This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Market's BIG bet just fell flat.

THIS Biotech thinks it cracked a multi-billion dollar problem.

IPOs might be back—these names are making moves.

Investors feel the heat with THIS correction.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 💥 Market's HUGE Bet Just Fell Flat

For decades, politicians measured success by how high the stock market climbed. Now? Trump 2.0 might flip the script…

Shifting focus from Wall Street to Main Street… this could mean a major shake-up for investors, businesses, and global markets.

Instead… policies could focus on small businesses, manufacturing, and middle-class jobs over stock market gains.

That’s a MAJOR switch-up… last time around, he tied his presidency to the markets. This time? Not so much.

Why crash stocks on purpose?… sounds crazy, right? not really…

High stock prices fuel inflation… when markets soar, investors cash out, buy second homes, new cars, and luxury goods. That drives up prices for everyone.

Drop stocks, cool inflation… if equity markets deflate, people spend less, which naturally slows inflation without the Fed needing to raise rates.

When stocks tumble, investors run to bonds… that pushes bond yields down. And that’s a big deal because the U.S. has $1 trillion in debt to refinance…

Lower bond yields = cheaper borrowing for the government.

Cheaper borrowing = less pressure on taxpayers.

If Trump sticks to this new plan, expect volatility. Markets hate change, and this is a big one. But if rates drop and inflation cools? Main Street could finally catch a break. So, who wins and who loses?…

Who wins…

Small businesses… lower interest rates could make it easier to borrow.

Manufacturing… bringing jobs back home could be a real push.

Who loses?

Stock market investors… if policies don’t favor Wall Street, expect some pain.

Wealthy asset holders… with stocks down, high-end spending on real estate, luxury goods, and services could slow.

2. 💉 Biotech’s New Crown Jewel?

Regenerative medicine is completely re-thinking healthcare, treating disease at the cellular level. But it’s costly and slow… one company thinks it cracked a solution… Orgenesis…

Orgenesis built the POCare Platform—hospitals can make therapies onsite, skipping costly logistics. Think Henry Ford’s assembly line, but for personalized medicine.

Here’s why we’re paying close attention…

Regenerative medicine is a $399B market. If Orgenesis' tech takes off, they could be a major player.

Strong pipeline of patents, 17… plus 30+ therapies in development, including nanotech for cancer detection and cell therapies for heart repair.

Strong partnerships with major institutions like Johns Hopkins.

They bought Neurocords' tech to turn stem cells into spinal cord neurons. The goal? Make treatments cheaper and easier. The market’s set to grow from $7.5B to $11.2B by 2031.

Pitfalls…

Regulatory hurdles… trials and approvals are slow and uncertain.

Orgenesis has a unique decentralized model, but big players like Vertex and upstarts like NanoXplore raise the stakes. They need to execute flawlessly.

Higher volatility… price swings can be extreme due to low trading volume.

Bottom line…

Orgenesis is a bold bet on regenerative medicine. High risk, high reward. If they pull it off, the upside could be huge.

This is where Money Machine Newsletter comes in. We spot momentum, lock in gains, and cuts risk with our exclusive setups. Become a premium subscriber and get alerted when this stock triggers our setup for entry point, target price, and stop loss.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🥩 Investors Demand Meat, Not Sizzle

After a long freeze, IPOs could be making a comeback…

Figma got blocked from selling to Adobe, so now an IPO is on the table.

Discord is dropping hints about a liquidity event.

Crypto firms like Kraken and Gemini see an opening after the crypto market’s rebound.

But the market isn’t just throwing money at anything anymore… investors aren’t interested in flashy, unprofitable startups… the real winners this time will be companies that can prove they’re sustainable…

Figma is a category leader with deep enterprise adoption.

Discord? Still figuring out its business model. Tougher sell.

Crypto IPOs? The Wild West. Regulatory wins help, but trust issues remain.

If these IPOs succeed, it signals that Wall Street is ready to bet on tech again—but under new rules…

Profitable, durable companies? In.

Hype-driven, cash-burning startups? Out.

The IPO market isn’t just reopening—it’s resetting.

