This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

A whole lot of pretending in the economy.

Your waistline might be cramping your sperm count.

A complete shift in Google’s keyword algorithm.

THIS CEO is thriving with Trump’s tariffs.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 😳 Economic Lie We've All Been Told

We’ve been in a recession. Just not the kind that makes headlines. No crash. No panic. Just a slow leak hidden by government money. Stimulus checks. Deficit spending. Easy numbers that made things look better than they were. Take that away? You see the cracks. Hiring’s frozen. Layoffs are brewing. Growth is gone. Survival mode is on. They called it a “soft landing.” Maybe it was just a soft lie…

Underneath the surface, things look shaky…

Most of the growth in 2024? Government spending. Not businesses investing.

In late 2024, public output went up 2.7%. Private investment? Down.

Wages are barely outpacing inflation — up just 3.8% year-over-year.

Job openings dropped from 11 million in 2022 to 7.6 million by early 2025.

Personal savings rate is down to 4.6% — near record lows. People are leaning on credit to stay afloat.

And the warning lights are blinking:

Manufacturing contraction? PMI stuck below 50.

Consumer confidence below recession-warning levels? Yep —Expectations Index fell to 72.9 in early 2025.

The real risk isn’t collapse. It’s comfort. Complacency dressed up as stability. That’s what keeps us from fixing what’s broken. Trump’s tariff play? It’s a wake-up call. No more one-way deals. The goal now is resilience.

Whether you’re all-in on tariffs or think the whole thing’s a mess, one thing’s clear… you can’t fix a problem you refuse to see. Maybe the real story isn’t what’s coming. It’s what’s already here — and what we’ve been pretending not to notice.

2. 💊 Sperm Count’s Secret Weapon

What if shedding a few pounds could help you start a family? Turns out, it might. A recent review of multiple studies says weight loss does more than trim your waistline—it boosts your sperm count…

According to the study, lose 12kg (about 26 pounds), and sperm quality shoots up.

GLP-1 drugs like liraglutide didn’t make people lose more weight—but they did help them keep it off. And that mattered. Men who kept the weight off a year later still had better sperm count. So it’s not the drug. It’s the weight. The drug just helped it stick.

Why does this matter?

Because we’re facing a fertility crisis—sperm counts have dropped more than 50% in the last 40 years. At the same time, GLP-1 drugs like Ozempic and Wegovy are helping millions lose weight. And if losing weight improves sperm count, that's not just a bonus—it's a big chance to boost fertility.

If you're overweight and want a baby, dropping 25 pounds might do more than make you slimmer—it could reboot your body. Sperm count isn't just a number, it's a health signal. Losing weight might be the simplest way to boost it.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 💬 You Don’t Google. You Ask.

We used to Google things. Now, we just ask AI. “What’s the best carry-on under $200?” “Find me comfy walking shoes that don’t look ugly.” “Which camera won’t die on a hike?” And AI answers. Confidently. In full sentences. With sources. No more blue links. Just straight answers.

Nearly 60% of online shoppers are swapping search engines for chatbots. That’s not a blip. That’s a behavior shift. And during peak season? Retail visits from AI spiked 1,300%. Travel sites? Up 1,700%.

The old game was SEO… Stuff the right words in the right places. Rank. Win. Repeat… The new game? Be the answer AI gives….

That means structure your product info. Build trust through reviews. Write real FAQs. Get mentioned in forums. Be clear. Be consistent. Be findable by machines.

Retailers are scrambling to catch up…

Amazon rolled out Rufus, a chatbot inside the app. Ask it anything—size, fit, style—and it answers with actual products. No filters. No forms. Just a chat.

Google baked Gemini into its shopping graph—45 billion products deep. It tracks your preferences. It watches for deals. It makes shopping conversational.

If you sell something online—product, service, anything—it’s not about showing up on page one anymore. It’s about being the answer.

Top 3 Charts of the Week

1. 👕 ThredUp Is Big in Resale—But Still Losing Money

Trump’s new tariffs closed a loophole that helped fast-fashion giants like Shein and Temu avoid taxes. ThredUp’s CEO is stoked! It levels the playing field.

ThredUp’s U.S.-based supply chain gives it an edge now. While other retailers took a hit, ThredUp’s stock stayed steady. It’s one of the few winners in a tough market.

Resale platforms like ThredUp may finally have a shot. After losing 85% since its IPO, this policy shift could help it—and others—bounce back.

2. 💵 America’s Stashing, Not Spending

Americans are stashing cash in money-market funds. These safe, low-risk investments just hit a record $7.4T—up 60% in five years.

