This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

The FDA said yes—to mind control.

THIS stock’s $545B backlog bet.

Google just gave AI muscle memory.

For the first time since 1917, the U.S. flinched.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🧠 FDA OKs Mind Control

Neuralink just got the FDA’s green light for a brain chip that lets you “talk” without a voice. No keyboard. No hands. Just thoughts…

A man with ALS is already using it to type full sentences—mind only.

This isn’t just about helping people speak again. It’s about a new way to communicate altogether.

Fixing a disability is just the start… once it works, how long until everyone wants the upgrade? Typing feels slow. Autocorrect is a mess. Thinking is faster. Cleaner. Direct.

But there’s a catch… when your brain becomes the interface, your thoughts become data… who owns that? who reads it? where does privacy go?

Right now, it’s a breakthrough. Tomorrow, it could be default. The mouse didn’t replace the keyboard. The phone didn’t replace email. But this? This might replace everything.

2. 💰 THIS Stock’s $545B Backlog Bet

THIS stock got grounded, beaten, humiliated — now clawing its way back… Boeing’s been through hell: deadly crashes, grounded planes, supply chain chaos, COVID… But now? Airlines need jets. Governments need defense. And Boeing? It’s got both…

Stock: Up 40% over the past 6 months.

Backlog: $545B worth of orders.

Commercial deliveries: +57% YoY in Q1.

Net loss? Nearly breakeven last quarter (–$31M vs. –$355M last year).

Cash on hand: $23.7B.

Debt? Still high at $53.6B, but shrinking.

Boeing’s building planes for a world that’s flying more than ever. Passenger traffic expected to hit 5.2B in 2025. Global defense spending? Record $2.72T…Boeing is straddling both.

Big tailwinds ahead…

FAA approvals for MAX 7 and MAX 10.

China just reopened to Boeing deliveries.

777X certification could unlock new orders.

Production is rising across the board.

Defense wins could stack up in the back half of the year.

The risk? Execution…

Boeing’s past missteps cost it trust. Now it has to earn it back — plane by plane. Any new defect, delay, or scandal could slam the brakes. Plus, it's still sitting on $54B in debt.

But here’s the thing… This isn’t a bet on a turnaround idea. It’s a bet on the American plane maker, with the wind finally at its back.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🤔 AI Now Has Muscle Memory

What if you could rehearse a million solutions to any problem before breakfast? Google’s new AlphaEvolve can… It builds better not because it’s smart — but because it never stops practicing…

Humans try things. So does AlphaEvolve — just a million times faster. That’s the trick. Not creativity. Not cleverness. Just speed. Feedback. And ruthless focus on what works.

The results so far are WILD…

It sped up GPU tasks by 32.5%.

It rewrote circuits for Google’s AI chips.

It solved math problems we couldn’t crack for decades.

It optimized data centers to save time and power.

All without being told how. Just what to aim for. Today, it works on problems with clear answers — math, code, hardware. Tomorrow? Imagine AI finding cancer treatments. Cleaner fuels. Fixes for the climate. Not because we walked it through the steps. Because we told it the goal — and it figured it out.

That’s the shift. We’re not just building tools anymore. We’re building things that learn. And they’re learning faster than we ever could.

