Ethereum’s Supply Struggle: Why It’s Stagnant—And What Comes Next

MMN Recommend

Today we’re featuring Panic Drop.

Markets swing. People panic. Most react. Few profit.

Panic Drop flips that equation.

It teaches you how to spot opportunities when everyone else is running scared. Stocks, crypto, market trends—broken down simply, with insights you can actually use.

If you want smart analysis without the fluff, this is a newsletter worth reading.

I’ll let Panic Drop take it from here…

3 Signs Liquidity Is Flooding Back to Ethereum (And How You Can Profit)

Most people don’t realize it, but Ethereum’s supply has been on a wild ride.

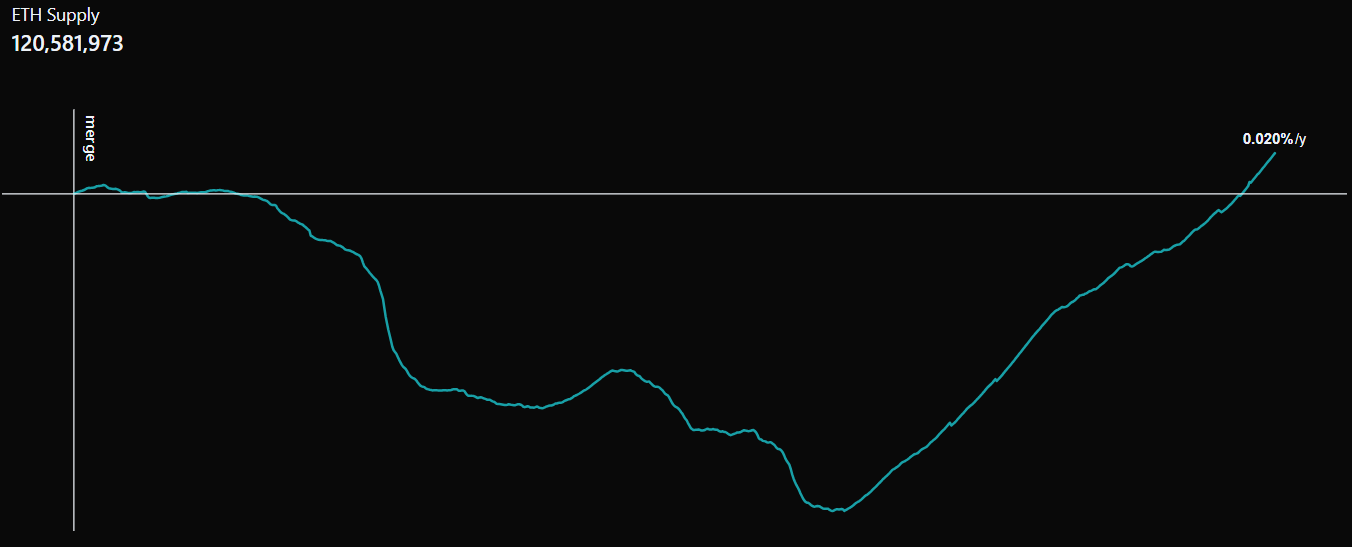

After the much-anticipated ETH upgrade, it went deflationary—burning more tokens than it issued, a feat heralded as a turning point for the blockchain’s economic design. Then, almost as quickly, it flipped inflationary again. Now, we’re back to square one, with roughly the same supply as before the upgrade. This isn’t just noise in the data. It’s a signal—a story about how liquidity moves, how networks compete, and how the promise of a decentralized future keeps getting reshaped by the present.

Picture a matchstick puzzle: "7 - 7 = 8 - 3." It’s wrong on its face, an equation that doesn’t add up. But with a few deliberate moves, you can set it right. Ethereum’s supply dynamics feel much the same—out of whack for a while, but with the pieces now shifting into place. Let’s unpack why it stumbled, and why it might be poised to rise again.

Why Ethereum’s Burn Rate Collapsed

Ethereum’s deflationary dream hinges on a simple mechanism: transaction fees. Every time someone swaps tokens, mints an NFT, or interacts with a smart contract, a portion of ETH gets burned—taken out of circulation forever. The more the network hums, the more ETH disappears. It’s an elegant design, meant to echo Bitcoin’s fixed supply while keeping Ethereum flexible. But in 2024, that engine sputtered. Three forces drained the fuel from Ethereum’s burn rate:

Layer 2 Chains Took Over: The rise of Arbitrum and Base was a triumph of engineering. These Layer 2 solutions made transactions cheaper and faster, easing the congestion that once plagued Ethereum’s main chain. But there’s a catch. By shifting activity off Layer 1, they slashed the number of transactions burning ETH. It’s a trade-off straight out of economics textbooks: scalability gained, deflationary pressure lost. The velocity of activity picked up, but the burn slowed to a crawl.

