🏠 Mortgages Doubling Overnight—WTF???

Plus: NEW Diabetes Study Has Big Pharma Shook, FDA Fast-Tracks Biotech That Holds $930M in Cash

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Imagine your mortgage doubles overnight—happening to many.

University close with Big Pharma just dropped a bombshell study.

$930M in cash, very little debt, and FDA fast-tracked—who am I?

THIS unheard-of beauty product mopped the floor with Estée Lauder.

And more. Let’s get to it!

Follow us on Instagram | Advertise to our 5K+ subscribers

Top Insights of the Week

1. 🏠 Mortgages Doubling Overnight—WTF???

Imagine waking up, and your $2,100 mortgage is now $4,100—it’s happening to many. There’s a scary number that recently came out and is surprisingly not getting enough attention. It’s from a word most are avoiding…prime rates…and it’s still at a scary high, 7.75%...

What the hell is a prime rate? It’s the interest banks offer to their safest bets—big, low-risk companies—for short-term loans. But here’s the kicker, this rate sets the bar for everyone’s credit card, loan, and mortgage rates. When it goes up, borrowing costs generally jumps for everyone.

Why 7.75%? In a nutshell, when the Fed raises or lowers its rate, the prime rate typically follows suit.

7.75% = bigger monthly payments, less spending power…

So, if you snagged an adjustable-rate mortgage a few years back at a sweet 3%-4%, refinancing now means facing a 7.75% rate hike. Absolute madness!

Regional banks are feeling the squeeze too…

With the prime rate at 7.75%, regional banks are sitting on loans and securities with losses in the Billions. Not a typo.

~$46B in office debt is coming due by 2025, and only 26% of last year’s office loans were fully paid off.

What are regional banks doing to avoid disaster? A little game of “extend-and-pretend”—stalling for time, hoping for rate cuts and better market conditions. In other words, "Jesus, take the wheel."

A glimmer of hope?

Fed recently cut rates by 0.25% to 4.5-4.75%, prime rate went from 8% to 7.75%.

Trump’s back. He’s pro-business and could give commercial real estate a lifeline. He might push the Fed to cut rates, but they don’t have to listen.

2. 😳 NEW Diabetes Study Has Big Pharma Shook

A university with close ties to Big Pharma just dropped a bombshell study revealing that stress might actually be the root cause of type 2 diabetes.

Their discovery…Fatty foods trigger stress signals, flooding your body with fatty acids, causing insulin resistance—leading to type 2 diabetes.

Two fat mice, 1 develops diabetes the other doesn’t…

Researchers tested two groups of mice: normal ones and others altered to block stress signals. Both ate fatty foods and gained weight, but only the normal mice got diabetes. The altered mice stayed healthy.

Who’s behind this research that challenges old assumptions? Rutgers University. And they have 2 major players turning heads…

Novo Nordisk could use this research to tackle insulin resistance at its source.

Eli Lilly is known for going after novel ideas in the diabetes field—don’t be shocked if they’re first to jump on this.

Regardless of who runs with this research, we're watching closely—economic impact could be huge…

Cost the U.S. ~$412/year due to healthcare and lost productivity.

Insulin costs alone tripled, ~$8B in 2012 to ~$22B in 2022.

~537M people are living with diabetes.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

MAKE MONEY or GET YOUR MONEY BACK GUARANTEE. If you subscribe today, use it actively for a year, and don't make money, we'll refund your payment and give you an extra year for free.

Get $13,890.80 worth of value for just $9/month to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

4. 💸 $930M Cash. Little Debt. FDA Fast-Tracked—Who Am I?

FDA is laser-focused on ending obesity and they’re all in on this one drug that top investors are calling a “goldmine”. And, The Wall Street Journal called it a “gold rush”. The drug sucking up all the attention…GLP-1.

GLP-1 mimics a gut hormone, telling your brain you’re full, so you eat less.

There's a small biotech who sees this as their opportunity to explode in growth. In fact, FDA "nudged" them to pick up the pace, fast-tracking their GLP-1 drug to Phase 3. Investors heard—and their stock shot up 30%…Viking Therapeutics.

Here’s why we’re paying close attention…

Helping patients lose AND keep the weight off, unlike Ozempic.

Swimming in $930M cash and very little debt.

Good relations with FDA, entering Phase 3 trials.

Offers both an injectable and pill, broader patient appeal.

Share are up 531% in the last 12 months, with no approved drugs—plenty of room for more growth.

