Today we’re featuring Digital Finance Briefing.

If you're in finance and trying to make sense of crypto, this is the one to read.

It’s written for professionals—not hype machines. Just sharp, useful insights on where the space is headed, what institutions are doing, and how regulation is shaping the game.

I’ll let Digital Finance Briefing take it from here…

A breakdown of Circle's IPO strategy, core business model, and its implications for stablecoin legitimacy in institutional finance.

The Litmus Test for Stablecoins

Reading time: 8–10 minutes

Circle’s upcoming IPO is more than a capital raise—it’s a litmus test for whether stablecoins are ready to meet the standards of institutional-grade finance. As the first major stablecoin issuer to go public (likely by June 2025), Circle offers a rare view into the economics, risks, and viability of tokenized dollars in a shifting macro environment.

For asset managers, banks, and fintechs exploring stablecoin integration, the listing is a real-world test case: can a reserve-backed digital dollar model deliver compliance, transparency, and earnings—especially as yields decline and competition rises?

This article dissects Circle’s business model, IPO strategy, and market positioning within the broader transformation of stablecoins into programmable financial infrastructure. I analyze the structural drivers behind this moment and what it signals for the future of regulated digital finance.

Executive Summary

Circle’s IPO is more than a listing—it’s a landmark moment for stablecoins as regulated financial infrastructure. As the issuer of USDC, Circle generated $1.68 billion in 2024 revenue (→ 99% from interest on fully backed reserves) and now seeks a $5–10 billion valuation on the NYSE under ticker “CRCL.” Its transparent, audit-backed model stands in contrast to market leader Tether and signals the institutional evolution of digital finance.

This deep dive unpacks Circle’s business model, competitive position, and IPO timing amid falling rates, rising tariffs, and shifting regulatory winds. Key risks include high distribution costs (>$1 billion), exposure to interest rate cuts, and growing competition from crypto-native and bank-backed stablecoins.

For institutional investors, Circle offers rare equity exposure to stablecoin adoption, tokenized treasury infrastructure, and programmable payment rails. Its IPO could set a new benchmark for compliant digital asset listings and test whether stablecoins are ready for the public markets.

1. The Institutional Stablecoin Narrative

Stablecoins Scale as Institutional Infrastructure

Stablecoins have quietly become crypto’s most scalable institutional use case. In 2024, total supply surged 59% to $227.5 billion—equivalent to 1.1% of U.S. M2 money supply. Annual transfer volumes reached $27.6 trillion, exceeding Visa and Mastercard combined. USDC and USDT alone processed over $5.8 trillion, while monthly volume climbed from $400 billion to nearly $700 billion in just 18 months.

Fiat-backed stablecoins remain dominant, growing 54.8% in supply last year. Though their share slipped slightly due to the rise of yield-bearing alternatives like Ethena’s USDe and Maker’s DAI, transparent and fully reserved tokens like USDC remain preferred for compliance and counterparty risk management.

From Trading Tool to Financial Rail

Initially designed as low-volatility assets to facilitate crypto asset trading, stablecoins now enable cross-border payments, on-chain credit, and real-time settlement infrastructure:

In emerging markets, they offer censorship-resistant savings and dollar access.

In decentralized finance (DeFi), they underpin lending and liquidity.

For institutions, they serve as faster, cheaper, and transparent rails in contrast to legacy systems.

Payment firms (e.g., Paypal), banks (e.g., JPMorgan, Fidelity), and even national states (e.g., Wyoming) are launching or piloting stablecoin solutions, while regulators are circling—but also legitimizing. The recent guidance published by the SEC affirms that fully reserved fiat-backed stablecoins may fall outside securities laws.

The bottom line is that stablecoins are no longer a fringe phenomenon. They offer a programmable, dollar-pegged infrastructure for efficient, global financial operations and thus are foundational to the future of digital finance.

