This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Market selloff of Mag7 isn't political — yet.

NVIDIA ditched wires for light.

VIX Hits 40, here’s your green light.

An American staple on the downtrend.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 📉 Selloff Is a Mag7 Problem, Not a MAGA Problem?

"The equity market selloff is a Mag7 problem, not a MAGA problem," BOLD statement from U.S. Treasury Secretary Scott Bessent… can’t say I agree, the fact is, it’s Mag7’s problem, until it’s not… if tariffs trigger a recession, we’re not just talking about higher prices. We’re talking about the whole political landscape shifting — hard left, hard right, no soft landing…

Tariffs promise a stronger America. More factories. More control. A rebirth of the middle class… But… right now… it's a bet with no clear outcome — and no plan for what happens if it fails…

So what happens if the bet goes bad?…

On the left: Bernie-style populism—“The rich rigged the system.”

On the right: An anti-elite, anti-corporate push—“Too much capitalism killed the dream.”

Both sides start agreeing on things like bigger government, crackdowns on Big Tech, and leaders like Lina Khan, who want to reshape corporate power. Who by the way, Vance has supported in the past.

The Trump administration needs to get better at telling a story. Not about what’s broken. But about where we’re going. If you want people to accept short-term pain, show them the long-term payoff. That’s missing right now. We need ambition that pulls us forward—not fear that holds us back. Tariffs might be the tool. But vision is the engine. Without vision, policy stalls. And so does progress.

2. 💡 NVIDIA’s Light Speed Leap

GPUs are the engines of AI. But even engines stall if the roads suck… well.. NVIDIA just built a new highway… and it’s made of light…

NVIDIA’s new networking switches don’t use old-school copper wires. They beam data using light—like fiber optics on steroids. Result? 2x faster speeds, 1.6 terabits per second per port. That’s like downloading your whole hard drive in a blink.

It’s not just faster—it’s smarter…

Most switches need separate parts to handle light. Not these. NVIDIA packed the optical tech inside the switch itself. Fewer moving parts. Less signal loss. Lower energy bills.

Big AI needs big connections…

We’re not talking hundreds of GPUs—we’re talking millions. At that scale, traditional networking breaks down. Latency spikes. Data crawls. Everything stalls. NVIDIA’s fix? A photonic switch that scales without breaking a sweat.

What this means...

Imagine 10 Groks, 100 ChatGPTs, and an army of AI agents all talking at once—without lag. That’s the world these switches unlock.

Available late 2025…. And when they hit, data centers will eat them up. Because faster GPUs only help if the data gets there on time.

AI’s future isn’t just about bigger brains. It’s about faster nerves. And NVIDIA just gave the internet a nervous system made of light.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🧐 VIX Hits 40, Here’s Your Green Light

The market’s freaking out. That’s usually when smart investors calm down. This week, the VIX — Wall Street’s “fear gauge” — crossed 40. That’s a big red flag… or a green light, depending on how you see it…

Volatility is spiking. The market’s falling. Fear is everywhere. But when panic rises, prices fall. And great companies go on sale. These aren’t random penny stocks — they all have $1B+ market caps…

This setup doesn’t happen often… when the VIX hits 40, the whole market’s on sale — but only a few deals are actually worth buying... a few names we’re watching closely…

AutoZone, McKesson, Coca-Cola – hitting new highs in a down market.

FedEx, Estée Lauder, Thermo Fisher – strong businesses hitting new lows.

These stocks either show strength through chaos… or are momentarily beaten down despite long-term value.

The VIX hasn’t hit 40 since early 2020, right before one of the greatest bull runs ever. Not saying history will repeat — but it tends to rhyme.

Warren Buffett once said: Be greedy when others are fearful. Right now? Fear’s doing all the talking. You just have to listen — stay level-headed, and act wisely.

Top 3 Charts of the Week

1. 🍺 U.S. Brewery Count Drops for First Time in Nearly 20 Years

More U.S. breweries closed (399) than opened (335) in 2024 — the first drop since 2005. The total brewery count fell to 9,842. People are drinking less alcohol, especially beer.

Rising costs, steel tariffs, and changing habits (like more folks choosing non-alcoholic drinks) are squeezing the industry. Even iconic names like Anchor Brewing shut down.

Beer is a big part of American culture and small business. When breweries struggle, jobs, communities, and prices get hit.

2. 😳 Goldman Cuts S&P 500 Outlook Again as Tariff Fears Grow

Markets around the world are falling after Trump hinted at a 20% tariff on all U.S. trading partners.

