This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

THIS bond trend hints at where the economy's headed… not good.

China’s quiet workhorse with serious power.

Big Pharma eyes a cancer treatment that stunned scientists.

Hitting a scary 125-year low brith rate.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 💵 Check Your Wallet…

Tariffs, tax cuts, and spending cuts will shape your investments, your paycheck, and your mortgage rate…

One side says tax cuts will supercharge growth and pay for themselves.

The other says tariffs and spending cuts could slow growth, making deficits worse.

What’s happening?

Markets are wobbling... S&P is up ~2%, but Tesla’s down ~27%, Google ~10%, and Amazon ~3%. The Magnificent 7 aren’t looking so magnificent.

Inflation is creeping up... CPI is at 3%. The Fed wanted 2%.

Bond yields are falling… investors expect slower growth and lower inflation—maybe even rate cuts.

Big debate brewing… growth vs. austerity…

Pro-growth side… cut taxes, slap tariffs on imports, spend more strategically. The idea? More cash in businesses' pockets = stronger economy.

Austerity side wants to cut the U.S. deficit from 7% to 3%. That means BIG government cuts. Less spending could drag down growth.

The wild card? Tariffs. Could bring in $1T+, but could also hike costs for businesses and consumers… the real question… do the tax cuts outweigh the higher costs from tariffs? No one really knows.

The economy's at a fork in the road. If growth slows, stocks and real estate could drop. If tax cuts work, the rally continues. But if tariffs choke trade, the deficit soars, bonds freak out, and turbulence follows.

Here’s what we’re keeping a close eye on…

Bond yields, if they keep falling, expect slower growth.

Tariff policies, if they ramp up, costs rise.

Spending cuts, the deeper they go, the more markets feel it.

2. 💪 China’s Quiet Workhorse

One company is quietly running China’s internet… you don’t hear about it—because that’s how they want it… a silent killer, working in the shadows, building an empire… Tencent.

Tencent runs WeChat, home to ~1.4B users. WeChat Pay and gaming keep the cash flowing. Q3 2024, WeChat’s total revenue ~$24B.

Here’s why we’re paying close attention…

Tencent’s cloud is big-time. Data centers in 21 regions, handles +1B transactions a day.

Sits ~$60 per share (as of writing this), with a ~$556B market cap.

Trades at a P/E of ~28x, below its 10-year peak of 42x.

It's Hunyuan AI model powers content recommendations, fights fraud, and keeps digital life running smoothly in China.

Tencent’s real money comes from payments, gaming, and cloud—dependable revenue stream.

Pitfalls…

Tencent plays by China’s rules, which can change overnight. That’s a risk. Its U.S. shares? A legal loophole called a VIE—investors don’t own Tencent, just a contract with it. If China cracks down, things get messy.

The bottom line…

Tencent doesn’t make headlines like its rivals—but it doesn’t have to. With a billion users and a thriving cloud business, it’s a quiet workhorse. Profitable, dominant, and built for long-term growth.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 😳 THIS Cancer Treatment Stuns Scientists

Glioblastoma is the worst kind of diagnosis. It’s the deadliest brain cancer that grows fast and is hard to treat. Most patients don’t make it past 18 months, and less than 5% survive three years… but a recent medical breakthrough could change all of this… and it’s raising eyebrows at a few Big Pharma companies…

Scientists in Australia tested a new treatment that uses the immune system to fight glioblastoma. Their approach—triple immunotherapy before surgery—triggered strong immune responses. After 18 months, no cancer came back. UNREAL.

The research behind it…

Instead of hitting the tumor after surgery, scientists boosted the immune system first using three checkpoint inhibitor drugs.

It supercharged T-cells—the body’s natural cancer killers.

The immune response was stronger than ever. When doctors removed the tumor, they found a swarm of immune cells attacking it.

What’s next…

Scientists are moving fast to test this in a larger group of patients.

This time, they’ll try using two types of immunotherapy together, either with or without chemotherapy, to see if it works better.

The Brain Cancer Centre and WEHI are leading the research.

If this new approach works, it’s not just a cancer breakthrough—it’s a business shift for Big Pharma.

The three drugs used (nivolumab, ipilimumab, relatlimab) are all from Bristol Myers Squibb… the second this trial shows promise there’s a BIG potential for Bristol Myers to run with it, iterate, and make BILLIONS.

More importantly… if this trial delivers, we might see a complete rethinking of how we treat not just brain cancer, but all cancers.

Community Spotlight

Newsletters from other independent thinkers you might find interesting.

👉 Nivaldo Puldon Ibarzabal, when it comes to trade advice, nothing beats relying on nearly 40 years of trading experience. This finance-focused newsletter condenses that experience for the benefit of fellow traders!

👉 The Market's Compass, technical analysis of various financial instruments to aid both short-term and long-term investors in their investment decisions.

👉 The Experiment Zone, testing the Latest Trends in business, AI , productivity and everything in between for a better tomorrow.

👉 All Things Self Improvement, holistic self improvement newsletter for creative solopreneurs.

👉 Alex of Rome Capital, researches under-followed US/European special situation and small-and-mid cap growth stocks and publishes in-depth thesis in an amusing way.

