Today we’re featuring The Setup Factory.

We’re always on the lookout for newsletters who do the work—who sweat the details so you don’t have to. The Setup Factory is one of those newsletters.

The Setup Factory is a no-fluff newsletter for stock traders. They handpick high-quality trades from the U.S. market, watches the trends, and shows you how to handle them—step by step. This one’s worth your time.

I’ll let The Setup Factory take over from here…

We Have A lot To Talk About Today

We will breakdown where we stand in the current market

Look for clues of a reversal by studying historical patterns

Put up a plan for how we will act and trade going forward

We have fear but we don’t have panic - yet

Sector observations

VIX

Smart and dumb money analysis

Breadth observations

This post is long containing many charts. Your e-mail might cut out a part of it. To ensure you can read the whole post, read it through the substack app.

I Want To Start On A Positive Note

The aftermath of bear markets produce the absolute best opportunities for swing traders. Stocks are much more likely to go 1000% after a bear market, than in a third year bull market. There will come opportunities that can change your life, if you play it right and find the next market leaders.

The aftermath of a bear market is my favorite time to trade, because the potential is so high. If you don’t study the actual bear market, you will not find the next true market leaders that can produce the biggest gains. Therefore this is the most crucial time to stay on top of the market looking for relative strength.

If You Have Followed Along Our Journey

We have had an almost 100% cash position since February 24. My equity curve is practically flat since the end of February. I have made no meaningful advance. And I have lost no money. I have made some good trades, but I have also had a lot of smaller stop losses that add up. The market has been very difficult to navigate and trade from the long side. The gains will come exponentially when the time is right in a better market. Trust your strategy.

Last Monday The Major Indices Was On The Cusp Of Choosing Direction

Now - Everything Has Finally Fallen

All leading sectors have broken down, all leading stocks have violated their setups. There is an absence of setups, only seen in significant and meaningful declines.

If I Only Would Have Followed My Own Advice

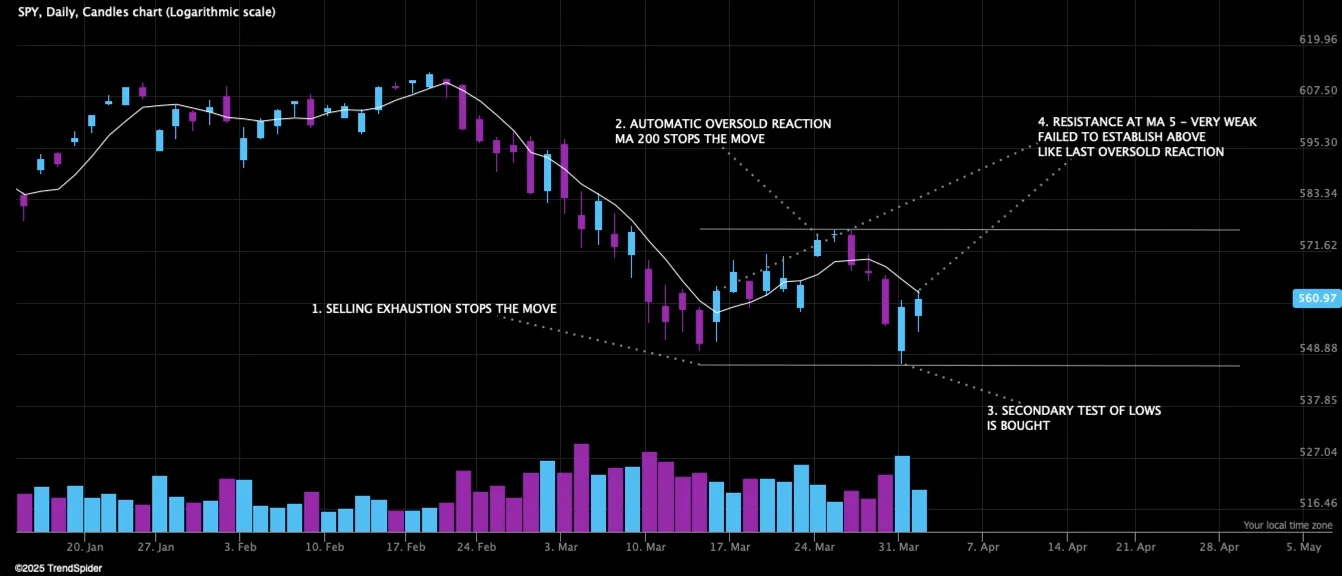

Chart and quote from February 28 post:

That would have been a perfect short. But it is hard during the process to see what is now obvious. At least for me, I am a hopeless bull and focus on playing the long side since the stock market has a underlying bullish bias. I hope some of you caught the move.

