Today we’re featuring Ahead of the Curve. A newsletter from Breakout Investors, a community of serious, curious, independent thinkers.

They focus on small-cap companies most people overlook. It’s smart analysis from investors who actually do the work. Make sure to check them out and subscribe!

I’ll let Breakout Investors: Ahead of the Curve take over from here…

A $DUOT report

Executive summary

Duos Technologies Group, Inc. (NASDAQ: DUOT) began as a developer of AI-powered rail inspection technology, creating systems that detect mechanical defects in high-speed railcars. Under a new management team, the company has recently gained traction in two new high-growth sectors: edge computing and mobile power generation. These new business streams appear poised to dwarf the legacy business, with growth rates expected to more than triple in 2025 from the power business alone, and additional upside from data centres, propelling the company this year into long-awaited profitability by a healthy margin.

The management team has repeatedly stated its intention to build a billion-dollar business, which would 10x the current fully diluted market cap. Whether they achieve this will depend on how well they maintain the current momentum and execution. If everything goes right, this goal appears plausible within a few years.

As for the downside, at current prices, the risk appears minimal. The company appears attractively valued based on its current rail and energy businesses; the probability of successful delivery on these is high, considering the management team's track record with similar businesses. The company targets a niche that is less attractive to larger players. The supply of energy and local data centres is structurally constrained and is likely to remain so for years. Due to the expansion of AI, demand for modular data centres and energy is unlikely to abate. Management also appears shareholder-friendly and loath to dilute.

The market dislikes uncertainty, and I believe the range of potential outcomes is quite wide here. That said, I believe the downside is minimal here, so I have taken a substantial position and am excited to see how the story unfolds. I will watch with interest and adjust my position if the management team’s execution exceeds or falls short of my expectations. Updated guidance on the earnings call, coming by the end of March, could be a nice catalyst for price appreciation.

Duos Tech (Rail Inspection)

Our journey begins with the rail business. Although this is the least exciting of the three business lines, understanding it is essential to the company's context and story.

Core Product and Service Offering

Duos Technologies' rail division specialises in automated railcar inspection systems that combine advanced imaging technology with artificial intelligence. The company's flagship product, the Railcar Inspection Portal, is a drive-through inspection station installed alongside railroad tracks that captures high-resolution images and sensor data from railcars as they pass through at operational speeds up to 125 mph.

These inspection portals use cameras, thermal sensors, LiDAR, and other detection technologies to create a 360-degree digital model of each railcar. The system's AI algorithms analyse this data in real-time to identify mechanical defects, structural issues, safety concerns, and unauthorised human presence. This automated inspection process replaces traditional manual inspections, detecting problems that human inspectors might miss while eliminating the need to stop trains for physical examination, thereby saving railroad operators substantial time and operational costs.

Historical Context

The Railcar Inspection Portal evolved from experimental prototypes to commercial systems between 2015 and 2020, initially supported by government contracts and partnerships with Class 1 freight railroads. Despite its technological merits, the rail inspection business struggled with widespread adoption, likely due to the industry's conservative nature and slow adoption cycles. Revenue inconsistency from infrequent, large-scale deployments and customer hesitation toward significant upfront investments limited Duos' ability to scale beyond initial partnerships.

By 2021-2023, Duos had shifted toward a "rail-as-a-service" (RaaS) business model, monetising data subscriptions for car owners and operators rather than simply selling hardware installations. This transition aligned with broader software industry trends toward recurring revenue streams and represented a strategic effort to create more predictable financial performance. As shown below, this has improved the predictability of results – the revenue line has smoothed out. The business remains volatile in the medium term and has not experienced any sustained growth since 2018. The business performed well in 2022 but has experienced a notable decline in 2023.

Other than a less-than-ideal target market, the company also has to compete against various sources of competition:

Traditional Manual Inspection: This remains the most established approach. It has lower upfront costs but is significantly more labour-intensive and prone to human error. That said, it is the path of least resistance for railroad companies.

Industrial Technology Competitors: Companies such as Wabtec (Beena Vision), KLD Labs, WID, IEM, and Camlin Rail participate in the visual and optical (laser-based) railcar inspection systems market. Several of these competitors, for example, Trimble Rail Solutions/Beena Vision and KLD Labs, focus primarily on wheel and brake inspections rather than Duos's comprehensive full-car inspection approach.

Railroad In-House Initiatives: Potential customers are also becoming competitors, as many Class 1 Railroads have begun developing their own "in-house" inspection solutions.

