Mobilicom Limited: An Underfollowed Drone Player Positioned for Major Upside in 2025 and Beyond!

MMN Recommend

Today we’re featuring 1035 Capital Management.

If you're tired of hearing the same stock picks recycled on every podcast and headline — this one's for you.

This newsletter skips the noise and goes straight to the signal. No bloated takes. Just clean charts, clear setups, and sharp ideas on the stocks no one’s talking about… yet.

It’s for readers who like to dig deeper, think independently, and maybe find a hidden gem before Wall Street shows up. If that’s you, subscribe. It’s worth it.

I’ll let 1035 Capital Management take over from here…

Summary

MOB is on the verge of a major inflection point, with two high-potential programs about to ramp up, potentially generating tens of millions in annual revenue.

Validated by key defense industry players, including two near-term "Program of Record" designations, positioning MOB for substantial growth in the next few quarters.

An ~$11.5M market cap, with $8.6M in cash — effectively trading near cash value despite high-growth potential.

Strong gross margins near 60% with further upside through cross-selling cybersecurity software, which come with 90% margins, driving both sales and margin expansion.

The company is uniquely positioned in a rapidly growing sector with limited competition and a clear path to profitability.

Intro

Mobilicom is a new name for us — introduced by Tim Weintraut over at AlphaWolf Capital — so credit where it’s due, and if you want to learn more check out his interview with Mobilicom here. Tim has a strong track record in the drone space and was instrumental in getting us into both UMAC and RCAT ahead of their big moves. That being said, we think Mobilicom (MOB) could be the next drone company in line for an outsized run.

Mobilicom is an Israeli company that went public in an unconventional way: through a reverse merger with a small Australian firm. While we’re not fans of that path to the public markets, we do like the business — and more importantly, the opportunity — both in the near and mid-term. And hey, at least it wasn’t a SPAC. So, what does Mobilicom actually do, and why should you care?

Mobilicom provides end-to-end cybersecurity and communication solutions for drones, robotics, and autonomous platforms. It’s a rapidly growing niche, and a critically important one — especially when you consider how real the risk of hacking becomes in these use cases. If you’re operating a kamikaze drone, the last thing you want is for it to be hijacked. And if you're building robotics, securing both the software and hardware layers is non-negotiable.

CEO Oren Elkayam, like many Israelis, completed his mandatory service in the IDF. But Oren was selected for an elite engineering unit in the Israeli Air Force, where he worked on cutting-edge problems involving drones and cybersecurity. After completing his service, he launched Mobilicom to commercialize his expertise — and the company has been steadily building a leadership position ever since.

We believe Mobilicom has established a meaningful first-mover advantage at the intersection of cybersecurity software and “hardened” drone hardware. The company is pushing to become a “end-to-end” provider of hardened drone components, hardware with an added cybersecurity component, with a strong focus on key control hardware and cybersecurity. Notably, MOB recently earned a place on the U.S. government's “Blue List” — a vetted group of defense vendors approved for use in critical infrastructure, with no supply chain exposure to adversarial nations. That alone opens the door to a wide range of early-stage defense programs in the U.S. and allied countries.

We believe that two government programs are on the verge of ramping to meaningful volumes. While the timing is always uncertain with government contracts, we’re confident MOB will land both deals — and likely more to follow. What really got us excited was the company’s strategy around end-to-end integration, increasing share of wallet, and cross-selling — which we’ll dig into that later.

This post is long containing many charts. Your e-mail might cut out a part of it. To ensure you can read the whole post, read it through the substack app.

US Drone Opportunity

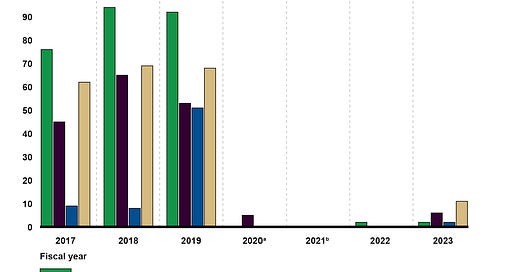

Back in 2020, the U.S. began pivoting its drone procurement strategy away from “adversary” nations and toward allied partners, driven by growing concerns over cybersecurity and physical security risks. That year, the Department of the Interior implemented restrictions on purchasing drones from adversarial nations — a move that marked the start of a broader strategic shift away from Chinese-made drones. The impact was immediate and significant, as shown in the chart below.

