Today we’re featuring The Nasdaq Playbook.

Felix, a former JP Morgan investment banker, figured out a Nasdaq ETF strategy that let him retire early. Now, he’s sharing what works. Simple, tactical insights on the Nasdaq and long-term investing with sharp analysis.

If you care about the market and want to learn from someone who's been in the trenches, this is a must-read. Make sure to check it out and subscribe!

I’ll let The Nasdaq Playbook take it from here…

PayPal just delivered robust Q4 results, with notable gains in active accounts, free cash flow, and operating income margins. The board’s approval of a massive $15B stock repurchase program highlights their commitment to returning value to shareholders ⭐. With strong free cash flow, aggressive capital returns, and a rebound in active account growth, I remain bullish on PayPal shares. Trading at a 13.9X P/E, the stock appears undervalued compared to other Fintech players. The main risk is a potential slowdown in account growth or a decline in free cash flow and margins.

Detailed Analysis

PayPal (NASDAQ: PYPL) outperformed expectations in its fourth fiscal quarter, posting sequential improvements in active accounts, robust free cash flow, and stable operating income margins. The new $15B buyback authorization sets the stage for significant shareholder returns 🚀. With enhanced cost management and rising margins, the current valuation suggests that PayPal shares may be substantially undervalued—a scenario that could prompt a stock re-rating this year.

Key Points:

Free Cash Flow Strength: PayPal’s core payment processing boosted free cash flow dramatically, with a 171% jump in the latest quarter, thanks to strong revenue and lower operating costs ⭐.

Active Account Growth: The addition of over 2 million net new active accounts in Q4 marks an inflection point that may drive organic revenue growth in FY 2025 🔹.

Operating Income Margins: Despite minor margin pressure, the overall trend shows improvement, indicating that cost-control measures are effective ✨.

Q4 Performance Highlights

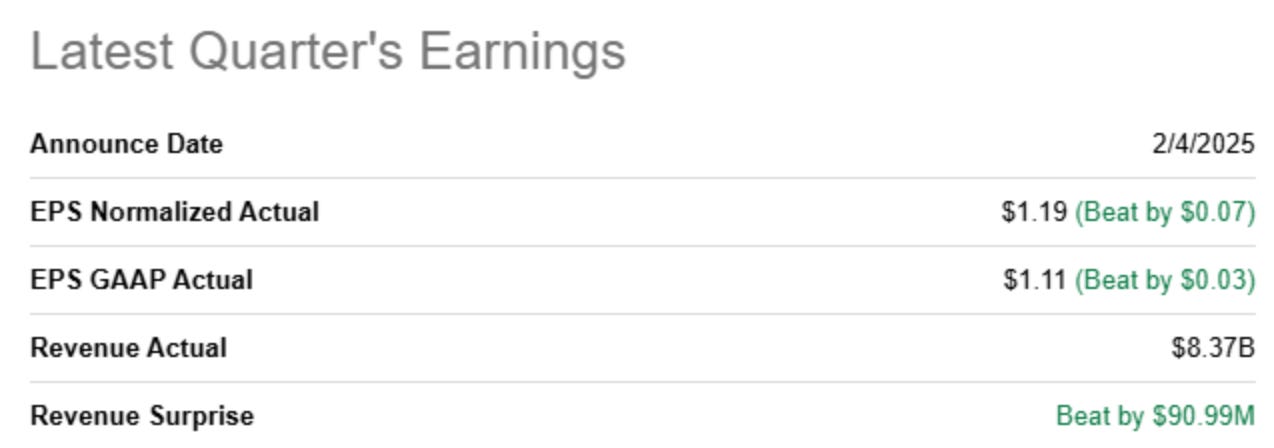

PayPal beat both top-line and bottom-line estimates in Q4. Adjusted earnings came in at $1.19 per share—$0.07 above consensus—while revenues reached $8.4B, exceeding estimates by $91M. Active accounts climbed to 434M by the end of FY 2024, marking the second consecutive quarter of growth. Additionally, transactions per active account rose to 60.6, a 3% increase compared to the same period last year.

Operating Income and Free Cash Flow

Operating income reached $1.5B, reflecting a 2% year-over-year increase, even though non-GAAP operating margins dipped slightly by 34 basis points to 18.0%. More importantly, adjusted free cash flow surged to $2.1B, achieving a 25% margin—a 15 percentage point expansion YoY. This performance allowed PayPal to exceed its FY 2024 target, generating $6.8B in free cash flow versus the $6.0B target.

Guidance for FY 2025

Looking ahead, PayPal forecasts further gains in EPS, revenue, and free cash flow for FY 2025. The company anticipates EPS growth of up to 10%, with adjusted EPS in the range of $4.95–$5.10 per share. In addition, while guidance points to $6–7B in stock buybacks, the recent $15B authorization could lead to even more aggressive repurchase activity. Overall, the guidance is in line with consensus expectations.

Valuation Perspective

PayPal’s valuation slump in recent years was largely due to modest account and earnings growth. However, renewed momentum—driven by growing active accounts and impressive free cash flow—has boosted investor sentiment. At a 13.9X P/E ratio (implying a 7% earnings yield), PayPal is attractively priced relative to peers like SoFi Technologies, which trades at a much higher multiple due to stronger near-term growth prospects. With updated consensus EPS estimates around $5.03 for FY 2025, a fair value calculation using a 20X P/E ratio suggests a target price of roughly $101 per share.

Risks

The main downside risk lies in the possibility of a reversal in the current trend of active account growth or any significant drop in free cash flow or operating margins. Nonetheless, PayPal’s profitability and strong recurring cash flow provide a cushion against these risks.

Closing Thoughts

Overall, PayPal appears to be on a promising trajectory. The company’s earlier focus on cost-cutting is now translating into improved free cash flow margins, and the commitment to substantial capital returns—underscored by the $15B buyback plan—adds further appeal. Coupled with its low P/E valuation relative to the Fintech sector and two consecutive quarters of robust account growth, PayPal looks well-positioned for future success ⭐.

Nothing in this email is intended to serve as financial advice. Do your own research.

Thank you for sharing! At this level Paypal is a real bargain.