While the company has failed to get this business to a self-sustaining revenue level, the tech beyond the service does seem impressive, with key competitive advantages including:

Data Processing: Real-time analysis of 50,000+ data points per railcar

Speed: Inspections at up to 125 mph vs. competitors' 10-30 mph

Sensor Integration: Combined visible light, thermal, and LiDAR systems vs. competitors’ single-mode detection

Edge AI Architecture: Edge processing delivers immediate defect detection, eliminating latency issues present in cloud-based competing solutions

Digital Modelling: Complete railcar models enabling predictive maintenance

Current Strategic Positioning and Future Prospects

The edge processing capabilities developed for rail inspection directly informed the technical requirements for the edge data centres, creating a technological through-line to newer business units. That said, let’s consider the prospects of the rail business independently first.

The rail technology division is now led by Jeff Necciai, the Chief Technology Officer (CTO), who brings over 35 years of experience designing and delivering value-driven technology solutions across various industries.

Management has explicitly indicated that they are not focusing on the rail division and are actively cutting costs, without allocating any additional resources to it. Management views the rail business as a non-core asset that no longer represents a strategic growth priority.

Despite this deprioritisation, the rail division maintains a couple of avenues which could see a healthy upside:

Border Security Applications: The technology's ability to detect human presence inside enclosed spaces, such as tanker cars and boxcars, has drawn interest from the Department of Homeland Security and Customs and Border Protection. If pilot deployments succeed, this CBP partnership could unlock significant federal contracts. I assign a low probability to this.

Intellectual Property Value: Duos retains patents on its "multi-modal sensor fusion" technology, potentially attractive to industrial acquirers or for white-label agreements with European rail operators. I don’t think management would oppose selling this business unit.

Although the rail business generates approximately $9 million annually with 28% gross margins, the division remains unprofitable, accounting for allocated overhead and operational expenses. However, with incoming cost-cutting ahead, and if the rail market rebounds to more normal levels, management expects this division could reach cash flow neutral.

While no longer the company's strategic focus, the rail business serves as proof-of-concept for Duos' edge AI capabilities, which now power its higher-growth business verticals in edge computing and energy infrastructure, which I will explore next.

Duos Edge AI

Historical Development and Strategic Context

Duos' Edge AI subsidiary evolved from their rail inspection technology, which required powerful local computing. In 2023, they recognised the broader potential for this expertise. They recruited Doug Recker, a former Marine with experience in telecom and data centres, who had also been a Duos customer. Under Recker's leadership, Edge AI launched in mid-2024, repurposing Duos' edge computing capabilities to bring cloud services to underserved Tier 3 and 4 markets.

Doug Recker (President, Duos Edge AI)

Doug Recker brings a background that includes Marine Corps service, telecom expertise, and founding two successful data centre companies. He built Colo5, a 225,000 sq ft facility serving over 100 clients, which was sold to Cologix in 2014. Additionally, he developed EdgePresence in 2017, which introduced innovative "EdgePods" at cell tower sites across five states before being acquired by Ubiquity in 2023. His industry experience and connections proved vital for securing Region 16 as Duos's first major customer. While Duos executives handle financing and integration, Recker provides the essential practical expertise and credibility in micro data centres that drive the venture's success.

Edge Data Centre Pods Architecture & Operations

Duos Edge AI's core product is a modular data centre pod measuring 55 feet long by 13 feet wide. It houses 15 IT racks with integrated power and cooling. Each pod supports 300-350 kW of IT load with N+1 redundancy for power and cooling systems, matching traditional data centre reliability standards. These units feature remote operation capabilities and incorporate lessons from Recker's previous ventures, including high-quality components to minimise failures, weekly backup generator testing, and a patented "clean room" entry vestibule that removes dust and insects before technicians enter (developed after a spider triggered a fire suppression system in an earlier design).

The pods are manufactured off-site by a Denver partner capable of producing up to 30 units monthly. Deployment involves transporting the pod to the site, securing it to a concrete pad, connecting power and fibre, and final testing. Duos contracts local firms for installation and maintenance—in Amarillo, they engaged a regional contractor with a 4-hour SLA for HVAC, electrical, and on-call support. This outsourcing approach keeps fixed costs low.

Duos only provides pod infrastructure. Each pod includes racks, power, cooling, and redundant fibre; customers install their own equipment or rent space as needed. This micro-colocation model minimises capital intensity as Duos invests in facilities, not IT hardware.

