From Retail Shelves to Digital Commerce: The €2.5B IoT Transformation Leader

MMN Recommend

Today we’re featuring Undiscovered Value & Growth Stocks.

Most people follow the same 200 stocks. This newsletter doesn’t.

It digs into the other 54,800+—the ones no one talks about but should.

That’s why I’m sharing it with you. If you’re curious, independent thinker, and tired of copy-paste advice, you’ll like this.

Check it out. You might discover something everyone else missed.

I’ll let Undiscovered Value & Growth Stocks take it from here…

Transforming physical retail with IoT and cloud solutions at 30.4% revenue CAGR.

Teaser

Meet the European tech innovator that's silently revolutionizing brick-and-mortar retail through IoT and cloud solutions. This retail technology leader connects physical stores to the digital world with electronic shelf labels, smart cameras, and a complete cloud platform that's driving remarkable financial results. With impressive growth metrics including a 30.4% three-year revenue CAGR and 113.5% three-year EPS growth, they're capitalizing on retail's digital transformation movement worldwide. Their €379M cash position and negative net debt provide substantial runway for growth, while the transition to higher-margin SaaS offerings positions them for significantly improved profitability ahead. Despite their €2B+ market cap , this commerce digitalization pioneer remains under the radar for most investors.

Note: Paid content usually below this line. This is a free preview of my work for everyone. Enjoy!

VusionGroup: Revolutionizing Retail Through Digital Transformation

Executive Summary

European retail technology leader VusionGroup (formerly SES-imagotag): IoT devices and SaaS solutions for retail

Digital transformation driving 30.4% 3-year revenue CAGR with €830.16M revenue

Impressive growth outlook: 47.6% EBITDA growth and 72.7% long-term EPS growth

Strong cash position: €379.52M with negative net debt of -€203.41M

Attractive forward valuation considering growth: P/E 39.1x with price target €209.57

Business at a Glance

Founded in 1992 and headquartered in Nanterre, France, VusionGroup S.A. (Euronext: VU) has established itself as a leading provider of digitalization solutions for commerce across Europe, Asia, and North America. The company, which recently rebranded from SES-imagotag in January 2024, offers a comprehensive ecosystem of Internet of Things (IoT) devices and retail SaaS solutions designed to transform traditional retail environments into connected, data-driven spaces.

Exhibit 1. Vusion’s partners (from IR presentation).

VusionGroup's product portfolio includes electronic shelf labels, cameras, fixtures, and IoT infrastructure components, complemented by cloud-based software solutions such as VUSION Cloud, Asset Management, and various marketing and automation platforms. The company serves diverse sectors including grocery, electronics, DIY, pharmacy, fashion, and industrial applications, providing retailers with tools to enhance operational efficiency, improve customer experience, and drive digital transformation.

Exhibit 2. Vusion’s solutions for digitalizing the “retail shelf” (from IR presentation).

With a market capitalization of €2.67B and an enterprise value of €2.46B, VusionGroup has positioned itself at the intersection of physical retail and digital technology, capitalizing on the growing demand for retail digitalization solutions in an increasingly omnichannel commerce landscape.

Growth Story & Revenue/Earnings Trajectory

VusionGroup has demonstrated remarkable growth in recent years, with revenue reaching €1B in the latest reporting period. The company has maintained strong revenue momentum, achieving a 30.4% three-year compound annual growth rate (CAGR) and a 29.5% five-year CAGR. This consistent performance reflects the accelerating adoption of retail digitalization solutions globally.

Exhibit 3. Vusion’s key figures (from IR presentation).

Looking at recent performance, the company's revenue increased from €620.9M in December 2022 to €800M in December 2024, representing a 29.2% year-over-year growth. Forward projections remain robust, with revenue expected to reach €954.7M in December 2024, indicating a 19% year-over-year increase.

While VusionGroup's profitability metrics currently show negative margins at the bottom line (net margin of -4.3%), the company's growth story is particularly evident in its earnings trajectory. Diluted EPS has grown at an impressive 113.5% three-year CAGR, reflecting the company's progress toward profitability as it scales. The 10-year diluted EPS CAGR stands at 19.7%, demonstrating long-term progress despite near-term investments in growth.

