💎 THIS Crystal Could Disrupt a Multi-Billion Dollar Industry

Plus: Biotech That Is Making Sex Obsolete, Sleep: Part of a $1.8 Trillion Goldmine, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

A tiny crystal is unlocking digital immortality.

THIS biotech lets parents design a baby.

Sleep has the highest unmet needs, a $1.8T goldmine.

80% of THIS sector has 0 employees, and it's growing fast.

And more. Let’s get to it!

Follow us on Instagram | Advertise to our 7K+ subscribers

But first…

Ready to get serious about investing?

Join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Become a premium subscribe today for just $9/month and receive market beating stocks. Picked by elite traders. In your inbox. Every Monday, before the market opens.

Top Insights of the Week

1. 💎 THIS Crystal Could Disrupt a Multi-Billion Dollar Industry

In Superman, they used crystals to store an unthinkable amount of knowledge…It’s no longer sci-fi. A new tech, being called Superman crystal or digital immortality, could represent a multi-billion-dollar opportunity in data storage.

What is this new tech? 5D memory crystals…

Ultra-fast lasers write data into tiny crystals.

Can store up to 360TB of data—imagine fitting 360M books into something the size of a coin.

Can survive both freezing or scorching hot temperatures.

A few companies quietly advancing this tech…

Microsoft’s Project Silica, glass plates that store 7TB and last thousands of years—partnered with Warner Brothers to archive films.

SPhotonix, crystals that store 360TB and last billions of years.

Cerabyte, ceramic-based data storage, 100TB, last thousands of years.

Next-generation data storage market: ~$89B in 2024, projected ~$136B by 2028.

2. 🤔 Biotech That Is Making Sex Obsolete

Is the future of reproduction more about lab coats and data than romance? Sounds strange, but it’s happening. Parents can now design a baby…It’s known as In Vitro Fertilization (IVF) with preimplantation genetic testing (PGT).

Cord blood banking is also seeing a rise in demand.

All of this taps into an incredibly powerful driver...parental fears. Parents will pay to secure their child's health. A few companies on our radar...

Cooper Companies, focuses on IVF technologies.

Revenue: $1.003B, compared to $929M last year.

Operating Income: $192.5M, compared to $151.6M last year

Profits: $104.7M, compared to $85.3M last year.

Takeaway: Strong in fertility products, with better profit margins thanks to improved efficiency.

Illumina, focuses on DNA sequencing and genetic testing.

Revenue: $1.11B, compared to $1.18B last year.

Operating Income: $84M, compared to $82M last year.

Profits: $57M, compared to $50M last year.

Takeaway: Improved its cancer detection tools, updated sequencing chemistry for its instruments, and released new data analysis software.

Cryo-Cell, cord blood banking company.

Revenue: $8.0M, compared to $7.8M last year.

Operating Income: Not disclosed, but spent 6% less on production costs and slightly cut their general expenses compared to last year.

Profits: $656K compared to $221K last year.

Takeaway: Steady growth with ongoing R&D, and new partnership with Duke for clinical studies and lab development.

Assisted reproductive tech market: ~$45B in 2024, projected ~$91B by 2028.

3. 💤 Sleep: Part of a $1.8 Trillion Goldmine

Sleep has the highest unmet needs among consumers for health and wellness.

Global sleep market is projected to hit $125.3B by 2027.

Cubby Beds helps special needs kids with sensory aids and cameras, bootstrapping to tens of millions in revenue.

Adapting a similar immersive sleep experience for health-conscious adults taps into unmet needs for sleep wellness–“the Huberman Bed”.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Partner Growth Newsletter, weekly newsletter doing deep dives into the fastest-growing startups and interviews with founders, operators, and investors. Subscribe for free.

👉 Wangari Digest, capital markets and sustainability analysis from a Paris-based particle physicist turned investment professional. New insights every Tuesday. Subscribe for free.

👉 ThirdSpace Buzz, unlock your entrepreneurial potential: a newsletter for visionaries, innovators, and leaders. Subscribe now for free.

👉 The Weekend Investor, take 5 minutes a week to boost your financial knowledge, build a strong portfolio, and stay updated on key market moves. Perfect for busy young professionals. Subscribe for smarter finances.

