💰GPU Blitz Will Print Money (Incoming!)

Plus: New Burst of Life for THIS Stock, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Elon's GPU Blitz will print more money.

THIS roughed up stock could make a HUGE comeback.

Brain diseases are surging, the cause could be right in front of us.

Investors rapidly switching billions of dollars into THIS ETF.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1.💰GPU Blitz Will Print Money (Incoming!)

Experts said AI models were hitting a wall with the limits of training, compute, and scale… Elon Musk said, NOPE… and built one of the world’s largest AI data centers, from scratch, dubbed “Colossus”… in 122 days… proving them wrong…

Colossus powers Grok 3… outperforming Google’s Gemini and OpenAI’s GPT-4 in benchmarks.

A few days back, Elon dropped a fascinating video on how they made it happen…

Where can I drop 100,000 GPUs?…

That’s a question he started off with… to run all those GPUs he needed, power, and LOTS of it… they ended up purchasing an old Electrolux factory in Memphis, Tennessee. Not made for AI, but plenty of room to make it work.

Buy every generator available…

The factory had 15 megawatts. They needed ~250. So they went out and bought up every generator they could find and stacked Tesla Powerpacks to keep the flow steady.

Cooling nightmare…

GPUs run hot. Cooling takes years to plan. Elon skipped the wait—bought a third of all U.S. liquid cooling and set it up on-site.

Hacked their own Tesla Powerpacks…

Elon didn’t just use Tesla batteries… he had Tesla engineers rewrite the firmware on the spot to squeeze out every watt.

Artificial timeline…

Elon set the clock—122 days or BUST… the limit had engineers sweating bullets, forcing focus. No time to overthink, just solve.

The BIGGEST winner besides Grok3?… NVIDIA.

Bigger models need more GPUs. And more GPUs mean NVIDIA keeps printing money… AI spending isn’t slowing down anytime soon.

2. 🧐 New Burst of Life for THIS Stock

2025 could be the breakout year for THIS roughed-up stock… in fact, it just got a major boost… with strong earnings, a killer expansion with a MAJOR retailer, and putting a few operational hurdles to rest… Zevia…

One of the first brands to simplify soda. No artificial sweeteners or chemicals.

Here’s why we’re paying close attention…

Zevia slashed $15M in costs and tightened operations, stabilizing margins.

Major expansion with Walmart from 800 store to 4,300… Walmart shoppers buy Zevia 4x more than competing brands.

Demand for cleaner zero-calorie drinks is surging.

Zevia’s digital push is paying off. Stronger social media engagement is boosting brand appeal.

Valued lower than similar drink companies. It trades at 1.2x its expected 2024 sales, while competitors like Celsius (5.8x) and Vita Coco (3.1x) are priced higher. The market isn’t betting on its growth or profitability like its rivals. For us, that means big upside potential.

Expanding into new flavors.

Pitfalls…

Past supply chain and automation issues could still be a risk if not fully fixed.

Leans heavily on one big retailer, Walmart. If that changes, sales could take a hit.

Big players like PepsiCo (Bubly) and Coca-Cola (AHA) are expanding into clean drinks. Zevia has to keep innovating to hold its ground.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $90/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

MAKE MONEY or GET YOUR MONEY BACK GUARANTEE. If you subscribe today, use it actively for a year, and don't make money, we'll refund your payment and give you an extra year for free.

TRY RISK FREE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $90/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

4. 🧠 New Brain Threat Found

Alzheimer’s, Parkinson’s, dementia—brain diseases are on the rise… but what if they have a hidden cause no one’s been looking for?… a new study found something shocking in human brains—and it’s not a virus, a toxin, or a bacteria… it’s plastic…

Scientists analyzed brains of people who past away and found 7–30x more plastic than in the liver or kidneys… most common plastics found... polyethylene and polystyrene... the stuff used in packaging and Styrofoam.

Other insane finds…

Brains with dementia had even more plastic buildup.

Microplastic levels in organs have been rising since 2016.

Scientists suggests a possible link to neurological disorders like Alzheimer’s.

This is the first time plastic has been found in human brain tissue. Scientists don't fully understand it yet. We're watching closely to see which pharmaceutical company runs with this research.

Here's an incredible thread on how to get plastics out of your body.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Ideal Wealth Grower, join 3,000+ subscribers learning how to invest in residential real estate for early retirement. It’s free, on point, and a must-read—delivering market news, deals, and tips in under 5 minutes!

👉 TheDailyDollar, if you’re into finance, investing, or crypto, The Daily Dollar is worth a look. Abhaya Anil shares how he's made millions in crypto, along with real lessons, mistakes, and practical money tips from his 15 years of experience. It’s honest, simple, and actually helpful.

👉 Global Dividend Journey, unlock the secrets to growing your wealth with dividends! Join to to learn smart investing, dividend strategies, and tips for steady passive income.

👉 Cyber H3rmetica, stop being a normie and join 3,000+ readers exploring the dark side of the Digital Age. Cyber Hermetica dives into the crossroads of technology, philosophy, occultism, and cybersecurity—your guide through a world in transition.