Top 3 Charts of the Week

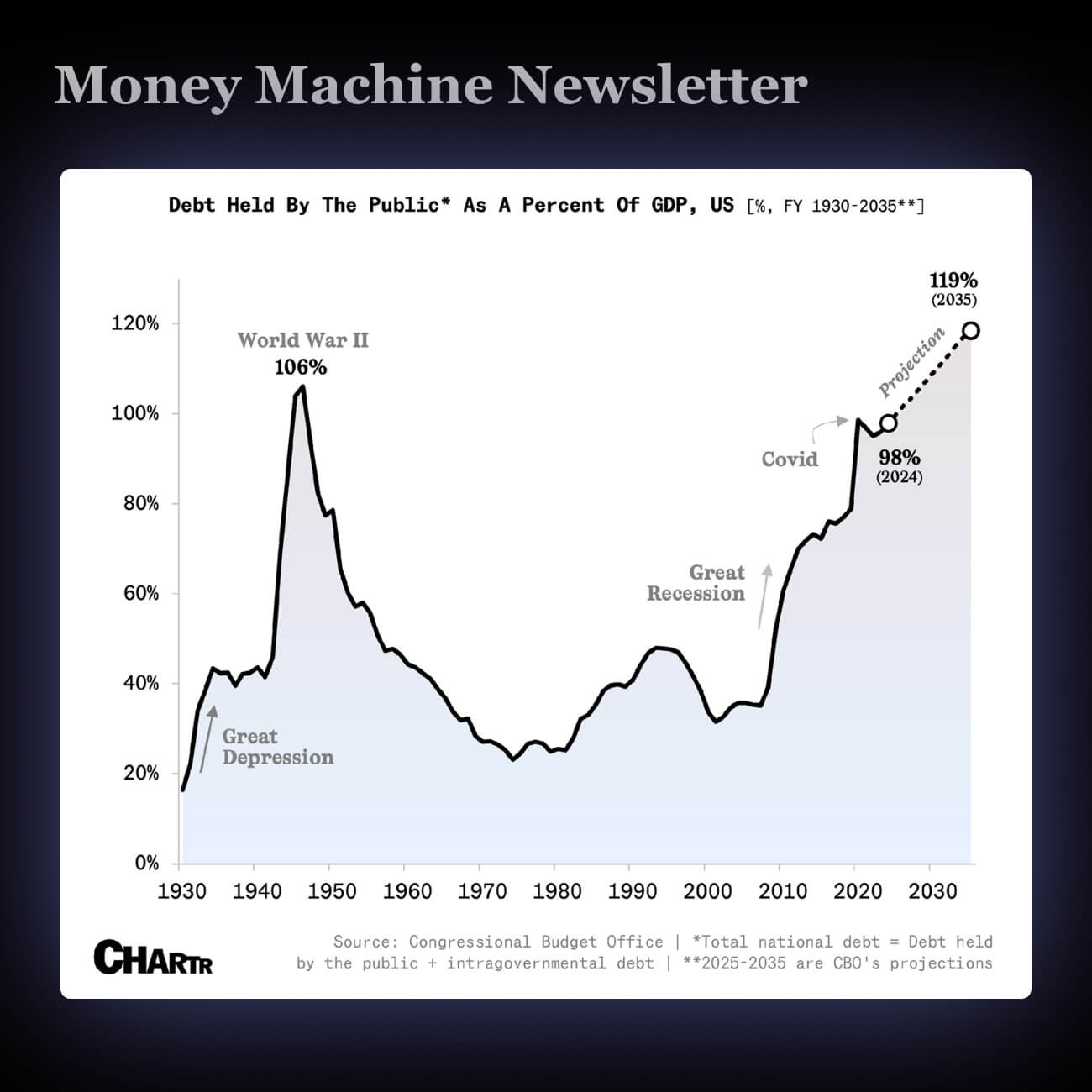

1. 😳 America's Public Debt Is Catching Up With Its Economy... Just Like After World War lI

Moody’s just downgraded the U.S. credit rating — the last major agency to do so. America no longer has perfect credit for the first time since 1917.

Our $36T debt is growing fast. Interest payments alone cost $880B last year. Credit downgrades make it even more expensive to borrow.

Higher debt means higher taxes, less room for public spending, and rising risks for the economy.

2. 🏠 U.S. First Homebuyers Are Older Than Ever

Fewer young people can afford homes, so older, wealthier folks are buying instead. The average age of first-time buyers hit 38. Overall buyers? Now 56. That's the oldest it's ever been.

America’s housing market is aging—both the people and the properties. The median home sold this year is 36 years old. Young buyers are locked out. Older homes mean more upkeep.

