🛒 Risking It All for City-Run Grocery Stores

Plus: Instant Cancer Diagnosis Is Here, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

When the system is rigged... ask for city run grocery stores?

AI just learned to spot death before doctors can.

Your electric bill pays for AI.

THIS tiny tool has a wedge into 95% of Fortune 500 companies.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🛒 Risking It All for City-Run Grocery Stores

A 33-year-old Democratic Socialist, Zohran Mamdani, just beat Andrew Cuomo in NYC's Democratic primary. A month ago, Cuomo had a 93% chance of winning. How did this happen? It comes down to math, a broken deal, and social media…

The numbers: Student debt sits at ~$2T. ~42M Americans have student loan debt. Most of Mamdani's voters? Young voters with student debt.

The deal that broke… they were told: Go to college. Get a degree. Get a good job. Pay off loans. Buy a house. All a pipe dream.

Mamdani’s social media game is completely outmaneuvering everyone else. He’s creating UGC type content that is charismatic. Tapping in directly with young voters.

The real winners? Colleges…

Students borrowed from the government. Schools got paid upfront. No risk for them. All risk on students. When demand went up, colleges raised prices. Quality went down. Debt piled up.

When people feel systems are rigged they look elsewhere. What are these voters asking for?

Free buses

Rent control

City-run grocery stores

$30 minimum wage

Fewer police, more social workers

Extreme? Absolutely. But doing nothing for them feels worse.

This isn't politics. It's survival. Trump offered "America First." This is "Workers First." Same pain, different solution. What's next?…

Too soon to tell. But pay attention. What's driving this isn't ideology. It's 80M people who played by the rules and got burned. That's why a 33-year-old nobody just won.

At the end of the day socialism is CRAP. It's never succeeded anywhere in history. But dismissing this as just a New York problem is dangerous.

2. ⚕️ Instant Cancer Diagnosis Is Here

We used to wait weeks for a biopsy report. Now? A single AI model can scan a slide, detect cancer, pinpoint where it started, and even forecast survival odds—in seconds…

Meet CHIEF. Built by Harvard Medical School. Not a human doctor. But trained on 44 terabytes of high-res pathology data. That’s a medical mountain… 9,491 pathology images… 19 cancer types… tested across 24 hospitals in different countries. It nailed 94% accuracy across 11 major cancers.

This isn’t your usual “AI does one thing well” story. CHIEF does many things well…

Finds cancer cells

Traces their origin

Predicts how long patients might live

Spots treatment-specific gene patterns

It doesn’t care if the sample came from a rural lab or a big-city hospital. Doesn’t flinch if the image was scanned with a different machine. It just works.

CHIEF isn't replacing doctors. It's giving them better tools. Faster answers. A reliable second opinion that's always there.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 💵 Your Electric Bill Pays for AI

Big ideas need big power. And AI? It’s hungrier than we thought. Right now, utility companies are sprinting to catch up…

$212B — That’s how much U.S. utilities are spending in 2025 to keep the lights on.

4% → 9% — That’s how fast data centers will more than double their slice of the national power pie by 2030.

100,000 homes — That’s the energy one large AI data center eats. Some use 20x more.

And the surge isn’t slowing down… Amazon’s dropping $100B to expand its digital brain. Google: $75B. Microsoft: $80B. Meta: $65B.

The grid was built for homes and factories. Not for rows of server racks running 24/7. Now we’re seeing 7-year delays just to plug into power. And at current pace, it’ll take 80 years to build the lines we need in the next 10.

What’s the backup plan?

Nuclear is back (hello, small modular reactors).

Renewables are surging (tech companies are the biggest buyers).

Natural gas still fills in the gaps.

But while the industry scrambles for solutions, you’re already footing the bill…

PJM, the power grid that covers much of the Midwest and East Coast, saw bills jump $9.4B from data center demand alone.

So yes, your ChatGPT queries are running on borrowed volts. But the tab? It’s showing up on your utility bill.

