😬 Meta: Your Closed AI Is My Opportunity

Plus: Bomb Chemicals in American Bodies, Banning Telegram?, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Meta's open-source AI (Llama 3) push is HUGE.

Most Americans have “forever chemicals” in their bodies.

TikTok ban passed…Telegram next?

Wall Street rapidly acquiring U.S. single-family homes.

Investments are pouring into de-extinction.

And more…Let’s get to it!

Top 5 Insights of the Week

1. 😬 Meta: Your Closed AI Is My Opportunity

Meta's open-source AI (Llama 3) push is HUGE. Meta Horizons OS also open-source. AI assistants now on all their apps.

Closed-source AI investments could lose billions—potential strategy shift for other tech giants.

Critics doubt Meta's AI, saying it relies too heavily on Nvidia for inference, as Nvidia is better at training AI models than performing inference tasks.

2. 🧬 Bomb Chemicals in American Bodies

Dupont invented Teflon for atomic bomb seals. Later sold it for non-stick pans. Unknowingly introducing harmful PFAS (per- and polyfluoroalkyl substances) a.k.a “forever chemicals” now found in many everyday products. Linked to serious health issues like cancer and birth defects.

Most Americans have PFAS chemicals in their bodies.

EPA banned Dupont and 3M from introducing PFAS into water systems.

As PFAS awareness rises, demand for PFAS-free options may surge. A few companies ahead of the curve on this;

3. 🚫 TikTok Ban Passed, Telegram Next?

Senate passed bill: TikTok must sell its U.S. operations or face a ban.

Bill raises free speech and privacy concerns by letting the government label foreign enemies broadly.

Could Telegram be next? Its unique encryption could lead to its removal from U.S. markets due to terrorist and extremist use.

Telegram; valued at $30B, 700M monthly active users.

4. 🏡 Wall Street Home-Buying Spree

BlackRock, State Street, and Vanguard, own 89% of the S&P 500—rapidly acquiring U.S. single-family homes, possibly owning 60% by 2030.

Lawmakers from both parties aim to rein this in. Accusing them of driving up property prices and limiting home-buying opportunities.

Ohio Republican Louis Blessing III pushes bill to heavily tax big landlords.

Q1 2020: median sales price of new U.S. houses was $329,000. By Q1 2023, surged to $429,000, up over 30%.

5. 🤯 Real Life Jurassic Park

Investments are pouring into de-extinction, the process of using biotechnologies to recreate extinct species.

Biotech startups working on this;

CRISPR Gene Editing Market projected growth: $1.89B in 2022 to USD 15.80B by 2031.

*from our sponsors

KnowTechie's Weekly Download

We read hundreds of tech headlines so you don't have to. Stay informed, stay ahead—tap into tech news that matters with each edition. Join today.

2 Sigma

Don't let a busy schedule stop your growth. Subscribe to 2 Sigma's 3x weekly newsletter for coaches, consultants, and entrepreneurs. Get transformative resources and join 80K+ subscribers.

LeadBook

My good friend Joss, is the owner of LeadBook (a Facebook Outreach Tool). He’s giving away a list of 50k Agency Owners and a list of 900k Realtors for FREE. They’re both VERIFIED lists that cost him $5k to obtain.

