🤔 Looking for $0 Billion Markets (Yes, Zero)

Plus: Predicting Crises with Pizza, Waffles & Big Macs, THIS Crypto Is Creating Its Own Category, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

$0 billion markets are where the real opportunities hide.

Unconventional indicators to natural disasters, wars, and currency valuation.

THIS crypto is creating its own category.

Alcohol's appeal is fading, guess who’s taking over?

And more. Let’s get to it!

Follow us on Instagram | Advertise to our 7K+ subscribers

But first…

Ready to get serious about investing?

Join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Become a premium subscribe today for just $9/month and receive market beating stocks. Picked by elite traders. In your inbox. Every Monday, before the market opens.

Top Insights of the Week

1. 🤔 Looking for $0 Billion Markets (Yes, Zero)

Look at your kitchen table. What do you see? Coffee maker, toaster, microwave–they’ve dominated America’s kitchens. Now imagine you’re tasked to create a new product for the kitchen. Sure, you can create a “better” coffee maker. Or, create a category of your own. That’s the real opportunity—$0 Billion Markets.

"$0 Billion Markets" are about creating new markets that don’t exist. Zero demand. Zero competition. It lets companies sidestep direct competition and focus on educating people on a new problem or a new solution to an old one. Is it risky? Absolutely. Certain that it will work? Nope. But the upside is HUGE.

Oh! back to the kitchen analogy. Lomi pulled this off. They created a new market—smart home composters. Attracting investors like Jay-Z.

All companies worth a damn have done this.

Netflix didn’t just improve movie rentals. It created subscription streaming.

Gojo didn't just make a better soap. They asked how can I clean my hands without water? And Purell hand sanitizer was born.

SpaceX didn’t just launch rockets into space. It made space travel a business.

Uber didn’t just create a better taxi service. It created a ride-sharing category.

Here are a few under-the-radar companies creating new categories.

Matterport creates 3D models of real spaces, creating a new category in real estate, construction, and retail.

Zscaler is creating a new category in cloud security with a zero-trust architecture.

Vicarious Surgical is creating a new category in medical robotics by combining VR with advanced robots.

2. 🍕 Predicting Crises with Pizza, Waffles & Big Macs

Waffle House Index, Pizza Meter, Big Mac Index…hungry yet? You won’t find these on any menu. They’re all unconventional indicators to natural disasters, wars, and currency valuation.

FEMA's Waffle House Index tracks storm damage: open is green, limited menu is yellow, closed is red.

Domino's deliveries surged 25% before the 1983 Granada and 1989 Panama invasions, as troops fueled up. Coined as the "Pizza Meter" for predicting big military moves. U.S. government now obscures this pattern by diversifying how they order.

Big Mac Index compares Big Mac prices worldwide to show if a currency is over or undervalued.

Quirky, unusual, odd—call it what you want. At the end of the day, it’s used to gauge sentiment in the markets and global crises. Here are a few more.

Satellite images to count cars in retail parking lots to predict sales before earnings reports.

Credit card data to track spending habits in real-time to predict company revenue before earnings reports.

Sentiment analysis on Twitter and Reddit to gauge public mood for better trades.

Two other fascinating alternative datasets.

Wikipedia’s edit count: a spike in COVID-19 Wikipedia edits often correlated with major health announcements.

Polymarket’s wisdom of the crowd: a prediction market that taps into crowd insights for future events and investments.

Alternative data market: ~$7.20B in 2023, projected $201B by 2030.

3. 💰 Why add private credit to your portfolio?*

Percent.

In 2023, private credit averaged a 12% return1 and the asset class is poised to grow to $2.3T by 2027.

As an individual investor though, alternative investments like private credit are often out of reach due to deal size and high minimums.

That’s changing with Percent, one of the first platforms to offer private credit to everyday accredited investors and that’s already funded over $1 billion in deals to date.

What can you find with private credit deals on Percent’s marketplace?

Double-digit yield potential: Percent’s Q1 LTM net APY was over 14% after fees.

Shorter term offerings: The average investment term is 9 months.

Diversification: Investors can choose from domestic or international deals in small business loans, trade finance, merchant cash advances, and other forms of direct lending.

Low minimums: Investments can start with as little as $500.

Monthly cash flow: Most deals offer cash flow through monthly interest payments.

Visit Percent to create an account and view all offerings - plus earn a welcome bonus of up to $500 with your first investment.

*Sponsored

4. 😯 THIS Crypto Is Creating Its Own Category

Imagine your very own literal virtual assistant. 100x more powerful. Works 24/7. No salary. Able to handle any transaction on its own. Former Goldman Sachs Executive, Raoul Pal, thinks it’s coming and we better be ready. It all boils down to AI agents.

AI agents will use cryptocurrency to transact all on their own. They won’t need traditional financial systems, says Raoul Pal.

