This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Big, beautiful bill… more like Big, beautiful mess.

THIS quiet stock is changing how we talk to machines.

Google founder’s BOLD bet on the one-person factory.

The milk wars just got interesting.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🪄 The $4T Magic Trick

Magicians call it misdirection—make you look over here while the trick happens over there. That’s what this new “big, beautiful bill” does… claims to fix the debt while quietly adding ~$4T more…

Meanwhile, we’re already ~$2T in the hole every year.

That’s not reform. That’s denial dressed up for a press release.

Let’s look at where this is headed…

Interest alone could hit ~$2T a year.

And the spending cuts? Weak. A $30B cut to food stamps sounds big until you realize it’s still 50% higher than it was pre-COVID.

It’s the same playbook every time: Cut taxes. Shave a little off the top. Ignore the hole at the bottom… And hope no one asks where all the borrowed money’s going.

Some say, “Just tax the rich.” It’s not that simple. That won’t fix a ~$2T annual deficit. The real problem is much bigger—entitlements, bloated budgets, and politicians who won’t make tough calls… Because tough calls don’t win elections.

But here’s the thing… the U.S. actually has options…

We own land. We have resources. We lease assets all the time. We could monetize them. Smartly. Transparently.

But that doesn’t get applause. Launching shiny new programs does.

The hard truth? Fixing this isn’t complicated. Just unpopular…

No new spending.

Go back to 2019 budgets.

Put our assets to work.

Or we keep pretending. And end up with two choices… massive inflation or massive austerity.

2. 🗣️ Undervalued AI Voice Play

Not every AI company needs flash… SoundHound’s got revenue growth, real clients, and no debt—yet Wall Street’s pricing it like a flop.

SoundHound is focused on one thing… letting people talk to machines like they talk to people… in your car… at a drive-thru… on the phone with your bank.

And while most folks haven’t heard of it, their voice AI is quietly powering over 13,000 restaurants, automakers like Lucid, and partners like NVIDIA.

2024 was the setup. 2025 could be the snap…

Revenue last quarter? Up 151% YoY.

Annual guidance? Nearly $170M, double last year.

Cash on hand? $246M.

Debt? Zero.

They just launched “Agentic AI” — a smarter, faster way for businesses to roll out AI voice agents. Used to take 12 weeks. Now? Days.

They’re also expanding beyond cars and fast food… into insurance, healthcare, hospitality, and finance.

Their tech listens better, understands better, and speaks faster than most out there. That’s because they’ve been doing voice AI for over a decade — long before ChatGPT was a thing… the stock? priced like they’re failing… SoundHound trades around $11/share.

The risks... Margins still need to recover (currently 36–50%). Still unprofitable (adjusted EBITDA -$22M last quarter)… But here’s the flip side…

They’ve already done the hard part — built the tech, landed the clients, and banked the cash. Now it’s just about growing into it.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🏭 The Rise of the One-Person Factory

You used to need a team to build a product… not anymore… that’s the bet behind Dynatomics…

A quiet startup from Google co-founder Larry Page. No flashy launch. No big press tour. Just one big swing at a trillion-dollar problem: how things get made.

Their idea? Feed in the specs, and out comes a production-ready design—auto-generated by AI. Think ChatGPT, but for building actual stuff.

No more trial and error. No need for a team of engineers to piece things together. The system handles it all.

Dynatomics isn’t alone. There’s a new wave coming…

Orbital Materials is doing this for batteries.

PhysicsX is doing it for cars and planes.

Dynatomics wants the whole factory floor.

Manufacturing hasn’t really changed in decades…

Most of the time, it’s humans using guesswork, spreadsheets, and CAD files. Dynatomics is saying: maybe machines can do that better.

If they’re right, design firms and consultants might be in trouble. Early adopters—startups, factories, even solo inventors—could move faster and build smarter.

Watch for big-name manufacturers quietly linking up. When they do, you’ll know this thing’s real.

Top 3 Charts of the Week

1. 🥛 Americans Are Losing Their Taste For Plant Milk

Oatly, once the poster child of plant-based milk, is struggling. Sales are down. Stock is down 98% from its peak. Even regular milk is making a comeback.

People are moving on. They're more picky now—wanting more protein, fewer sweeteners. And Big Dairy isn't sitting still. They're jumping into oat milk, too.