2. Deep Dive Into Circle’s Business Model and Market Position

“If you could take what we think of as money, make it digital and available on the internet, then that would dramatically change the way we use money and open up opportunity around the world. That’s the idea behind Circle.” — CEO Jeremy Allaire

A Regulated Digital Dollar Platform

Founded in 2013, Circle has pivoted from consumer-based crypto to become a regulated infrastructure provider for digital dollars (USDC) and euros (EURC). Its core product, USDC (~99.8% of its total reserves vs. ~0.2% for EURC), is fully backed by cash and short-duration U.S. Treasuries. As a key differentiator to its competitors, Circle discloses reserve composition weekly and undergoes monthly audits by Deloitte.

How Circle Makes Money

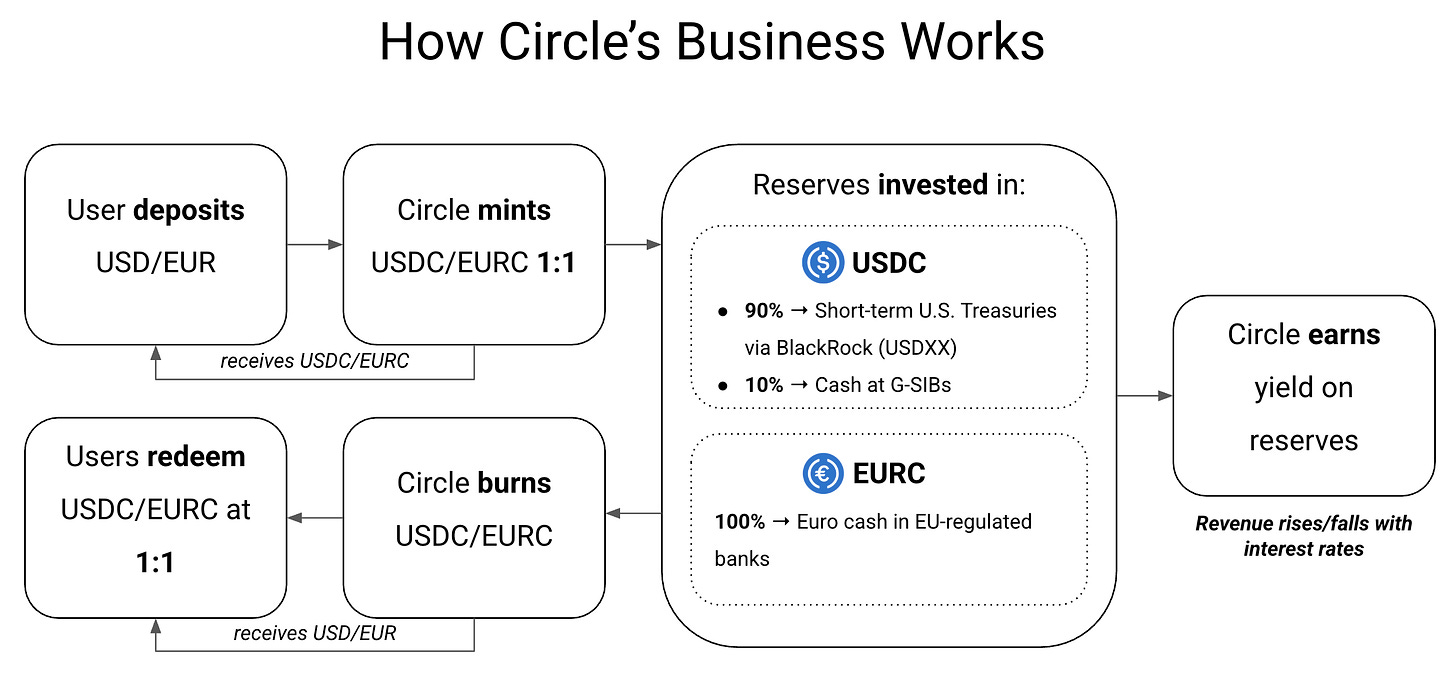

Circle’s business model mirrors a money market fund: it issues USDC (and EURC) in exchange for U.S. dollars or euros, and invests those reserves in low-risk, yield-bearing assets. These asets acquired on the primary and secondary markets, closely tracking current Fed rates:

For USDC, approximately 90% of reserves are allocated to short-term U.S. Treasuries and repurchase agreements via the BlackRock-managed Circle Reserve Fund (USDXX). The remaining ~10% are held as cash deposits at global systemically important banks (G-SIBs) to ensure redemption liquidity.

