This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Big energy plans but no parts to build them.

One number just shook global trade.

China’s next energy play is already live.

Jeff Bezos' bet on hand-crank windows.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 💣 The Infrastructure Time Bomb

Everyone’s hyped on AI, EVs, and clean energy. But here’s what no one wants to say out loud… The clean energy rollout is jammed.

Why? No parts. No paperwork. No progress…

Wind turbines, transformers, grid gear—it’s all stuck in 3-to-6 year backorders.

GE Vernova even stopped taking new orders.

And even if the gear shows up? Red tape strangles it.

One lawsuit? One permit snag? Game over. Project iced for years.

Gas was the backup. But building a new gas plant has tripled in cost since 2022…

So here we are. Power demand rising. Supply slowing. Investors backing away.

2. 😳 Trade Wars Hit the Tipping Point

Shipments from China are falling off a cliff—down 60%. Warehouses across the U.S. are thinning out. Layoffs are looming. All because of one number… 145%.

That’s the tariff slapped on Chinese goods. If your cargo left China after April 9, you’re eating the full cost.

So now, businesses are scrambling… Some are stashing shipments in bonded warehouses—legal loopholes where you don’t pay the tariff until the goods move.

Others are rerouting through Mexico or Canada. Waiting for a policy pivot.

And while that may sound clever, it’s just survival mode. Because this isn’t about cheap plastic toys or knockoff headphones. Real businesses are getting hit—hard...

Apparel brands. Hardware startups. American small businesses who just happen to source parts overseas. They’re just stuck.

Because moving a supply chain isn’t like switching apps. It takes time. Money. And a little predictability.

But predictability is the one thing no one’s offering right now… Every few months, the rules change. A new tariff. A new exception. A new penalty. And every flip-flop shreds whatever fragile plan a small business had.

There is a way out…

Incentivize U.S. manufacturing. Cut red tape. Offer real tax breaks for companies that build here. But mostly? U.S. needs to make a plan—and stick to it.

If this keeps up, we won’t just be missing shipments. We’ll be missing something far worse—trust. And that’s not something you can rebuild with a new warehouse.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🔋 China’s Betting on a Different Battery

While the West obsesses over lithium and Teslas, China’s been busy building something else… A hydrogen highway…

Sinopec—China’s biggest oil refiner—just built a 1,150 km hydrogen corridor. Four new refueling stations. Enough hydrogen to power 220,000 truckloads a year. And it’s already live.

From Chongqing to Qinzhou, trucks are rolling. Not electric semis. Hydrogen ones. They fill faster, go farther, carry more, and weigh less. For long-haul freight, that’s everything… This one corridor could support 360,000 trucks a year.

Meanwhile, the U.S. is still debating the tech. China’s deploying it…

Fuel-cell companies like Plug Power, Bloom Energy, and Ballard could benefit.

But the real upside? Finding the smaller players tucked into the supply chain—fuel cells, electrolyzers, infrastructure.Yes, hydrogen still has problems… It’s expensive to make. Tough to transport. Needs serious scale. But here’s the thing… China doesn’t wait for perfect. They build fast, then fix. That’s their typical playbook.

Top 3 Charts of the Week

1. 🧐 Bezos Bets on $20K EV Truck

Jeff Bezos–backed startup, Slate Auto, unveiled a no-frills electric truck for under $20K. Two seats. Hand-crank windows. No screens. Just basics.