Investors are spooked. Goldman Sachs cut its stock market forecast and now sees a 35% chance of a U.S. recession. Odds of a recession hit 63% on prediction markets like Kalshi.

“Tariff” is now Googled more than “inflation” was during its peak panic.

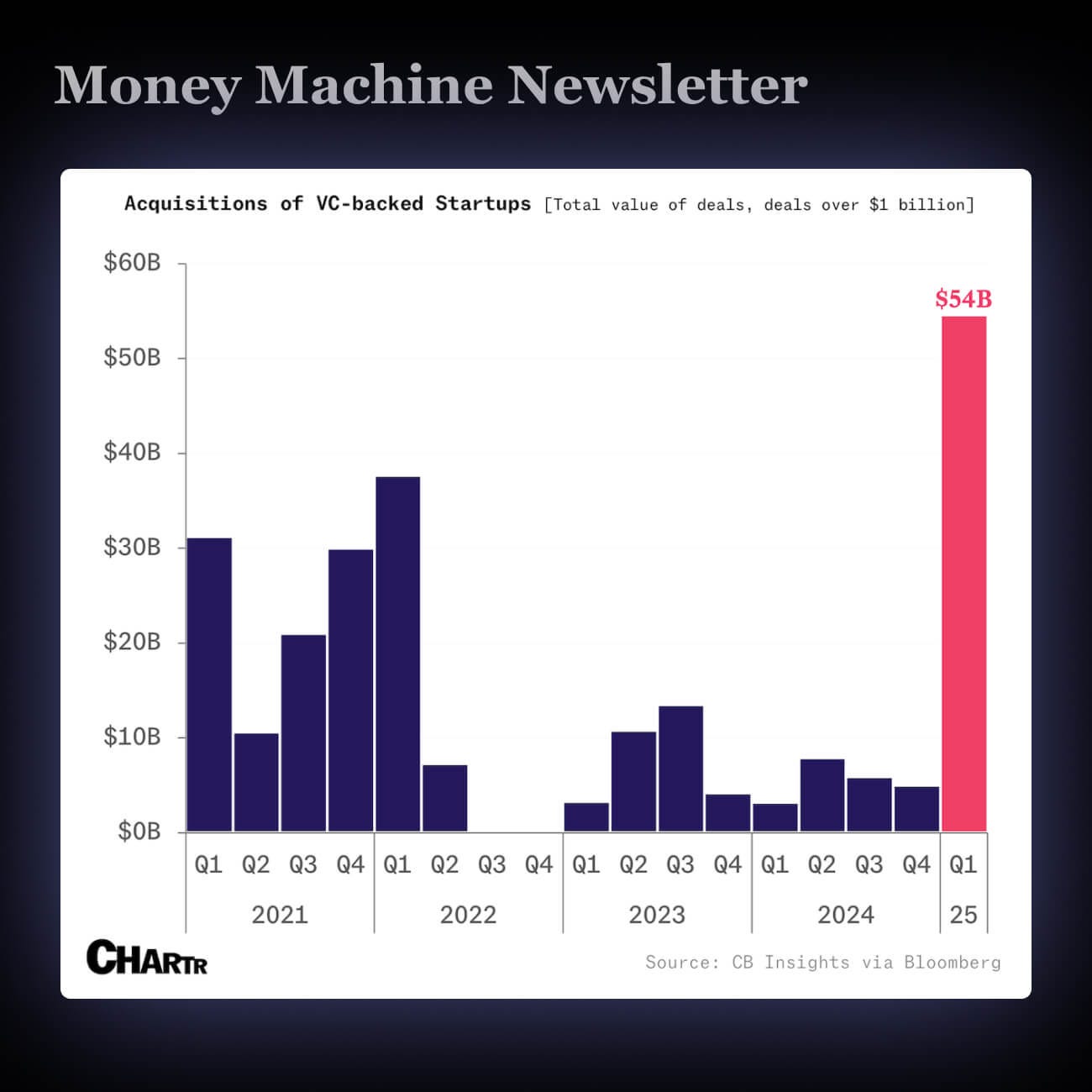

3. 💵 Big Tech Went on a $54B Shopping Spree for Startups in Q1

Big Tech is buying up startups like candy — 11 were snapped up for over $1B in just the first 3 months of 2025, totaling $54.5B. Google alone dropped $32B on Wiz.

AI is shaking things up. Tech giants would rather buy than build. With fewer government roadblocks and founders ready to sell, this could be the start of a major buying spree.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.