Looking forward, VusionGroup's earnings growth potential appears substantial. EBITDA is forecast to grow by 47.6% over the next two years, while EPS is projected to increase by 14.1% over the same period. The long-term EPS growth estimate of 72.7% suggests significant earnings potential as the company continues to scale and improve operational efficiency.

Exhibit 4. Vusion’s revenue growth (from IR presentation).

The company's transition from hardware-focused to a more balanced business model incorporating higher-margin SaaS solutions is expected to drive margin expansion in the coming years. With gross profit margins improving from 22.8% in 2021 to 27.8% in 2022 and 25.2% in 2023, VusionGroup is showing progress in its business model evolution despite ongoing investments in growth initiatives.

Margins & Capital Allocation

VusionGroup's financial profile reflects a company in transition, balancing significant growth investments with a gradual improvement in profitability metrics. The company maintains gross margins of 27.9%, which while modest compared to pure software companies, represent a solid foundation in a hardware-software hybrid business model.

EBITDA margins currently stand at 5.3%, with operating margins at 3.7%. The company's pre-tax and net margins are currently negative at -3.1% and -4.3% respectively, reflecting ongoing investments in growth, R&D, and market expansion. However, these figures should be viewed in the context of VusionGroup's strong growth trajectory and transition toward a higher-margin business model.

Exhibit 5. Vusion’s latest annual report.

Free cash flow (FCF) is a bright spot in VusionGroup's financial profile, with an FCF margin of 28.4%. This strong cash generation capability provides the company with resources to fund its growth initiatives while maintaining financial flexibility.

The company's capital efficiency metrics show improvement over recent years. Return on total capital has increased to 8.7% in 2023 from -1.3% in 2020, while return on equity has surged to 33.9% from -4.1% over the same period. Return on assets has likewise improved to 10% from -1.6%, demonstrating increasing operational efficiency as the business scales.

Working capital management shows positive trends, with the cash conversion cycle improving dramatically from 112 days in 2020 to just 43.1 days in 2023. This improvement reflects more efficient inventory management (days inventory outstanding reduced from 146.3 to 91.2 days) and accounts receivable collection (days sales outstanding reduced from 107.2 to 54.8 days).

As VusionGroup continues to scale and increase its software and services revenue mix, margins are expected to expand further, improving the company's overall profitability profile while maintaining its strong growth trajectory.

Financial Health

VusionGroup maintains a robust balance sheet that provides both stability and flexibility to support its ambitious growth plans. The company holds €379.52M in cash against a net debt position of -€203.41M, essentially making it net cash positive. This strong liquidity position allows VusionGroup to invest in product development, geographic expansion, and potential strategic acquisitions without financial constraints.

Exhibit 6. Vusion’s global key figures as of the beginning of 2025.

The company's debt-to-equity ratio of 0.7 reflects a balanced approach to capital structure, while its EBIT/interest coverage ratio of 2.2x, though modest, indicates its ability to service existing debt obligations. Total assets have grown significantly to €1.05B in 2023, supported by a healthy equity base.

VusionGroup's cash flow generation has shown remarkable improvement, with cash from operations reaching €248.3M in 2023 compared to €20M in 2022. Free cash flow has likewise surged to €160.8M from -€31M during the same period, demonstrating the company's improving ability to generate cash while funding its growth initiatives.

The strong balance sheet and improving cash flow metrics provide VusionGroup with a solid financial foundation to continue its growth trajectory while managing the investments required to expand its market presence and develop new solutions for retail digitalization.

Valuation Analysis

Forward P/E ratio of 39.1x

EV/EBITDA of 13.4x

P/B ratio of 10.1x

EV/Gross Profit of 10.6x

VusionGroup's valuation metrics reflect a company with significant growth potential but also the premium investors are willing to pay for exposure to the retail digitalization trend. Trading at a forward P/E of 39.1x, the company commands a premium valuation relative to traditional retail technology providers, though this appears justified given its 30.4% three-year revenue CAGR and long-term EPS growth estimate of 72.7%.