Click here to get the 50k Agency Owners

Click here to get the 900k Realtors

Top 3 Charts of the Week

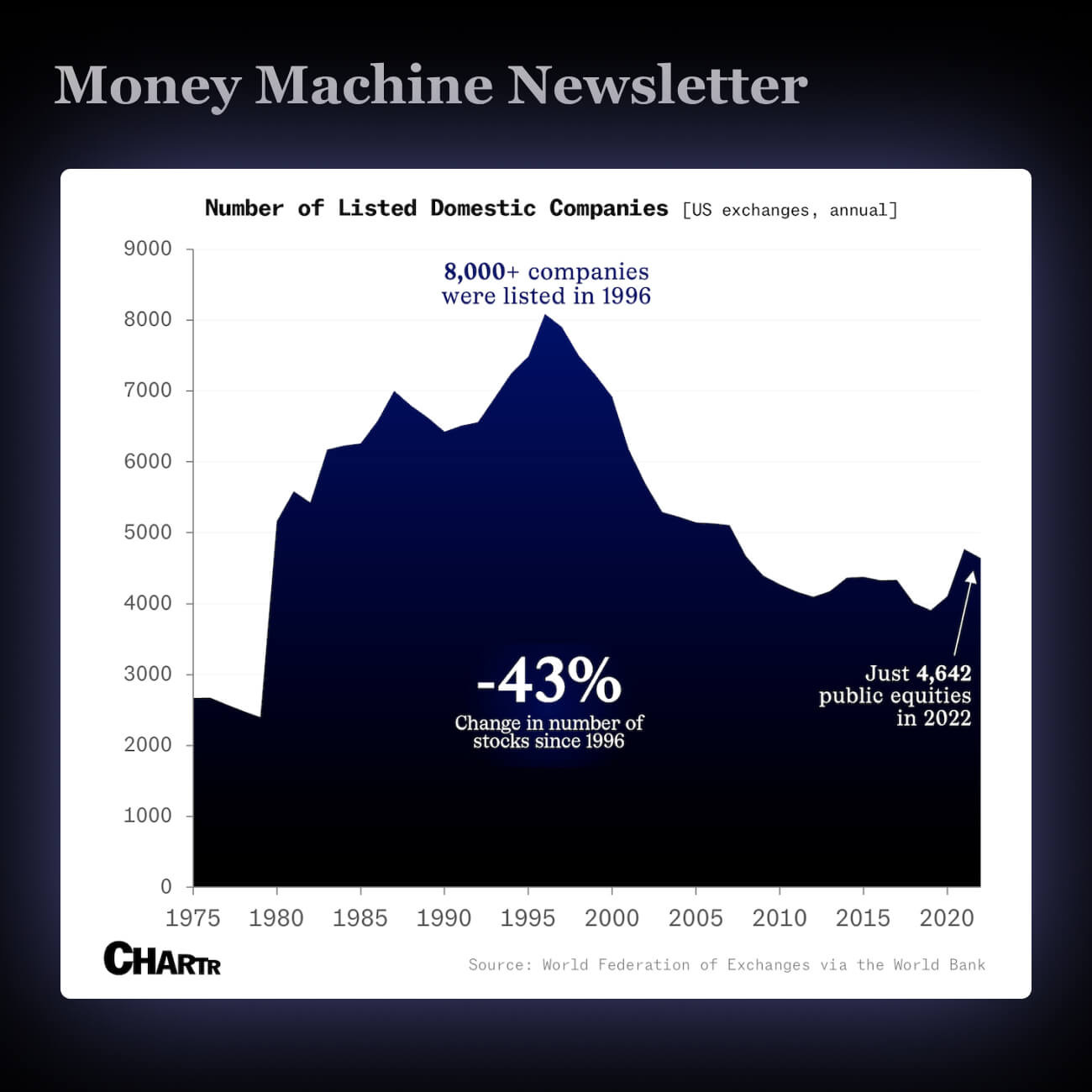

1. 🧐 Countless Stocks Have Vanished

U.S. publicly traded companies halved from 8K in 1996 to 4.6K in 2022.

Regulations, like the Sarbanes-Oxley Act, were blamed for making going public too costly, but the decline began before their implementation.

Rise of private equity and venture capital, providing 5 times more funding than public markets.

