This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Google’s winning on paper—but losing where it matters.

The real crypto play? It’s already happening, quietly.

THIS stock moves dirt and cash.

Flights just broke the rules of inflation.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. ⏳ Google’s Moment Is Slipping Away

Google’s making money. Lots of it. ~$90B in revenue. Profits up ~50%. $70B in buybacks. The machine is humming. But under the hood, something’s off…

Gemini, their big AI bet, isn’t landing… Not because the tech is bad—it’s actually solid. It’s the experience that’s off. Clunky pop-ups. Random tools in random places. No rhythm. No “wow.” Just noise.

They’ve got 270M paying users. Yet instead of giving them a clean, magical Gemini moment… they give them confusion. Meanwhile, ChatGPT is turning into muscle memory. It’s the first place people go. That’s not easy to reverse.

The real issue…

Google’s hedging. They want to go big on AI—but not too big. Can’t upset the ~$67B ad empire. So they try to do both. That’s how you end up in no man’s land.

Instead… they should stop wedging Gemini into the old stuff. Build it into YouTube Premium. Google One. Gmail. Anywhere ads don’t live. Let people use it. Really use it. That’s how habits form.

The tech’s ready. The users are waiting. The cash is endless. But what’s missing is direction. A real call. Not “AI by committee.” Just someone bold enough to say, "Here’s how it works. Period.” Otherwise, all that cash won’t save them from missing the moment.

2. 💰 Big Money’s Quiet Crypto Bet

Wall Street didn’t crash into crypto. It crept in… No fireworks. No tweets. Just $8.2B in deals in four months. Quiet money. Serious money. That’s more than 3x all of last year. And it’s not chasing hype—it’s building infrastructure.

This isn’t meme coin season… This is suits and strategy. Custody, compliance, pipes, rails. The boring stuff that makes things real.

What’s been going down…

Companies aren’t just buying Bitcoin—they’re running on it. It’s not an investment anymore. It’s a balance sheet decision. Think MicroStrategy, but more are lining up.

Old finance isn’t fighting crypto. It’s joining it… The DTCC—yes, the DTCC, the one that moves trillions—bought a blockchain company. One login, two worlds. That’s the plan.

Ripple bought Metaco to build vaults for institutions. Secure, regulated, buttoned-up crypto. No USB sticks. No passwords on napkins. Just vaults with badges and security protocols.

Kraken spent $1.5B on a futures broker. Why? To make it easy to move between stocks and crypto like switching tabs.

And over in the AI corner… Fetch.ai, Ocean Protocol, and SingularityNET are merging. A real team-up. Shared users. Shared tokens.

Crypto isn’t growing up. It already did. The adults just moved in.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🧐 THIS Stock Moves Dirt and Cash

While everyone’s chasing AI chips and robot arms, a dusty sand company in Texas is quietly moving in the shadows.… Atlas Energy Solutions (AESI).

No, not a green startup with a buzzword name. They move sand—the kind oil companies can’t drill without. And they just built a 42-mile conveyor belt across the desert to move it.

Atlas is the backbone of the Permian Basin—America’s busiest oil patch. Every new well needs a mountain of sand. Atlas has 14 mines, a trucking fleet, and now, driverless trucks. They delivered 100 sand loads this year using autonomous Kodiak rigs.

Let’s talk money…

$1.06B in 2023 sales (up 72%)

$256M in operating cash

7% dividend yield ($0.25/share)

$200M buyback already in motion

And yet... the stock’s still stuck around $14 (as of writing this)…

Atlas isn’t just selling sand. They own the whole system—mines, trucks, belts, and delivery. No middlemen. Just speed, savings, and control.

They even bought a power company—Moser Energy—for $220M. That could add $40–$45M in high-margin earnings next year.

It's a true energy infrastructure play… Become a premium subscriber and get alerted when this stock triggers our setup for entry point, target price, and stop loss.

Top 3 Charts of the Week

1. ✈️ Flights Are Cheaper Now Than 15 Years Ago

Airlines say they’re in a recession. CEOs are cutting forecasts. Fares are falling fast—down 5.3% in March.

Flights are one of the very few things actually cheaper than 15 years ago—down 4%, while most prices jumped nearly 48%.

If you’ve been itching for a trip, now’s the time. Airfare’s on sale, no strings attached—just good old-fashioned competition doing its job.