Top 3 Charts of the Week

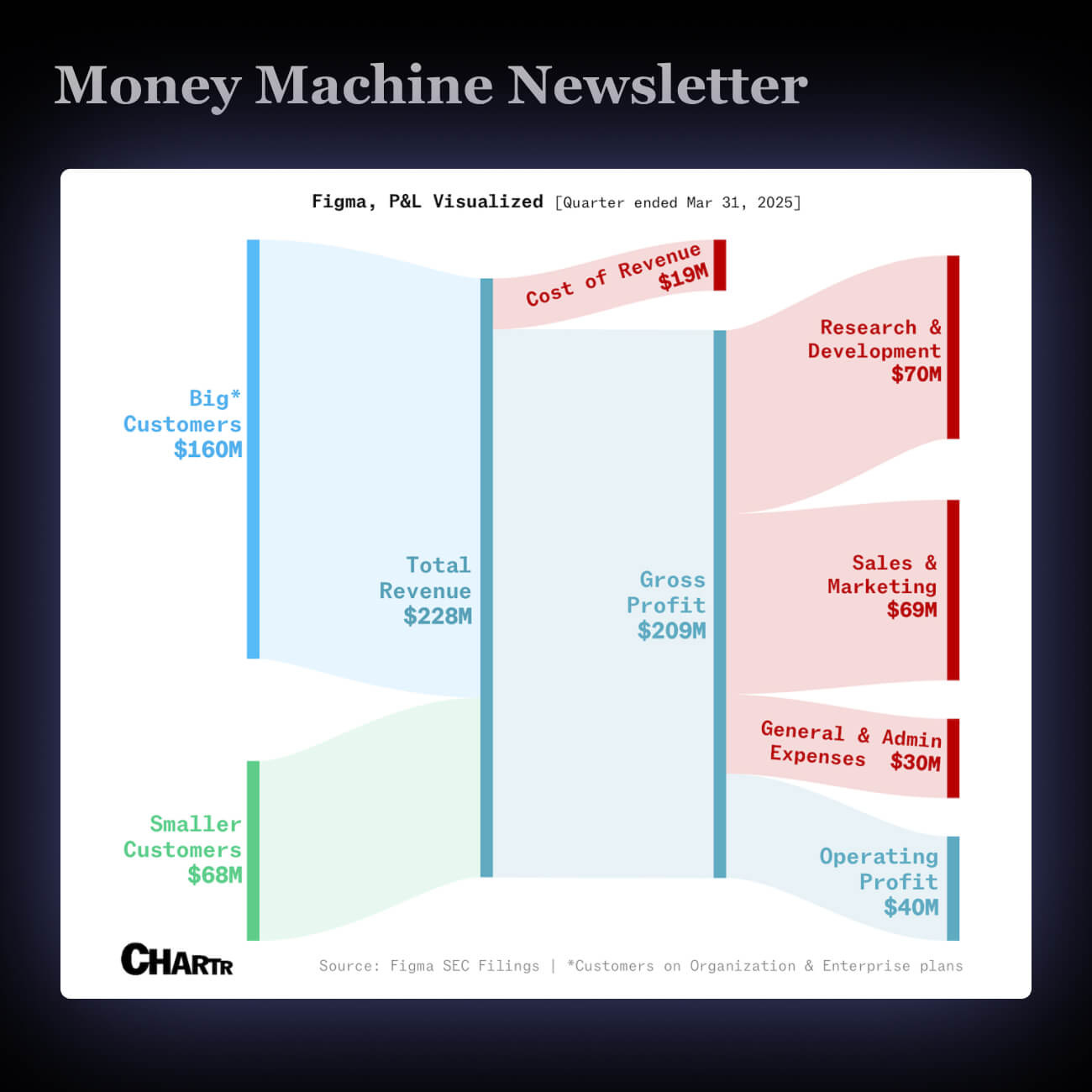

1. 🎨 Figma Files for IPO, Opens Its Books for the First Time

Figma just filed to go public. It made $228M last quarter, is profitable (17% margin), and 95% of Fortune 500 companies use it.

This isn’t just another flashy tech IPO. Figma is a real business, not just hype. Adobe once offered $20B for it. That says something.

Figma’s IPO could set the tone for other startups eyeing Wall Street—like Canva. If Figma flies, expect a parade of tech companies behind it.

