🤔 China's AI Trojan Horse Strategy

Plus: Quantum Just Went From "If" to "When", and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

China's giving away top AI while others charge big. There's a catch.

Something BIG shifted in quantum.

THIS stock dethroned banks.

Every phone around you just became part of a secret network.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🤔 China's AI Trojan Horse Strategy

While OpenAI and Google are charging subscription fees, Chinese companies like DeepSeek and Zhipu are handing over their best language models. No cost. Seems generous, right? NOPE… It's not charity. It's strategy…

When you give someone your software, you don't just give them a tool—you give them your way of thinking. Your architecture becomes their foundation. Your decisions become their defaults.

Countries across Asia, Africa, and the Middle East are skipping Silicon Valley entirely. Why pay for AI when Beijing gives it away? They're building their digital future on Chinese code, Chinese standards, Chinese assumptions about how AI should work.

This isn't about being behind or ahead in some AI race. This is about who writes the rules everyone else follows. And China is handing out the rulebook.

Chinese AI companies are state-backed. They don't need to make money from their models—they can afford to give them away. American companies? They're privately funded. They have to charge. Two completely different business models leading to two completely different outcomes.

2. 👀 Quantum Just Went From "If" to "When"

Remember when the iPhone launched? It was neat, but nobody saw what was coming—how it would reshape everything from conversations to entire industries. Quantum computing is quietly having its iPhone moment right now…

IBM just announced Starling—a fault-tolerant quantum computer launching in 2029. Not a lab experiment. Not a proof of concept. A real machine built to solve real problems.

Late last year Google made their own breakthrough, cracking a major problem in quantum error correction.

Here's why this matters…

These aren't just faster computers. They're computers that think completely differently.

They could model every molecule in a new drug before anyone touches a test tube. They could make today's encryption useless overnight. They could change how we predict markets, weather, everything.

IBM's Starling will perform 20,000 times more operations than today's quantum computers—a massive leap in quantum capability.

The quantum market is expected to jump from $4B to $72B by 2035.

This is not hype. This is a new economy being built and the timeline just got real. We've moved from "what if" to "when." And "when" is a lot closer than you think.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🏦 THIS Stock Dethroned Banks

Apollo Global Management (APO) is quietly building an empire in private credit. The kind of financial engineering that doesn't just make money... it prints it

While banks stepped back from lending, Apollo Global Management moved in. They're not just making loans—they built the entire machine.

The Athene merger was genius. It gives them $380B in stable insurance money that needs somewhere to go. That's the cheapest funding you can get.

Here's how it works: Apollo originates the loans, funds them through their insurance company Athene, then sells off the excess. They own every step. It's like controlling the factory, the supply chain, and the store.

And they're picky. Apollo moves $150B annually, mostly investment-grade stuff that's boring and safe. The kind of loans that pay well because banks can't make them anymore.

$729B in assets under management (up 10% year-over-year).

$1.37 adjusted EPS last quarter (beat expectations).

100-200 basis points of extra spread vs. public markets.

60% of their book is investment-grade (boring and profitable).

Risks…

When interest rates drop, the gap between safe and risky returns shrinks. Investors won't pay extra for risk they don't need to take.

Competition heating up (KKR, Blackstone aren't sleeping).

Top 3 Charts of the Week

1. 🔵 More Than 5 Billion Devices Will Ship With Bluetooth This Year, 31 Years Since Its Invention

Bitchat (build by Jack Dorsey) uses Bluetooth to create a private mesh network between nearby phones. No Wi-Fi, no cell service, no phone numbers. Messages hop from device to device until they reach their target.

Communication that can't be shut down, tracked, or controlled. When governments cut internet access or companies decide what you can say, this still works.

Bluetooth will hit ~8B devices by 2029. Dorsey just turned them into an unstoppable communication network that bypasses everything.