Thursdays Price Action Was Sending Mixed Signals

While the major indices and tech/software was dumping hard, there where no overall fear in the charts. Strong tech names where not doing lower lows, and there where a significant rotation into defensive stocks. This is not something you see in a meltdown. In a meltdown everything plummets, like we did on Friday. I actually thought there where a chance that we were bottoming, and that this would be a normal intrayear decline.

Then Came China Tariffs - Prolonged Trade War Was Not Priced In

Since there still were no signs of real fear, bad news will accelerate the down move. When we have real fear and the sentiment is bearish enough, we do not meltdown on bad news. Because the selling pressure is already exhausted. That is why we always look for real fear and selling exhaustion as swing traders. It is the best signal of some sort of bottom forming.

Fridays Move Was Pure Liquidation Of Stocks

Erasing almost all trading setups in all sectors. There were no meaningful sector rotations. Defensive stocks collapsed together with the overall market. This is an indication of a more significant underlying problem in the stock market. When all trading setups disappear, there is serious damage to the overall market health.

Chart courtesy of Deepvue

Where We Stand Now

The S&P 500 has now declined 10% in 2 days. The decline has had an accelerating character on expanding volume. Back to back day low closes, on moves like this are historical and very concerning.

The Weakness In This Decline Is Amazing

So amazing, that a rapid decline of this magnitude from a market top, has only happened three times in history before - 1929, 1987 and the COVID-crash. Furthermore, Friday posted the largest trading volume of shares, across all US-stock exchanges, in history. Ever. On a bearish move like this.

We are currently at the last major zone of support before the next one, which is the market top of the 2022 bear market. If we don’t recover quickly from here, we might be looking at a continued violent decline until we find support at the 2022 bear market top. Closing the week, under the 2023 August low, decreases the likelihood of a quick recovery.

Nasdaq Composite, Nasdaq 100 And Russell 2000 Have Officially Entered A Bear Market

Which is defined as >20% decline from a recent high. But it is important to know that some indices can be in a bear market while others aren’t. The S&P 500 is the primary benchmark, the most important index. And it still has some room on the downside before entering a bear market. But with the overwhelming weakness this time, I find it almost inevitable that we will enter a bear market in the S&P 500 as well. A sudden deal that shifts the whole narrative will likely be needed to prevent it.

How Much Further Can We Decline? - Short Term - Days

If we assume no narrative shifting news descend from the gates of heaven, producing a V-recovery like the COVID crash. We will still get a counter reaction.

We Are Extremely Oversold In The Short Term

However I am not so sure it is going to happen immediately on Mondays open like most expect. The character of the decline and the back to back day low closes of the indices are magnificently weak, giving clues of continued selling pressure. If Trump doesn’t pump it during the weekend, a gap down on Monday seems very likely. Maybe if that gap down is bought, it could be the start of a counter move.

