This $19.9 Million Market Cap Has An Enterprise Value Of Just $12.6 Million

MMN Recommend

Today we’re featuring The Value Road.

The Value Road goes places most people don’t. Tiny companies. Weird sectors. Hidden gems.

The kind of stuff no hedge fund will touch—but might make you real money.

If you're tired of copy-paste analysis and want fresh, unusual stock ideas with real upside and downside protection, subscribe. It's worth it.

I’ll let The Value Road take it from here…

Hello Money Machine Newsletter readers. My name is Lee Roach and I write a newsletter here on Substack called “The Value Road”. For a while now I have had some other Substack authors reach out to me to engage in a collaboration. After some consideration and after finally finding a bit of free time I agreed. I’m hoping that some of the readers of Money Machine will enjoy and find useful my value investing approach as it relates to micro and nano-cap stocks.

My General Investment Philosophy

My general philosophy is that these stocks are often overlooked because larger institutional investors are unable to buy shares into these companies without buying up so much stock that they’d be obligated to help manage the business. In many cases these stocks have market caps so small that if a hedge fund wanted to invest in these companies in any way that would have a material affect on their portfolio they would have to buy the whole company. Sometimes buying an entire company still wouldn’t produce results large enough to move the needle on a multi-billion dollar hedge fund.

When it comes to my own investment funds however, I'm not out here working with millions or billions of dollars. I have $33,000 in a brokerage account. I can buy into these small companies when I find one that’s clearly been passed over or forgotten about by other investors. These stocks are cheap, sometimes trading significantly below NAV (Net Asset Value) and or EV (Enterprise Value). There is a bit more to it however…

This post is long containing many charts. Your e-mail might cut out a part of it. To ensure you can read the whole post, read it through the substack app.

The Nuance

Sometimes stocks are cheap because their business deserves to be priced so. An outdated business with falling revenues and no owned assets that’s just digging a hole for itself by taking out debt to continue to operate more and more poorly probably deserves a cheap market valuation. A company that has fallen out of favor with investors due to cyclical commodity pricing or because of a bad year that has no debt and enough cash to ride out their spat of unprofitability might, on the other hand, just be something worth taking a look at. Sometimes I find companies that are at the end of the road as far as being viable businesses but have an enormous surplus of assets (usually land or buildings) that could be attractive to another industry. In these situations the company will often be priced like they are going to go bankrupt even though they’re really sitting on an asset pile worth a ton of cash.

With smaller companies it can take longer for investors to catch wind of a business turn around which gives a small time investor like me a chance to swoop in and buy shares while the stock is still cheaply priced. One of the only things I do know about the human condition is that people absolutely freak out and overreact about almost everything. Extreme pessimism can turn to extreme optimism. When a company has a bad year the market often overreacts sending the company’s share price far below what may be warranted. On the flip side, once any new news indicating that this bad business environment that the company has found itself in is dissipating, the market will often get ahead of itself driving the share price past what any current conditions might indicate the stock is worth.

When you invest in big companies these huge value discretions lessen and the window of opportunity to buy into them usually closes much faster than with these smaller companies. This is due to the fact that large hedge funds and investment firms have entire floors of skyscrapers filled with market analysts who do nothing but pick apart every aspect of these companies every day. I can’t compete with that. Management at Apple, Inc. ($AAPL) isn’t exactly gonna talk to a guy with $30k invested into them and I’m never gonna out read and out research thousands of professional analysts with access to more resources than I could ever dream of. That’s why I invest in these small businesses that these big funds won’t touch. You can see value discretions, do a deep dive into the company, see if there’s a real catalyst for their future success, then invest and wait. Usually, eventually, the stock price will catch up to that company’s business performance. Now with this long-winded explanation of how and why I invest the way that I do out of the way, let’s dive into a company.

If you guys enjoy what you’re about to read below and want to see my writings more regularly, you can subscribe to my Substack “The Value Road” right here.