The company's EV/EBITDA multiple of 13.4x is reasonable for a growth-stage technology company transitioning toward higher profitability. Similarly, its EV/Gross Profit ratio of 10.6x reflects the market's expectations for continued revenue growth and margin expansion.

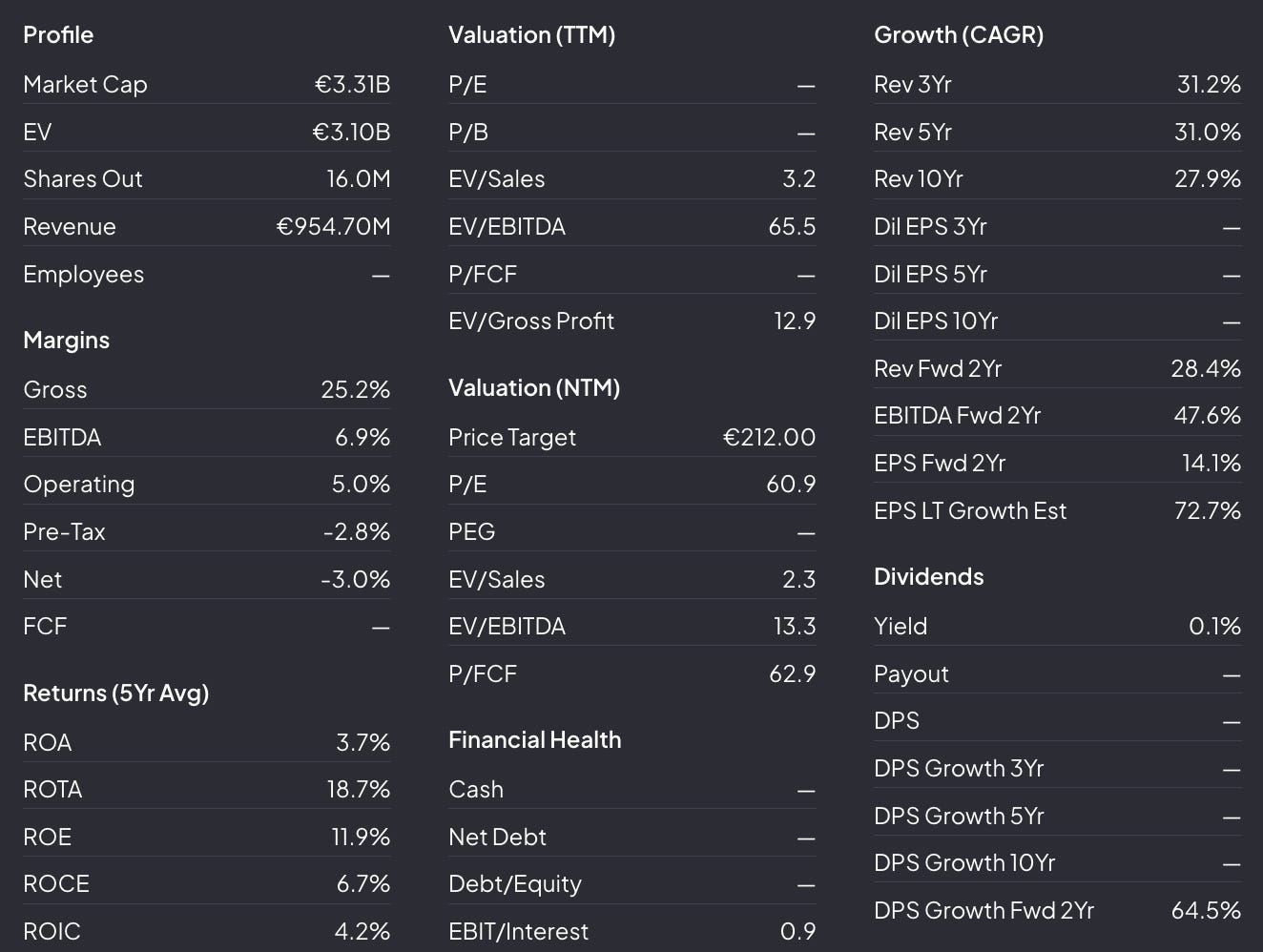

Exhibit 7. Vusion’s valuation metrics (from Finchat)

VusionGroup's P/B ratio of 10.1x indicates a significant premium to book value, justified by its technological leadership, market position, and future growth potential. The company offers a modest dividend yield of 0.2%, suggesting that management appropriately prioritizes reinvestment for growth over current income distribution to shareholders.