2. 😳 AI's Dark Horse: DeepSeek

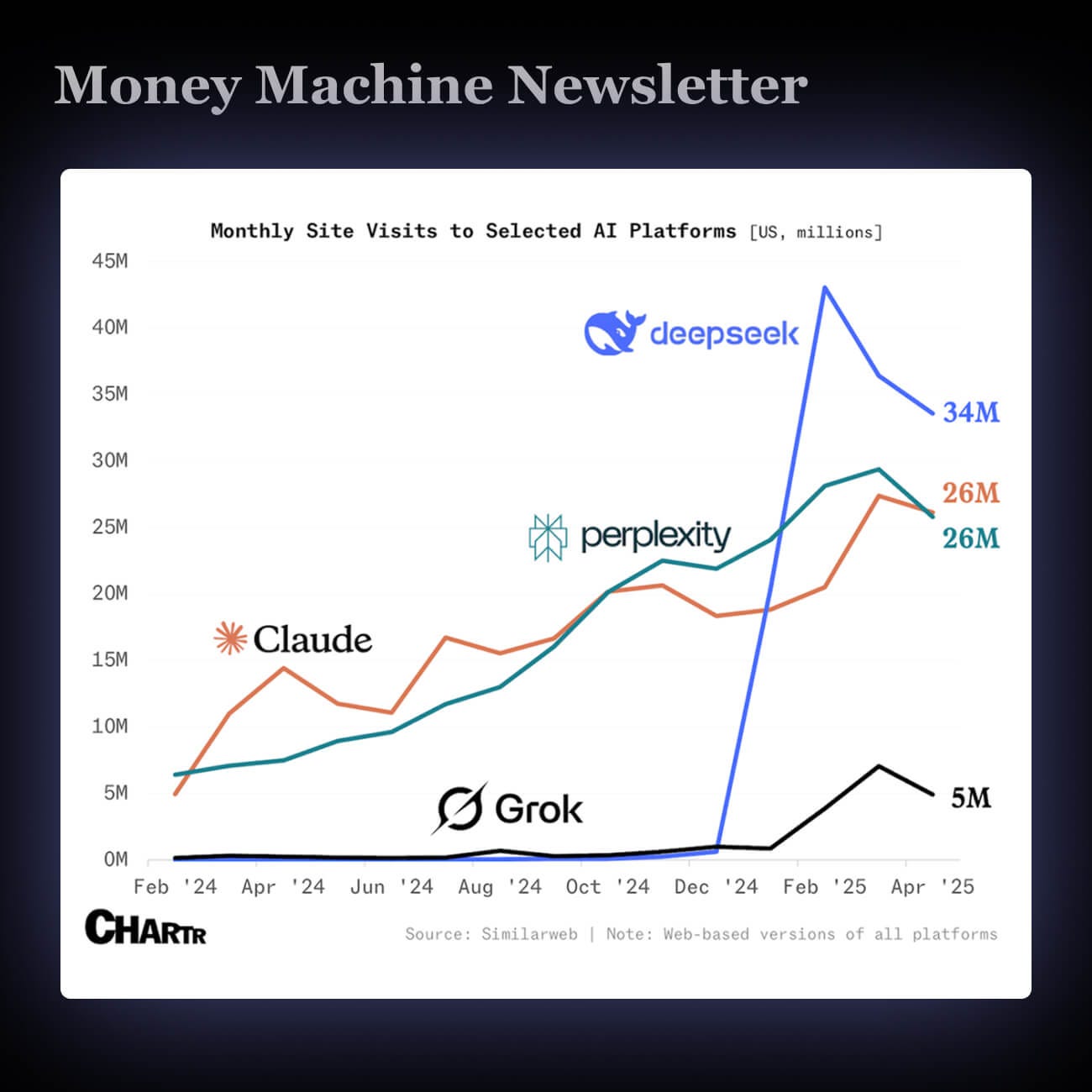

Perplexity is raising $500M at a $14B valuation and launching an AI browser. Meanwhile, DeepSeek leads all indie chatbots in web traffic — hitting 43M visits at its peak.

OpenAI’s ChatGPT still dominates with 780M U.S. visits in April — 8.5x more than DeepSeek, Perplexity, Claude, and Grok combined. But DeepSeek is the strongest non–Big Tech rival so far.