SCI Engineered Materials, Inc. ($SCIA)

SCI Engineered Materials, Inc. ($SCIA) is a supplier of materials to the PVD industry. These materials are used to produce nano layers of metals and oxides that are used to create thin films that are then used for a wide variety of purposes including transparent anti-scratch coatings on eyeglasses, coatings on kitchen faucets, all the way to flat panel displays, photonics, semiconductors, thin film for solar panels, and even applications within the aerospace and defense industries. The company produces ceramic powders via several different processing techniques but also produces something called ceramic targets that are essential for depositing these thin films onto substrates through a process called sputtering. Most of the company’s products are manufactured from component chemicals and metal oxides. SCIA has taken the due diligence of finding several suppliers for their needed materials in an effort to mitigate any potential future supply chain disruptions and so that the company can meet future demand as they continue to grow their business.

SCIA’s Cheap Enterprise Value

The first thing that caught my eye when I was scrolling through the OTC market’s stock screener is SCIA’s very cheap enterprise value. To find out a company’s EV you simply take the company’s market cap and add to that figure the company’s debt and then subtract the company’s cash and cash equivalents. This EV figure is what you’d actually be paying if you were to purchase the entire company outright. The reason I like looking into companies with EV’s far lower than their market cap is that these companies oftentimes have no debt and a lot of cash on their balance sheet. This is in my opinion, a particularly great place to start snooping around for cheap stocks.