Top 3 Charts of the Week

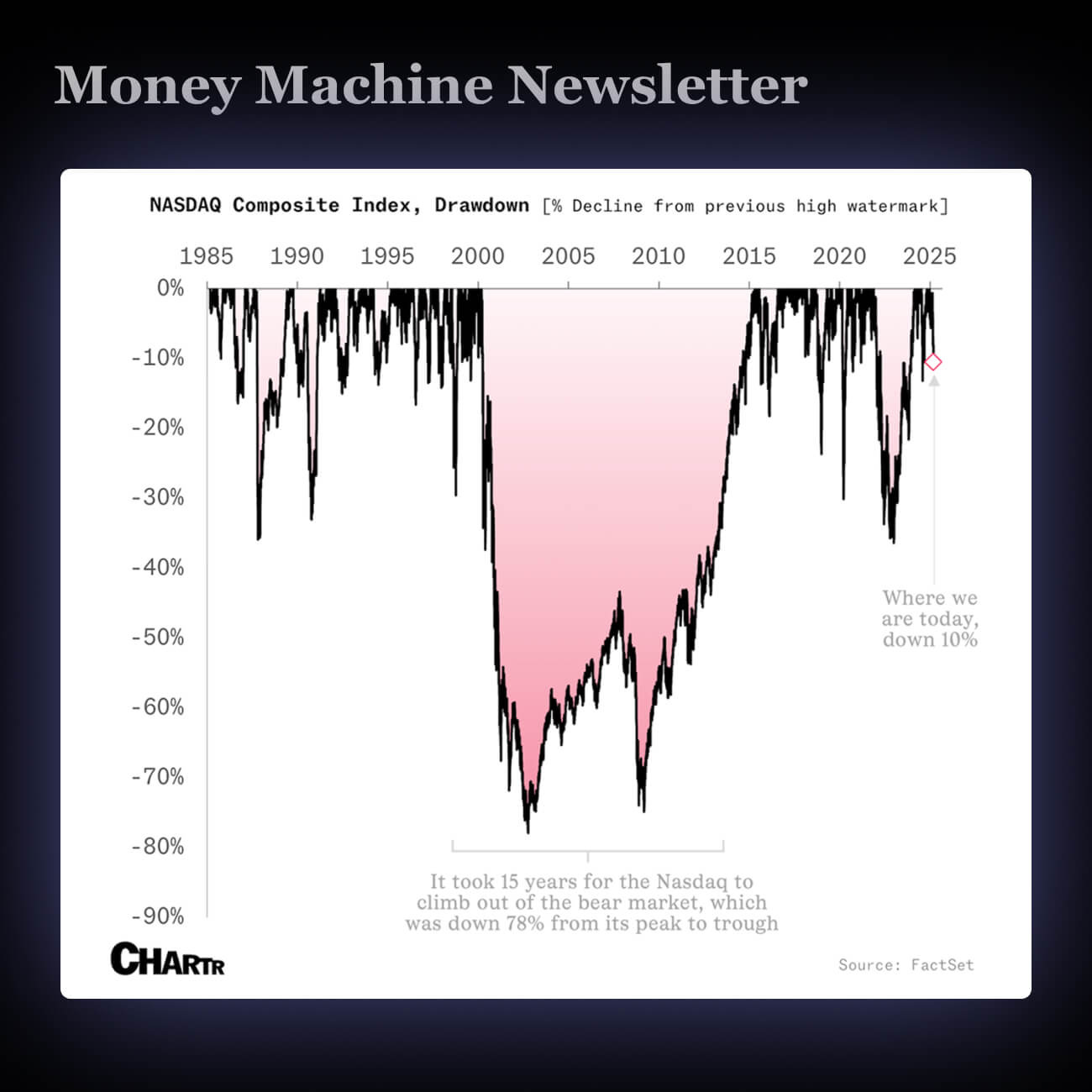

1. 🩸 The Nasdaq Hits Correction Territory

The Nasdaq, packed with tech stocks, is down 10% since December—that’s a correction. It’s not the dot-com crash, but investors feel the heat.

The difference from the dot-com era? Many firms today make real money—Broadcom pulled in $5.5B last quarter. But if the slide continues, pricey tech stocks could still take a hit.

2. 🥗 Why Selling $16 Salads Isn’t Working

Sweetgreen, famous for pricey salads, is adding fries to the menu. They hope it helps turn a profit since they lost $90M in 2024, or about $2.26 per salad sold.

Despite $677M in revenue, high costs are crushing profits. Fries are cheap and popular, but investors aren’t buying it—Sweetgreen’s stock is down 34% since February.

