Today we’re featuring The Pragmatic Investor.

Most people chase Buffett's trades after it's too late.

This newsletter shows you how to think like him before the crowd catches on.

Clear thinking. Smart positioning. No hype.

If you care about protecting and growing your money in a messy market, this is worth your time.

I’ll let The Pragmatic Investor take over from here…

The Buffett Reposition: What His Latest Moves Really Mean

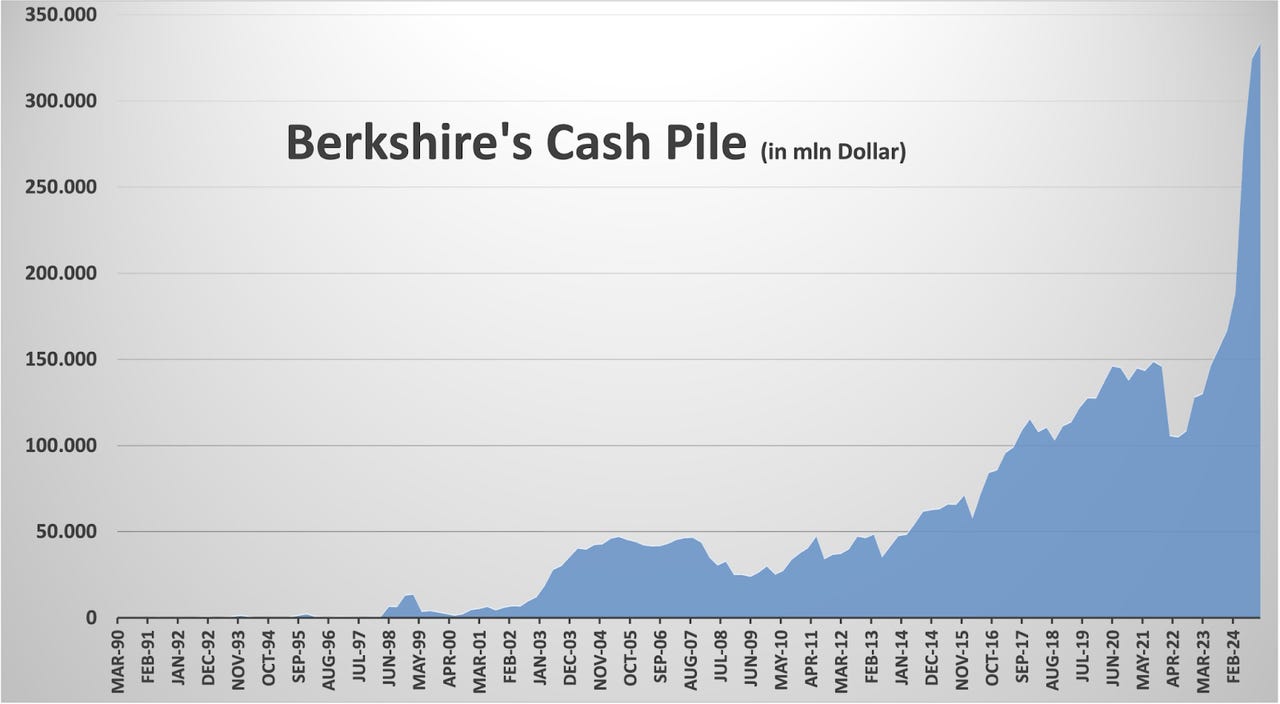

Warren Buffett is being praised—for good reason. As markets slid in recent weeks, Berkshire Hathaway (BRK.B) emerged looking prescient, with a record $167 billion in cash and a much leaner equity portfolio.

But while headlines focus on what Buffett sold, smart investors should be asking: what is he buying—and why?

Because beneath the surface, Berkshire hasn’t just gone risk-off. It’s repositioned, quietly building exposure to the sectors and strategies that could dominate the next decade.

And it’s striking how much this portfolio rhymes with Buffett’s 1970s playbook.

Buffett Gets Praised for Selling… But Look Closer

The financial press lit up when Berkshire’s Q1 13F showed it slashed stakes in Apple (AAPL), a longtime cornerstone. Berkshire’s Apple position was reduced by 67%—a huge move for a famously slow-moving portfolio.

Berkshire now holds more cash than ever, with over $167B on hand, primarily in short-dated U.S. Treasury bills.

Translation? Buffett is cautious, but also preparing to deploy capital when others panic.

But what’s not being discussed enough is what Buffett is buying.

Berkshire's Latest Buys: What They Tell Us

Let’s break down some of the most telling additions to Berkshire’s portfolio:

Occidental Petroleum (OXY): With warrants included, Berkshire now owns nearly 40% of the oil major. Combined with Chevron (CVX), energy now makes up over 10% of the portfolio.

Constellation Brands (STZ) & Domino’s Pizza (DPZ): Defensive consumer staples. In a downturn, people still buy beer and pizza.

Five Japanese Trading Houses: Exposure to Japan is climbing, bolstered by Berkshire’s recent bond sale in yen—a clear sign of commitment.