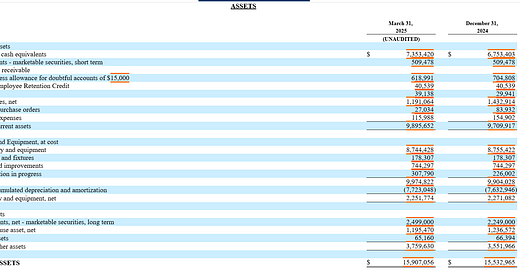

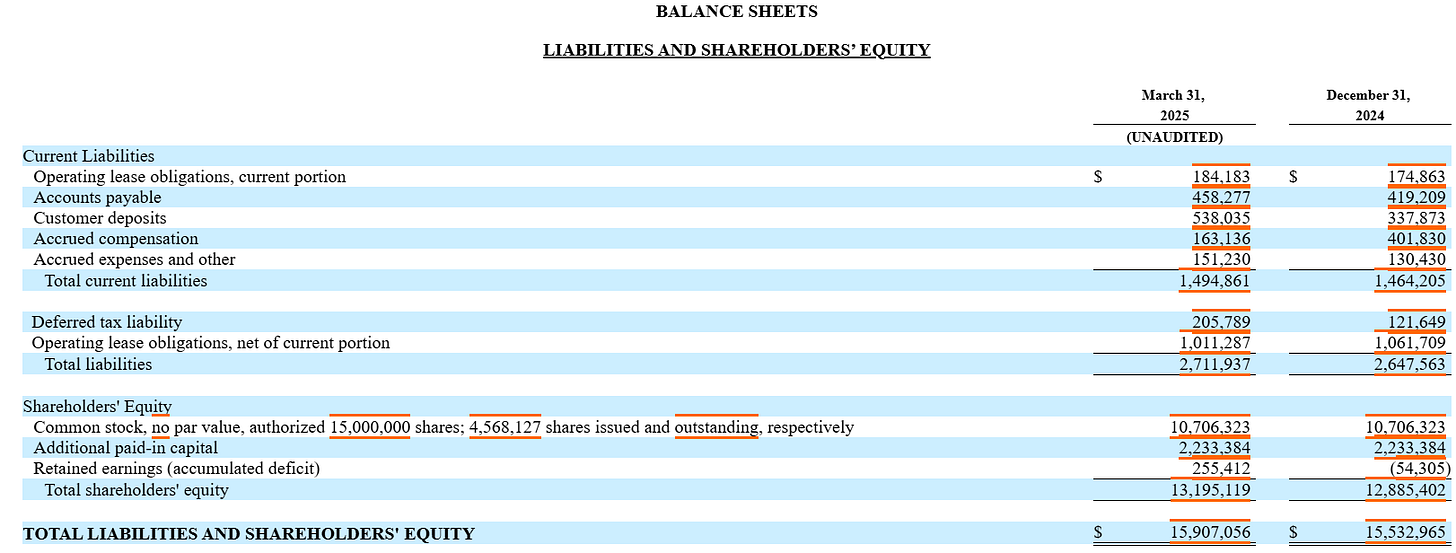

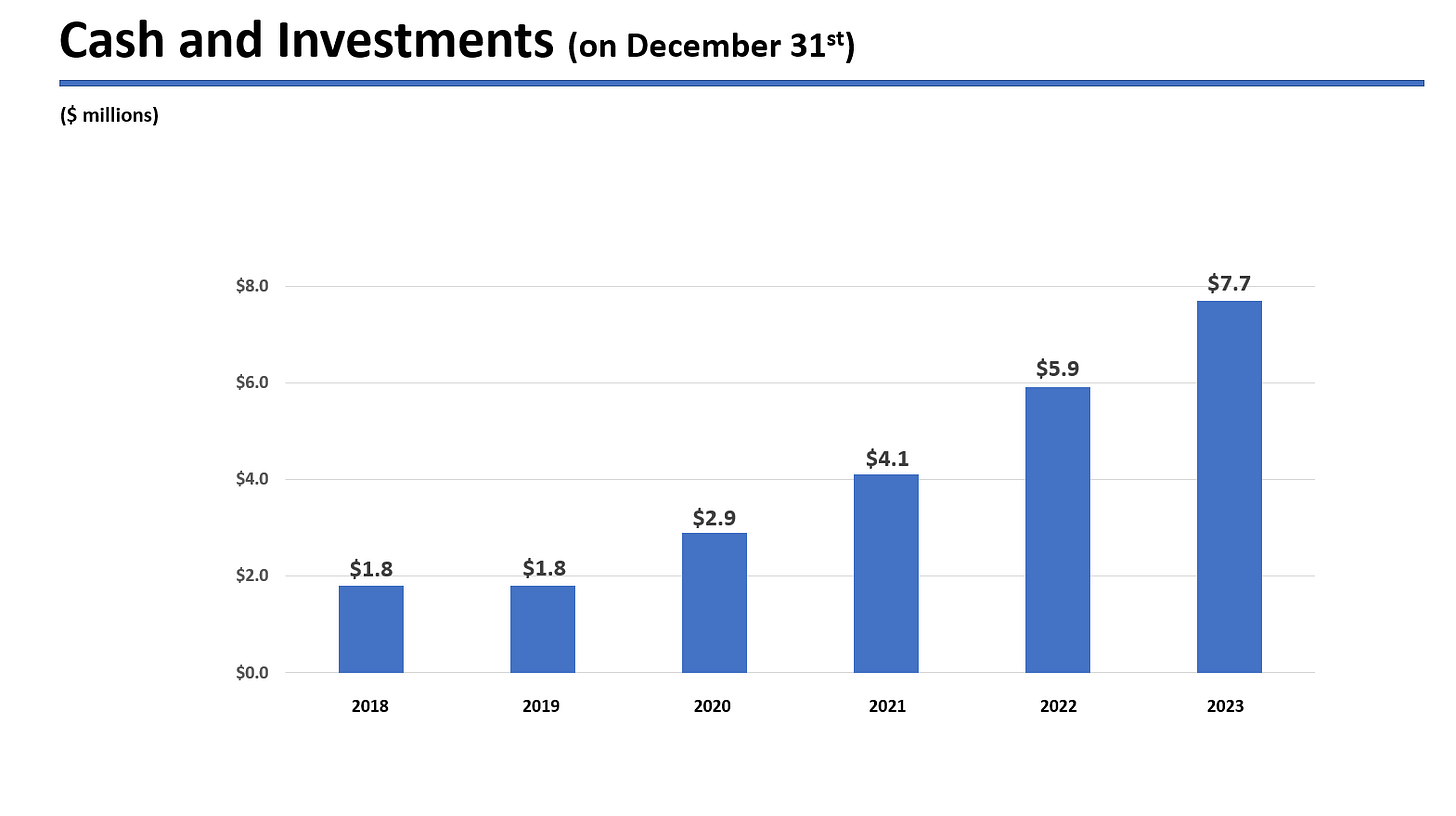

When you take a look at SCIA’s financial statements you can see exactly what I’m talking about. The company has no long-term debt and almost $7.4 million in cash on its balance sheet. SCIA does have the ability to draw up to $1 million worth of credit on a revolving credit line it has in place with Fifth Third Bank but hasn’t borrowed any money from Fifth Third in at least the past two years. No interest payments, that’s a huge advantage that comes with having a large cash pile at your disposal.

When we take SCIA’s 4.57 million shares outstanding and multiply it by their $4.35 share price we get a market cap of $19.9 million. Since SCIA has no debt we don’t need to add anything to that figure and just need to subtract the company’s current cash from their market cap. Once we subtract SCIA’s $7.3 million in cash from the company’s $19.9 million market cap we get an EV of $12.6 million. Simply put you can essentially buy a $19.9 million company for a total expense to you of $12.6 million, not bad.

