Good morning, everyone, and welcome to all who joined over the weekend!

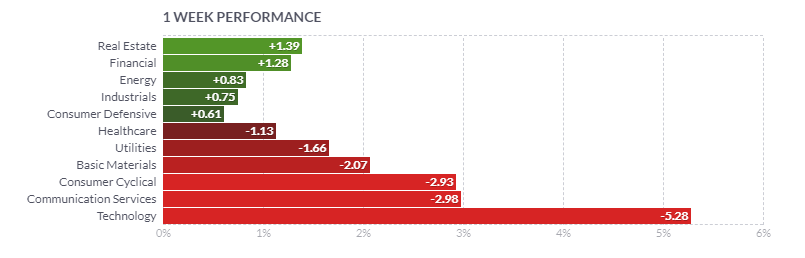

Last week we saw some pretty hard selling for three consecutive days. While this is not out of the norm, given the strong rally we’ve had for a few months, some things caught our attention. 1- Buyers have been quick to buy the dip in recent declines but not last week. 2- We broke a solid support level on the S&P 500 and closed below it. 3- Investors are rotating out of the technology sector and looking for defensive sectors. 4- Political turmoil is having a more significant impact on equity markets than in the previous few months. These items on their own are not of major concern, but combined, they certainly signal a potential change of trend, at least in the short term. This does not mean we have to turn bearish yet, but we should definitely trade with caution and start looking at the sectors below that monies are rotating into.

Check out this week’s trade ideas.