In contrast, EURC reserves are held as euro-denominated cash at regulated European financial institutions and do not generate comparable yield.

Circle retains the interest income while guaranteeing 1:1 redemption. Unlike traditional money market funds, its stablecoin structure operates on the blockchain with full transparency and third-party audits. Since revenue is tied to yield on reserves, Circle’s earnings scale with interest rates—and decline when rates fall.

In 2024, the company generated $1.68 billion in revenue—99% from interest income—with net income of $157 million.

Cost Structure and Partner Economics

Circle’s distribution costs have been climbing, according to its SEC S-1 filing. For example, Coinbase received $908 million in 2024 as part of a long-term incentive structure, representing over half of Circle’s net revenue. In addition, Binance secured a $60 million onboarding fee. Circle also pays $100 million annually to BlackRock (renewed contract: 2025–2029) for its reserve management, solidifying its position in regulated digital dollar infrastructure.

Strategic Edge & Competitive Context

Circle positions itself as the compliant alternative to Tether (i.e., USDT), offering real-time disclosures, Big Four audits, and MiCAR compliance for their Euro denominated stablecoin, EURC.

Yet, Tether maintains more than twice Circle’s market share ($143 billion vs. $58.9 billion) and generates $13 billion in annual profit (over 80x Circle’s net income!) through a riskier asset strategy. Still, USDC’s share rose to 25.8% by April 2025, supported by rising DeFi adoption and institutional preference for transparency.

4. Why Now? IPO Timing and Regulatory Tailwinds

A Second Attempt

Circle’s IPO represents its second attempt after a failed 2022 SPAC deal. This time however the company pursues an IPO via a traditional listing on the NYSE under ticker “CRCL” with JPMorgan and Citi as lead underwriters. Circle seeks a $5–10 billion valuation on the back of ~$1.7 billion in 2024 revenue, mostly from reserve income.

Favorable Politics and Regulatory Winds

This IPO aligns with a significant shift in U.S. crypto policy. President Trump’s SEC appointee, Paul Atkins, has signaled a “rational” regulatory approach. Concurrently, Congress is actively debating stablecoin legislation, while the SEC has quietly dropped most enforcement actions against crypto firms. Circle’s move may also preempt future requirements, such as Fed-issued licenses for stablecoin issuers, by positioning itself as a regulatory-first mover.

“Becoming a public company is a continuation of our desire to operate with the greatest transparency and accountability possible.” — CEO Jeremy Allaire

The IPO reinforces Circle’s institutional narrative: compliant, transparent, and reserve-backed infrastructure for digital dollars.

Major Investor Backing

With support from Accel, Breyer, Fidelity, and BlackRock, the IPO is backed by major financial players. However, Circle faces rising distribution costs (over $1 billion last year) and stiffening competition from Tether, PayPal, and bank-issued tokens. I explore key risks and challenges in the following section.

Despite compressed margins and rate sensitivity, Circle’s IPO signals a long-term bet on stablecoins as institutional payment infrastructure.

5. Circle’s Strategic Risks and Competitive Pressures

Interest Rate Sensitivity & Narrow Revenue Base

Circle’s revenue model remains narrowly concentrated: 99% of its $1.68 billion in 2024 revenue came from interest earned on USDC reserves. This makes the firm acutely vulnerable to monetary policy: a 1% rate cut could reduce annual earnings by $200–400 million.

With ongoing market turmoil driven by global tariff tensions and rising bond prices (i.e., declining yields), expectations of interest rate cuts in 2025 have intensified. This will put further pressure on Circle’s future yield-based revenue model.

