Taking Flight: A Deep Dive Into the Drone Supercycle With Unique Investment Opportunities

MMN Recommend

Hey,

Today, we’re featuring an article by the Industrial Tech Stock Analyst, a Wall Street analyst delivering actionable insights on industrial tech stocks in emerging industries, including robotics, drones, warehouse automation, optical networking, and digital manufacturing.

Most research on these industrial sectors is vague, outdated, or full of fluff. Not this.

Their research provides industry deep dives, price targets, downloadable financial models with 5-year projections, and stock recommendations on select names under coverage.

These insights rival the best sell-side research—clear takeaways, no jargon, just what actually matters.

Make sure to subscribe below and check them out.

I'll let Industrial Tech Stock Analyst take over from here...

For the past decade, we have followed the evolution of the drone industry. We believe the sector is at an inflection point, with surging demand driven by advancements in automation, AI, and legislative support for U.S. domestic manufacturing. This confluence of factors is creating compelling investment opportunities for both public and private investors. In this deep dive, we provide an in-depth overview of the drone industry, exploring key technologies, the shifting competitive landscape, and critical insights into this fast-moving market. Our goal is to equip investors with a comprehensive understanding of the opportunities and challenges shaping the future of drones.

Investment Thesis

We believe the drone industry is entering a transformative supercycle, driven by both military and commercial applications, and our bullish thesis is underpinned by favorable U.S. legislation that will tilt the playing field toward domestic manufacturers. On the defense side, drones are becoming indispensable to modern military strategies globally. Under the Trump Administration, we anticipate a heightened emphasis on drone technology, with public statements indicating his plans to expand the U.S. drone fleet significantly. We believe this will prompt other nations to enhance their own drone capabilities, intensifying global investment in drones. On the commercial front, the market is expanding rapidly as industries such as public safety, security, agriculture, logistics, energy, and infrastructure increasingly adopt drone technology to improve efficiency and reduce costs. While we believe the commercial market still needs a streamlined regulatory framework for commercial applications, we believe more favorable legislation could come in 2025. In addition, this part of the market is ripe for disruption as advancements in AI, payload capacity, and battery life enable new use cases. We also believe the counter-drone market is set to grow in parallel with the rapid expansion of the global drone industry, as governments, defense organizations, and commercial entities seek solutions to address potential security threats posed by unauthorized or hostile drones. Lastly, the U.S. drone space is still fragmented, and we believe the industry is ripe for consolidation as companies expand their portfolios into new drone solutions.

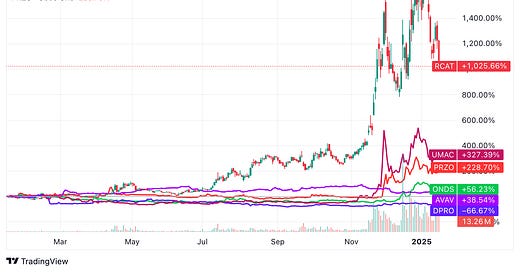

As shown in the chart below, drone stocks have experienced a significant rally in 2024 fueled by favorable legislative developments, increased global defense spending, and growing commercial adoption of drone technologies. While we believe the end of year rally was driven by retail momentum and likely stretched valuations, we still believe the emerging drone supercycle presents a compelling opportunity for long-term, patient investors. In turn, we believe the U.S.-based pure play drone players, including Red Cat RCAT 2.71%↑ , AeroVironment AVAV 5.79%↑ Ondas Holdings ONDS 2.99%↑, Unusual Machines UMAC 1.51%↑ , DraganFly DPRO 0.61%↑, ParaZero PRZO 3.89%↑ and Redwire RDW 15.36%↑ among others are worth adding to your watch lists. However as we explain below, the infancy of the drone market presents inherent risks, including regulatory uncertainties, technological competition, and funding needs. Despite these challenges, we believe these companies represent unique opportunities, as they are poised to play critical roles in the development and scaling of this transformative industry.

(MUST READ) Investment Risks With Drone Stocks

Investing in drone stocks comes with several inherent risks that investors should carefully consider. First and foremost, military defense spending, a key driver for many drone companies, is often lumpy and difficult to predict, which is not ideal for publicly traded companies trying to meet Street expectations. On the commercial side, adoption of drone technology remains uneven, as many applications are still viewed as "nice-to-have" rather than "need-to-have," making them particularly susceptible to economic downturns or shifts in corporate spending. Regulatory uncertainties also pose a significant risk, as changes in legislation or compliance requirements can create hurdles for market growth. Increased competition, both domestically and internationally, adds pressure on margins and market share, particularly as larger, more established players enter the space. Furthermore, many of these public drone companies are small, with annual revenues below $10M, and face the challenge of capital-intensive hardware development that will require them to raise additional funds to sustain operations. These factors make the sector inherently risky, requiring careful due diligence and a long-term perspective from investors.

Favorable US Drone Legislation

A key catalyst to our drone supercycle call is driven by favorable U.S. legislation that is creating a significant tailwind for domestic drone manufacturers, positioning them to gain market share over foreign competitors like DJI. New legislation includes:

The American Security Drones Act: Passed as part of the 2024 National Defense Authorization Act (NDAA), this legislation prohibits government agencies from using drones made by foreign companies, ensuring that U.S.-based manufacturers dominate government contracts.

The Countering CCP Drones Act: Expected to be signed into law as part of the 2025 NDAA, this act will regulate airwaves to ban foreign drones from operating on U.S.-controlled frequencies, effectively removing them from U.S. airspace and providing a significant advantage to domestic producers.

That said, further regulatory progress is needed to unlock the full potential of commercial drone applications. Key areas requiring legislative action include streamlining approvals for Beyond Visual Line of Sight (BVLOS) operations, which are critical for scaling applications like delivery, infrastructure inspection, and agricultural monitoring. The Federal Aviation Administration (FAA) is expected to release a new rule called Part 108, which is expected streamline approvals for these advanced applications but timing is a bit uncertain. We dive deeper into Part 108 in our Commercial Market overview section.

Drone Ecosystem Ripe For Consolidation

We believe the entire U.S. drone ecosystem, spanning hardware, software, and counter-drone technology, is ripe for consolidation as the industry matures and demand accelerates. The rapid adoption of drones across commercial and defense applications has created a fragmented market with numerous players competing for market share. As legislative support grows for domestic production and national security concerns drive the need for secure, integrated solutions, larger companies are increasingly pursuing acquisitions to strengthen their portfolios. Redwire’s (RDW) recent $925M acquisition of Edge Autonomy is a perfect example of this trend, showcasing how industry leaders are leveraging strategic acquisitions to expand capabilities and position themselves for new long-term growth drivers. We believe this consolidation dynamic represents a core thesis for both public and private drone investors.

Investor Gifts

Looking to become a better investor or find that perfect gift for your finance friend? Check out these products from our partner Investor Gifts.

Click below to read more for an in-depth overview of the different drone technologies, key end markets, and unique investment opportunities in this rapidly evolving sector.

Whether you're tracking advancements in autonomous drones, military applications, or commercial drone adoption, this research breaks down the most important trends and the stocks best positioned to benefit.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.