🤫 Insiders Quietly Bet Big on Small Caps

Plus: THIS New AI Doesn’t Need You, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

While everyone ran for the exits, insiders quietly walked in.

THIS new AI doesn’t need you.

The fix for aging might be hiding inside you already.

One forgotten bet just paid off BIGGER than anyone expected.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🤫 Insiders Quietly Bet Big on Small Caps

While everyone’s panicking over recessions, tariffs, and trade wars... insiders are slipping in the back door and buying…

Small-cap stocks have been kicked around this year — the Russell 2000 dropped like a rock in April. Headlines screamed doom. Investors ran for cover. But guess who didn’t flinch? The people running those companies…

CEOs, CFOs, founders — the ones who know the books, the customers, the pipeline better than anyone — are quietly scooping up their own stock at bargain prices.

In Australia, one CEO bought $5M of his company’s stock this year.

In Canada, a finance exec grabbed $20M worth.

In the U.S., a fintech founder stuffed six figures into his own firm during the March dip.

The list goes on…

These aren’t diversifying trades. These are bet-the-farm moves. They’re not buying because the price might bounce. They’re buying because they know the business better than anyone else — and they think the market’s got it wrong…

It’s the old “follow the smart money” move. Insiders buy heavy → Stocks usually bottom out → Rebounds often follow.

In a market obsessed with scary headlines and clickbait panic, these insider bets are a quiet reminder… not everyone’s bearish.

2. 🧐 THIS New AI Doesn’t Need You

Everyone’s busy talking about AI getting better at chatting, writing, coding… But the real leap? AI solving problems on its own — no babysitting required…

That’s what OpenAI’s new model, o3, is starting to do… o3 can now use tools by itself — search the web, run Python code, read files, create images. It picks what it needs, solves the problem, and moves on.

It’s not perfect. o3 still hallucinates about 33% of the time — double the old model. Sometimes it gets carried away — digging too deep, running extra searches, crunching when it doesn’t have to.

And the world’s reaction? Crickets.

After years of fireworks with every new AI launch, nobody really flinched. Even though this might be the biggest shift yet.

Seems like people have hit AI fatigue. Another model? Yawn.

But if AI keeps moving this way, the winners won’t be the ones building fancier prompts or prettier apps… the winners will be the ones who build systems where AI just works — quietly, in the background. No hand-holding. No endless back-and-forth… You’ll just say what you want. And it’ll happen.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $90/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

MAKE MONEY or GET YOUR MONEY BACK GUARANTEE. If you subscribe today, use it actively for a year, and don't make money, we'll refund your payment and give you an extra year for free.

TRY RISK FREE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $90/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

4. 💪 Longevity's New Secret

What if fixing a failing heart — or slowing down aging — was as easy as swapping out some batteries? Turns out, it might be…

Scientists are transplanting healthy mitochondria — the tiny engines inside your cells — into damaged ones. And it’s working.

At Boston Children’s Hospital, babies with failing hearts usually had a 60% survival rate. After getting healthy mitochondria? That jumped to 80%.

It’s not just hearts. The University of Washington is testing it for stroke recovery. Minovia Therapeutics is working on rare genetic diseases like Pearson's syndrome.

This isn’t a band-aid. It’s a whole new kind of repair. Not replacing organs. Fixing them from the inside out.

Young mitochondria can even make old cells act young again. (Maybe that’s why young blood helps old mice live longer.)

Right now, your blood naturally carries about 3.7M mitochondria per milliliter. They’re already moving — scientists are just learning how to guide them better.

If they pull it off? We’re not just talking about faster healing. We’re talking about changing how we age.