Source: GAO Report: Federal Lands: Effects of Interior’s Policies on Foreign-Made Drones

Fast forward to December 2023: the American Security Drone Act (ASDA) was passed as part of the National Defense Authorization Act (NDAA), formally prohibiting federal agencies from procuring or operating drones manufactured by Chinese companies. The ASDA is a meaningful legislative milestone — one aimed squarely at enhancing national security by limiting foreign access to critical infrastructure and government operations.

The intent is clear: reduce the risk of espionage, data theft, and national security breaches by eliminating foreign-made drones from federal use. It’s also an early and explicit example of the broader push to re-shore or “friend-shore” critical manufacturing capacity — a theme gaining significant support under the current administration.

The result? A near-complete halt to Chinese drone sales to U.S. agencies, creating a major market opening for domestic and allied manufacturers. The opportunity is especially ripe for smaller drone companies with security credentials and scalable supply chains — companies like MOB.

Here’s the issue: today, the drone industry remains overwhelmingly dominated by China. According to Statista, as of March 2021, Chinese giant DJI held a staggering 76% global market share, followed distantly by Intel at around 4%. DJI is widely known for its consumer drones, but it also builds commercial platforms used in agriculture, infrastructure, energy, and public safety.

This level of dominance is exactly what has regulators, investors, and national security officials worried. China has a long and well-documented history of subsidizing strategic industries — not just to capture market share, but as a potential foothold for surveillance and control. The telecom industry is a case in point: Huawei, ZTE, and China Telecom have all faced credible accusations of espionage, with former CIA and NSA Director Michael Hayden directly alleging that Huawei shared sensitive foreign telecom data with the Chinese government.

Chinese firms have consistently denied such claims, but the pattern is hard to ignore. In many cases, internal documents later leak confirming the very behavior in question — from violating sanctions to building backdoors — as reported by outlets like The Washington Post. The risk is real, and the concern is bipartisan.

The Chinese 2017 National Intelligence Law only intensifies the unease. Article 2 of the law obligates Chinese companies to “support, assist, and cooperate with” China’s intelligence agencies — a legal mandate that makes true separation between private enterprise and state objectives virtually impossible. That quote isn’t from us — it’s from the Council on Foreign Relations, a mainstream voice on international policy.

So yes, on the surface, it’s fair to ask: If Chinese drones are better and cheaper, why shouldn’t Americans use them? The answer becomes clear once you understand the tactics: massive state subsidies to undercut competition and gain a dominant position — not unlike what happened with Huawei in the telecom world.

The European Commission found that Huawei underbid rivals by as much as 70%, thanks to government backing. We believe DJI has benefited from the same playbook, which explains why domestic drones have historically looked far more expensive.

In the chart below — drones that used to cost $3,000–$4,000 jumped to $13,000–$15,000 after restrictions on Chinese imports were enacted. While domestic costs should come down over time, the current price spike highlights how aggressive Chinese pricing had become — given the past precedent this is at least partially the result of government subsidies, in our opinion.

Source: GAO Report: Federal Lands: Effects of Interior’s Policies on Foreign-Made Drones

When a foreign government enables private companies to illegally undercut competition while posing a national security threat, it's no surprise regulators are stepping in. By the end of 2025, Chinese drones will be phased out from government use, creating a significant tailwind for domestic and allied manufacturers.

Mobilicom (MOB) stands to benefit meaningfully from this transition — especially given its U.S. “Blue List” approval, end-to-end integration strategy, and strong cybersecurity positioning. The door is open, and now it's about execution.

Hardened Hardware, with a side of software

Mobilicom’s go-to-market strategy centers on securing hardware sockets in as many new drone and robotics programs as possible—primarily through its Blue List-approved SkyHopper product. The SkyHopper is a bidirectional data link that shares and distributes real-time video and data, and its approval under the U.S. DoD’s Blue UAS Framework gives the company a distinct advantage in winning contracts faster.

Complementing this is Mobilicom’s recently launched OS3 cybersecurity solution, built on Nvidia’s platform—an important detail, as many drone and robotics companies rely on Nvidia’s Jetson series chips. This alignment strengthens Mobilicom’s value proposition as both a hardware and software provider.