Top 3 Charts of the Week

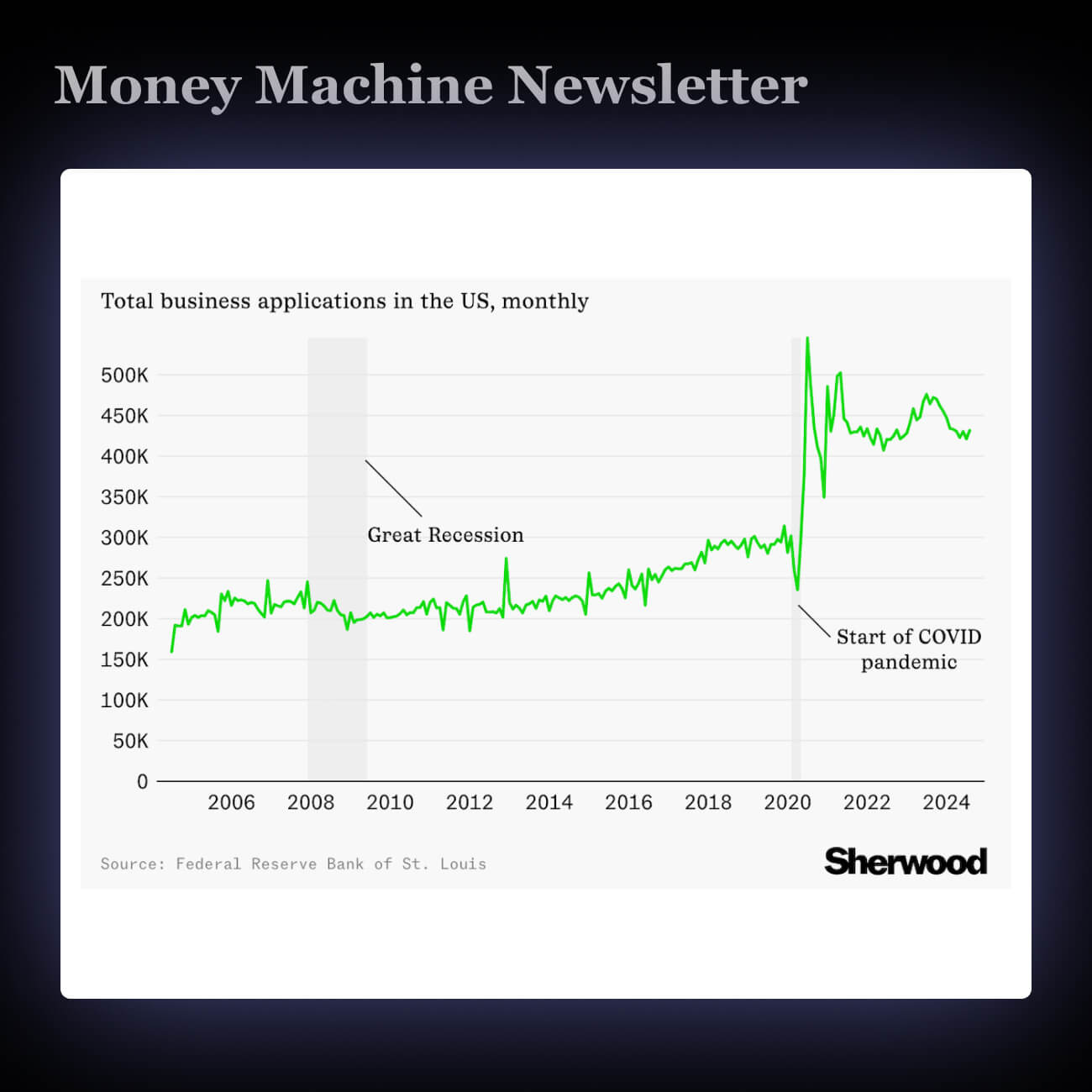

1. 📈 Small Businesses Keep Growing

U.S. small businesses are booming, with 17M new ones started under Biden.

Digital tools and remote work make starting a business easier.

80%+ small businesses have 0 employees.

2. 🏷️ How Have Prices Changed in 4 Years?

The Fed cut interest rates. Inflation is down to 2.5, from 9.1% in 2022.

Prices are rising slower, not dropping.

Lower rates impact borrowing, saving, and spending.