Go-to-Market & Deployment Strategy

Duos Edge AI's initial focus is the Texas Panhandle, using a replicable template. Their first deployment at the Region 16 Education Service Centre in Amarillo (late 2024) serves over 50 rural school districts across 26,000 square miles that previously relied on costly, low-bandwidth Dallas connections.

Their mini data centres at school service hubs reduce latency from hundreds of miles to near-site levels. These pods host multiple carriers (AT&T, FiberLight, etc.), creating new regional internet exchanges in formerly AT&T-dominated areas. They offer schools faster connectivity through carrier redundancy while enabling local cloud caching and edge AI.

Region 16's CTO described it as "a vital catalyst for digital equity," with Texas’s governor in attendance at the ribbon-cutting ceremony. Duos targets all 20 Texas education regions within one to two years, with 25 additional sites planned.

Management describes the rollout as a "cookie-cutter process," partnering with anchor customers such as schools (which benefit from E-Rate subsidies), hospitals, and municipalities that host pods and commit to partial capacity.

The multi-tenant pods serve various needs—from school networks to county 911 systems, hospital specialist connections, and enterprise rack space. Recker explains, "We put the data centre where the eyeballs are." By utilising existing sites with land, utilities, and ISP connections, Duos creates carrier-neutral colocation points in underserved markets while building community goodwill.

Business Model, Revenue Streams & Unit Economics

Duos Edge AI operates a hybrid colocation and managed services model at a micro scale. They generate revenue by renting rack space and power within each pod, with potential additional charges for value-added services like network transit or remote hands support. For Region 16, income likely comes from the school district's recurring fees (possibly E-Rate funded) and colocation fees from carriers.

Each pod costs approximately $1 million, making sense for a site like Amarillo, which "doesn't justify a $30M data centre." At 60% utilisation, pods produce about $200-250K in annual recurring revenue, while fully utilised 15-cabinet pods could generate over $300K annually (roughly $1,500-2,000/month per rack plus network fees).

Duos targets 70% gross margins for the mature Edge business. After the initial capital expenditure, ongoing costs remain low: customers provide the hardware, while Duos primarily pays for power, bandwidth, maintenance, and depreciation. EBITDA breakeven occurs at around nine filled racks, which Amarillo achieves with Region 16 using 5-6 cabinets and carriers occupying 1-2 cabinets each (typically installed on both sides for redundancy).

Duos employed creative approaches for initial financing: three pods through a master lease with Generate Capital (which had pre-fabricated units available) and several more with traditional debt, deploying approximately six pods with minimal equity investment.

For its 2025 target of 15 pods, the company is considering both debt and equity financing, ideally leveraging cash flow from its power division and initial pods, or securing asset-backed loans. However, management acknowledges the possibility of equity issuance. The Edge business should become self-funding once approximately 40 pods are deployed.

Competitive Positioning & Differentiation

Duos Edge AI has secured an early-mover advantage in underserved Tier 3/4 markets. Recker recognises these areas as "in desperate need of bandwidth," with Duos often bringing the first modern data centre to communities like Amarillo.

Their vertical integration with Duos Energy provides a key differentiator. By bundling on-site power generation with data centres, they deliver more reliable power in areas with weak infrastructure. Fortress's mobile gas turbines create microgrid solutions that eliminate utility markups—what Recker calls avoiding "double marginalisation"—offering comprehensive advantages in location, power, and connectivity.

Strategic partnerships bolster Duos' position by collaborating with local entities, accelerating adoption and creating relationship barriers that competitors would struggle to overcome. Financial partnerships with Fortress and Generate Capital further strengthen their market position.

Unlike competitors focused on urban infrastructure via telco offices or cell towers, Duos targets rural broadband enhancement, aligning with government funding that indirectly subsidises their projects—a niche overlooked by larger data centre REITs and cloud providers.

Their primary vulnerability is the limited proprietary technology, as similar modular data centres are widely available. However, Duos' Texas success, Recker's expertise, and energy integration provide a head start. Network effects may emerge through their distributed footprint or volume purchasing advantages with scale.

In essence, Duos Edge AI occupies favourable territory in a greenfield market. It is strengthened by its unique combination of edge computing and on-site power capabilities, led by a proven team.

Growth Strategy & Outlook (2025-2027)

Duos Edge AI's near-term strategy targets aggressive Texas deployment, aiming for 15 operational data centres by the end of 2025. With three pods already live or finalising and three in contracting, they need roughly one new installation monthly, which is feasible given their "cookie-cutter" approach.