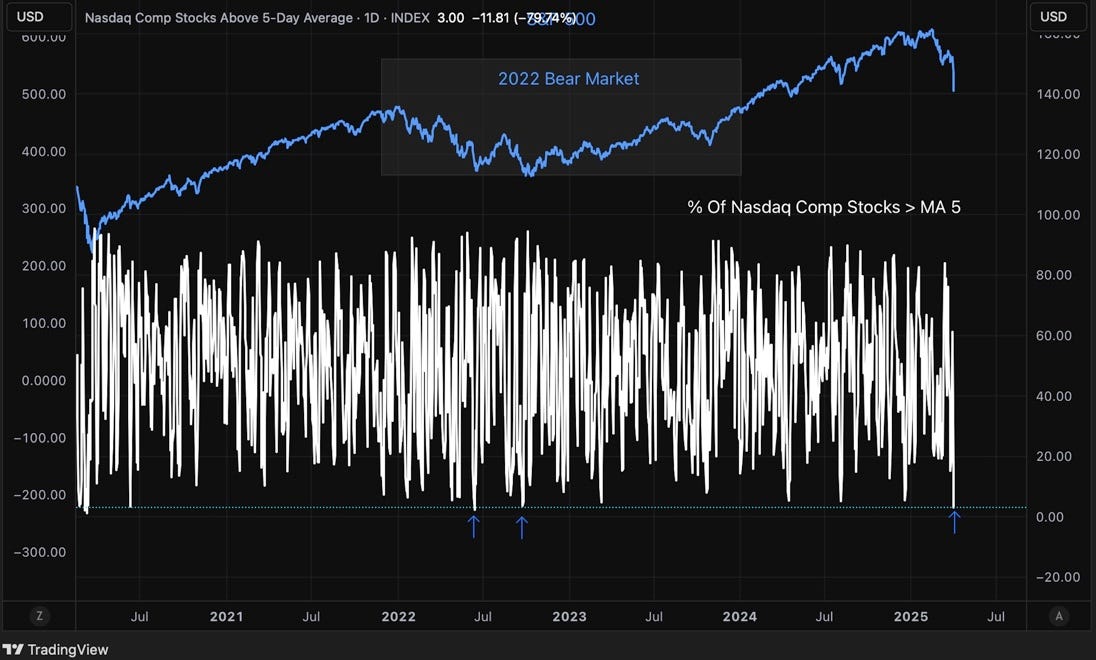

Only 3% Of Stocks in Nasdaq Composite Is Over The 5 Day Moving Average - An Extreme Reading

Only achieved near the bottom of the 2022 bear market and around the COVID-crash, in recent years. And during those times it only stayed that oversold for 1-3 days. So some form of counter reaction will come in the coming days, but it might be very brief and weak.

We Can Stay Oversold - And Get More Oversold In The Intermediate To Longterm

If we assume that no news driven V-shaped recovery will occur, essentially saving the stock market, and that we will stay in this bear market for a while. There is a lot of room for further decline going forward. We are not at levels of oversold in the intermediate to longterm, that is typically seen at a bottom of a bear market.

If We Compare With The Last Three Bear Markets - We Are Just Getting Started

This chart shows the amount of stocks > MA 200, meaning stocks that still are in a longterm uptrend, compared with the S&P 500.

(Source: SentimenTrader.com)

A single 10% trade on a $2k position covers a full year of stock ideas and market insights at The Setup Factory.

Lock in your Early Supporter Lifetime Price - Deal expiring

Dumb Money Still Not That Scared

We want to go against dumb money, since they have a proven track record of poor market timing. When Dumb money confidence is low and smart money confidence is high, stocks will mostly likely rise.

Dumb Money Confidence - Grey Shaded Areas Are The Three Recent Bear Markets

(Source: SentimenTrader.com)

Dumb money confidence is low, but not sufficiently low for a bottom, if this is a true bear market.

Smart Money Is Betting On An Increase In Stock Prices - But This Is Not A Short-term Buy-signal

(Source: SentimenTrader.com)

In 2022 - Smart money confidence spiked early in the bear market. After that the S&P 500 produced a 4.6% rally, just to continue plummeting 20% more until it bottommed. Smart money confidence spiked to almost the same level on Friday.

Up Or Down, One Thing Is Sure - We Will Live With High Volatility For A While

In last weeks market analysis, I highlighted the fact that it is extremely uncommon for VIX to make a higher low from a reading as high as around 20. Looking back historically, that pattern is mostly seen in bigger bearish events and crashes. Well, it was a clue, and on Friday VIX exploded 50% closing over 45. The highest reading during the 2022 bear market was 39. As long as VIX is at these extreme levels, the likelihood of a real reversal is poor. We need to see a meltdown in VIX - which would be a bullish sign.

VIX Compared To The S&P 500 - Extreme Degree of Uncertainty And Volatility In The Current Market

Makes you kind of worried right.