The yield sensitivity model above based on Circle’s reserve structure (90% in short-term Treasuries and repos, 10% in cash) shows how short-term yields directly affect operating income. Assuming a 10% annual reserve growth to $66 billion and fixed 2025 cost estimates (~$1.075 billion in distribution and $550 million in OpEx), Circle only breaks even at around a 3% yield. Below this threshold, operating losses widen sharply.

This model clearly highlights how rate cuts could materially compress Circle’s earnings power in the months ahead.

Customer Incentives Weigh on Margins

Profitability is further constrained by over $1 billion in annual distribution costs, including $908 million to Coinbase, $60 million+ to Binance, and $100 million to BlackRock, as shown above. These recurring payments create margin compression and limit flexibility in forming new strategic partnerships.

Structural Disadvantages vs. Tether

Despite Circle’s regulatory and transparency edge, it trails Tether in market share and profitability. Tether’s $13 billion in net income dwarfed Circle’s $157 million last year, highlighting the limits of Circle’s conservative approach in a high-risk, high-reward market.

Moreover, USDC’s temporary depeg during the SVB collapse dented confidence, even if reserves were ultimately protected. In a crowded and fast-moving stablecoin landscape, market share is hard-earned and easily lost.

High Operating Expenses

Meanwhile, Circle’s high operating costs, driven by its 900+ workforce, global regulatory compliance, and legacy legal expenses from its failed 2022 SPAC attempt, limit margin expansion despite top-line growth.

6. Implications for the Market

A New Playbook for Stablecoin IPOs

Circle’s public listing could define the regulatory and operational blueprint for future crypto-native IPOs. With SEC filings, institutional custodians, and audited reserves managed by BlackRock, it sets a new standard for stablecoin transparency.Pressure on Market Leaders

As the first stablecoin issuer to go public, Circle raises the bar for disclosure—potentially pressuring competitors like Tether to reveal reserve practices or risk losing institutional access. Public scrutiny and compliance could soon become competitive advantages in the global stablecoin race.

Infrastructure, Not Speculation

Unlike Coinbase’s trading-fee model, Circle’s revenues stem from yield on fully backed reserves, positioning USDC as programmable infrastructure rather than speculative risk. Its partnerships with ICE and Hashnote hint at broader ambitions in tokenized asset settlement and on-chain collateral markets.

Institutional Trust & Allocations

For institutional allocators, Circle’s IPO may transform USDC into “investable” financial plumbing. Public market access acts as a trust signal in a sector still repairing post-FTX credibility. A successful listing could unlock capital markets access for Ripple, Kraken, and others, catalyzing a more compliant, regulated digital asset economy.

7. What This Means for Institutional Investors

A Transparent Entry Point to Stablecoin Growth

Circle’s IPO gives allocators an equity-based route into stablecoin infrastructure, offering exposure to reserve-backed yield without holding volatile crypto assets or digital tokens directly.Benchmark for Valuation and Risk

For the first time, public investors can assess a stablecoin issuer through audited GAAP financials. Circle’s IPO sets a precedent for valuing digital payment infrastructure, but also exposes how reliant such models are on macro conditions like interest rates.Strategic Considerations

Circle’s disclosure model, regulatory alignment, and institutional partnerships provide a real-world case study for asset managers, banks, and fintechs evaluating stablecoin integration or issuing their own tokenized cash instruments.Portfolio Implications

As regulatory clarity improves, USDC may transition from utility token to programmable settlement infrastructure. But allocators must weigh upside exposure to digital dollar rails against the downside risk of a rate-sensitive, narrowly concentrated revenue model.

8. Conclusion

Circle’s IPO marks a turning point for stablecoin legitimacy and institutional adoption. Yet with falling yields, rising tariffs, and cautious investor sentiment, market conditions may challenge both short-term earnings and valuation upside.

Still, the listing offers a rare window into a digital dollar infrastructure and a proxy for stablecoin adoption at scale.

Do you consider buying Circle stock? Share your investment thesis (or concerns) in the comments below.

Nothing in this email is intended to serve as financial advice. Do your own research.