Management expects initial pods to be "fully loaded" with customers by late 2025, generating $3.5 million in annualised revenue. For 2026, plans accelerate to 60+ pods (~$16 million in revenue), expanding into Illinois, the Carolinas, and Ohio, while potentially deepening the Texas presence.

The long-term vision targets 150-200 pods by the end of 2027, potentially generating $60-65 million in annual recurring revenue. This growth would likely require partnerships with infrastructure funds or strategic investors; however, alternative financing options could include anchor customer pre-payments, equipment leasing, or cash flow from their power business. Securing a web-scale customer from the top 7 tech companies, which could require 20+ edge sites, would transform their trajectory through bulk orders and upfront funding.

Duos is evolving toward a multi-tier strategy, combining small installations with larger campuses (such as Pampa's 50MW facility), while developing AI-managed infrastructure as an Edge-as-a-Service platform.

Key Uncertainties & Risks

Financing & Capital Intensity: Each pod requires approximately $1 million in capital expenditures. Despite creative financing, scaling to 150+ pods will eventually need substantial capital (likely $100m+ excluding cash flows). Debt funding could become too costly if credit markets tighten, forcing dilutive equity raises. Management believes that after ~40 pods, the business will be self-sustaining, but I am unconvinced, as the installations and capital expenditure requirements are set only to accelerate. That said, management could always slow down expansion if they can’t finance the growth in a manner that is agreeable; I’m just not sure if they would. Investors should monitor cash burn and leverage in 2025-26. Off-balance-sheet financing capability will be crucial.

Deployment Execution: Rolling out data centres in remote areas presents logistical challenges. Delays in site readiness, fibre provisioning, or contractor work could slow progress. Duos' plan to outsource to local partners creates dependencies. While the Amarillo deployment was smooth, replicating this 10+ times annually may reveal bottlenecks. Site-specific issues (permits, NIMBY objections, technical problems) could arise. Though pod technology is proven, integration with local infrastructure presents learning curves.

Market Adoption & Fill Rate: The assumption is that demand is pent-up in these markets. Region 16's uptake and multiple carriers in the first pod support this thesis. However, it's uncertain if every pod will quickly attract 2-3 telcos and sufficient enterprise customers to reach breakeven. Some regions' ecosystems might develop more slowly. Duos mitigates this by securing anchor tenants upfront and selecting sites with unambiguous needs. If pods remain partially empty, revenue and margins will lag. The target 70% gross margin may prove optimistic, though management believes even 50% margins would still make a good business.

Competition and Technological Moat: Duos lacks a patented technology moat for its Edge pods. If the opportunity is as significant as projected, competitors will emerge, whether startups or telecom companies expanding edge capabilities. Duos' best defence is moving quickly and securing key partnerships. Alternative technologies, such as improved satellite broadband or distributed cloud software, might address some of the pain points Duos targets. Duos will need to continue innovating to maintain their advantage and margins.

Summary

The following 18-24 months need to prove scalability. Success would result in substantial recurring revenues with strong margins, a strategic moat, and a digital inclusion impact. Texas momentum and team quality inspire optimism, although investors should probably maintain a wait-and-see approach for what are ambitious plans. The opportunity is substantial, with Duos well-positioned, while execution and financing risks are real. I consider this business unit to offer substantial upside, but with no guarantees of broader success, I do not consider it sufficient to mitigate the downside risk of the investment. That’s where Duos Energy comes in.

Duos Energy

Duos Energy Corporation is the new energy-focused subsidiary of Duos Technologies Group, established in 2024 to capitalise on surging demand for dedicated power solutions. The business deploys fast-track mobile power generation – notably natural gas-fired turbines – providing "behind-the-meter" electricity for customers needing immediate, reliable energy capacity, deployable within weeks.

This serves markets such as data centre developers (especially those at edge or rural sites), high-performance computing, and emergency power needs, where traditional grid power is insufficient or too slow. Duos is working with sister subsidiary Duos Edge AI on small data centres in remote Texas markets and plans to power a 200MW data centre campus in Pampa, TX, with 500MW of mobile gas turbines combined with wind power. By vertically integrating power with edge computing, Duos delivers full-stack solutions: data centres with on-site generation, enabling rapid deployment even where the electric grid is a bottleneck.

Management Team and Domain Expertise

Duos Energy is led by industry veterans with deep domain expertise in fast-track power projects, making the team well-suited to execute this business plan.