The Solana Memecoin Frenzy: Meanwhile, Solana stole the spotlight. With its low fees and lightning-fast transactions, it became the playground for memecoin mania—think $DOGE knockoffs and speculative pumps. Ethereum, once the default home for such experiments, watched traders migrate. Solana wasn’t just competing; it was dominating, siphoning liquidity and attention from its rival. Network effects, it turns out, can shift faster than anyone expects in the crypto wilds.

A More Efficient Network: Here’s the irony: Ethereum got too good at its own game. Post-upgrade, gas fees—the lifeblood of the burn mechanism—dropped as the network streamlined. Efficiency is a win for users, but it’s a paradox for the deflationary model. Fewer high-fee transactions meant fewer meaningful ETH burns. Success, in this case, undercut the very narrative it was meant to bolster.

For months, Ethereum’s supply stagnated, even crept upward. The deflationary promise flickered. But narratives don’t stand still—and neither does liquidity.

Why ETH’s Transaction Volume Is Set to Rise Again

The tide that flowed out is showing signs of rushing back. Ethereum’s transaction volume, a proxy for its vitality, could be on the cusp of a rebound. Here’s why:

The Meme Cycle Burnout: The memecoin rollercoaster—tokens like $MELANIA and $LIBRA—crashed hard in 2024. Scams multiplied, rug pulls proliferated, and traders nursed their losses. What started as a speculative frenzy ended in a sobering realization: these are zero-sum games, and most players lose. Disillusionment is a powerful force. It’s pushing capital away from hype and toward something more durable.

A Return to Utility Coins: Enter DeFi. Ethereum’s decentralized finance ecosystem—protocols offering lending, staking, and real-world applications—never went away. It just got drowned out by the noise. Now, with memecoin fatigue setting in, investors are rediscovering utility. Lending on AAVE or staking via Lido isn’t as sexy as a 100x memecoin moonshot, but it’s sustainable. That shift could bring liquidity roaring back to Ethereum’s main stage.

Trump’s Ethereum Buy-In: Then there’s the wild card: Donald Trump. Say what you will about the politics, but when a figure like Trump buys ETH, it’s not just a transaction—it’s a signal. Major players, from hedge funds to retail speculators, take notice. It’s less about his wallet than the narrative it spins: Ethereum is back on the radar of the powerful. In a market driven by sentiment as much as fundamentals, that’s a spark that could ignite broader interest.

These aren’t isolated trends. They’re threads in a larger tapestry—a pivot away from froth and toward substance, with Ethereum positioned at the center.

If you buy this story—that Ethereum’s doldrums are giving way to a resurgence—holding ETH might not be enough. How do you amplify your bet? Three options stand out:

AAVE (DeFi Lending Protocol): As DeFi heats up, AAVE could be a prime beneficiary. It’s a lending platform where users borrow and lend crypto, generating fees that flow back to the ecosystem. More liquidity on Ethereum means more activity on AAVE—higher volumes, higher valuations. It’s a leveraged play on the network’s revival.

ENS (Ethereum Name Service): Think of ENS as Ethereum’s domain registrar. Those .ETH addresses—like vitalik.eth—tie identity to the blockchain. If Ethereum adoption spikes, demand for these names could soar. Brands, influencers, even institutions might clamor for their slice of digital real estate. ENS is a bet on the infrastructure underpinning Ethereum’s next wave.

BTCS Inc (Publicly Traded Crypto Company): Not everyone wants to wrestle with wallets and private keys. For those who prefer the stock market, BTCS Inc offers a backdoor into crypto’s upside. It’s a publicly traded firm with exposure to Ethereum and other digital assets—a way to ride the wave without leaving the comforts of traditional finance.

These aren’t guarantees, but they’re ways to tilt the odds if you see Ethereum reclaiming its stride.

Where Do We Go From Here?

Ethereum’s deflationary model isn’t broken—it’s just been waiting for its moment. The matchstick puzzle of its supply, misaligned for a time, is finding its fix. Speculative liquidity is shifting, real use cases are resurfacing, and the network’s fundamentals remain as robust as ever. ETH is primed for a resurgence—not because of blind optimism, but because the conditions that dimmed its shine are fading.

The question isn’t whether Ethereum can rebound. It’s whether you’re positioned for it when it does.

Thanks for reading,

Written by Timothy Assi, a popular investor on eToro.

Connect with me on:

🟦 Linkedin: Timothy Assi

🟪 Instagram: @panic_drop

⬛ X: @timoassi

Nothing in this email is intended to serve as financial advice. Do your own research.