👉 Nuclear’s Substack, advanced option trading strategies based on the #1 Amazon bestseller The Nuclear Option.

Top 3 Charts of the Week

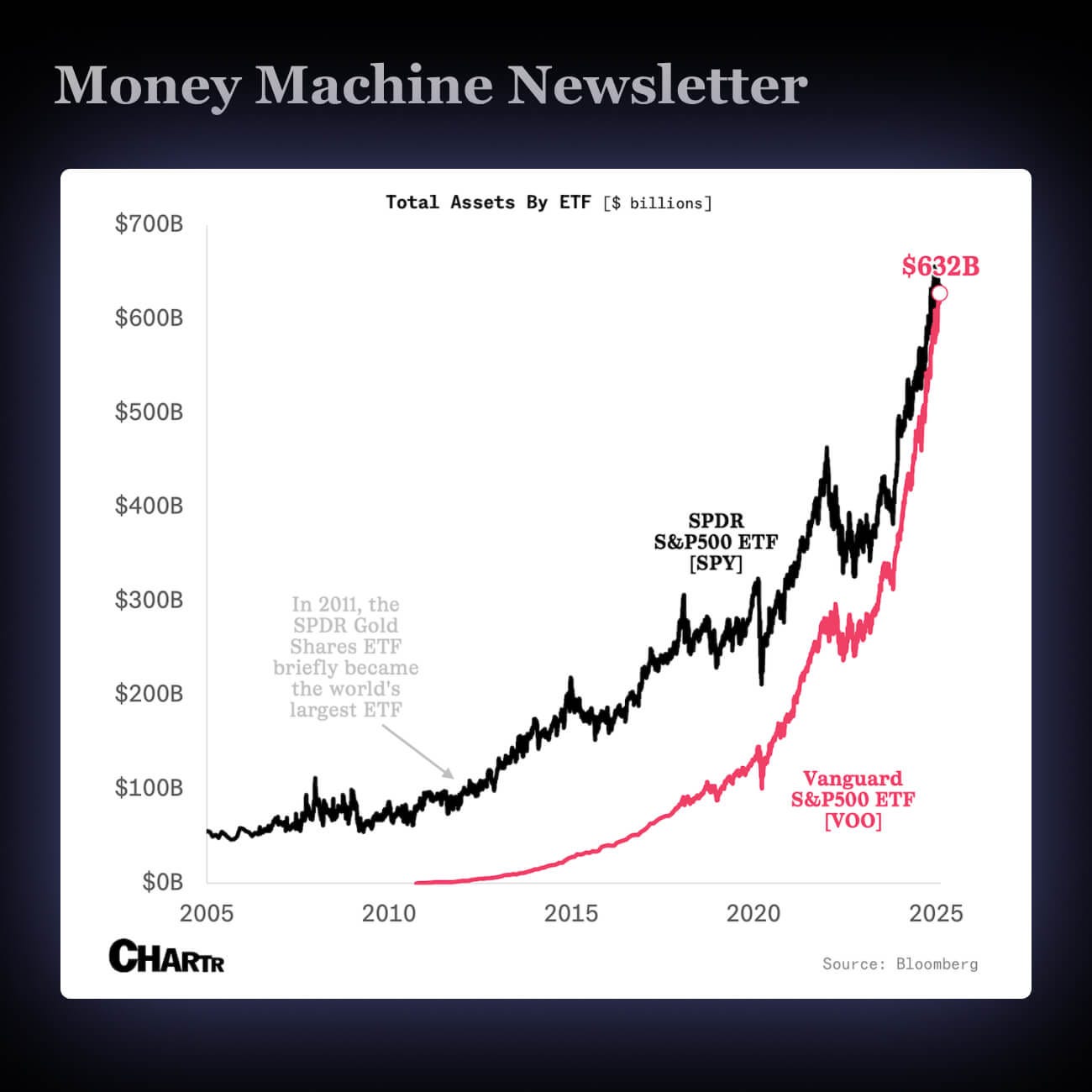

1. VOO Just Took SPY's Crown as World's Largest ETF

VOO became the biggest ETF, overtaking SPY with $632B in assets, because it's cheaper to own.

VOO charges 0.03%, while SPY charges 0.09%… even tiny fee differences matter—a 0.06% savings made investors switch billions of dollars.

2. Are Americans Finally Over Big Trucks?

Americans are buying fewer trucks because they're expensive ($60,000 average), causing truck interest to drop by 3% this year.

Sedans and smaller cars (averaging $39,233) might become popular again after trucks dominated nearly half the market for years.

Trucks and SUVs grew from 24% to 45% of vehicle sales in just 10 years… Ford’s F-Series has been America's top-selling truck for 48 years straight.

3. Home Listings Dropped Sharply at the End of Last Year

More homes (73,000) were pulled off the market in December—up 64% from last 2023—because fewer people can afford them.

Even though more new homes (118,000) were built, high prices and mortgage rates near 7% mean fewer buyers.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.