SCIA’s Business Performance

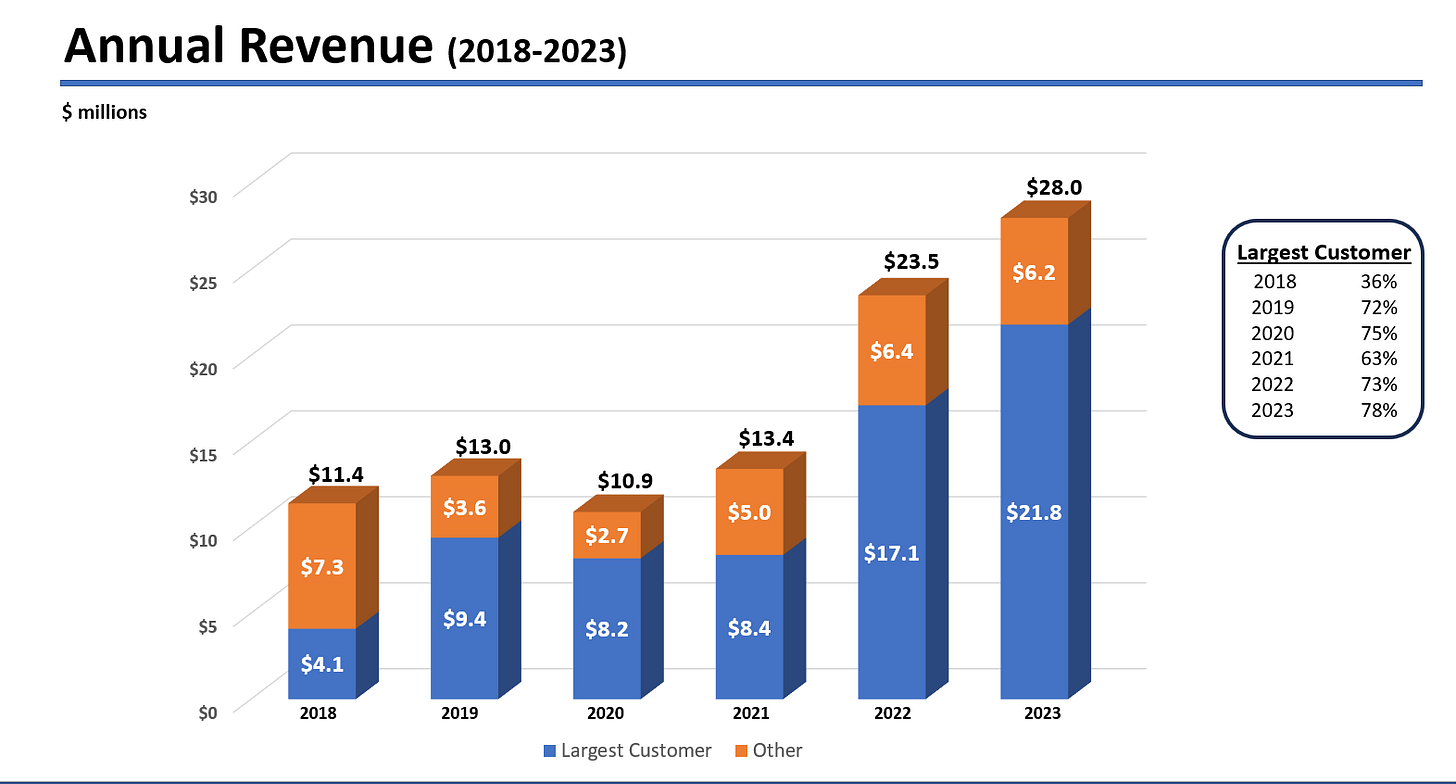

SCIA has had a pretty nice run of constant growth in their cash pile, revenues, and net income.

SCIA’s 2024 and 2025 Q1

That growth had stalled out in 2024. When you see the company’s revenues this pull back looks really bad but when you start to look more closely at the company’s income statement things aren’t quite as bad as they first appear.

SCIA’s gross profit only fell 3.8% while their revenues fell by 18.2%. This drop is much less alarming when you learn that most of this decrease in revenue is directly related to a large decrease in raw material pricing that was then passed down to the customer. The company’s gross margins actually increased to 22.2% in 2024 versus the 18.8% figure that the company saw in 2023. Gross profit overall only fell by 3.8% from $5.3 million to $5.1 million from 2023 to 2024. SCIA’s operating income came in 20% lower YOY from $2.5 million to $2.0 million and their net income 13.6% lower YOY from $2.1 million to $1.9 million from 2023 to 2024.

SCIA’s gross margin rose again to 30.6% in Q1 of 2025 versus a 16.8% gross margin in Q1 of 2024 but their gross profit fell 21% from $1.4 million to $1.1 million when comparing quarters. SCIA’s operating income fell 51% in Q1 of 2025 versus their Q1 of 2024 from $618k to $303k. Their net income also dropped 43% from $545k to $310 from Q1 of 2024 to Q1 of 2025.

Where’s SCIA’s Business Operations Headed?

It seems like SCIA has hit a bit of a snag in their growth story. Their 10-K stated that they have multinational customers and that tariffs could have a negative effect on those customers’ orders. As you’ll note from the company’s revenue graph from their 2024 investor presentation they have one customer that has taken up a very large portion of the company’s revenues.

According to SCIA’s 2024 10-K “Our largest customer represented approximately 74% of total revenue in 2024 and 78% in 2023”. Although this is mere speculation as SCIA has not responded to my email asking them who their largest customer was, I get the feeling that this is some sort of defense contractor. Like I said this is speculation but the phrase “and even applications within the aerospace and defense industries” leads me to believe they might be making products for technologies involved in hi-tech military gear. “Flat panel displays, photonics, semiconductors, thin film for solar panels” are some other phrases the company uses to describe the products its PVD materials help to produce. All of those things are products that would interest a military especially the U.S. military since this company operates domestically in Ohio. The company also exhibited its services at six trade shows in 2024 and most of them were heavily defense industry orientated.

