This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

China is already inside your car, your house, and your grid.

A quiet $165M bet was just made on a future without diesel.

THIS stock loves your totaled car—and business is BOOMING.

It started with hotdogs, now they’re running a fuel empire.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🧩 China's $5B Bet to Beat the West

You’ve probably never heard of China’s CATL… But if you drive an electric car, they might be under your hood. If you use solar at home, they might be storing your energy...

This week, they raised $5B. Not to grow in China. To grow outside it—Hungary, Spain, Germany. Deals with BMW. Stellantis. Even Ford…

CATL makes 1 out of every 3 electric car batteries on Earth. They're way ahead. And they’re still pushing…

Last year, they spent $2.6B on R&D. That’s nearly 3x more than LG Energy, their closest competitor.

They’re not just making car batteries anymore. They’re building for the grid. Developing new tech. Even exploring sodium-ion.

This isn't a happy accident. It’s strategy…

China spent years building everything—mines, refineries, ports, factories. Now, three-quarters of the world’s lithium-ion batteries come from there. So do most of the raw materials.

Meanwhile, America is trying to catch up. The Inflation Reduction Act kicked things off. $130B into clean energy. New factories from Kentucky to Nevada. Jobs. Momentum. Real signs of life.

But now, Congress might gut it…

The two tax credits that helped launch the battery boom—30D (for buyers) and 45X (for U.S. builders)—are on the chopping block. No credits, no cushion. Just when the race was getting good.

2. 🤔 Diesel’s Quiet Replacement Is Here

While everyone’s busy arguing about giant nuclear plants, one company is building something smaller. Way smaller…

Radiant just raised $165M to make a nuclear generator the size of a shipping container. No diesel. No smoke. Just 1 megawatt of steady power. Quiet. Clean. Reliable.

Backup power isn’t sexy. But it’s everywhere—hospitals, army bases, data centers. When the grid goes down, diesel kicks in. It’s a $30B market. Running on machines that haven’t changed much since the '80s. Radiant wants to swap those out.

Here’s what they’ve got going…

Raised $165M, led by DCVC

Total funding: $225M

Building a factory to make 50 microreactors a year

Testing starts in 2026, shipping by 2028

Working with the U.S. Department of Energy on exclusive fuel tech

Most of the world still relies on diesel when power cuts out. But diesel is loud, dirty, and expensive. It works. But it’s a last resort…

Radiant’s not replacing the grid. It’s replacing the rusty generator out back. With something cleaner. Something better.

If this takes off, it opens the door for…

Crypto mines that never go dark

Remote AI centers powered off-grid

Military bases without fuel trucks

Emergency power without fumes

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🚗 THIS Stock Loves Your Totaled Car

Most people see a car crash and think: “What a mess.” Copart Inc. (CPRT) sees inventory. They built a $53B empire off bent fenders and busted bumpers…

They don’t fix the cars. They don’t tow the cars. They just auction them off — online. And business is booming.

How wrecks became riches…

Every time a car gets totaled, there's a 50/50 shot it ends up in Copart’s hands.

They’ve turned junkyards into a global marketplace — 185+ countries, 250+ locations, over 4M cars a year.

They own the land. That’s key. Competitors lease. Copart buys dirt cheap, sits on it, and watches it 10x in value. No rent. No risk of eviction. Just leverage.

And with 2.7 million wrecks a year in the U.S. alone, Copart’s inventory pipeline is locked and loaded.

Last quarter’s financials…

But... there are some potholes…

Land’s getting pricey.

Autonomous vehicles could mean fewer crashes… eventually.

Expansion into new countries brings regulatory and operational risks.

Still, none of that breaks the model — yet.