Once Mobilicom wins a hardware socket and that system becomes a program of record, it becomes extremely difficult for competitors to displace them. This not only locks in recurring hardware sales, but also fosters deeper relationships with Tier 1 defense and robotics system integrators. Mobilicom anticipates that this close collaboration—paired with its strategy of building an end-to-end solution and first mover advantage in cybersecurity—will translate into increasing market share over time.

In the near term, the company can also leverage its position as a privileged supplier to cross-sell its cybersecurity software to drive sales and margin growth. Because Mobilicom is already integrated into programs of record and listed on the Blue UAS framework, it can offer additional software products without triggering a lengthy procurement process. This is particularly important in the defense space, where procurement cycles can be slow and bureaucratic. Cross-selling software not only increases wallet share but also boosts margins, as software sales tend to carry significantly higher gross margins.

In the company’s Q4 2024 earnings press release, CEO Oren Elkayam said, “In 2025, we are excited to leverage our breakthrough innovation and first-to-market advantage by building an infrastructure for success through strategic and commercial partnerships, positioning us as a leader at the intersection of drones and robotics, AI, and cybersecurity.”

We believe Mobilicom is well-positioned for strong growth. Its combination of differentiated, security-hardened hardware with its OS3 cybersecurity suite—an evolution of its earlier ICE solution—creates a compelling value proposition. Alongside SkyHopper and OS3, Mobilicom also offers mesh networking, a proprietary ground controller, and ControliT, a software suite for secure network and fleet management. The company plans to expand into additional hardware categories, as outlined in the slide below.

Source: Mobilicom Investor Deck

A natural concern for investors might be the cost of scaling drone hardware production. However, Mobilicom addresses this by employing a fabless model, relying on third-party contract manufacturers to build the physical products. Mobilicom then layers its proprietary software onto the hardware—allowing the company to maintain gross margins in the 60% range even on hardware sales.

As the installed base grows, so does the opportunity to cross-sell additional products and services. Over time, the company expects to expand margins further by increasing wallet share and introducing licensing for its cybersecurity software. This software-as-a-service (SaaS) model could yield 90%+ gross margins, significantly enhancing overall profitability—as illustrated in the slide below.

Source: Mobilicom Investor Deck

With a solid foundation in place, Mobilicom is well positioned to rapidly grow its pipeline—driven by its recent addition to the Blue UAS list and its first-mover advantage in cybersecurity. As alluded to previously, the company is also on the verge of converting two major opportunities into programs of record: one in the U.S. and one in Israel. We will cover these key catalysts in the next section.

Pipeline

Mobilicom has been steadily building a robust pipeline of opportunities. As of year-end 2024, the company reported a confirmed backlog of $1.1 million, to be delivered in the first half of 2025. While this figure is modest, it represents 33% of 2024 sales, and we believe it understates the company’s near-term potential. Mobilicom is on the verge of two meaningful program ramps expected in the second half of 2025, each of which could ultimately represent tens of millions in annual revenue.

Based on our research, both programs are for loitering or kamikaze-style drones—effectively one-time-use platforms. This characteristic implies a recurring demand profile with potential for large, repeat orders.

This is particularly important given management’s previous profitability guidance: the company expects to reach cash flow breakeven and profitability at a $10 million annual revenue run rate. While current revenues remain small, MOB has demonstrated early success in securing key customers. The disconnect between customer traction and recognized revenue seems to be one of the primary reasons for the company’s depressed valuation.

So, what’s taking so long? The answer lies in the long procurement cycles typical of DoD programs and similar foreign defense customers. It’s critical to distinguish between Mobilicom winning a hardware slot on a platform and that platform ultimately becoming a designated Program of Record. In the early stages, drone volumes are minimal, used for testing, evaluation, and proof of concept. As platforms mature and win their own procurement competitions, the volume of orders accelerates significantly—translating into meaningful, recurring revenue for MOB, as illustrated below.

Source: Mobilicom Investor Deck

At the time of the Q4 2024 earnings release, the company had already received five production-scale orders for the SkyHopper Pro from different customers, in addition to other product orders. Given that the SkyHopper product family is the first to achieve Blue UAS certification, it’s unsurprising to see strong demand across multiple defense programs and we expect multiple of these programs to ultimately provide production volume quantity orders.