Forward valuation metrics show potential improvement, with forward EV/EBITDA expected to decrease from 14.7x (Dec '23) to 14.3x (Dec '24) and 13.4x (NTM), reflecting anticipated EBITDA growth. Similarly, forward P/E is projected to improve dramatically from 232.1x (Dec '23) to 42.1x (Dec '24) and 48.9x (NTM) as earnings growth materializes.

With a price target of €209.57, representing potential upside from current levels, VusionGroup appears positioned for valuation expansion as it executes on its growth strategy and demonstrates progress toward sustainable profitability.

Exhibit 8. Stock performance in the past 5 years (from Finchat)

Investment Considerations

VusionGroup represents an intriguing investment opportunity for those seeking exposure to the global retail digitalization trend. The company combines several attractive characteristics that position it for potential long-term success:

Market Leadership: VusionGroup has established itself as a leading provider of IoT and cloud solutions for retail, with a comprehensive product portfolio addressing key pain points in modern commerce.

Strong Growth Trajectory: With a 30.4% three-year revenue CAGR and projections for continued robust growth, VusionGroup is capitalizing on the accelerating digital transformation in retail.

Improving Financial Profile: Despite current negative bottom-line margins, the company shows strong improvement in key metrics including gross margin, cash flow generation, and capital efficiency.

Solid Balance Sheet: €379.52M in cash and a net cash positive position provide financial flexibility to fund growth initiatives and weather potential market challenges.

Transition to Higher-Margin Business: The ongoing evolution from hardware-focused to a more balanced model incorporating higher-margin SaaS solutions positions the company for potential margin expansion.

Expanding Addressable Market: As retail continues its digital transformation globally, VusionGroup's addressable market expands across geographies and retail segments.

However, potential investors should consider several risk factors:

Current Negative Profitability: The company currently operates with negative pre-tax and net margins, requiring faith in the path to profitability.

Valuation Premium: Trading at a forward P/E of 39.1x, VusionGroup's stock incorporates significant growth expectations that must be met to justify the premium.

Competitive Landscape: The retail technology space is increasingly competitive, with both established players and new entrants vying for market share.

Execution Risk: The company's growth strategy requires successful execution across product development, market expansion, and operational efficiency improvements.

For investors with a long-term horizon and confidence in the retail digitalization trend, VusionGroup offers exposure to a market leader with substantial growth potential and improving financial characteristics.

Important disclaimer:

Data is taken from Finchat.

The content provided in this newsletter is for informational purposes only and should not be construed as financial or investment advice. While I strive for accuracy, some metrics and data presented in these reports may not be entirely accurate or up-to-date. I take no responsibility for any investment decisions made based on the information provided herein.

Investing in the stock market, especially in undiscovered or lesser-known companies, carries inherent risks. The companies discussed in this newsletter may be subject to volatility, liquidity issues, and other factors that could impact their performance.

It is crucial that you conduct your own thorough research and due diligence before making any investment decisions. I strongly recommend consulting with a qualified financial advisor who can provide personalized advice based on your individual financial situation, risk tolerance, and investment goals.

Remember that past performance is not indicative of future results. The stock market is subject to fluctuations, and the value of investments may go up or down. You should only invest money that you can afford to lose.

By subscribing to and reading this newsletter, you acknowledge that you understand and accept these risks and limitations. You agree that I will not be held liable for any losses or damages resulting from the use of information provided in this newsletter.

Always invest responsibly and within your means. Your financial decisions are ultimately your own responsibility.