This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

2M new SSNs handed out last year—no one blinked.

Trump is opening up the flood gates to $700B.

THIS Stock's turnaround story is happening.

Importers front-running pharma tariffs.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🤦♂️ MAJOR Fumble by the U.S.

Something weird’s going on at the border—and it flew under the radar until the numbers blew up…

For decades, non-citizens with work visas could get Social Security numbers. Routine stuff… then, suddenly—~2M in a single year. No new law. Just… system overload.

Here’s how it works:

Someone shows up at the border.

Says it’s unsafe to go home.

Gets a court date—six years from now.

Files one form for asylum.

Files another for a work permit.

Boom—Social Security number shows up in the mail.

No interview. No background check. Sometimes no fingerprint.

That number ~2M? It opens every door—Medicaid. Unemployment. Driver’s license. Even voter registration. 1.3M are already on Medicaid. This isn’t a future maybe. It’s now.

Some are working. Contributing. Playing by the rules. Others? Not so much. Some flagged for crime. Some on terror watch lists.

This isn’t a red-or-blue thing. It’s a systems thing. When you skip the guardrails, things break. And that’s exactly what we’re watching.

2. 💥 Trump Says “DELETE ALL OF IT”

The government’s buying process is broken. Thousands of pages. Endless hoops. Rules stacked on rules. Trump just hit Ctrl+Alt+Delete on ALL of it…

This week, he signed an executive order with one goal… Make it easier for the government to buy stuff.

Not from buddies. Not from insiders. Just from people who can actually do the job.

Now agencies have 180 days to rewrite the Federal Acquisition Regulation—That clunky manual from the 1980s collecting dust and red tape.

The new rule? If it’s not legally required or genuinely helpful, it’s gone.

And there’s a timer now… rules expire every 4 years unless someone bothers to renew them.

Before this, small businesses had to jump walk through fire just to bid. Too much paperwork. Too many outdated rules. Now? The government can finally shop like the rest of us. See it. Need it. Buy it.

And this isn’t just bureaucracy talk—It’s about a $700B market suddenly more open for business… If you run a company—big or small—Uncle Sam’s now in your customer list.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. ✈️ THIS Stock's Turnaround Story Is Happening

Boeing isn’t a turnaround story waiting to happen. It’s already happening. Deliveries are rising. Cash burn is shrinking. And they’re quietly selling off non-core assets to beef up their balance sheet. The street’s asleep at the wheel…

They’ve got a $545B backlog.

They’re cranking out more planes—aiming for 38 a month by late 2025.

And deliveries are ticking up: 130 this quarter vs. 83 last year.

Airbus delivered a record 766 jets in 2024.

Losses are shrinking. Cash is flowing. Sounds good… but Wall Street’s still not convinced—yet.

At the end of the day, Boeing still has to over-deliver—More planes, better margins, and a comeback in China… if they do, the upside is HUGE. Become a premium subscriber and get alerted when this stock triggers our setup for entry point, target price, and stop loss.