Fascinating research…

Patients taking Viking’s drug saw 14.7% weight loss in 13 weeks. Ozempic took 68 weeks for similar results.

All the benefits of GLP-1s for weight loss with very little side effects.

Improved blood sugar levels could help those at risk of diabetes or with metabolic issues.

Weight-loss market: ~$274B in 2024, projected ~$405B by 2034.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 fetcharts, tired of superficial news? Join the likes of people from Palantir, Macquarie and others who indulge in our engaging charts and actionable insights on Finance and Economics in less than 5 minutes. Delivered weekly, without flooding your email.

👉 Polymathic Being, counterintuitive insights from technology, innovation, philosophy, psychology, and more.

👉 Moneyin2, personal finance, saving and investing: Demystifying money and making you richer, in just 2 minutes a day.

👉 YourLastLife, wealth, self development, sovereignty. A weekly newsletter from a deep thinker always trying to improve and gain more freedom.

👉 Thoughts From The DataFront, breaks down complex ideas related to AI and big data into practical insights, making them accessible for a broader audience. From the future of work to the importance of learning new skills, explore how AI can augment human intelligence and society.

Top 3 Charts of the Week

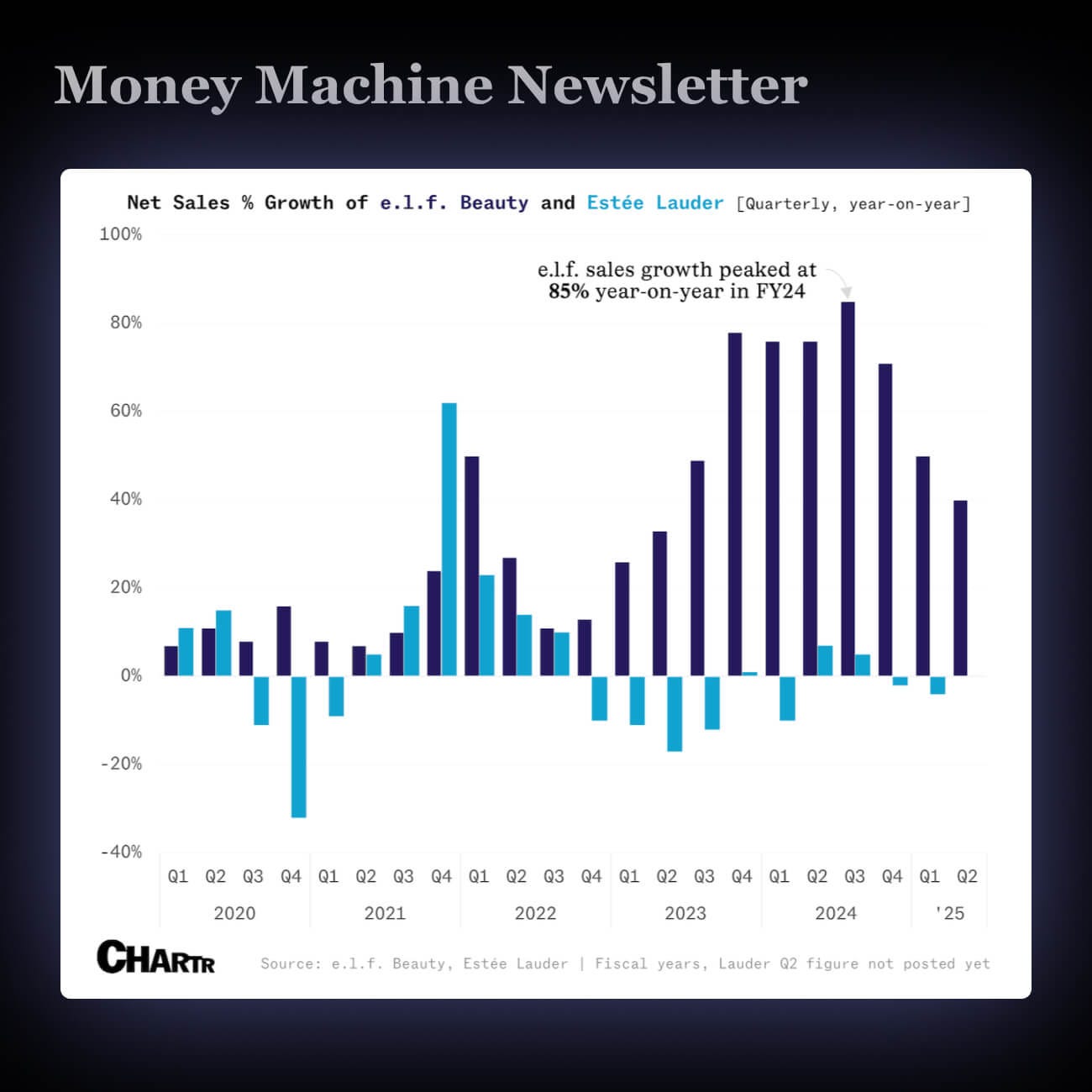

1. 📈 Insane Revenue Growth by e.l.f

e.l.f. Beauty’s sales jumped 40%, smashing expectations, while big names like Estée Lauder saw drops.