But, for AI agents to work solo, they need to pay for things themselves. So who will be the crypto darling to provide this infrastructure? Fetch.ai catches our eye.

It’s a decentralized platform that combines AI and blockchain to create a digital economy run by independent smart agents.

It has a no-code platform for creating and managing AI agents.

These AI agents can work on energy grids, transportation systems, and supply chains. Wild!

Recently announced a merger with SingularityNET and Ocean Protocol to launch a new token, ASI (valued at $7B). Significantly boosting its resources.

Global AI market: ~$196B in 2023, projected ~$1.75T by 2030.

*Sponsored

William Lobb's Blog, Newsletter and General Tomfoolery

A landlocked pirate trying t survive 21st Century mediocrity. Join today for free.

MetaphysicalCells

A newsletter about Science, Technology and AI Drug Discovery delivered weekly to your inbox. Join today for free.

Top 3 Charts of the Week

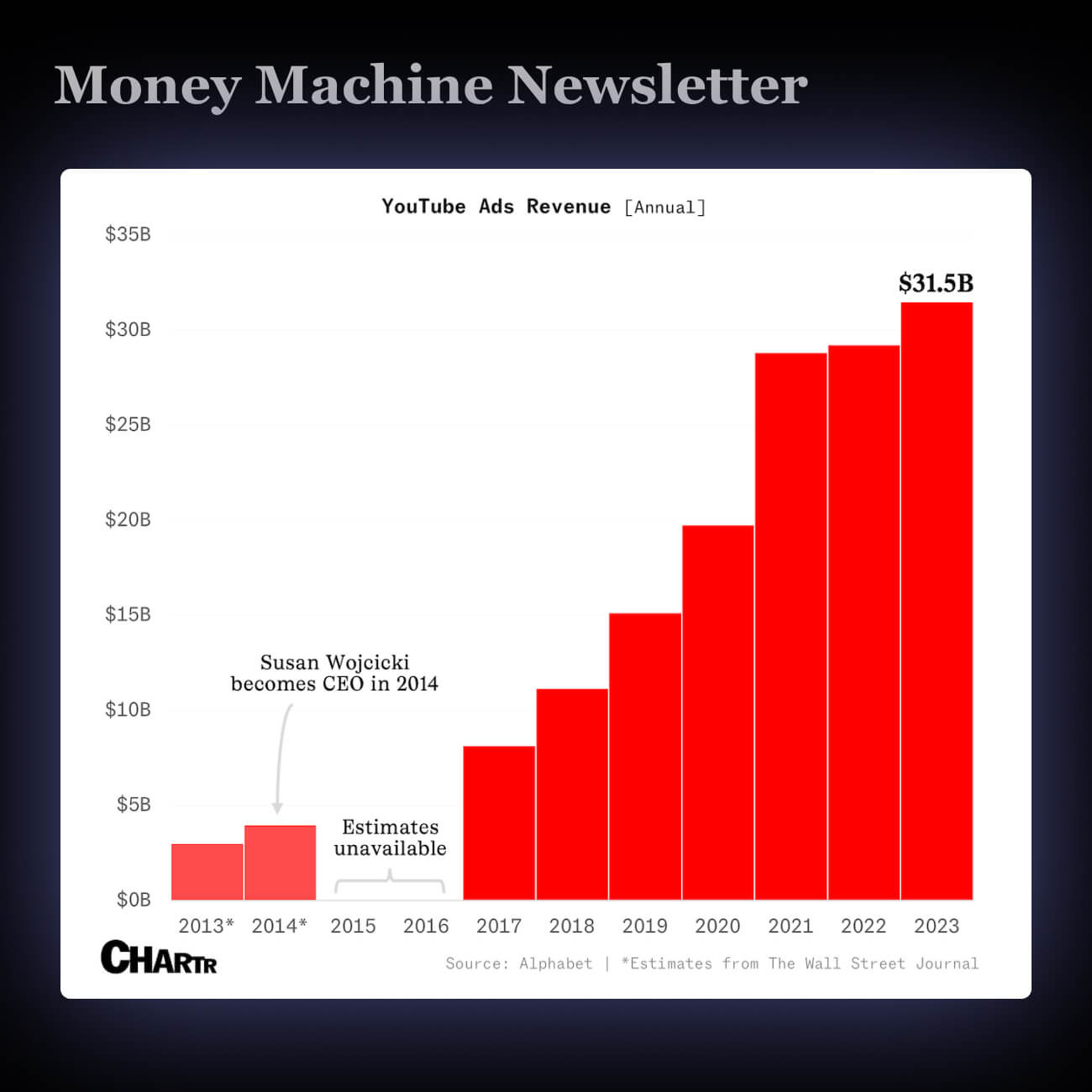

1. 💰 YouTube's Expanding Ad Power

Susan Wojcicki, ex-YouTube CEO, recently passed away at 56 from lung cancer.