Top 3 Charts of the Week

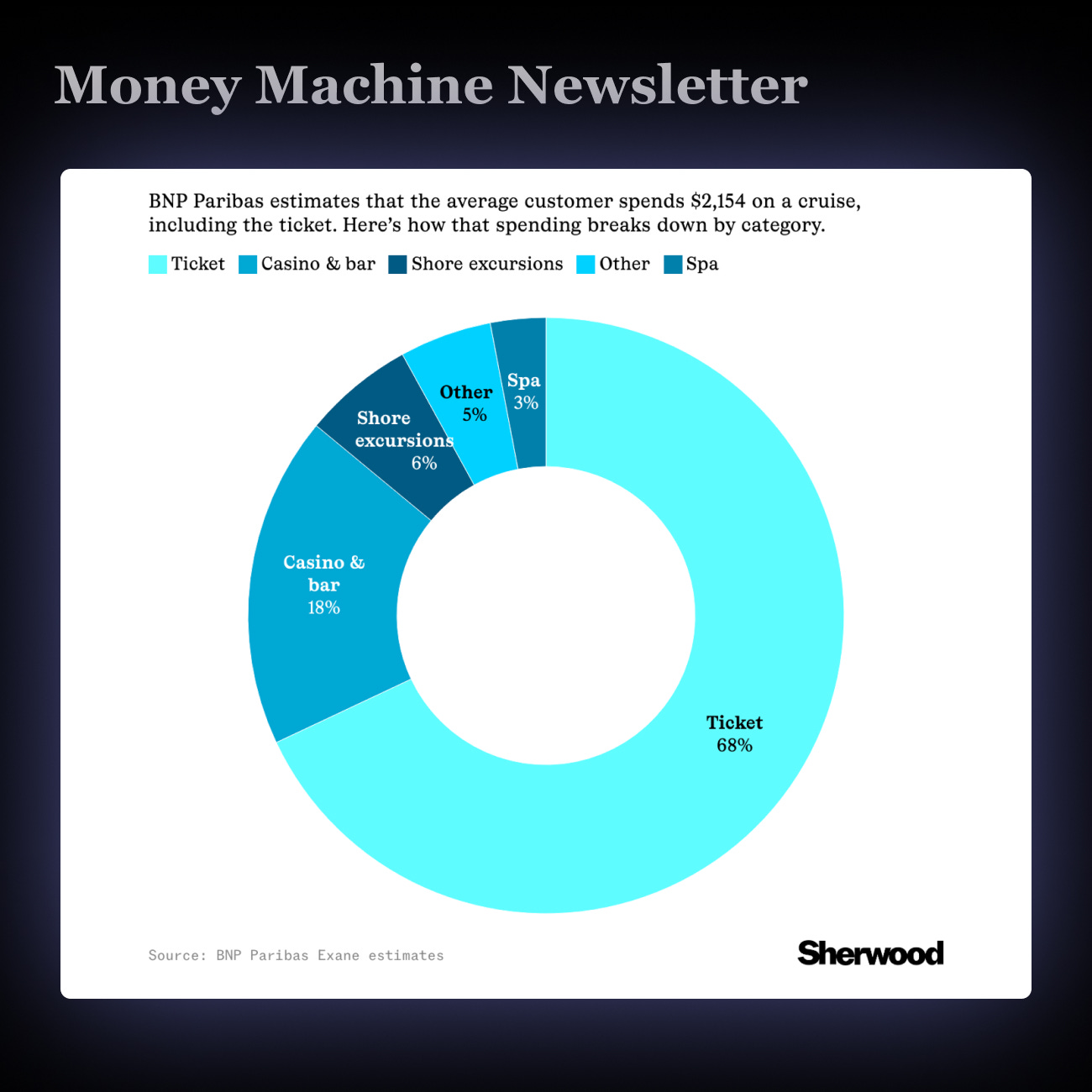

1. 💰 Cruise Ships Now Minting Millions

Cruises aren’t just for grandma anymore. The average passenger is now 46. A third Under 40… Forget bingo—think spa days and cocktail labs.

Cruise lines are not making their money on tickets… they’re cashing in after you board… Massages. Mixology. Bucket-list shore trips. Onboard spending now drives up to 30% of revenue—with fatter margins.

Meanwhile, they’re quietly poaching hotel customers. Ridership jumped from 5M in ’95 to 35M today.

2. 💊 Importers Front-Running Pharma Tariffs

Drug imports just jumped to $37B in two months—up from $31B last year. Why the rush? Pharma companies are bracing for a comeback of Trump-era tariffs.

Name-brand drugs from Ireland and Denmark led the charge. But it’s generics—from India and China—that’ll take the hit if tariffs land.

90% of U.S. prescriptions are generics. If prices rise, you won’t hear it in the news. You’ll feel it at the pharmacy.