Their low-cost "dupes" are winning over Gen Z and beyond.

e.l.f. is crushing it by selling great beauty products that don’t break the bank.

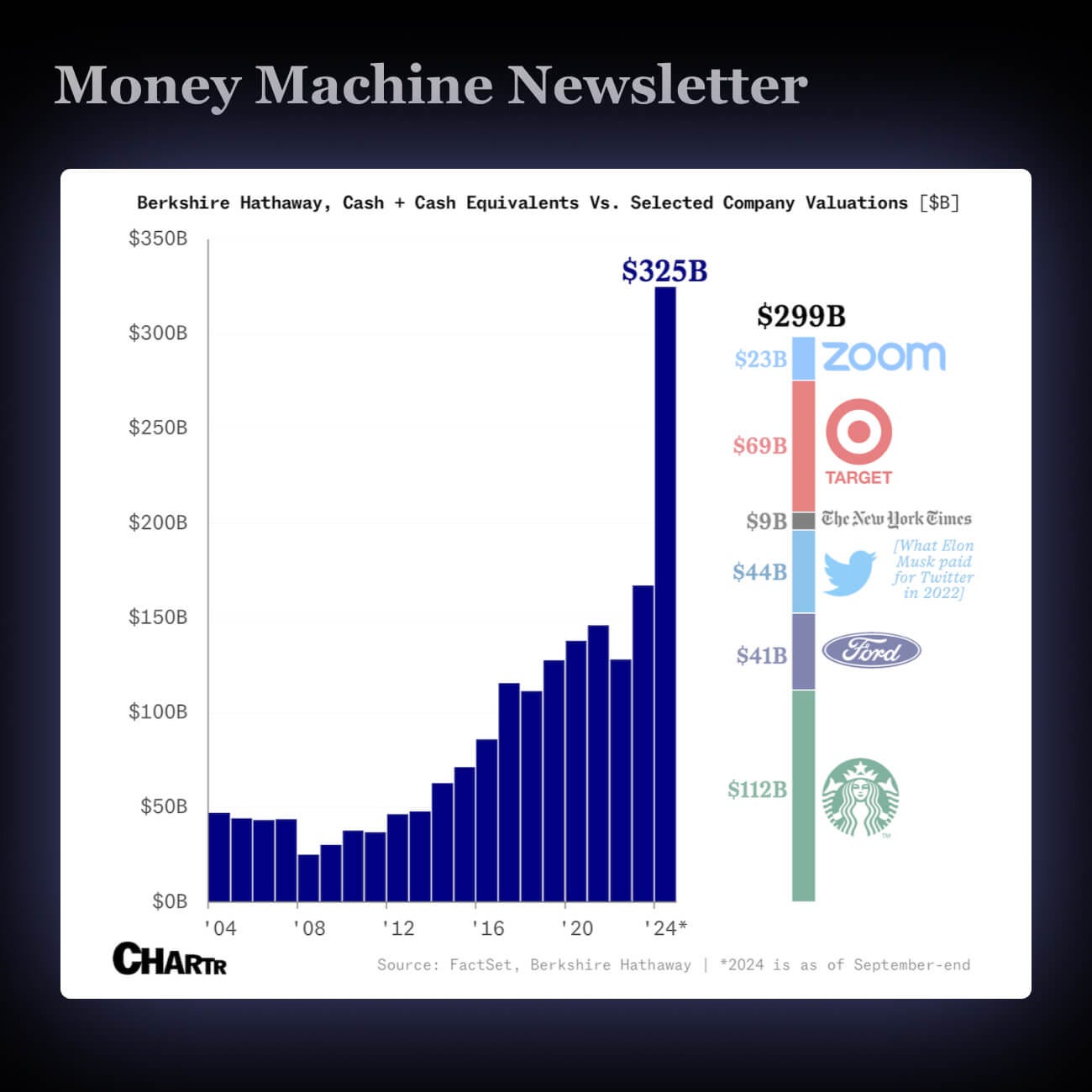

2. 💰 Berkshire's $325 Billion Cash Stack

Buffett's team sold $36B in stocks, boosting their cash stash to a record ~$325B, cutting Apple shares again.