Pool Corp (POOL) & Sirius XM (SIRI): Niche bets, possibly tied to broader lifestyle or recession-resilient trends.

What’s the pattern?

Defensive and recession-proof sectors

International diversification

Hard assets and cash-generating businesses

This isn’t a portfolio chasing high-growth tech. It’s positioning for resilience and inflation.

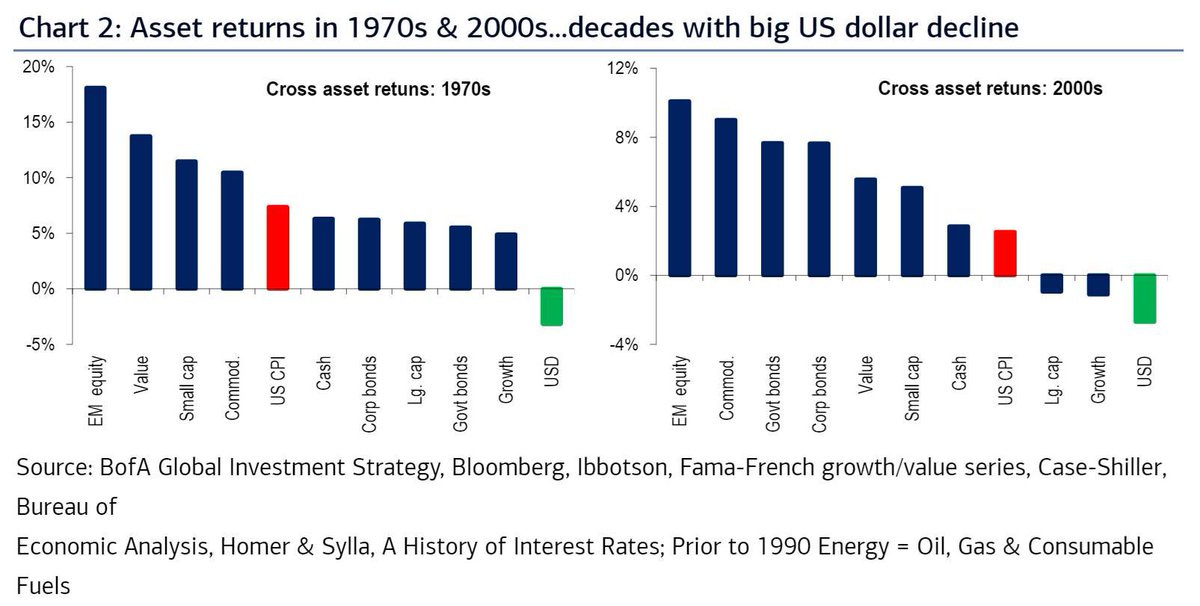

Buffett Is Positioning Like It’s the 1970s

Let’s take a quick history lesson. The 1970s were marked by:

High inflation

Rising oil prices

Weakening dollar

Geopolitical turmoil

Sound familiar?

In that environment, the winners were:

Commodities

Value stocks

International equities

Real assets

The losers? Long-dated government bonds and high-growth tech.

Buffett appears to be dusting off that old playbook. He’s slashing exposure to mega-cap tech (Apple), loading up on energy (Occidental), and diversifying internationally (Japan).

He’s also staying out of long-duration bonds—choosing T-bills over 10-year Treasuries. That’s telling.

Why This Matters Now

The broader macro landscape is shifting. U.S. debt-to-GDP is at post-WWII levels. The Fed can’t hike much further without blowing up the budget.

So what happens next?

Likely a blend of:

Currency devaluation

Mild inflation

Financial repression (keeping rates below inflation)

In that environment, cash is a melting ice cube. Long-dated bonds underperform. But cash-generating businesses with pricing power thrive.

Buffett is already there. And if history is any guide, he’s early—but not wrong.

The Buffett Portfolio: Built for This Market

To help subscribers position themselves accordingly, I’m launching a new portfolio: The Buffett Portfolio.

This isn’t a copycat list of Berkshire’s holdings—it’s a modern update of Buffett’s principles:

🛡️ Durable businesses with wide moats

💸 High free cash flow and sensible valuations

🌍 Global exposure to hedge against dollar risk

🛢️ Inflation-resistant assets like energy and hard infrastructure

This will be a long-term, conviction-driven portfolio that reflects the world we’re entering—not the one we just left behind.

📌 Subscribers to The Pragmatic Investor will get:

My full portfolio of Buffett-style equities

Monthly updates with entry/exit rationale

Macro research tailored to value investing

I’ll be revealing the first batch of holdings next week. Don’t miss it.

Final Thoughts

Everyone’s talking about how Buffett timed the top.

But timing isn’t what made Buffett Buffett. Positioning is.

And right now, Buffett is positioning for a regime change: higher inflation, weaker dollar, and stronger demand for real assets.

I agree with this thesis, and that’s why The Buffett Portfolio is launching now.

You don’t have to agree with every move Berkshire is making. But you’d be wise to understand what it’s preparing for.

This is how the next cycle gets won.

Stay pragmatic. Stay invested.

Nothing in this email is intended to serve as financial advice. Do your own research.