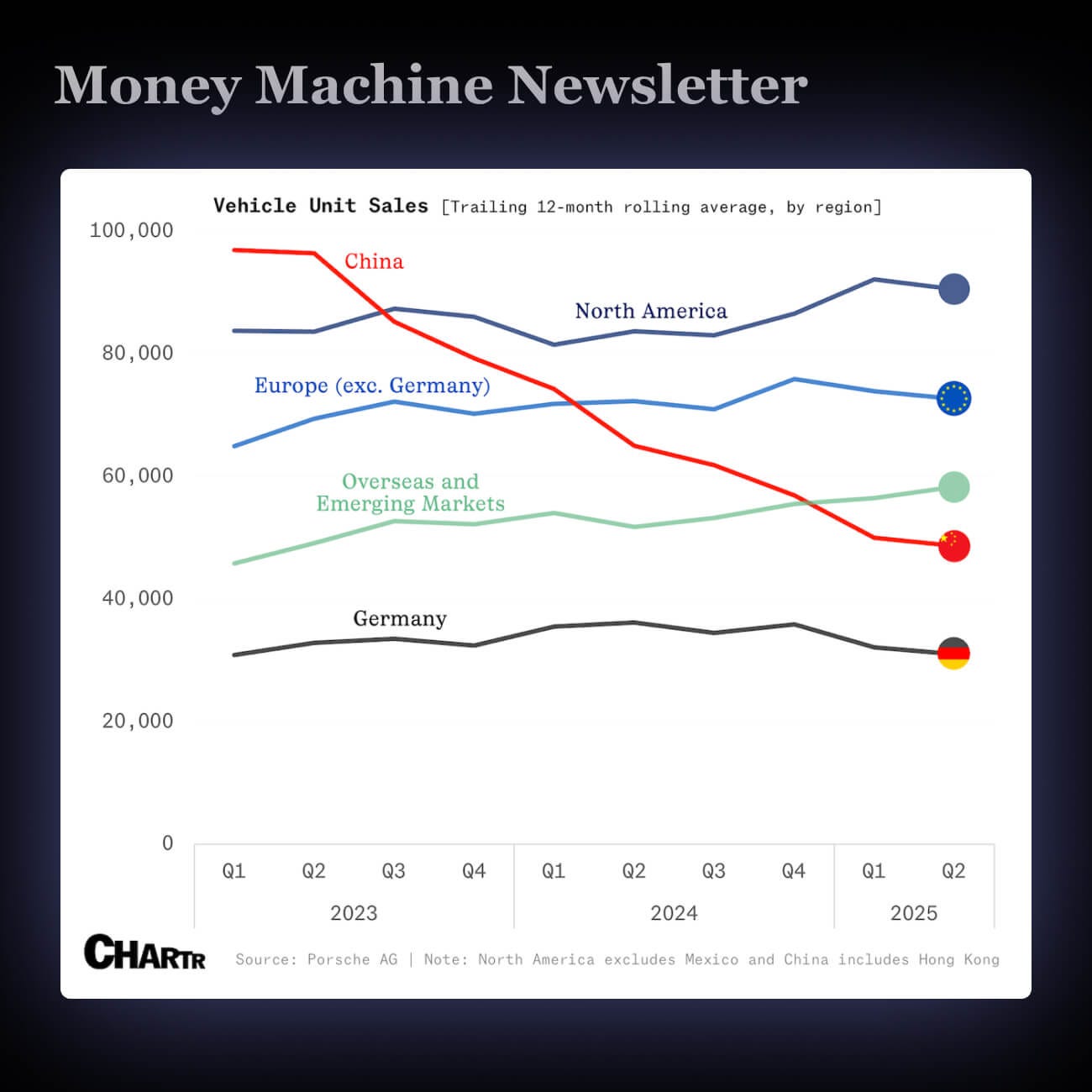

2. 🚘 Porsche’s China Sales Keep Sliding

Porsche’s car sales dropped 6% worldwide, with China crashing 28%. That’s a big hit, since China used to be its top buyer. Even its top model, the Macan, couldn’t save it.

Chinese buyers are turning to cheaper, high-tech electric cars from local brands like BYD and Xiaomi. Porsche (and other luxury brands) is losing ground fast in a market that once fueled its growth.

3. 🇺🇸 More Than Half of Americans Say It’s Time for a Third Political Party

Elon Musk wants to launch the “America Party” to shake up the two-party system. Trump mocked it. Tesla shares dropped 7% after the news.

Most voters say they want a third option—58% in a recent Gallup poll—but history shows they rarely vote that way. The system favors red or blue.

Musk’s move isn’t just political—it’s business too. His brand and companies could take hits if investors or consumers see this as a distraction or risk.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.