This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Did DeepSeek just scrap NVIDIA's real moat, CUDA?

China gamified shopping and 63% of people are gobbling it up.

America’s forgotten stock (dirt-cheap right now).

THIS country owns 1.5% of all public stocks and is killing it!

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. ⚠️ NVIDIA'S Real Moat, Scrapped?

HOT TAKES… did DeepSeek steal OpenAI’s AI model? sure… did they also innovate? ABSOLUTELY… did China want to disrupt the U.S. economy? always… did big tech get lazy and just throw money at AI with no constraints? probably… this can all be true at the same time… but the real breakthrough… DeepSeek ditched NVIDIA’s CUDA…

NVIDIA’s CUDA is the software controlling AI training… they skipped it, instead, they coded on the hardware (PTX), never been done before. THAT’S A FLEX 💪.

Did they only drop $6M to create DeepSeek? Nope, fugazi…

The real cost, +$1B on compute.

$6M is just the final training run, it’s like bragging about building a skyscraper for the cost of the last shipment of cement.

DeepSeek didn’t get VIP entrance to the club, so they used the back alley door…

OpenAI says DeepSeek trained R1 using GPT-4’s outputs.

DeepSeek’s early model would straight-up say it was as GPT-4 in tests… I mean at least be subtle about it, geez.

Huawei just joined the party… they adapted DeepSeek’s AI for their own chips, slashing costs by 70%.

NVIDIA chips still flowing to China…

Despite U.S. bans, China still got tens of thousands of NVIDIA’s best chips, potentially through Singapore.

What happens next is anyone’s guess, but don’t expect Washington to sit still… game on.

2. 💸 QVC Effect Is Back—On Steroids

Remember back in the day when you would get home at 3am, drunk as hell, near blacking out, sat down to go ham on the personal pizza you just picked up, and all of the sudden you’re being sold a the George Foreman grill on QVC… buy 1, get 1 free, YES PLEASE, speed dial! All of the sudden you have two baller grills on your kitchen counter… Ah, yes, the golden years… well… it’s happening all over again, minus the booze and pizza, and China is all over it…

Chinese apps like Douyin and Xiaohongshu make shopping feel like a game. Scroll, laugh, buy. No effort, no searching—just perfectly timed impulse buys.

Douyin sold $375B worth of goods in 2023. Xiaohongshu, ~$1B in profit for 2024.

Shopping has shifted from search to discovery, and we’re gobbling it up… 63% of people prefer finding products they weren’t even looking for, the algorithm gods working overtime.

Big players are catching on—Instagram and Facebook have in-app shopping, Amazon Inspire mimics TikTok with shoppable videos… but there's one company in particular that is quietly dominating... Whatnot.

$359M in revenue for 2024 (+102% YoY).

Valued at ~$5B and backed by big dawgs like Andreessen Horowitz & DST Global.

Processed more than $3B in total sales in 2024 (doubled from 2023).

Whatnot isn’t public—yet… but livestream shopping is heating up… when the right player goes public, it could be a big win for self-directed investors… we’ll be watching closely.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $90/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

MAKE MONEY or GET YOUR MONEY BACK GUARANTEE. If you subscribe today, use it actively for a year, and don't make money, we'll refund your payment and give you an extra year for free.

TRY RISK FREE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $90/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

4. 🥃 America’s Forgotten Stock

For years, THIS particular company thrived in a protected market—with steady growth, fat margins, and market-beating returns… then came the setbacks… a rough stretch sent shares tumbling nearly 50%... but now, something’s stirring… a high-profile activist investor is demanding change and it’s triggered our radar… Brown-Forman.

Today, it's facing a few threats…

Gen Z is drinking less.

50% EU tariff could crush international sales.

U.S. Surgeon General is linking alcohol to cancer.

While most investors see risk… we see an opportunity…

Revenue fell 1.18% to $4.18B in 2024, but profits jumped 30.78% to $1.02B.

Stock is down 40% YoY, hitting five-year lows, currently undervalued.

Cutting 648 jobs, closing its cooperage, and saving $70–80M a year—all to boost profits.

Profitable for a long time. With brands like Jack Daniel’s, it’s a strong, stable business.

Actively keeping debt in check, $2.39 billion as of October 31, 2024—down 9.91% from last year.

RTD cocktails are booming, and Brown-Forman is jumping in.

Gen Z drinks less but spends more on premium spirits. Brown-Forman sees the shift—hence the buyout of Diplomatico Rum.