Top 3 Charts of the Week

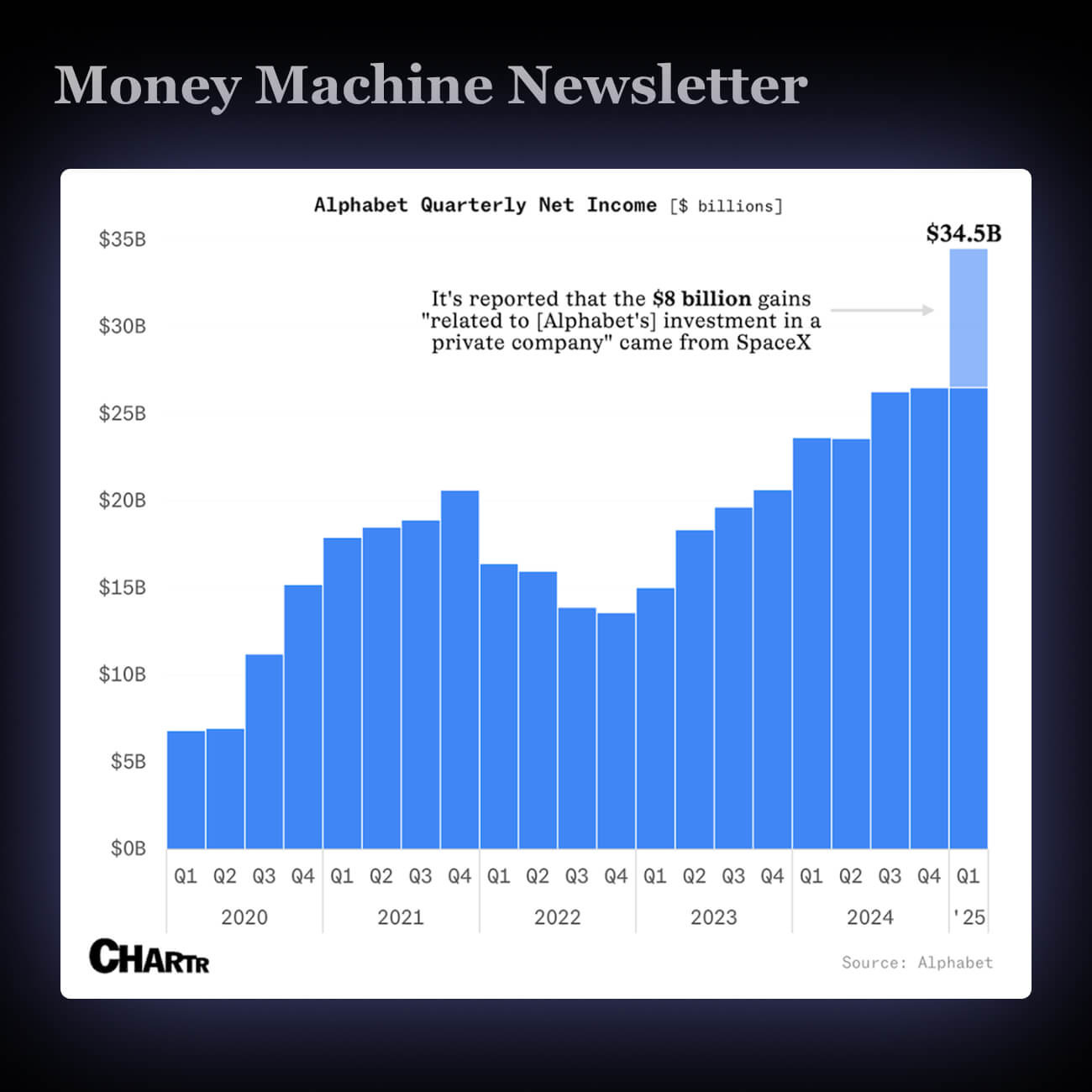

1. 🚀 Google’s SpaceX Bet Just Scored an $8 Billion Boost

Nearly 25% of Google’s Q1 profit came from its investment in SpaceX, not its core business.

A $1B bet Google made on SpaceX in 2015 just added $8B to its bottom line — thanks to SpaceX’s $350B valuation surge.

Even tech giants win big when they invest smart. Sometimes the biggest payoff isn’t from what you build — it’s from what you back.