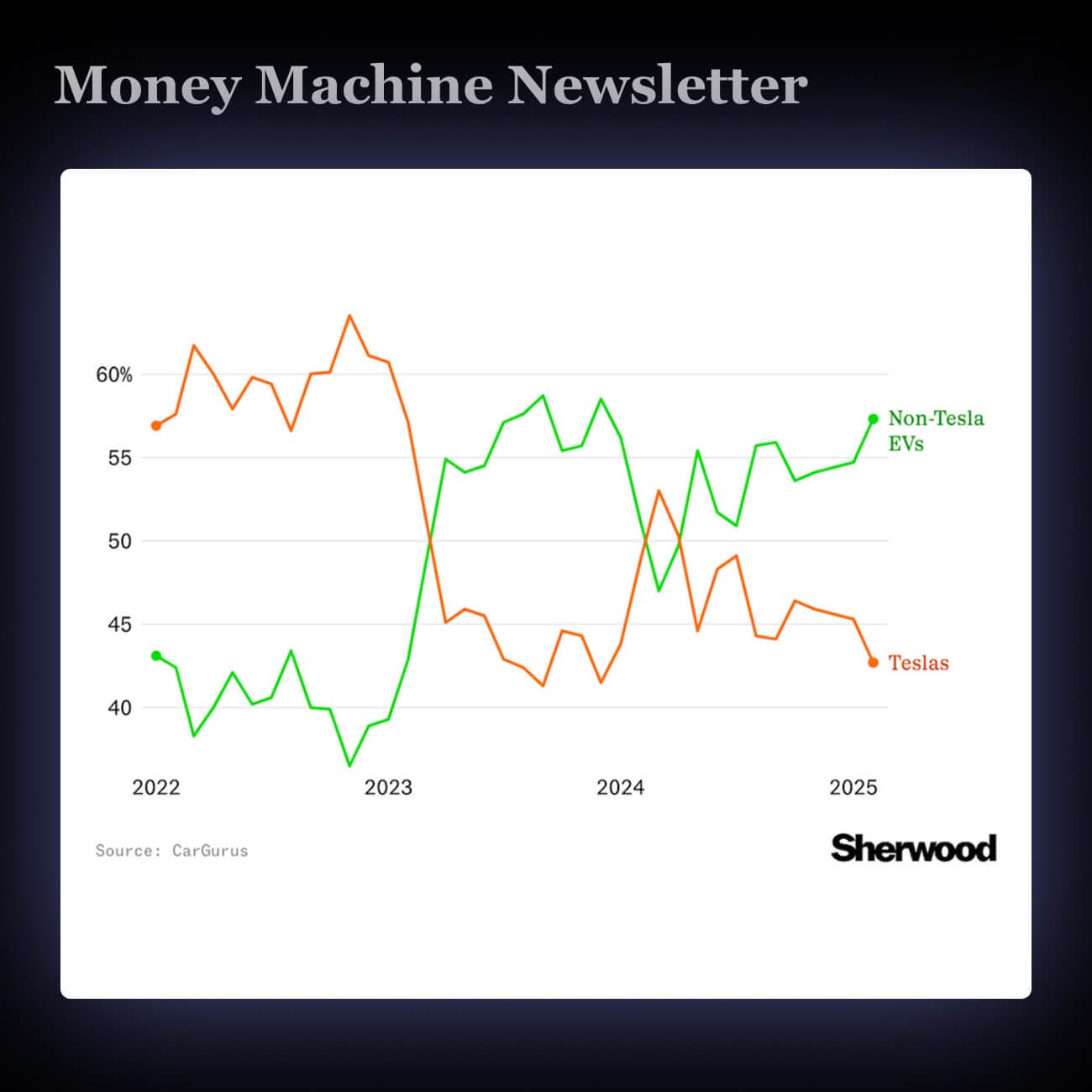

3. 🚘 Tesla’s Grip on Used EV Market Weakens

Tesla’s used car prices have crashed—down 58% from $71K in 2022 to $30K today. Even with discounts, demand is fading, and rivals are catching up.

Its grip on the EV market is slipping. New car sales are slowing, driverless tech is lagging, and even used Teslas aren’t moving like before.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Give InvestorSnippets daily newsletter a try. It scours over dozens of sources to bring you the most interesting bite-sized stories on markets📈, stocks🏢, and ETFs💸 in under 3 minutes. It’s completely free and read by thousands of investors each day!

👉 The Experiment Zone, testing the Latest Trends in business, AI , productivity and everything in between for a better tomorrow.

👉 All Things Self Improvement, holistic self improvement newsletter for creative solopreneurs.

👉 Alex of Rome Capital, researches under-followed US/European special situation and small-and-mid cap growth stocks and publishes in-depth thesis in an amusing way.

👉 Sharpening Saw by Kunal Mehta, curated quality content from the internet brought to you weekly with a special focus on actionable mental models. Subscribe and join 100+ startup leaders and future CXO's.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.

Interesting thesis that Trump 2.0 doesn't mind stocks falling so that inflation and interest rates come down