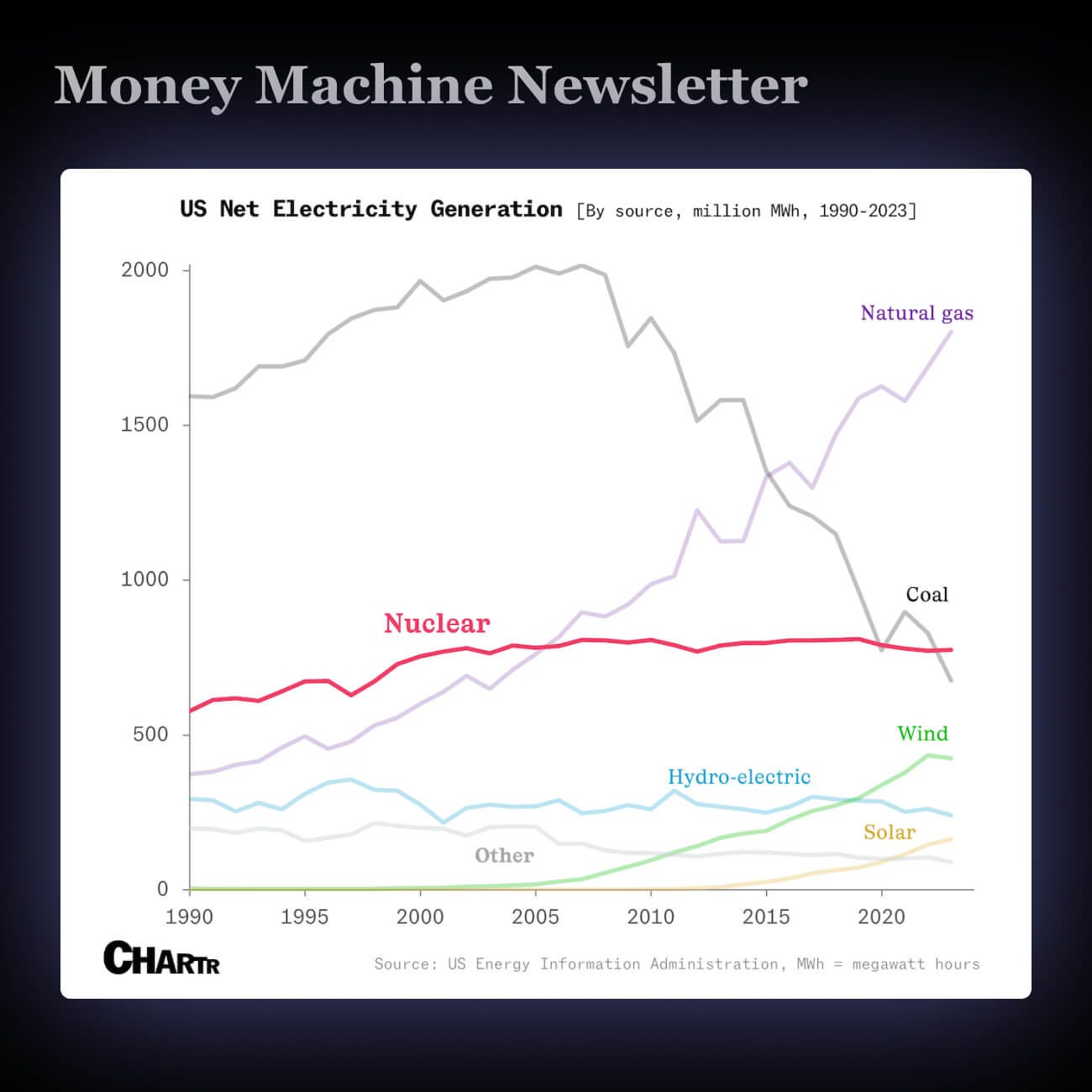

2. ☢️ America’s Nuclear Output Plateau

Plant Vogtle’s Unit 4 starts operation 7 years later, costing $30-35B.

Vogtle becomes largest U.S. carbon-free electricity source.

Nuclear energy's comeback is questioned due to high costs and time delays.

