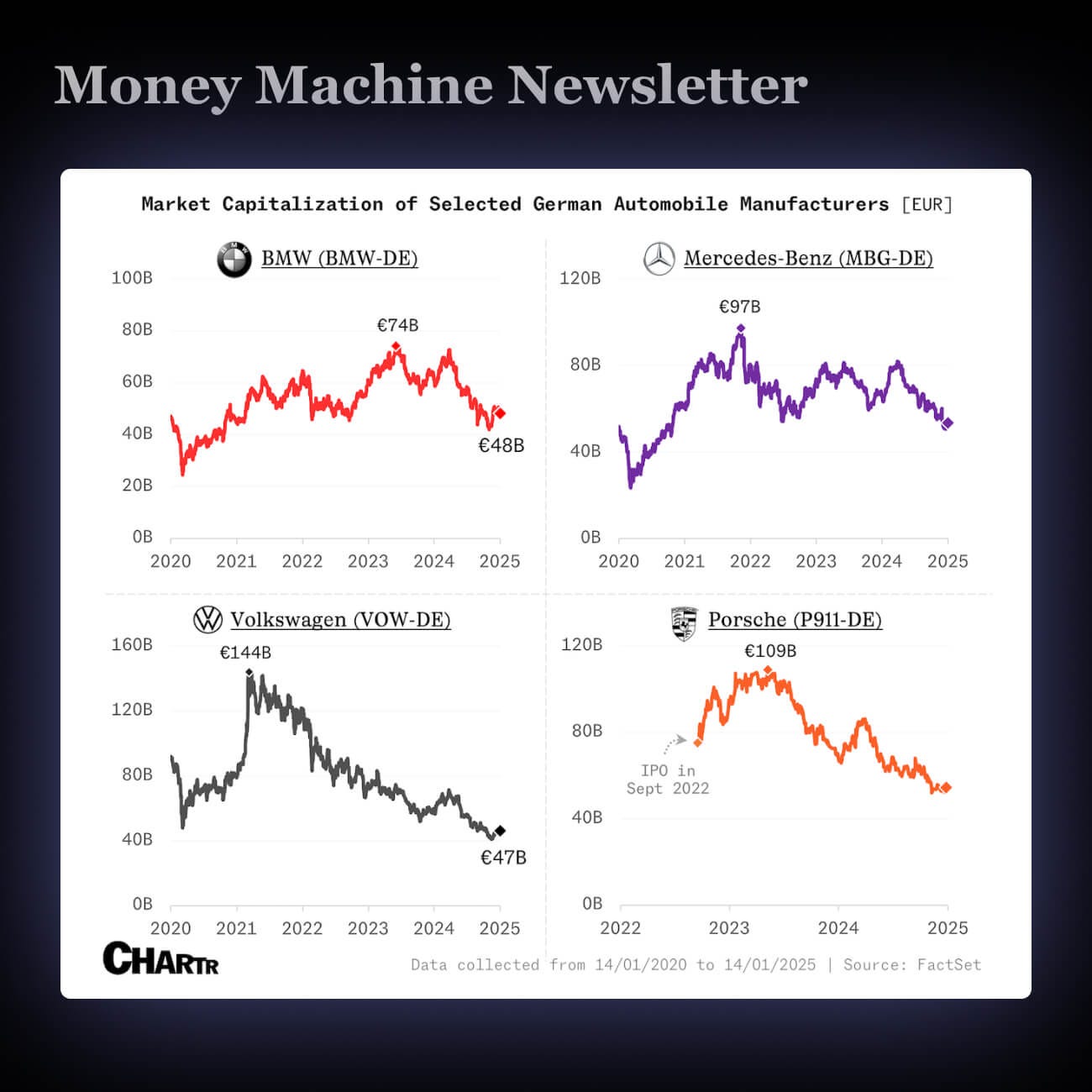

1. 🚗 Germany's Iconic Carmakers Are Losing Ground

Germany's economy shrank again as high energy costs, rising rates, and China’s cheaper EVs hit growth.

Volkswagen, BMW, and Mercedes-Benz saw global sales drop 2%-4% in 2024. In China, where local brands now dominate 70% of the market, their sales fell even more—up to 28%.