Top 3 Charts of the Week

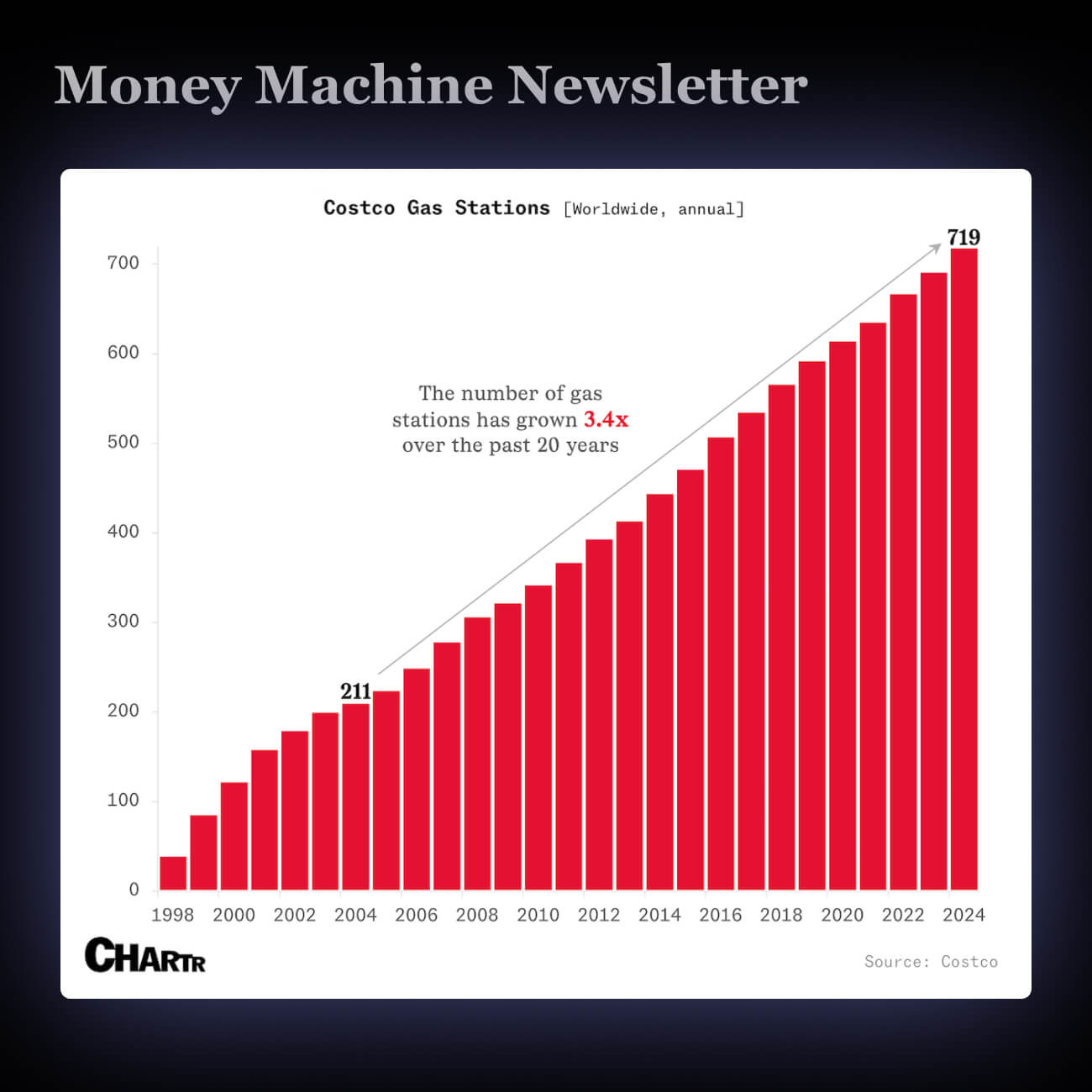

1. ⛽️ Costco Quietly Built a Gas Empire One Pump at a Time

Costco and Walmart are quietly becoming gas station chains. Costco now runs 719 fuel stops — and gas makes up 12% of its revenue.

Fuel is bait. Costco uses cheap gas (up to 30¢ off per gallon) to pull people in. Over half of gas buyers end up shopping inside too — that’s the real win.

Gas margins are shrinking. Prices fell 13.4% year-over-year, hurting sales. Still, Costco’s gas play is more than a side hustle — it’s a strategy to drive foot traffic and sales.

2. 🧐 Americans Are Seeking More Help With Adulting

More Americans are Googling how to do basic life stuff — like washing clothes, filing taxes, or using a hammer. Searches for simple “how-tos” are hitting all-time highs.

People are growing up without learning basic skills. Schools cut practical classes like home ec, and now YouTube, TikTok, and ChatGPT are filling in as the new “Dad, how do I?”

3. 📱 U.S. Smartphone Imports from China Crash to 2011 Numbers

China’s smartphone exports to the U.S. fell 72% in April — the worst drop since 2011 — thanks to paused-but-scary tariffs that rattled supply chains.

Electronics shipments are stalling. Laptops and storage gear also dipped. America relies heavily on China for gadgets — $124B worth last year.

Your next phone might be late, pricier, or both. Trade spats don’t just hit governments — they hit your pocket.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.