She drove YouTube’s ad revenue up 690% and set new parental leave standards.

Wojcicki's impact reshaped digital media and workplace norms globally.

2. 📚 Fiction Book Sales Have Soared Since 2020

Colleen Hoover’s books, boosted by TikTok, have sold nearly 30 million copies.

TikTok is driving fiction sales, outpacing nonfiction.

#BookTok has over 35.6 million posts and 200 billion views as of last year.

Social media is now a key force in book publishing.

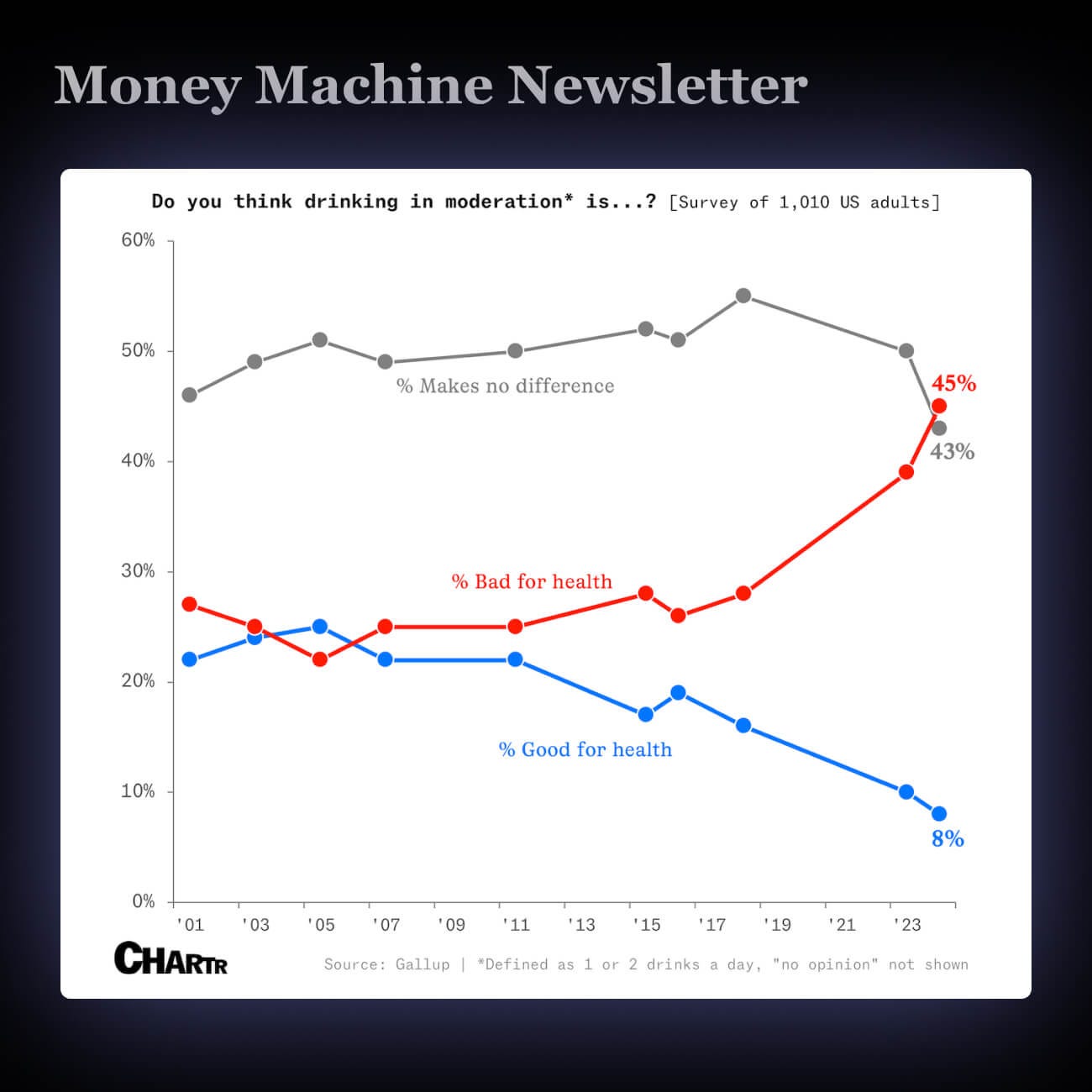

3. 🥃 Alcohol's Appeal Is Fading

Alcohol is losing its appeal; 45% now view moderate drinking as harmful.

New markets for low-alcohol drinks are emerging, like Athletic Brewing at $800M.

Cannabis use is now surpassing alcohol as the preferred way to unwind.

Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth.

Subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber 🚨

TOP 5 STOCK IDEAS, picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS throughout the week as we spot them.

Access to OUR COMMUNITY of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY of which ideas performed best.

NO GUESSWORK. You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS, discover opportunities and risks not highlighted elsewhere.

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.