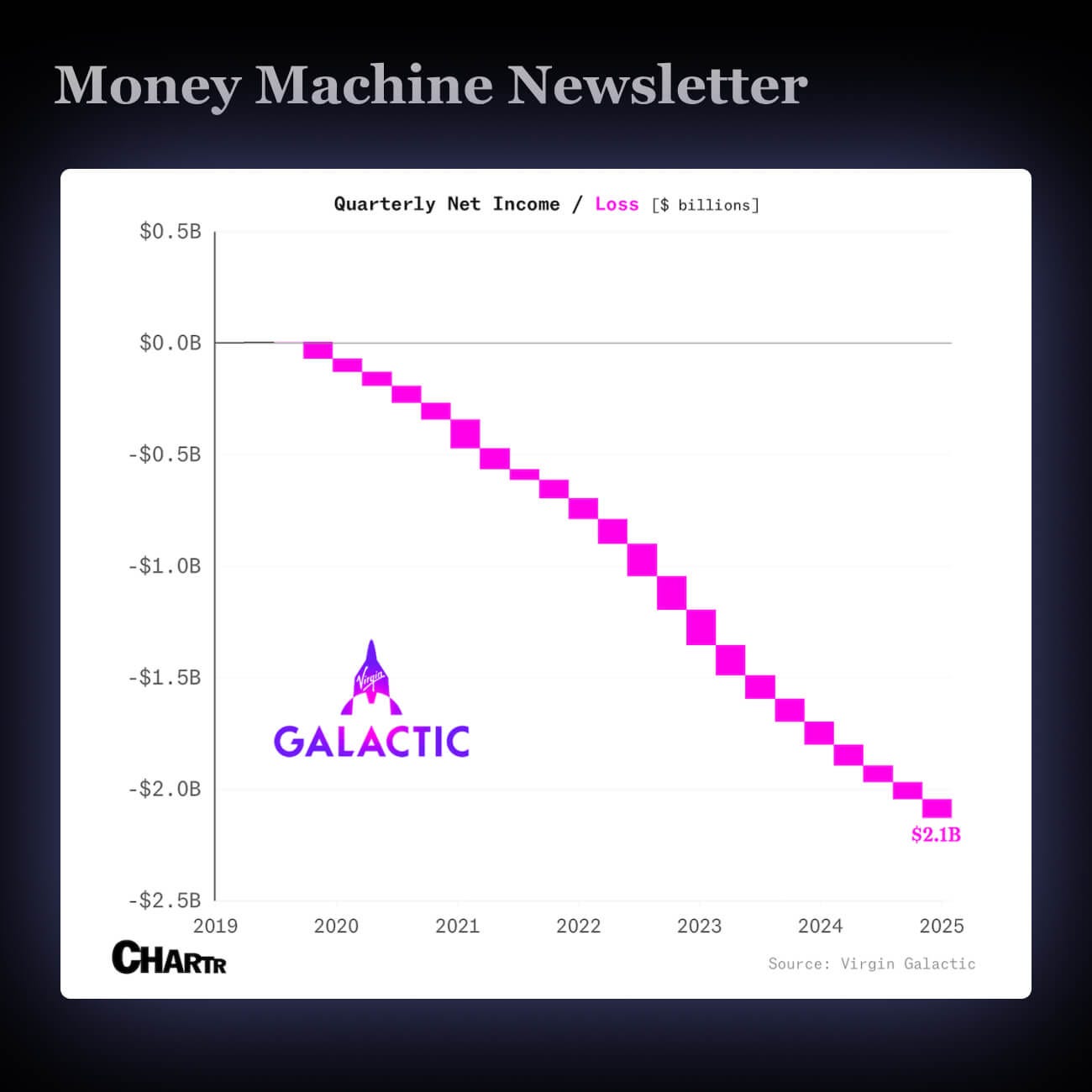

3. 🔭 Virgin Galactic Has Lost $2B+ Since Its IPO

Virgin Galactic is hiking its $600,000 space ticket price and plans to relaunch sales in 2026 with new, larger spacecraft.

They need rich customers fast—after burning $2.1B and crashing 99.5% from their stock peak, the business isn’t close to profitable.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.