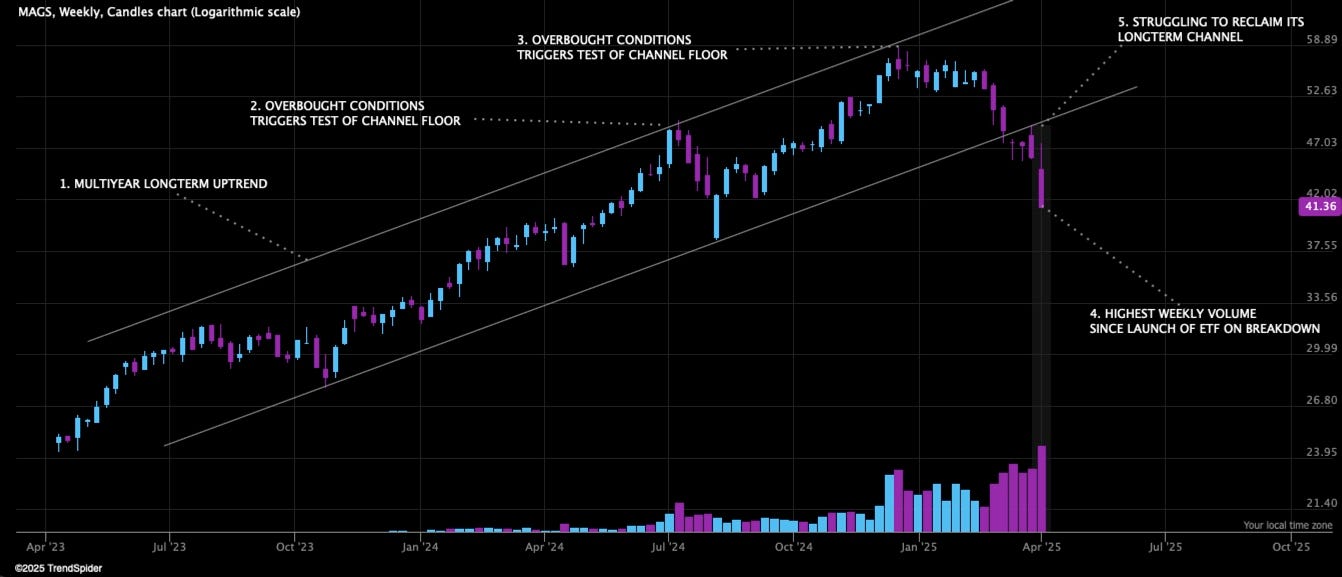

MAGS Still Can’t Catch A Bid

The S&P 500 is a weighted index. MAGS comprises 32% of the S&P 500. That is why I have said that we need MAGS, for the overall market to turn. And MAGS is showing no life yet.

Every Sector Have Fallen

Insurance was the last man standing

Energy Ran Out Of Gas

Energy was one of the leading sectors, a historical late cycle bull outperformer. Oil as well as energy stocks plummeted in two days due to several factors:

OPEC+ unexpectedly increasing production

China tariffs

Recession fears

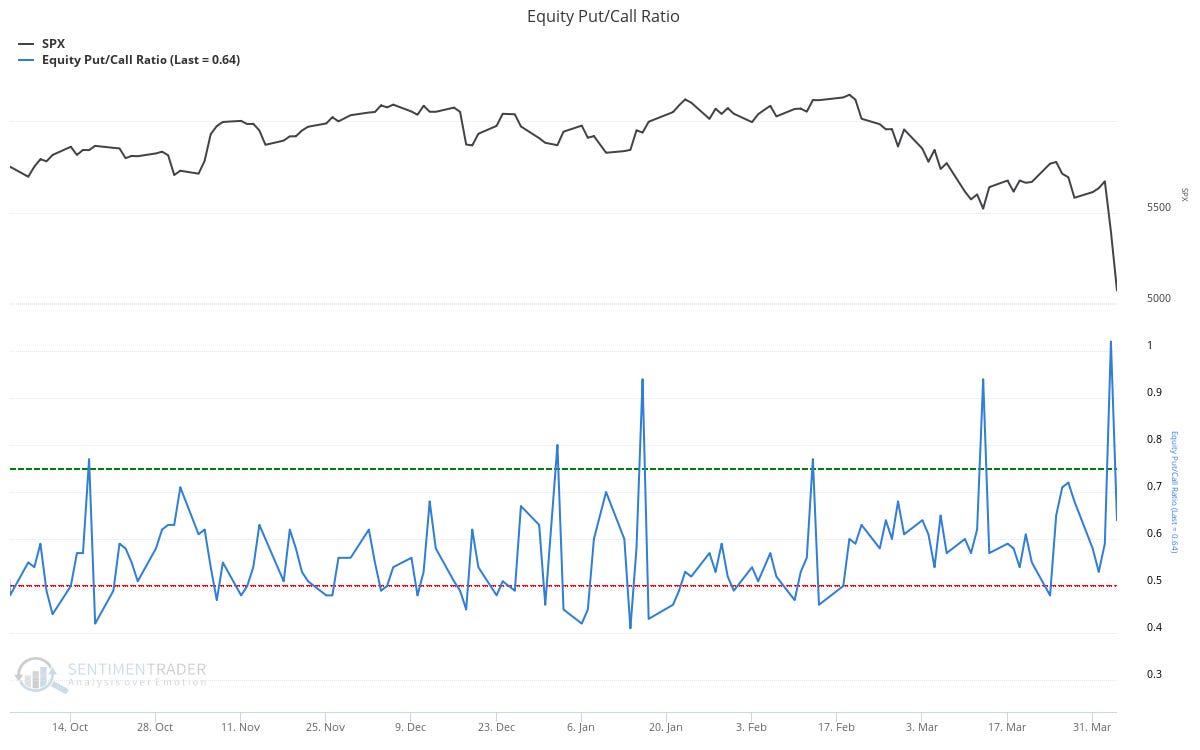

We Have Fear But We Don’t Have Panic

(Source: SentimenTrader.com)

Equity Put/Call spiked at 1.02 during this decline. This is certainly fear. For panic we would like to see a reading of 1.2 or more. Panic is great - it forms the best bottoms and reversals. We do finally have fear and some capitulation. But no panic. Panic can come in a second wave down later on, or not at all, but it is a great signal of a reversal when it occurs.

My Main Scenarios Going Forward

1. Major Trump Deal Removing Or Decreasing Tariffs Significantly

In my opinion, this is not a likely scenario. Too much uncertainty and geopolitical damage is done already, for the stock market to just forget and trust anything Trump says about this. But it is a possibility, which could produce a COVID-like recovery.

2. We Will Test The Market Top Before The 2022 Bear Market - Located 5% Down

This is my main scenario:

When you have such a significant liquidity and support zone that are this close. It is almost always tested. It is too close, and the sentiment is too bearish, for the market to be able to turn without testing supply at the most major support zone underneath.

If the S&P 500 tests this level, it would by definition fall into a bear market. If I have to guess, we will arrive there next week.

We will get a relief rally. All sharp declines have sharp relief rallies. The question is if we can produce it before falling into a bear market. I believe not.

3. Bullish scenario

We only dip our toes in the bear market over the next couple of weeks, while Trump repairs the economic damage and we recover fast.

What Do We Do Now?

It’s fun to have some scenarios, but it doesn’t affect my execution. We will follow price and price action and position us accordingly.

At this moment we are at system critical levels of uncertainty. 100% cash is the position. I closed my 2.5% portfolio exposure on Friday due to the price action of the S&P 500

These next couple of days will be volatile and hard to interpret

But soon we will see which sectors and groups are leading

We will find the strongest stocks in the strongest sectors and stalk them for clues of a reversal

Clues of reversal are groups of stocks setting up in valid trading setups - my favorite signal

Leading stocks and sectors bottom long before the major indices stabilize

If we get a relief rally and stocks setting up, we will play that. Everybody has different risk tolerance and timeframe, and it is never wrong to just sit in cash until the market improves.

But bear market rallies can be very powerful and profitable. The key is to lock in profits fast, because the overall market trend is down

Also breakouts work bad in bear markets, so we will have to adapt our strategy accordingly. More on this as we go along.

Charts courtesy of SentimenTrader.com

Charts courtesy of TrendSpider

Charts courtesy of Deepvue

Charts courtesy of TradingView

Disclaimer:The Setup Factory is not licensed to give any investment advice. The content provided in this email and from this Substack-account is my own thoughts and ideas about the stock market. It is for educational purposes only and should not be considered as any form of investment advice. Do not invest in any stock based solely on the information provided here. Trading stocks is highly speculative and involves a high degree of risk of loss. You could lose some or all of your money. You should conduct your own research and due diligence in any investment you do, to verify any information provided.