Join Money Machine Newsletter to get our buy/sell setups, we’re watching this one closely. If Brown-Forman weathers tariffs and capitalizes on premiumization, the upside could be massive. It looks like a bargain, but timing matters.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Ideal Wealth Grower, join 3,000+ subscribers learning how to invest in residential real estate for early retirement. It’s free, on point, and a must-read—delivering market news, deals, and tips in under 5 minutes!

👉 TheDailyDollar, if you’re into finance, investing, or crypto, The Daily Dollar is worth a look. Abhaya Anil shares how he's made millions in crypto, along with real lessons, mistakes, and practical money tips from his 15 years of experience. It’s honest, simple, and actually helpful.

👉 Global Dividend Journey, unlock the secrets to growing your wealth with dividends! Join to to learn smart investing, dividend strategies, and tips for steady passive income.

👉 Cyber H3rmetica, stop being a normie and join 3,000+ readers exploring the dark side of the Digital Age. Cyber Hermetica dives into the crossroads of technology, philosophy, occultism, and cybersecurity—your guide through a world in transition.

👉 Nuclear’s Substack, advanced option trading strategies based on the #1 Amazon bestseller The Nuclear Option.

Top 3 Charts of the Week

1. 💰 Norway’s Wealth Fund Hits Record Profits

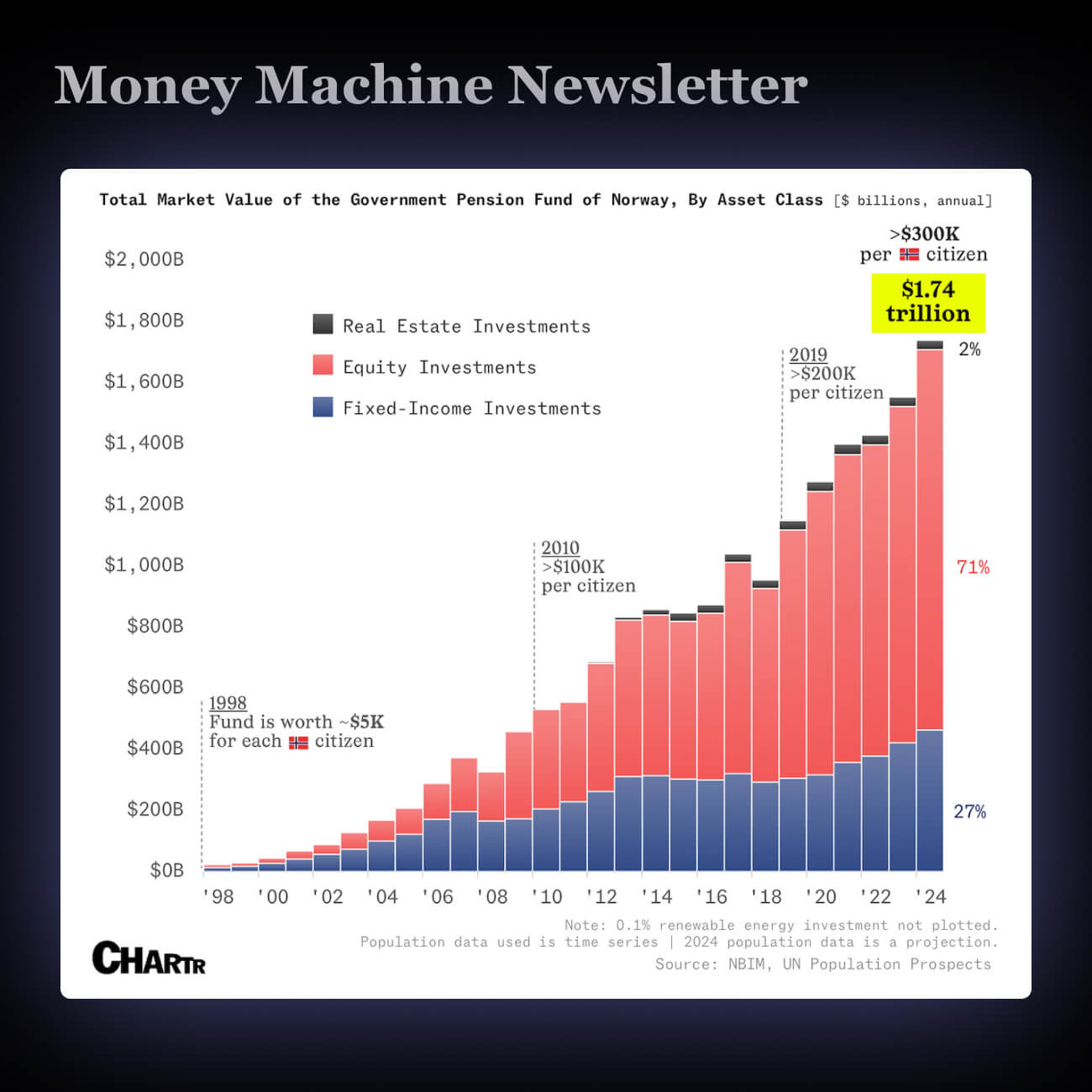

Norway saved its oil money instead of spending it and invested it in stocks, real estate, and bonds. Now, that fund has grown to ~$2T, making $222B in profit last year. If divided equally, each Norwegian would get $319,900. It’s the biggest investment fund in the world, owning 1.5% of all public stocks.