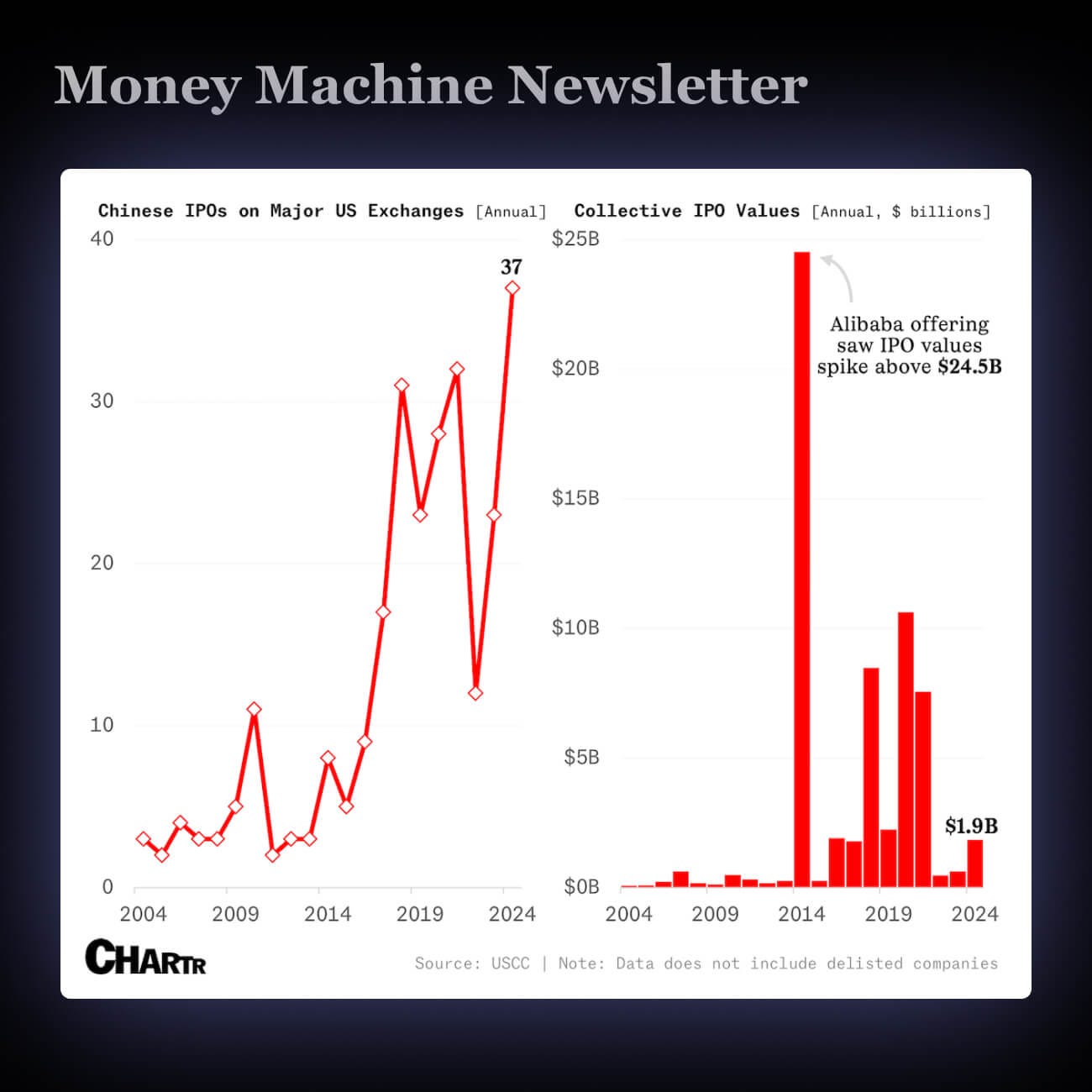

2. 🇨🇳 Chinese Companies Are Back on Wall Street — But Big IPOs Are Hard to Find

Chinese companies are starting to go public in the US again, like tea giant Chagee, which jumped 21% on its first day and hit a $6.2B value.

Even with political tensions and new tariffs, Chinese IPOs in America are up 47% from last year — but the money raised is way smaller than before ($1.9B vs. $10.7B four years ago).

It shows that despite all the noise between the US and China, some companies still see American investors as their best shot to grow big.