Chuck Ferry

Chuck Ferry, CEO of Duos Technologies Group, began with 26 years in the US Army, leading Joint Forces and Special Operations. After military service, he successfully led corporate turnarounds.

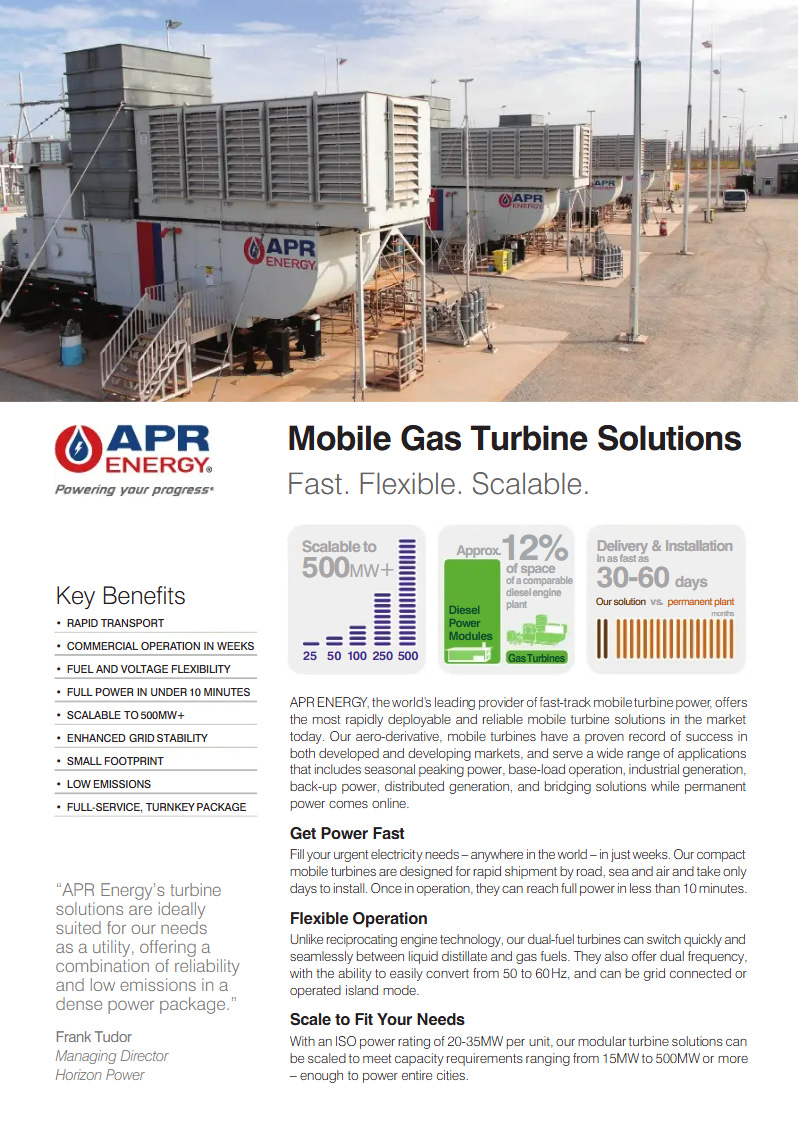

Before Duos, Ferry served as CEO of APR Energy, a mobile gas turbine power generation company (yes, just like Duos) based in Jacksonville. Duos Energy's model is effective, akin to "APR Energy 2.0" (a capital-light version). Between 2016 and 2020, he turned around the struggling APR, which was acquired by Atlas Energy in 2020 for $750m.

His power generation experience proved valuable for Duos' expansion into energy infrastructure. Ferry joined Duos in 2020 amid significant management changes. Since then, he has led a strategic transformation, expanding beyond rail inspection technology into edge computing and energy infrastructure.

Other significant overlap with former APR Energy

As of mid-2024, Duos has hired ~15 former APR Energy employees (from a total staff of around 70) for its power division. Several senior figures who previously ran APR's global fast-track power operations now lead Duos' energy business, supported by APR engineers and PMs. Management claims over 100 years of combined power project experience, including installing and operating more than 1 GW of fast-track generation between 2016 and 2020.

Key leadership includes COO Chris King, an APR Energy alumnus with over 20 years of experience in energy operations, including across 16 power plant sites at APR, and helped close over $1 billion in projects and asset sales. His direct experience with mobile turbine installations adds strong execution capability. Also noteworthy are Lee Wilson, President of APR Energy, with over 30 years of experience as a financial executive, and Andrew Murphy, CFO, with over 18 years of finance experience. Wilson's expertise spans finance, M&A, and capital markets, while Murphy previously oversaw pricing and risk management for over $800 million in global transactions at APR Energy.