2. ☕️ Starbucks' China Struggles Persist

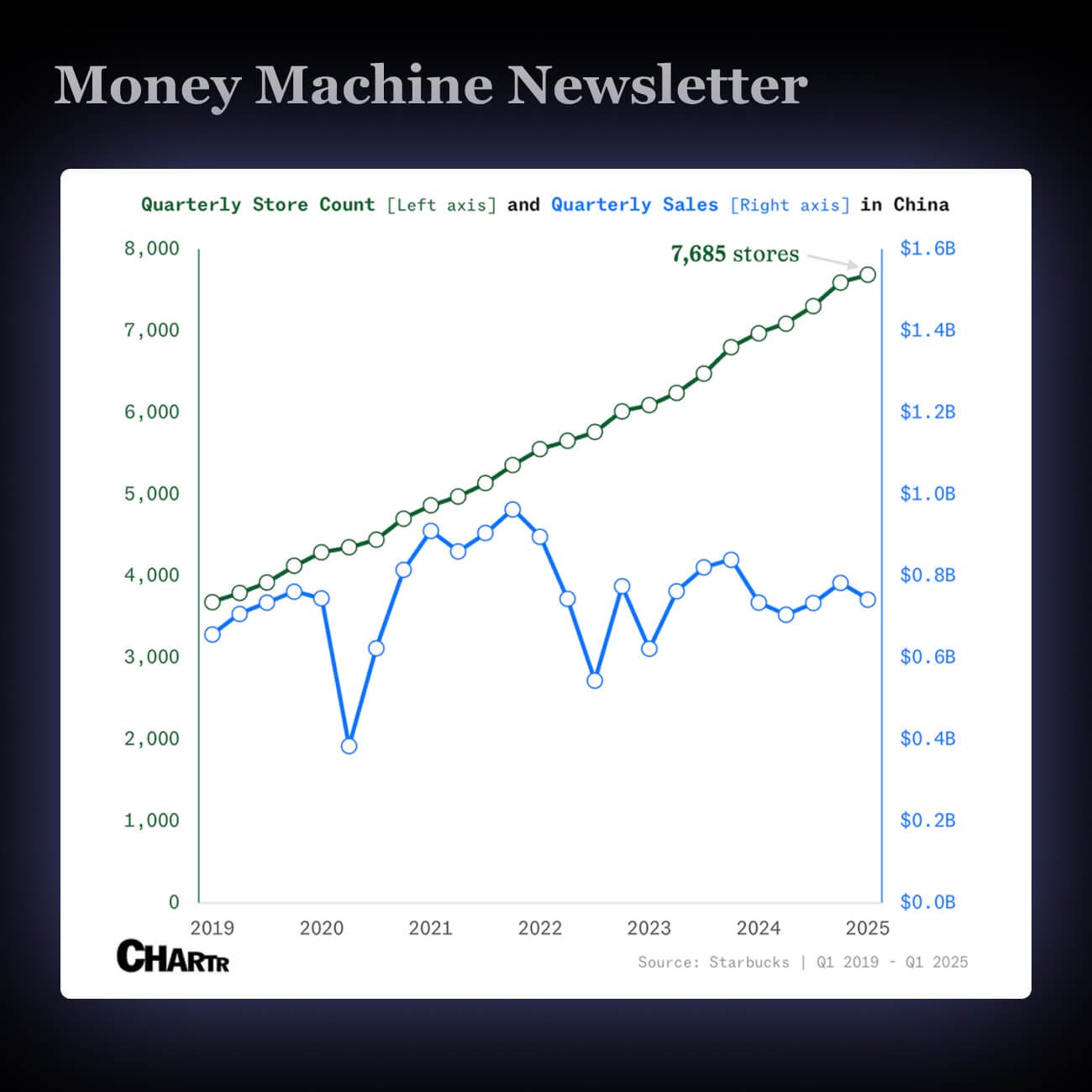

Starbucks is struggling in China. Sales fell over 5% last quarter, even after adding nearly 100 new stores. Fewer customers are visiting, and those who do are spending less—average ticket size dropped 4%.