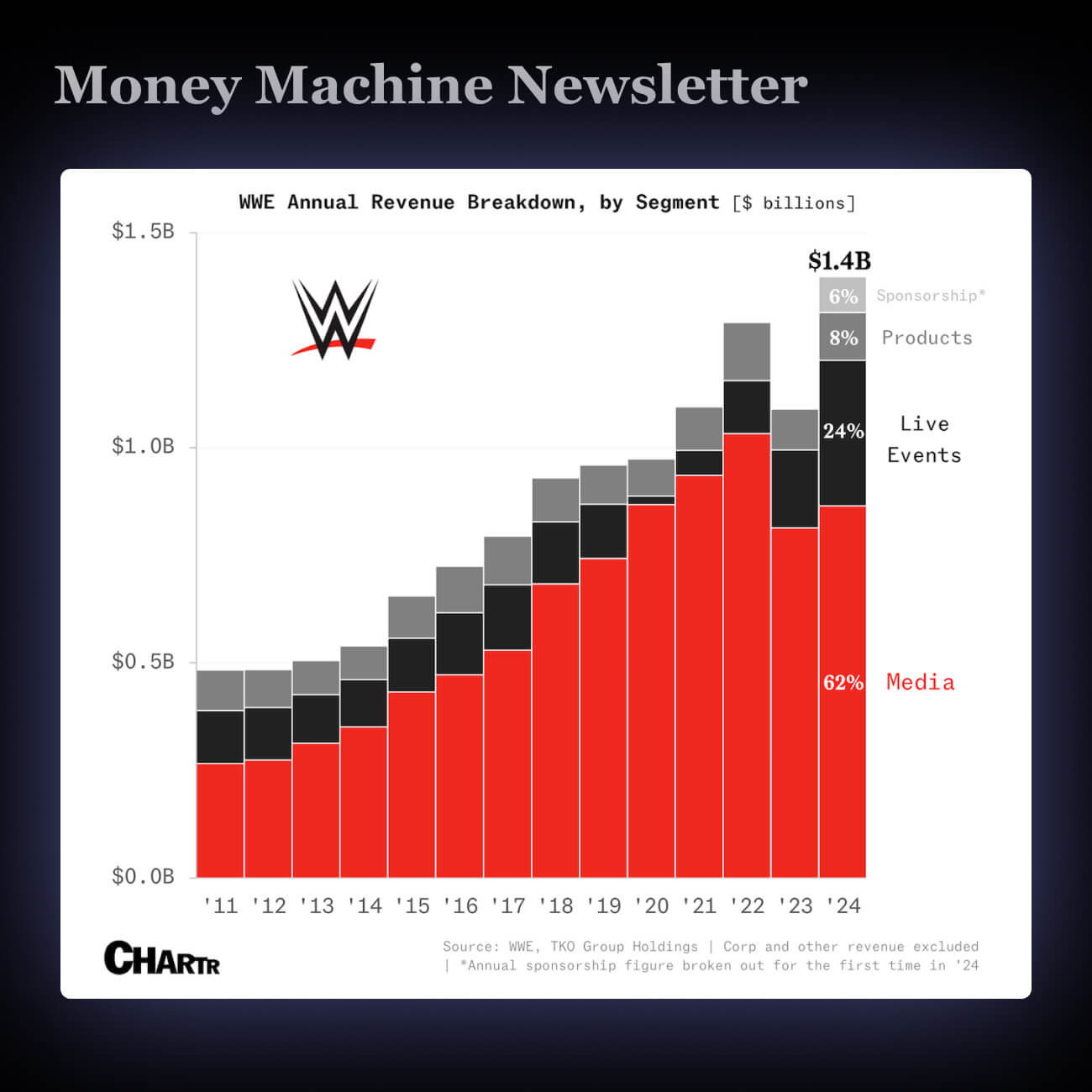

3. 😳 Wrestlemania 41 Breaks Records

WrestleMania 41 smashed records: biggest event ever for WWE in views, merch sales, and revenue. Viewership jumped 114%, and on-site sales rose 45%.

WWE’s $5B Netflix deal is paying off fast. Live event revenue almost tripled in two years, and big numbers strengthen WWE’s hand in future media deals.

WWE is showing how live events + streaming deals = monster profits.

What did you think of today’s newsletter?

Enjoy this content? Follow us on Instagram, YoutTube, Linkedin

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.