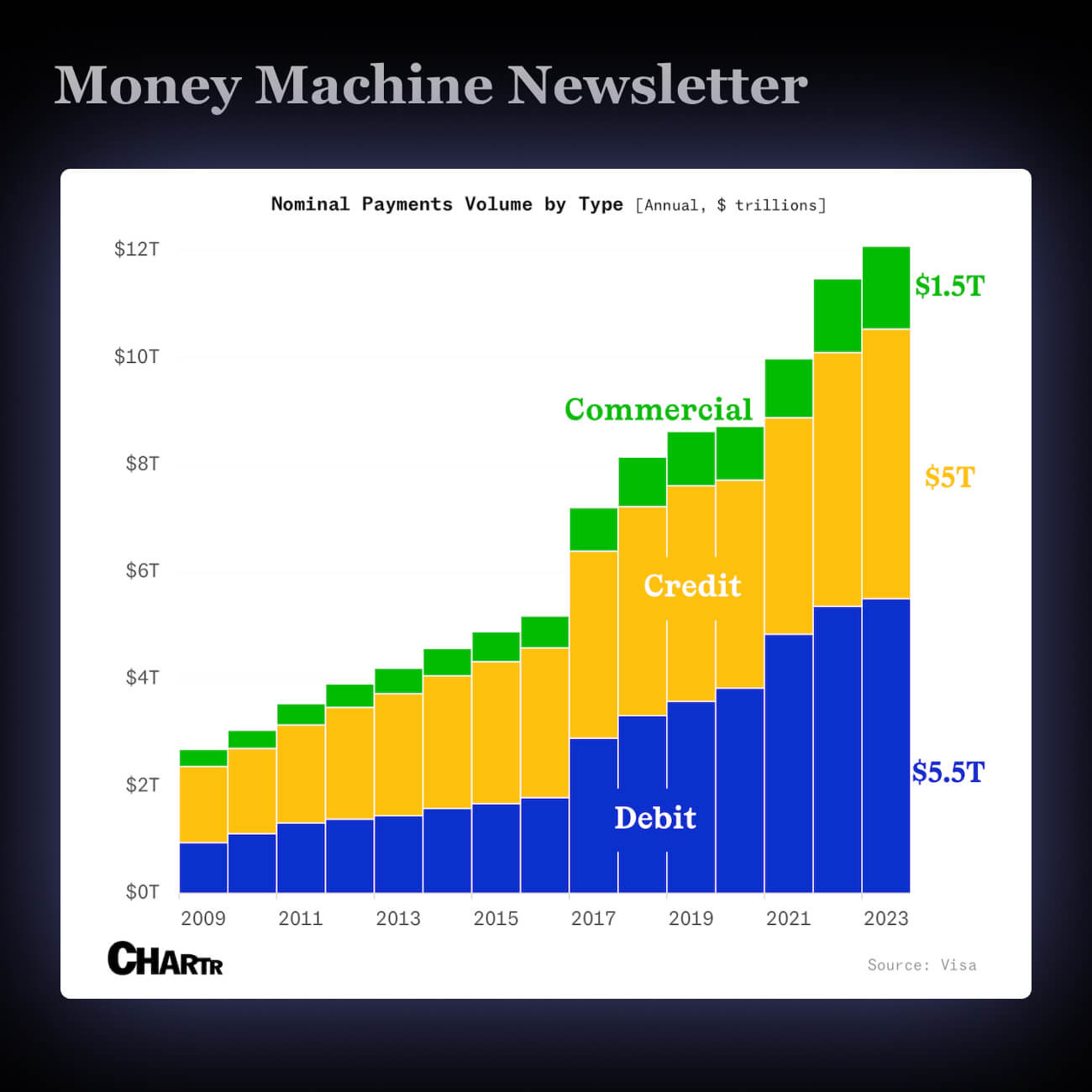

3. 💰 Debit Drives Visa's Business

DOJ is suing Visa for dominating the debit market and stifling competition.

Visa controls 60% of U.S. debit transactions, driving up fees.

This case could cut debit fees for consumers and businesses.

Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth.

Subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber 🚨

TOP 5 STOCK IDEAS, picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS throughout the week as we spot them.

Access to OUR COMMUNITY of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY of which ideas performed best.

NO GUESSWORK. You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS, discover opportunities and risks not highlighted elsewhere.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.