Expanding stores isn’t helping. Local competitors like Luckin are cheaper, Chinese consumers are leaning away from Western brands, and nationalism is rising. The old Starbucks playbook isn’t working.

China is Starbucks’ second-biggest market. If this decline continues, it could hit revenue hard. Investors expecting growth might be in for a bitter surprise.

3. 🧪 Reality Labs Is Still Incinerating Cash

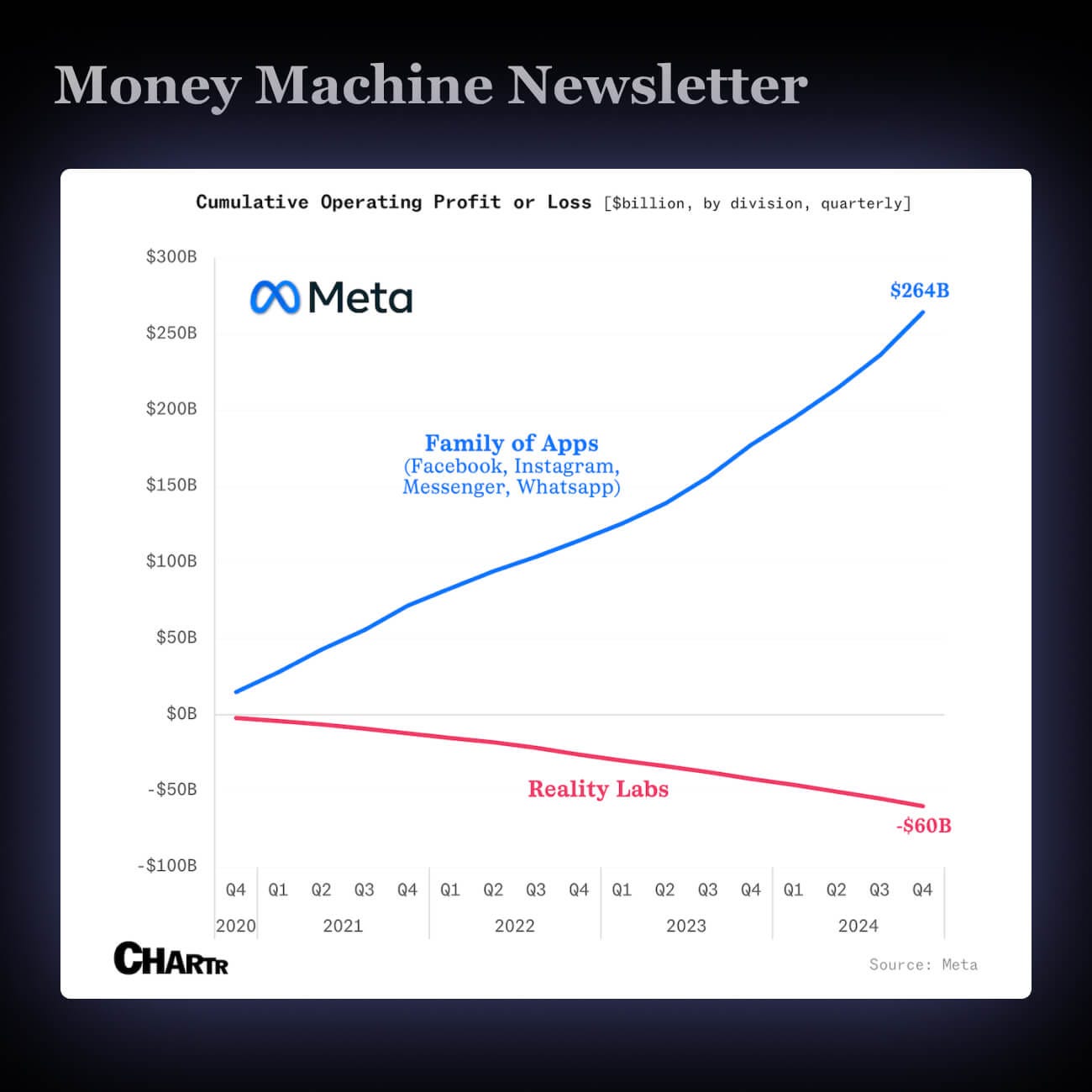

Meta’s Reality Labs has lost $60B since 2020. But Meta’s core apps print money, so they keep funding the dream.

Meta still dominates VR/AR with 70% market share and sold 3 million Quest 3s. They’re betting big—2025 is the “pivotal year for the metaverse,” and they’re spending $65B on AI and capex this year.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.