The Duos Energy team’s domain expertise is a critical asset: they understand the technical, logistical, and commercial challenges of mobile power plants and have established supplier networks, significantly reducing execution risk. The team has even retained the “APR Energy” brand for market recognition, with the new venture branded as the new APR Energy to leverage the credibility and customer relationships of the original APR.

Fortress Investment Group Deal Breakdown

The cornerstone of Duos’ energy business is an Asset Management Agreement (AMA) with Fortress Investment Group. Under this agreement, Duos is responsible for storing, maintaining, deploying, and operating 30 mobile gas-powered turbine generators, while also handling sales and business development to identify deployment opportunities.

Asset history: Chuck and his team at APR Energy previously managed these assets before their sale to Atlas Group. In late 2024, Fortress acquired these assets for $440m from the original APR Energy (now under Atlas); APR's entire fast-track generation fleet was transferred to Fortress's ownership. Simultaneously, Duos (through Duos Energy Corp.) signed and closed the two-year agreement with Fortress affiliates to manage, deploy, and operate the 850MW portfolio of mobile gas turbines.

Transaction Structure: Fortress owns the physical assets through Sawgrass APR Holdings, LLC, with a subsidiary, Sawgrass Buyer, LLC, holding the turbines. While Duos Energy doesn't own the turbines, it is the exclusive operator under the AMA. Duos received a 5% equity stake (profit interest) in the parent entity that owns the assets, giving them ownership in "New APR Energy". Fortress maintains ~95% ownership and ultimate control. Duos has significant operational involvement, with CEO Chuck Ferry serving as the holding company's Executive Chairman and board member. COO Chris King and other Duos staff hold management roles in the venture (while remaining employed by Duos). Fortress paid Duos Energy a $5 million upfront advance upon closing (December 31, 2024), which will be credited against the monthly management fees.

Financial Terms: Duos will invoice the Fortress affiliate for management and deployment fees totalling roughly $42 million over 24 months, averaging approximately $1.75 million per month in revenue. This covers staffing and operations, including a profit margin, which is expected to fully ramp up by Q2. Importantly, Duos earns high-margin revenue not primarily from ongoing operations but from setting up, installing, and relocating the turbines. As noted in the call, "where they are making money is from setting everything up, installing them, connections, all those kinds of things..." Duos benefits from repeatedly moving assets between customers, as each redeployment generates additional high-margin revenue. While power sales revenue flows to Fortress (with Duos accruing 5% of profits through their equity stake), Duos' contract is largely fixed-fee, insulating them from commodity price risks and utilisation variability. The CFO expressed high confidence in achieving the $42 million revenue target, stating that they would have to perform poorly to not reach that target, and if anything, there is room to the upside.

Assets: The portfolio comprises 30 mobile gas-powered turbines, along with related balance-of-plant equipment, capable of producing 850 megawatts (MW) of electricity. These mobile turbines are immediately deployable on trailers for power projects. They are sizeable aero-derivative gas turbines (likely GE TM2500 units or similar) that each produce tens of megawatts, often deployed in pairs or sets to deliver 50–100+ MW blocks. Collectively, 850MW can power several large data centres or a small city.

Strategy and Deployment Rights: The agreement permits Duos to deploy these units for various clients in critical sectors, as they deem fit. Initially, focusing on data centre power (supporting both Duos' edge data centres and other hyperscale facilities), Duos also serves other industries and emergency power needs. In February 2025, the partnership, branded as New APR Energy, executed its first major project: deploying four turbines (~100 MW) to provide behind-the-meter power for a U.S.-based AI hyperscaler's data centre, which was completed in just 10 days. More deployments are expected soon.

Strategic Integration with Duos’ Edge AI Business: The demand for Duos' energy venture and edge computing unit is interwoven. The energy capability solves critical bottlenecks for edge deployments, while the proliferation of edge data centres creates demand for Duos Energy's services. This vertical integration is central to Duos' long-term strategy at the intersection of intelligent computing and power infrastructure.

Through the AMA, Duos Energy functions as the asset manager and operator of one of the world's largest mobile power fleets without capital investment in the equipment—a transformational deal that provides immediate revenue and involvement in large-scale power projects.