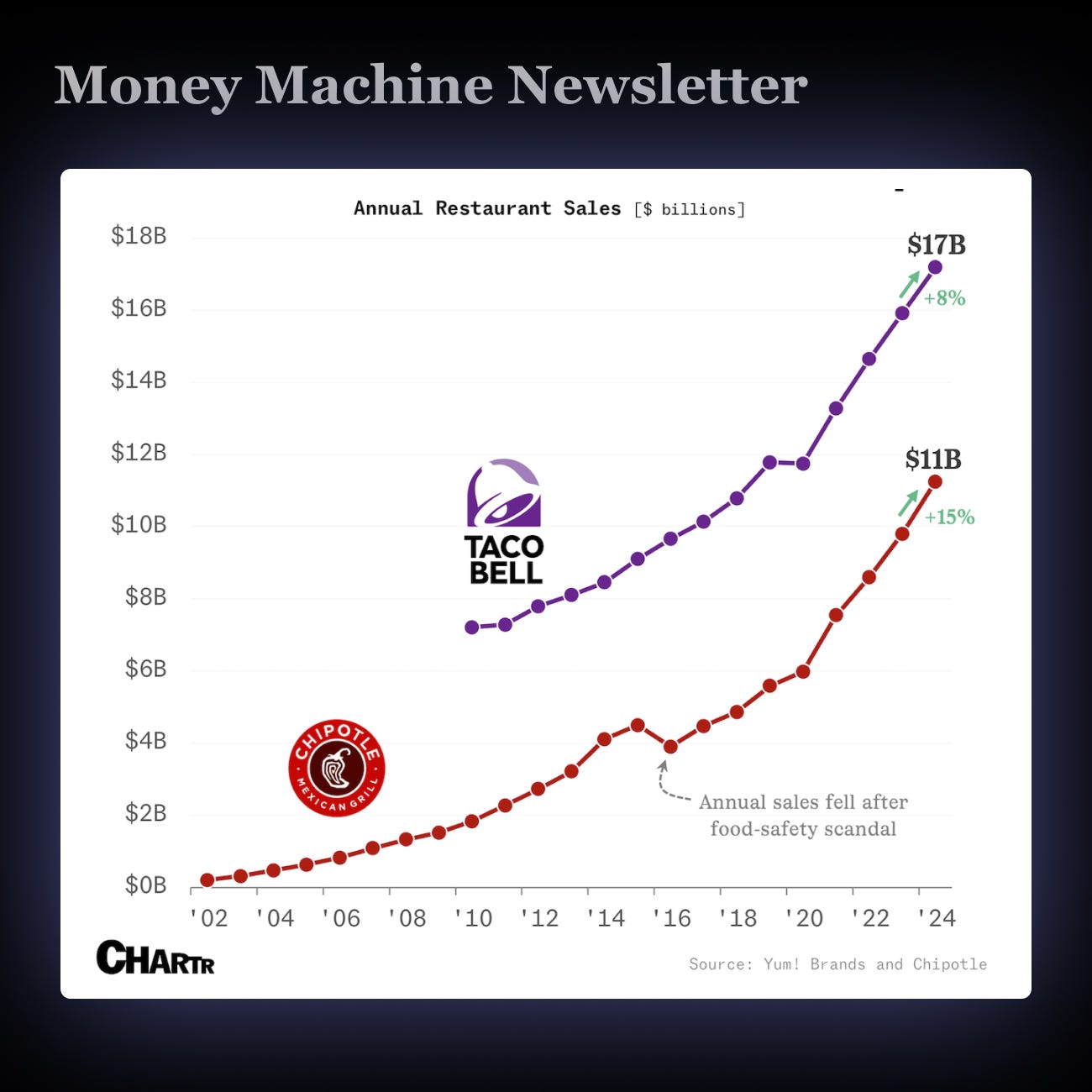

3. 🌯 Taco Bell Still Rules, But Chipotle’s Closing In

Chipotle’s heading to Mexico. Yep—the place that inspired its whole menu. They’re teaming up with local heavyweight Alsea to make it work.

Taco Bell tried this twice and failed. But Chipotle’s got momentum—revenue’s up 15% this year.

This isn’t just about culture. It’s about cost. Being closer to ingredients like avocados could save big—especially if tariffs hit.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.