Buffett’s cash move suggests he's waiting for better investment opportunities.

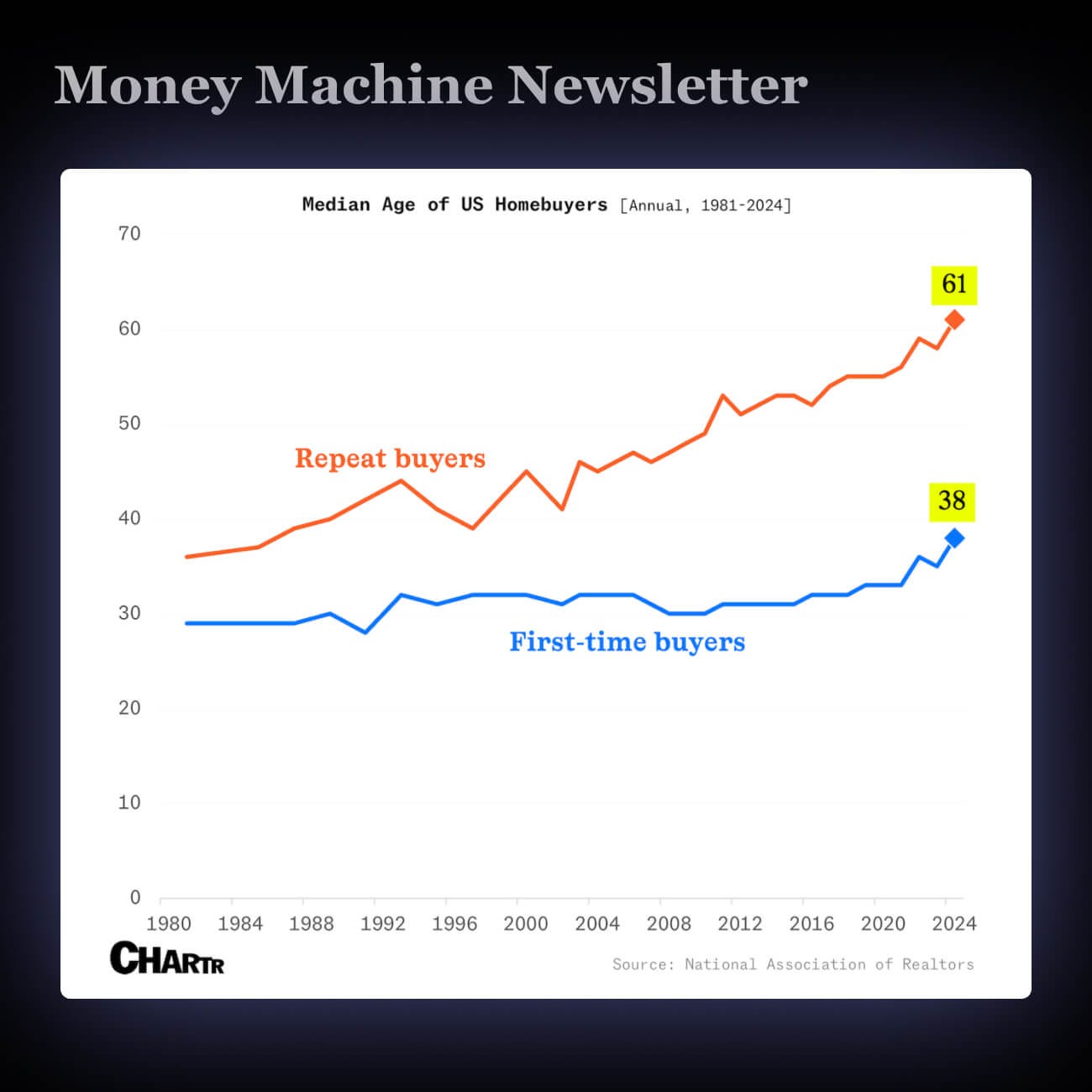

3. 🤔 First-Time Homebuyers Hit Record High Age

First-time homebuyers are now 38 years old—the oldest ever. High prices and mortgage rates are delaying homeownership.

More people are renting longer. Today’s buyers are older and paying cash.

Rent costs are climbing faster than wages, especially in big cities.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.