Financial Projections and Outlook for Duos Energy

The Duos Energy segment operates with approximately 30% margins on its $42 million Fortress contract, significantly improving its overall profitability outlook. According to the CFO, Duos earns its highest margins not from ongoing operations but from setup, installation, and relocation activities. Duos benefits financially when assets move between customers, as each redeployment generates additional high-margin revenue. This could result in revenue exceeding $42 million.

This contribution is expected to drive Duos to operating profitability in 2025, with the Fortress contract providing a financial baseline that de-risks the coming two years while other business segments scale up.

Key Success Factors and Risks

Duos Energy's success will depend on several critical drivers, as well as the company’s ability to mitigate key risks and challenges.

Drivers and Strengths

Surging Demand for Fast-Track Power: The demand for power, particularly for data centres driven by AI and cloud growth, is outpacing existing electrical infrastructure. Fortress projects that "power demand will exceed supply for at least a decade," creating a sustained need for supplemental generation. The Duos team has "never seen such demand for power in their lives," with inquiries from hyperscalers facing multi-year wait times for utilities. Customers are willing to pay $0.18-$ 0.25/kWh, compared to a grid average of $0.12/kWh, for rapid deployment.

Unique Integrated Offering: Duos provides a turnkey solution combining edge data centres with guaranteed power. This vertical integration is a key differentiator, especially in regions like Texas, where taxes and regulations favour companies that provide all the necessary elements. The Fortress partnership enhances this appeal by bundling financing, real estate, and power provided by Duos for hyperscalers. This advantage is evident in the Pampa Energy Center, where Duos will deliver 200MW of edge data centres powered by its own 700MW+ on-site generation.

Enhanced Market Access: The synergy between Duos Energy and Edge AI opens up new opportunities beyond the initial $42M contract, yielding approximately $21M per year. With an 850MW fleet (comprising 30 turbines) capable of supporting five customers at full utilisation, Duos is pursuing approximately 45 potential customers requiring fast-track power. Their offering particularly appeals to regions with weak grids. The Fortress partnership accelerates access to global data centre projects, with Fortress actively working on data centre projects globally, including those with hyper-scalers.

Operational Advantages: Co-locating turbines and data centres reduces transmission losses and potentially enables waste-heat reuse. Duos plans to apply AI expertise to optimise operations through intelligent load balancing, generator efficiency, and predictive maintenance management. Mobile turbine units can be deployed in weeks, versus 24 months or longer for utility infrastructure, allowing Duos to recognise revenue quickly and rotate assets efficiently.

Experienced Team: Major customers trust Duos with mission-critical power because the team has extensive experience. Early evidence supports this capability: Duos (New APR) deployed 100MW to a hyperscaler in days in Q1 2025. Key leadership comprises experienced executives from APR Energy who understand the technical, logistical, and commercial challenges associated with mobile power plants. The "New APR Energy" branding leverages the credibility of the original APR.

Financial Structure: The Fortress deal addressed the capital requirements of entering the energy business. Fortress has expressed interest in funding additional data centre builds or power assets if Duos secures major customers, potentially supporting the company's ambitious growth plans without excessive dilution.

Risks and Challenges:

Project Execution & Operational Risk: Deployments involve complex permitting, site preparation, fuel supply, and logistics. Some older turbine units may require refurbishment before use. Delivery failures could impact client operations, resulting in penalties or lost business. The two-year Fortress AMA serves as a trial period—Duos must prove themselves to secure extensions. Scaling from a small tech company to managing global power projects with 100+ staff presents significant challenges in maintaining quality and safety standards. The experienced team partially mitigates these risks but doesn’t remove them.

Capital Intensity and Funding Needs: Duos has a light balance sheet relative to its capital-intensive projects. If demand exceeds expectations, the current 850MW might prove insufficient. Scaling beyond the existing contract could require additional capital from Fortress or alternative financing through joint ventures or debt. This primarily represents a risk to upside potential.

Partnership Concentration Risk: Heavy reliance on a single partnership with Fortress creates vulnerability. Diversifying the energy client base—by providing asset management for other owners or eventually owning projects directly—would mitigate this concentration risk.

Competition and Barriers to Entry: While Duos has a first-mover advantage, established power rental firms such as Aggreko and other fast-track power providers will likely compete for similar contracts. Some data centre operators might pursue their own power solutions. The company's small size is a disadvantage when competing against larger firms, though the Fortress partnership adds credibility. Barriers to entry include acquiring assets with fixed supply (Fortress's purchase of APR's fleet removed a key asset pool from the market) and specialised knowledge. The company's success has been dependent on human capital; losing key team members would significantly diminish its competitive edge.