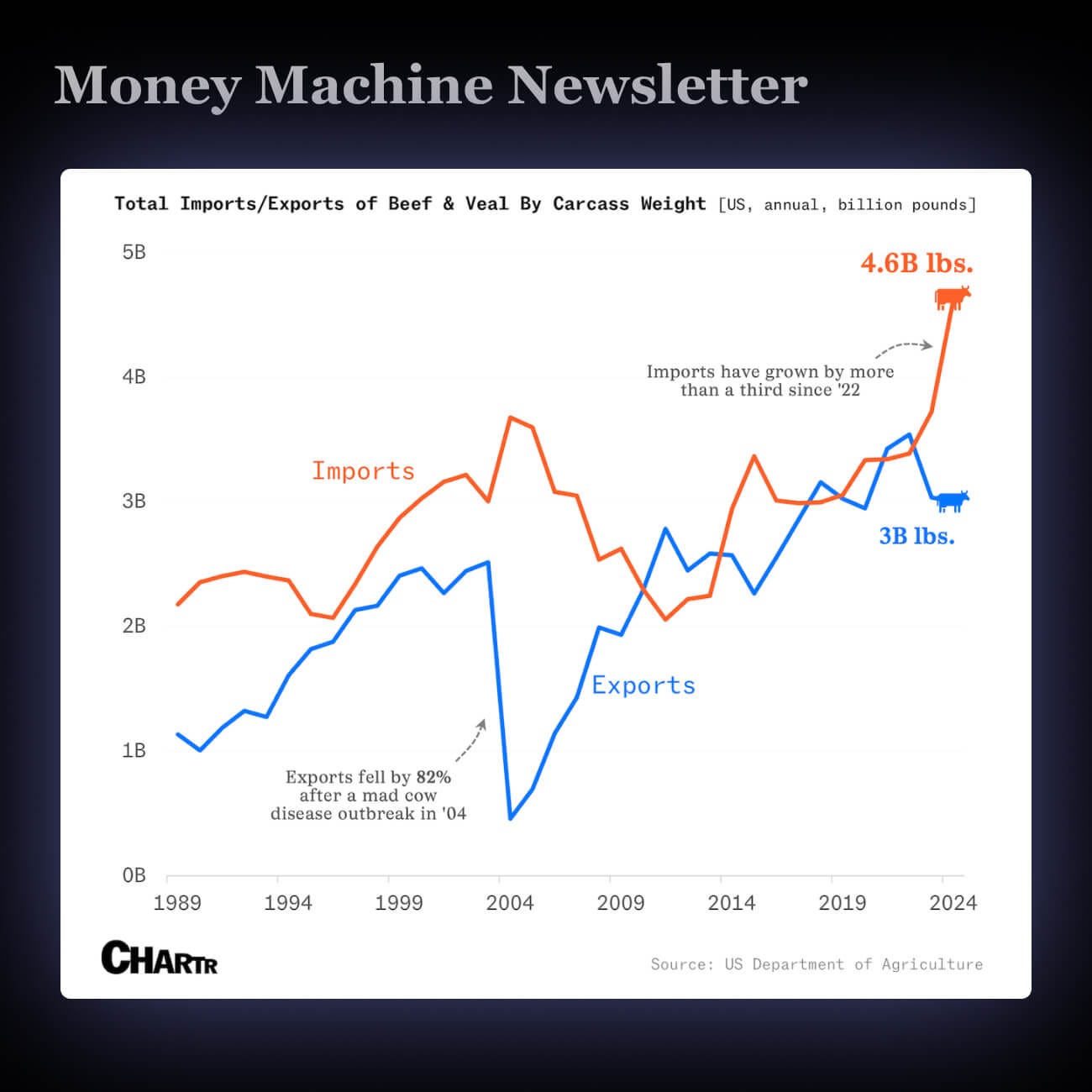

2. 🥩 America’s Bringing Home the Beef—From Elsewhere

America wants steak. Lots of it. Imports are up 37% in two years. Exports? Down 15%. Steakhouses like Texas Roadhouse are packed. Demand’s not the problem.

Supply is.

Tariffs and trade snags are making it tough to get enough U.S. beef on the table. So we’re filling the gap with imports.

But here’s the rub—If prices keep rising or supply gets squeezed, your next ribeye might cost a whole lot more… or not show up at all.

3. 💸 Your $45 Tumbler? Now $110

Stanley and Yeti went viral, made ~$1.7B combined, and rode the TikTok wave. But 96% of their stuff comes from China. Now it’s facing 145% tariffs.

That $45 cup? Could cost $110. Yeti bottles? Maybe $159. Why? New rules to cut China out of the supply chain.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.