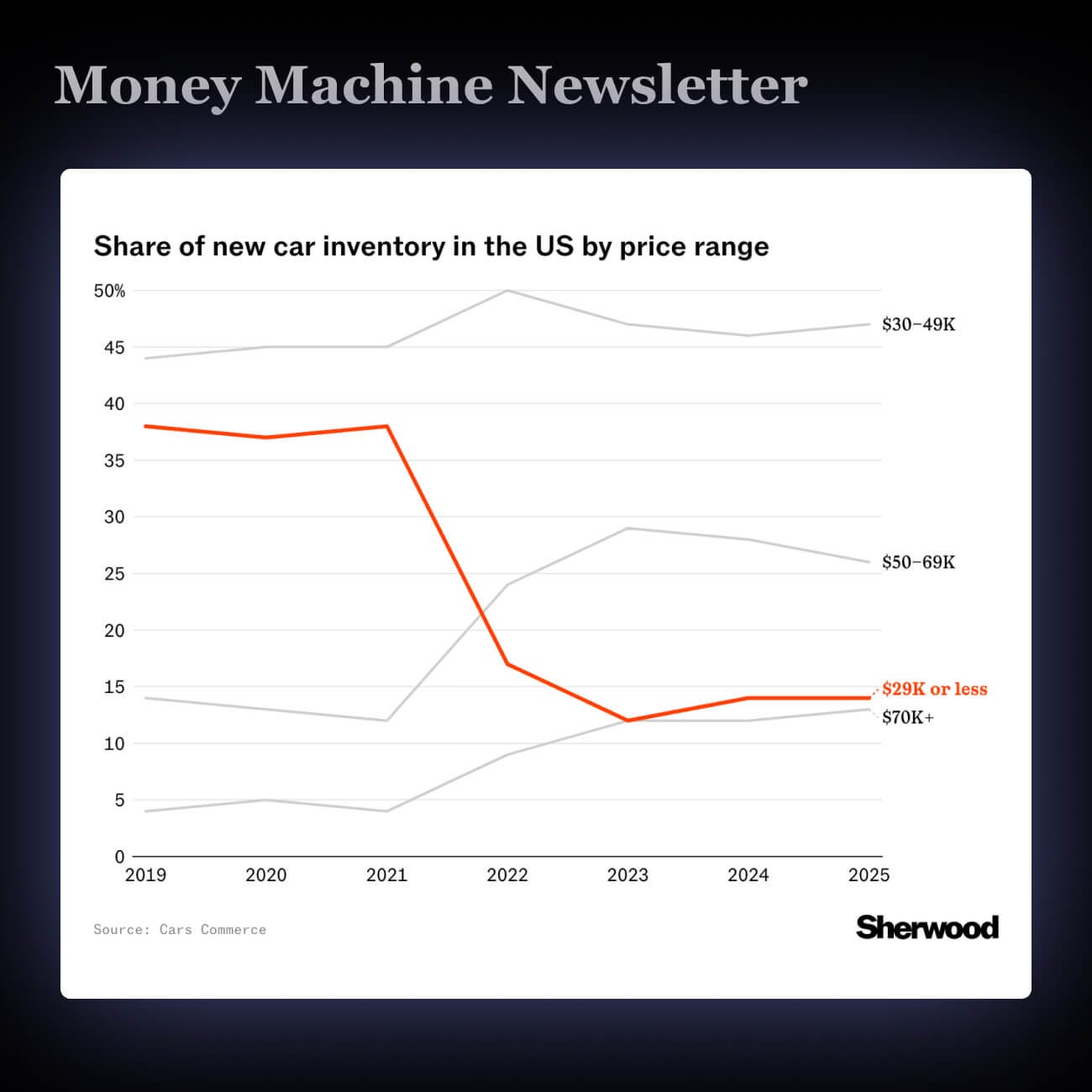

It’s one of the few truly affordable cars in America. Only 14% of new cars cost under $30K—and most are made overseas.

If Slate pulls this off, it could reshape the EV market. A cheap, made-in-USA truck that dodges tariffs? That’s a big deal in a world of $60K+ EVs.

2. 😰 Starbucks' Big Fix Still Falling Flat

Starbucks' profit dropped 45%, and sales are still falling. Their big fix-it plan isn’t working—yet, even after five straight bad quarters.

They’re spending more to try new ideas — like faster service and new rules in stores — but it’s hurting profits, not helping yet.

If Starbucks can’t turn this around, its stock (already down 10%) could keep falling. Big changes cost money — and so far, no payoff.

3. 📦 Amazon’s Delivery Domination

Amazon is spending $4B to speed up deliveries in rural areas—adding 200 new stations, 100K jobs, and aiming to ship 1B more packages per year across 13,000 ZIP codes.

While UPS is cutting 20,000 jobs and stepping away from Amazon, the e-commerce giant is doubling down—building its own delivery empire where others are retreating.

Amazon already delivers 6.3B packages a year. This move makes them the #1 private delivery service—and widens the gap between them and everyone else. Faster shipping, even in the middle of nowhere.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.

You got that right.