People are nervous. Between tariffs, recession fears, and shaky markets, they’re choosing safety and yield (as of writing this ~4.2%) over risk.

When everyone hides their money, it signals fear—not confidence. And that fear might say more about the real economy than the stock market does.

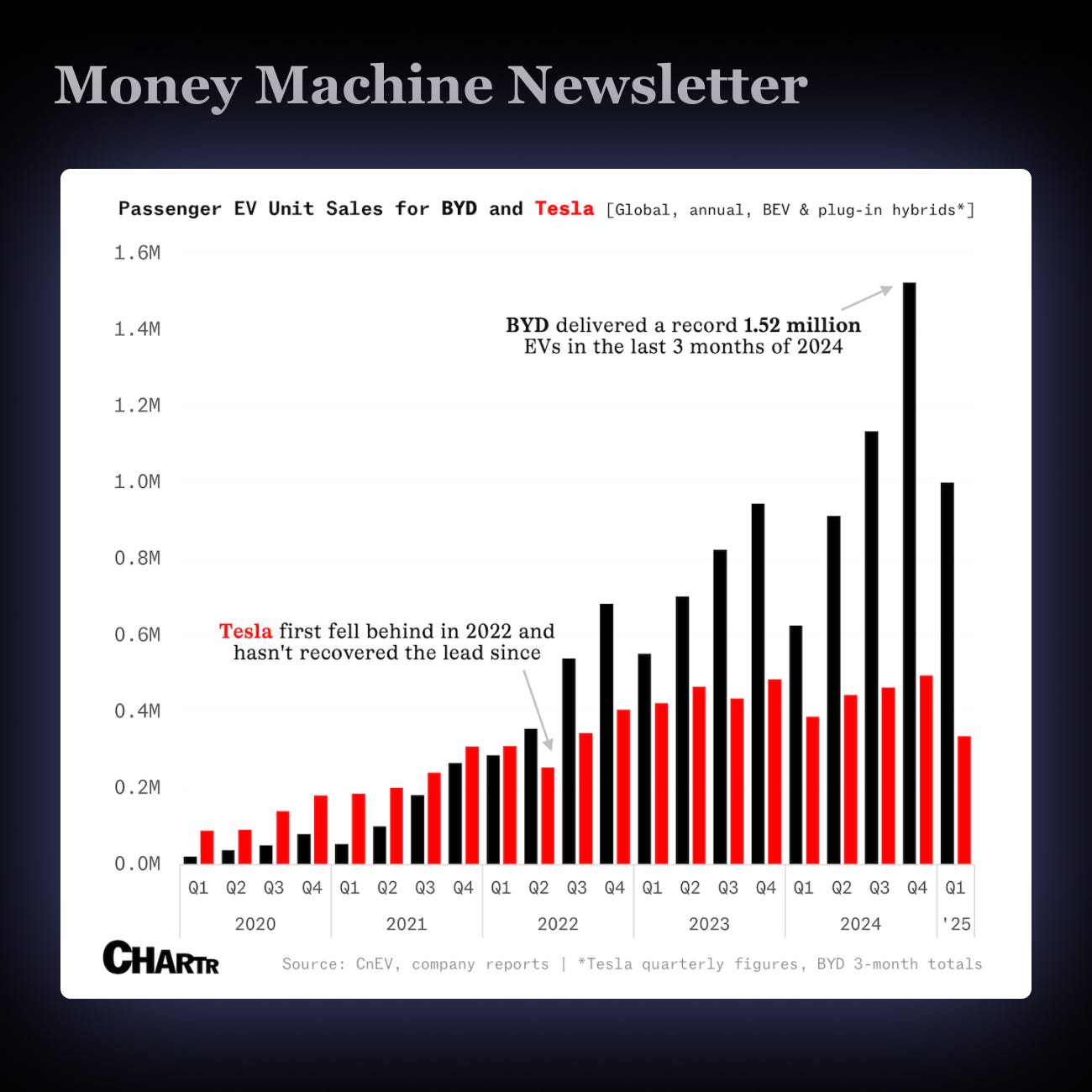

3. 🔋 BYD Smokes Tesla in EV Race

BYD delivered over 1 million EVs in Q1 2025—3x Tesla’s number—and expects profits to nearly double to $1.4B. Sales hit $107B, finally passing Tesla for the first time in 7 years.

BYD’s cheap, fast-charging EVs are flying off lots. Meanwhile, Trump’s tariffs—meant to hurt China—don’t touch BYD, but might cost U.S. automakers $108B more per year.

Tesla’s slipping. BYD’s rising. And if trends hold, the world's top EV brand may no longer be American.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.