They also had this to say about one of their other products,

“SCI utilizes its manufacturing footprint and industry expertise for defense applications involving Boron Carbide Armor and Enriched Boron Carbide. Boron Carbide Armor is used in bullet-resistant gear which significantly contributes to increased resiliency concerning high-speed impacts. Enriched Boron Carbide has several attractive properties which involve high-temperature applications in the aerospace and nuclear markets. Both Boron Carbide applications are highly valued when produced by domestic manufacturers.”

The U.S. military has some pretty strict regulations that force it to buy American made products when available to produce the goods that keep it running. Many executive orders have been initiated to strengthen the domestic sourcing requirements of the U.S.’s military gear since 2017 by both President Trump and Biden and has seen a lot of bipartisan support, something quite rare these days. The push for all of this domestic sourcing seems to coincide pretty closely with the explosion of revenue growth seen from the company’s largest customer. This is a very large part of why I think that SCIA’s largest customer is a military supplier.

If SCIA’s biggest customer is a military supplier it will probably see it’s profitability return once global trade eventually finds a new normal. The products that SCIA makes are components pieces and not finished commodities. If its largest customer is unable to source the other components for their end products they won’t be able to order more products from SCIA. This is true whether this customer is a military supplier or just some random company that makes consumer products. If SCIA’s largest customer is just a consumer product producer the negative effects on SCIA could become more dire but I think it’s more likely that this customer probably makes both consumer, military, and aerospace products. Once and if tariff tensions ease up this customer will likely be able to resume normal operations and SCIA could see its share price increase. Just this week we heard the news about tariffs between the U.S. and China dropping substantially. We also got some news in this week that the U.S. is planning to sell $142 billion worth of military equipment to Saudi Arabia. That’s the largest arms deal ever between the countries and a sign that we might be ramping up defense contractor production here in the United States. These could potentially be the catalysts to SCIA’s business operations that are needed to turn the company back into a growth story.

SCIA’s Share Price Performance

SCIA’s stock is down 17.6% over a one year period and 5.4% YTD.

Despite this recent setback the company has had a pretty good long-term growth story when it comes to their share price.

SCIA’s very cheap EV makes this company a good candidate for a competitor to buy. The company has many competitors that are substantially bigger than SCIA. These companies include Vacuum Engineering & Materials, Process Materials, Inc., and Materion. Materion ($MTRN) is the only publicly traded company out of those names. They have a market cap of $1.6 billion but each of these companies I just mentioned are much larger than SCIA and could easily afford to buyout the company if they wanted to. Collectively management owns less than 20% of SCIA’s outstanding shares so in theory this company is also a candidate for an activist investor to step in and make something happen. An activist investor might try to force a sale or they might even try to get the company to pay out all of there excessive cash in the form of dividends.

Either way the stock is cheap, cheap enough for anyone interested in the company to think about acquiring the business itself or at least a substantial portion of its shares.

Conclusion

I think once some of these tariff tensions finally ease up SCIA’s operations will probably return to normal. Having one large customer that deals internationally could put a lot of pressure on SCIA’s business operations in the near-term but if the Trump administration continues to walk back the tariffs it’s implemented I think this stock could really take off. If SCIA’s biggest customer is primarily a military contractor then this new $142 billion arms deal might be a win for the company too. Even if these tariff talks don’t go the way that I hope they do, the large cash pile and lack of debt that gives SCIA a very low EV also makes it a prime candidate to be bought out by one of its competitors. The company’s cheap stock price also makes this company a likely candidate for an activist investor to enter into the picture and shake things up a bit. I will personally not be investing in SCIA, at least not until I can find a bit more information on who their largest customer is. If anyone reading this is able to dig something up please, comment some links down below.

If you guys enjoy what you’re about to read below and want to see my writings more regularly you can subscribe to my Substack “The Value Road” right here.

Disclosure: I do not currently own any shares of SCI Engineered Materials, Inc. ($SCIA) but may buy a position anytime after this article is published. This is not investment advice. Do your own research.