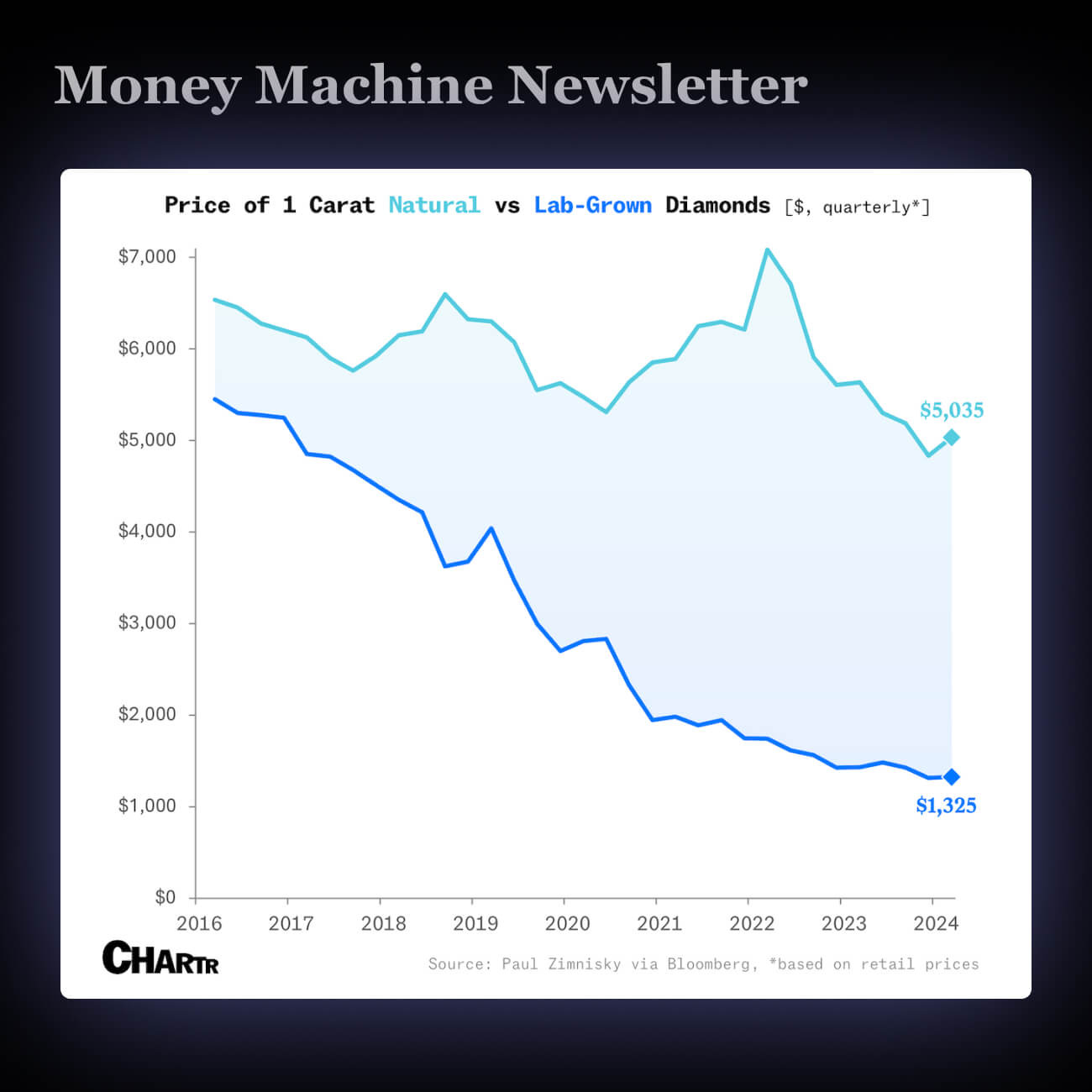

3. 💎 Sparkle for Less with Lab Diamonds

Lab-grown diamonds made in 2.5 hours vs. natural ones in 1-3 billion years.

Synthetic diamonds disrupt the diamond industry, driving prices down.

Industry giant De Beers faces challenges as lab-grown alternatives gain popularity.

Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth.

Subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber 🚨

TOP 5 STOCK IDEAS, picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS throughout the week as we spot them.

Access to OUR COMMUNITY of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY of which ideas performed best.

NO GUESSWORK. You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS, discover opportunities and risks not highlighted elsewhere.

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.