Regulatory and Operational Dependencies: Mobile power plants require navigating regulatory approvals, obtaining environmental permits, and securing a reliable fuel supply. While the team appears well-equipped to handle these domestic challenges, risks may increase if operations expand into foreign markets; however, the team also has experience managing these assets internationally.

Combined business

Financial summary

Revenue Forecast

FY2025: $28.6M (up from $7.4M in FY2024)

FY2026: $46.0M

FY2027: $80.0M (preliminary)

Revenue Breakdown

Energy: $21M annually from Fortress contract (35% margins) – room for upside in this number

Edge AI: Growing from $6M ARR (end of FY2025) to $30M ARR (end of FY2026) to $65M ARR (end of FY2027) - 70% target margins. The potential range of outcomes on this is broad.

Rail: ~$9-10M annually with 28% margins – room for upside.

Profitability Path

According to Northland:

FY2025: Near breakeven with EBITDA of $(1.0)M

FY2026: Positive EBITDA of $6.0M

FY2027: EBITDA expansion to $33M

I consider these numbers conservative, and I believe the company will be EBITDA profitable this year.

Financing Strategy

Edge Data Centres: $1M capex per pod; self-funding after ~40 pods

Energy Business: Capital-light via Fortress partnership; $42M in fees over 24 months

Future Funding: Fortress backing, customer prepayments, operating cash flow, dilution as last resort. Worth noting, the balance sheet will be strengthened by $5m this quarter thanks to Fortress

Valuation

Northland target: $14 (based on 5x FY2026 revenue, 10x FY2027 EBITDA discounted)

5% stake in APR Energy likely valued at $30-60m

Management expects to provide more definitive guidance at the end of March 2025.

Management

I’ve already mentioned the other key players, but I’ll briefly mention Adrian Goldfarb, who serves as CFO of Duos Technologies Group. Goldfarb has been with Duos since 2015, overseeing its transition to public markets and implementing financial strategies to drive multi-segment growth. His contributions include structuring the asset management deal with Fortress Investment Group (great job on this) and maintaining a clean capital structure despite funding constraints.

Valuation

As of March 25th, 2025, Duos Technologies is at approximately $6.18 per share, with a market capitalisation of around $51.9 million based on 8.4 million shares outstanding. On a fully diluted basis (15.28 million shares), the market cap would be approximately $94.4 million.

Rail: Using a revenue multiple, this business is likely worth at least $10 million or so.

Energy: The core energy operations stem from a $42 million, two-year contract ($21 million annually) with Fortress Investment Group to manage and deploy their 850 MW fleet of mobile gas turbines. With margins of approximately 30-35% on these management and deployment fees, this business is expected to contribute roughly $6-7 million in annual EBITDA. Applying a 4-5x EBITDA multiple (standard for stable service contracts with renewal potential), this component alone could be valued at $30M. If the contract renews for a more extended period than two years, I think it would warrant a higher multiple.

5% Stake in New APR Energy: Likely valued at around $30 million to $ 50 million.

Edge AI: The edge computing business represents the highest growth potential within Duos' portfolio. Current deployments are expected to generate approximately $3.3 million in annual recurring revenue by the end of 2025. Plans are in place to rapidly scale to 60 pods by 2026, generating approximately $16 million in revenue, and to 150-200 pods by 2027. With target gross margins of 70% at scale, management projects that this business could generate $65 million in Annual Recurring Revenue and approximately $41 million in EBITDA by 2027. Applying industry-standard multiples of 10 to 15x EBITDA for growing high-margin recurring revenue businesses, this segment alone could be worth $410-615M.

Conclusion

I would like to see more from the Data business before assigning a definitive price target. Despite the enormous opportunity, it’s hard to say how successful that part of the business will be. That said, the company is poised for a period of substantial revenue growth and is expected to achieve profitability this year. This Fortress deal doesn’t seem to be priced in; the current share price is lower than before the Fortress deal clarifications.

So, while waiting for more information on the data centre side, I feel comfortable already entering this business with a substantial investment. Between the rest of the business (Duos Rail, Energy, and APR stake), the current valuation is likely covered. If the Edge business takes off, it’s easy to see this company becoming a multi-bagger—how many bags remains unclear.

Nothing in this email is intended to serve as financial advice. Do your own research.