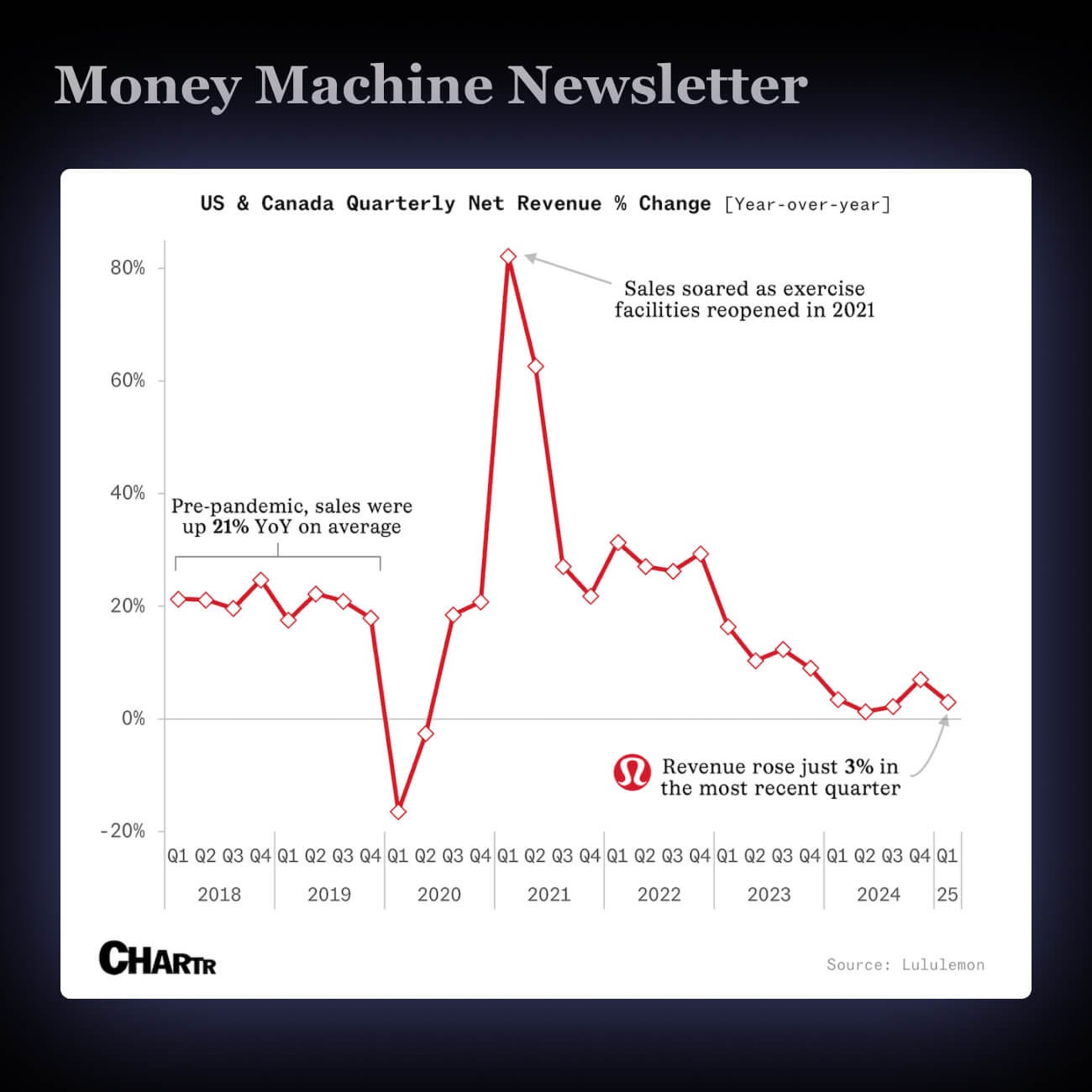

2. 📉 Lululemon’s Grip on U.S. Shoppers Starts to Slip

Lululemon is suing Costco for selling lookalike clothes—like $118 hoodies copied and sold for $8. They say Costco’s copies are too close for comfort and hurt their brand.

Lululemon’s U.S. sales are slipping. Revenue is only up 3%, but same-store sales are down 2%. They’re battling cheaper rivals, cautious shoppers, and now—bargain dupes.