Once Mobilicom, or any other supplier, is selected on a platform, it tends to be very “sticky.” The procurement lifecycle, while slow, results in high customer retention and excellent visibility once a Program of Record designation is achieved. According to company disclosures, MOB is on the cusp of securing two near-term Program of Record designations, marking key inflection points for the business.

The first near-term opportunity involves a Tier 1 U.S. defense contractor. According to the company, this platform is already entering the commercial ramp phase and has been selected for a SOCOM (Special Operations Command) contract. It is also a finalist or sole-source bidder for three additional U.S. government programs. Should any of these convert to a Program of Record, the associated order volumes would likely be enough to drive MOB to profitability on their own.

As production ramps, the company plans to cross-sell its OS3 cybersecurity solution to the same customers, expanding wallet share and improving margins. This flywheel—hardware wins enabling software sales—should lead to accelerating growth and margin expansion in 2H25 and beyond.

Source: Mobilicom Investor Deck

The second Program of Record opportunity is with the Israeli Defense Force (IDF). While not yet confirmed, we view this as highly likely given Mobilicom’s origins, CEO Oren Elkayam’s background, and the company’s early customer base within Israel. Notably, this platform is also intended for NATO export, opening the door to a broader European market.

Historically, NATO contracts have not been meaningful revenue drivers, but recent geopolitical shifts could change that. The Ukraine conflict and the Trump administration’s proposed NATO pullback have prompted European nations to significantly increase defense budgets—with drones emerging as a key focus area.

Interestingly, unlike the U.S. program—believed to involve Teledyne FLIR—we know the IDF platform includes two MOB products: the SkyHopper Mini and Mobile Controller. In contrast, we believe the U.S. platform is only using the SkyHopper. This suggests the Israeli program may drive revenue faster, with a higher dollar value per drone.

In both cases, Mobilicom intends to follow the same playbook: build market share through hardware sockets and then expand into high-margin cybersecurity software sales.

Source: Mobilicom Investor Deck

Beyond these two near-term programs, Mobilicom has reportedly won an additional 6–12 platforms, including a recent production-scale order from a Tier 1 Asian robotics manufacturer. This deal not only signals international traction, but also represents entry into a new vertical—robotics—beyond drones.

Taken together, we believe Mobilicom is approaching a major inflection point. The combination of deep customer relationships, sticky hardware sockets, expanding software sales, and a growing pipeline positions MOB for a strong second half of 2025 and a step-change in long-term value creation.

Valuation

Valuing early-stage defense and drone technology companies like Mobilicom (MOB) is inherently difficult, especially given the lumpy and uncertain timing of revenue recognition. For that reason, we will not attempt a traditional DCF analysis. Instead, we focus on what appears to be a meaningful disconnect between MOB and comparable peers in the public market.

For context, Red Cat (RCAT) and Unusual Machines (UMAC)—both of which are in similar early growth phases and are not yet profitable—trade between 5–6x next-twelve-months (NTM) sales. Even AeroVironment (AVAV), a much more mature player, trades at ~4.6x NTM sales.

MOB generated only $3.5M in revenue in 2024, but based on expected program ramps, we anticipate that number to double or triple over the next 12 months. Just reaching a $10M sales run-rate—the breakeven level management has indicated—would justify a $50–60M valuation using peer multiples.

At first glance, that may not seem dramatic. But it becomes compelling when compared to MOB’s current valuation:

Market cap: ~$11.2M

Cash: $8.6M as of year-end

Quarterly burn: $1–1.5M

Shares outstanding (fully diluted): ~11.6M

Cash per share: ~$1.00

No Debt/Convertible Debt

This valuation implies the market is ascribing almost no value to MOB’s pipeline, technology, or blue-chip customer base—despite early commercial wins and the strong potential for two near-term programs of record.

Importantly, the company has some additional outstanding warrants, which could provide a meaningful source of capital. While we are not typically a fan of warrants, at current share price levels, approximately $2.2 million worth of warrants are already in-the-money and likely to be exercised. Beyond that, there is another tranche of warrants—representing up to $15 million in potential proceeds—that become exercisable at prices between $5.00 and $5.16 per share. While these higher-priced warrants are not yet in the money, they represent substantial capital optionality for the company as the business scales.