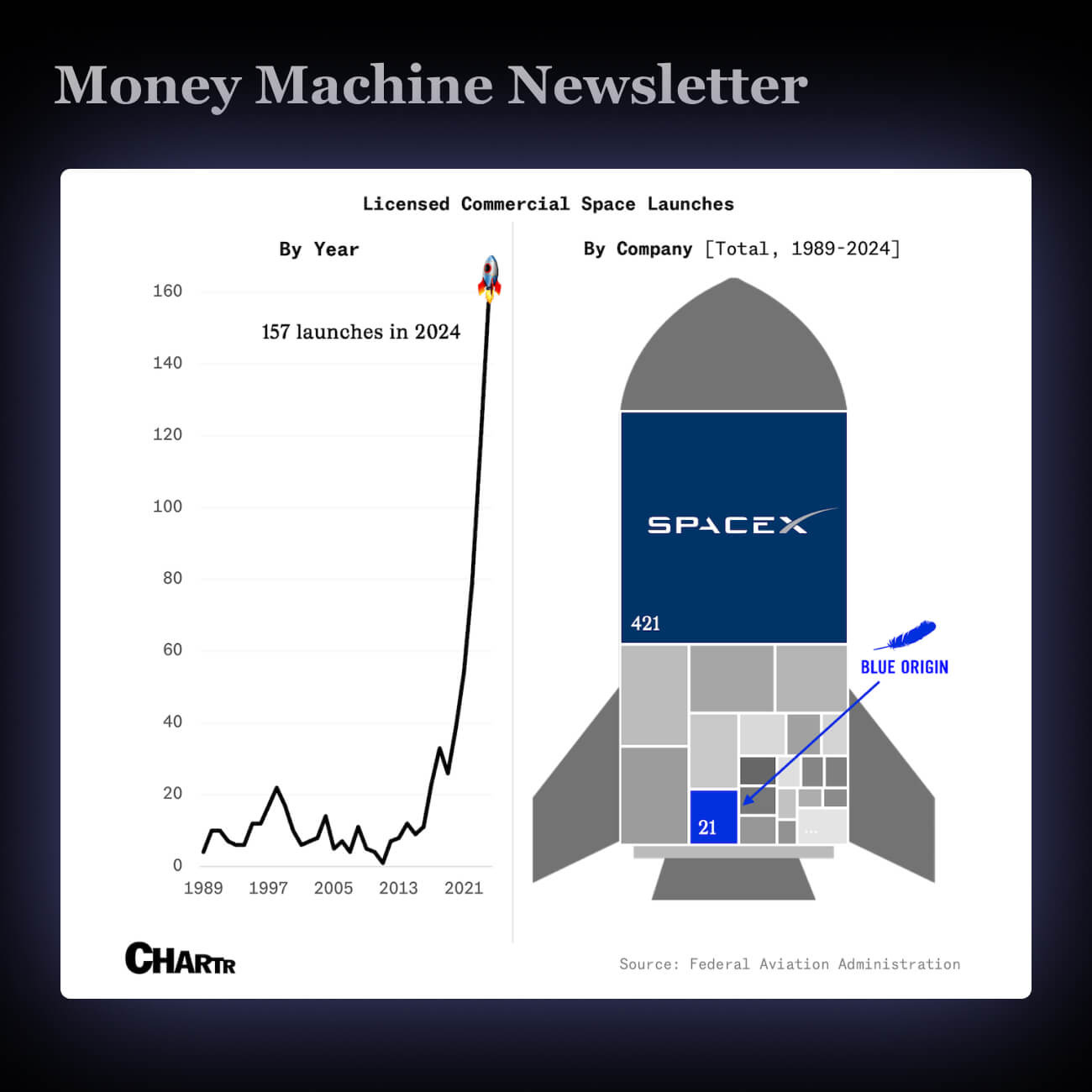

2. 🚀 SpaceX Is Ahead in Space Race

Blue Origin's New Glenn rocket made its first orbital launch from Cape Canaveral—a major milestone.

SpaceX is winning the space race, with 65% of U.S. commercial launches.

New Glenn rocket could secure major Pentagon contracts and compete with SpaceX.

3. 🍔 Has McDonald’s Reached Its Peak in America?

McDonald’s is testing a new drink-focused restaurant, CosMc’s. After a year, they're closing three big stores and opening two smaller ones to refine the concept.

McDonald’s is struggling to grow in the U.S., with over 900 stores closed since 2015, including ~200 in 2021 alone. CosMc’s is their experiment to find fresh profit ideas, but results so far seem mixed.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.