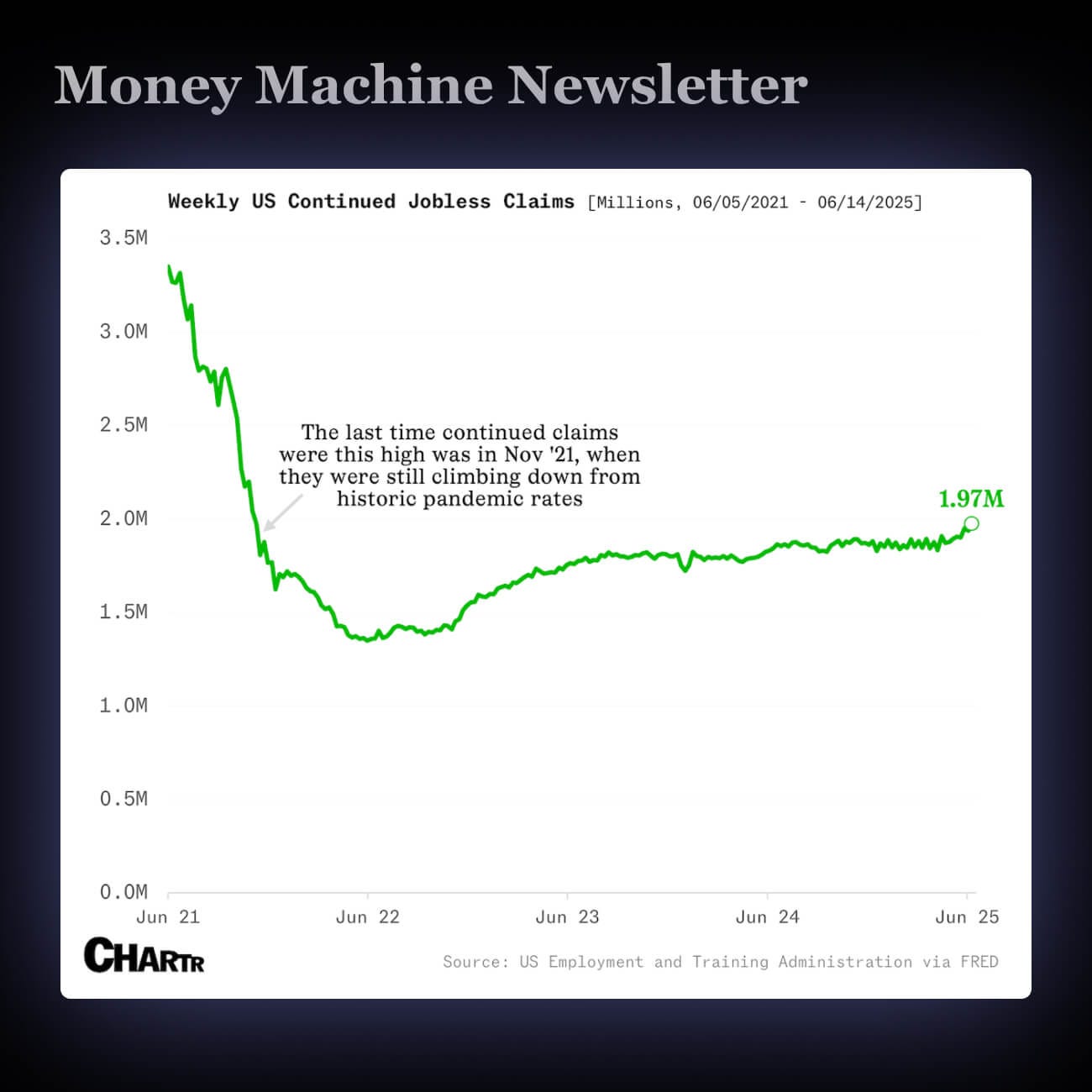

3. 😳 More Americans Are Staying Jobless For Longer - The Highest Level Since 2021

Fewer people are getting hired and fired. But once someone loses a job, it’s taking a lot longer to find a new one. Continuing jobless claims just hit a 3.5-year high: 1.97M.

The job market’s stuck in neutral. Only 52% of industries are hiring more than they did pre-COVID. People feel jobs aren’t “plentiful” anymore, and retail sales are dropping — not great for future hiring.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.