3. 💧 Nestlé Wants Out of the Water Game

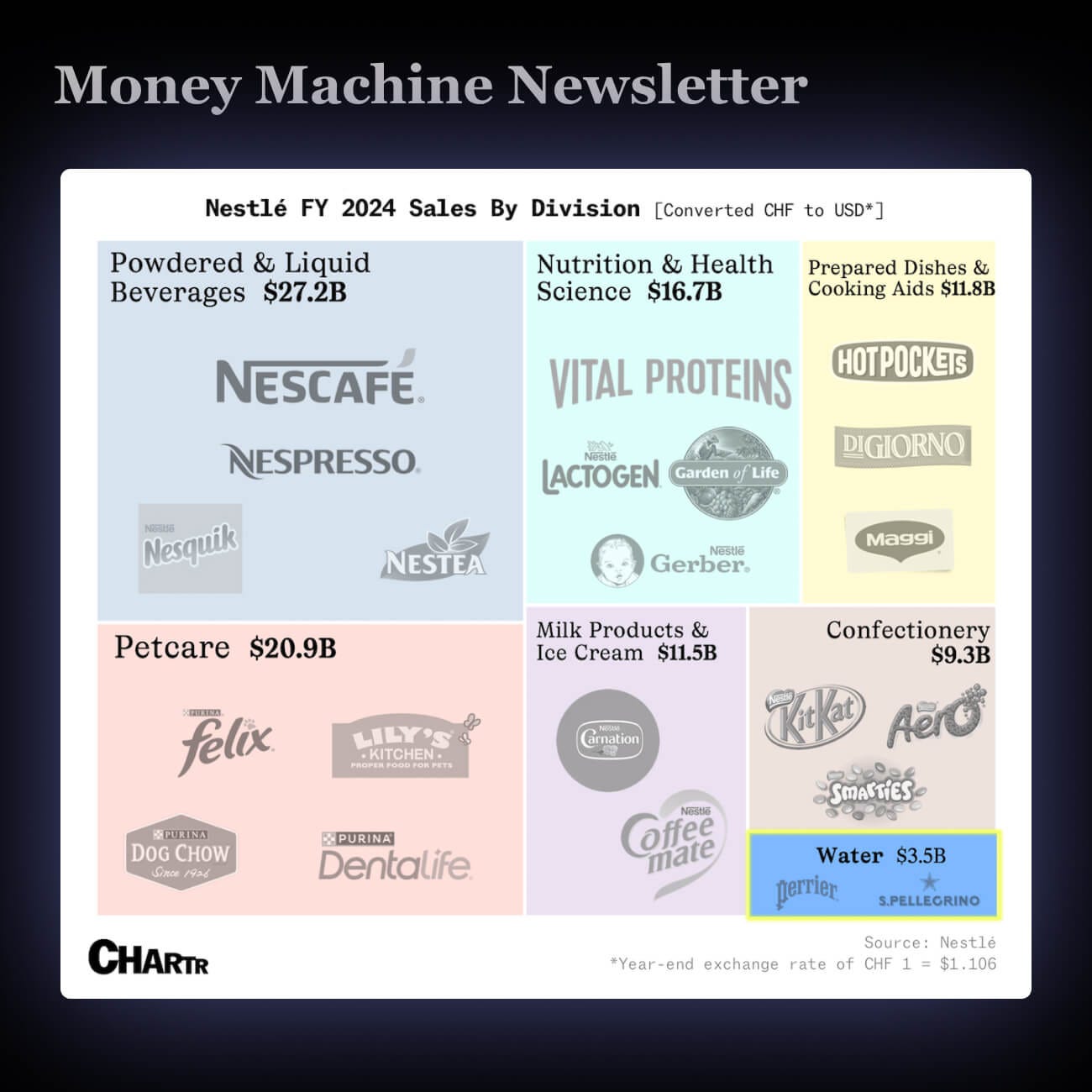

Nestlé wants to sell its bottled water brands, like Perrier and S.Pellegrino, and hired Rothschild to help find a buyer. The water division is worth around $5.5B.

Water only brings in 3% of Nestlé’s sales, and it’s become a headache — scandals, regulation issues, and slowing demand. The new CEO is cleaning house and focusing on bigger brands that actually move the needle.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.

Good article, once again!

I just subscribed and I'm going through this article and it keeps asking me to subscribe to see the premium play? What am I missing?