If we assume full warrant conversion over the next several quarters, along with a few more quarters of moderate cash burn, MOB could exit 2025 with approximately 11.6 million shares outstanding and more than $20 million in cash on the balance sheet. At that point, the company would likely be well into the early ramp of its two key near-term programs, with a credible path to the $10 million revenue run-rate that management has guided as the threshold for reaching cash flow breakeven.

Taking a longer-term view, and factoring in pipeline opportunities beyond the two leading programs, we believe MOB could reach a $20–30M revenue run-rate exiting 2026. Applying peer multiples to that level of sales suggests a future market cap north of $100M—equivalent to ~$10/share.

While execution risk and timing delays are real, MOB’s high-margin products, modest burn rate, and strong balance sheet significantly reduce downside risk in our opinion. With multiple levers for upside—from key program ramps to broader adoption across NATO and Asian partners—we believe MOB represents a highly asymmetric opportunity.

Why do we like MOB now?

Where we find ourselves scratching our heads with MOB is in the disconnect between the company’s positioning and the market’s current indifference. MOB appears to be on the cusp of two large-scale programs ramping into production, each of which could fundamentally change the company’s profile. And this isn’t some distant, blue-sky projection — management has indicated a 1–3 quarter window before these two lead programs enter meaningful revenue generation. Between them, we believe MOB could be looking at tens of millions in potential annual sales, and that’s without factoring in the dozen or so additional programs already in the pipeline.

Now, before the usual criticisms about cash burn and lack of profitability surface, it’s important to clarify that MOB is not in a desperate cash position. In fact, the company has enough on hand to fund operations for nearly two years, even without considering any upside from warrant exercises. That’s a solid buffer while waiting for program ramps that, which we believe, are not a matter of if but when.

What makes this opportunity compelling isn’t just the size of the upcoming programs or the healthy 60% gross margins. It’s what happens next. Once MOB’s hardware is embedded into these drone platforms, the second act begins — cross-selling its proprietary cybersecurity software. This isn’t just a minor upsell. This is the kind of product extension that transforms the economics of the business. Software margins in this category can exceed 90%, and layering those revenues on top of already high-margin hardware sales will have an outsized effect on both profitability and return on assets.

We’ve long referred to these kinds of companies as “triple threats” — businesses that simultaneously improve sales, margins, and asset efficiency. Historically, those have been the engines of sustained cash flow growth and strong shareholder returns. That’s why we pay attention when we find one that isn’t already priced for perfection.

What’s even more unusual — and frankly what makes this a “why now” setup — is that MOB is trading at essentially cash value. You’re getting a company doing $3.5 million in revenue, growing, with a strong gross margin structure, and positioning for an inflection point... all for the 1.5x the cash balance. We think part of this discount is structural — a small company that went public in a non-traditional way, with no meaningful research coverage, and caught in the broader risk-off environment for microcaps. But sometimes those odd combinations create the exact sort of dislocations worth leaning into.

If either of these two near-term programs begins to ramp — and especially if both do — MOB could quickly become a $50 to $100 million market cap company. That’s 5–10x upside from today’s levels. And that’s before even considering the optionality around further contract wins, expanded product adoption, or successful cross-selling of cybersecurity solutions.

This is one of those rare moments where the setup is asymmetric, the timing is visible, and the underlying economics are compelling. If management executes even moderately well, the story — and the valuation — could change dramatically.

Risks

Inability to raise capital on favorable terms

Technology Risk

Customer Concentration

Unexpected regulatory changes

Failure to win platforms and associated orders

Inability to procure necessary regulatory approval

Competition pressures pricing

Inability to add new partners

If you enjoyed this article and would like to be alerted of new publications, please follow and Subscribe to Unloved and Underfollowed by clicking the "Subscribe" button or click here.

Disclosure: I/we have a beneficial long position in the shares of MOB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from subscribers on Substack). I do not currently have a business relationship with MOB, but may in the future, whose stock is mentioned in this article.

1035 Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.

Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Substack as a whole.

Nothing in this email is intended to serve as financial advice. Do your own research.