Top 3 Charts of the Week

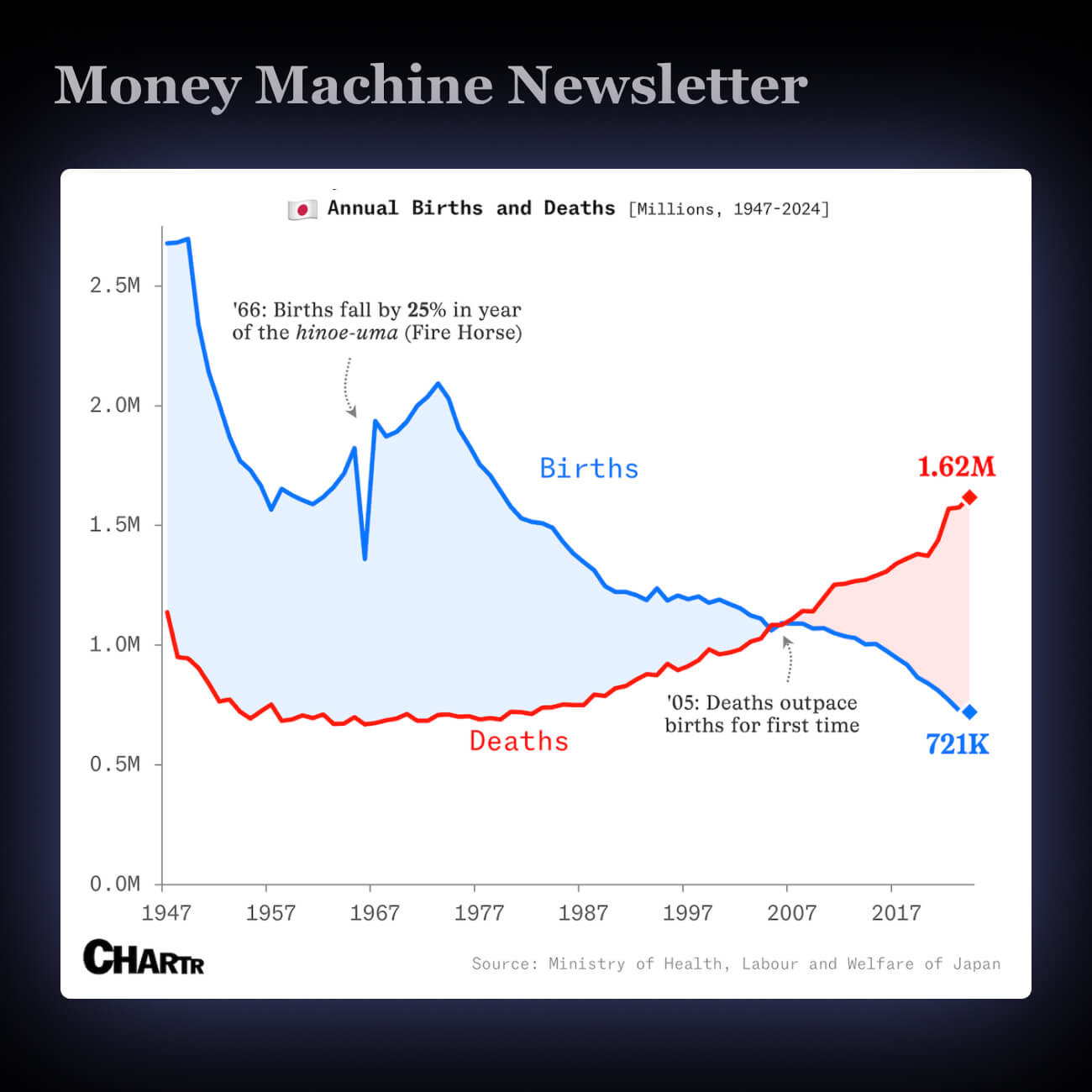

1. 🇯🇵 Japan’s Birth Rate Hits Record Low as Deaths Climb

Japan’s birth rate hit a 125-year low in 2024, with just 720,988 births, a 5% drop from last year. Deaths hit 1.62M, shrinking the population by nearly 900,000 people.

Japan’s population is aging fast—one-third of citizens are now 65+. Government incentives, like a four-day workweek and cash payments, haven’t reversed the trend. Experts didn’t expect births to fall this low until 2039.

A shrinking population means fewer workers, slower economic growth, and rising healthcare costs. Japan is a test case for other aging nations.

2. 🍺 The Biggest Beer Maker Is Selling Less Beer

Bud Light owner AB InBev’s revenue hit $59.8B in 2024, up 2.7%, but beer sales keep sliding—down for seven straight quarters. Shares jumped 8% (when writing this), but total volume fell 1.4% last year.

People are drinking less, shifting to alternatives, or avoiding beer altogether. China, Argentina, and Bud Light’s 2023 backlash hurt sales. Even non-beer brands struggled.

The beer business isn’t bulletproof. Health trends, tariffs, and changing tastes are shaking things up. Even giants like AB InBev can’t rely on past dominance.

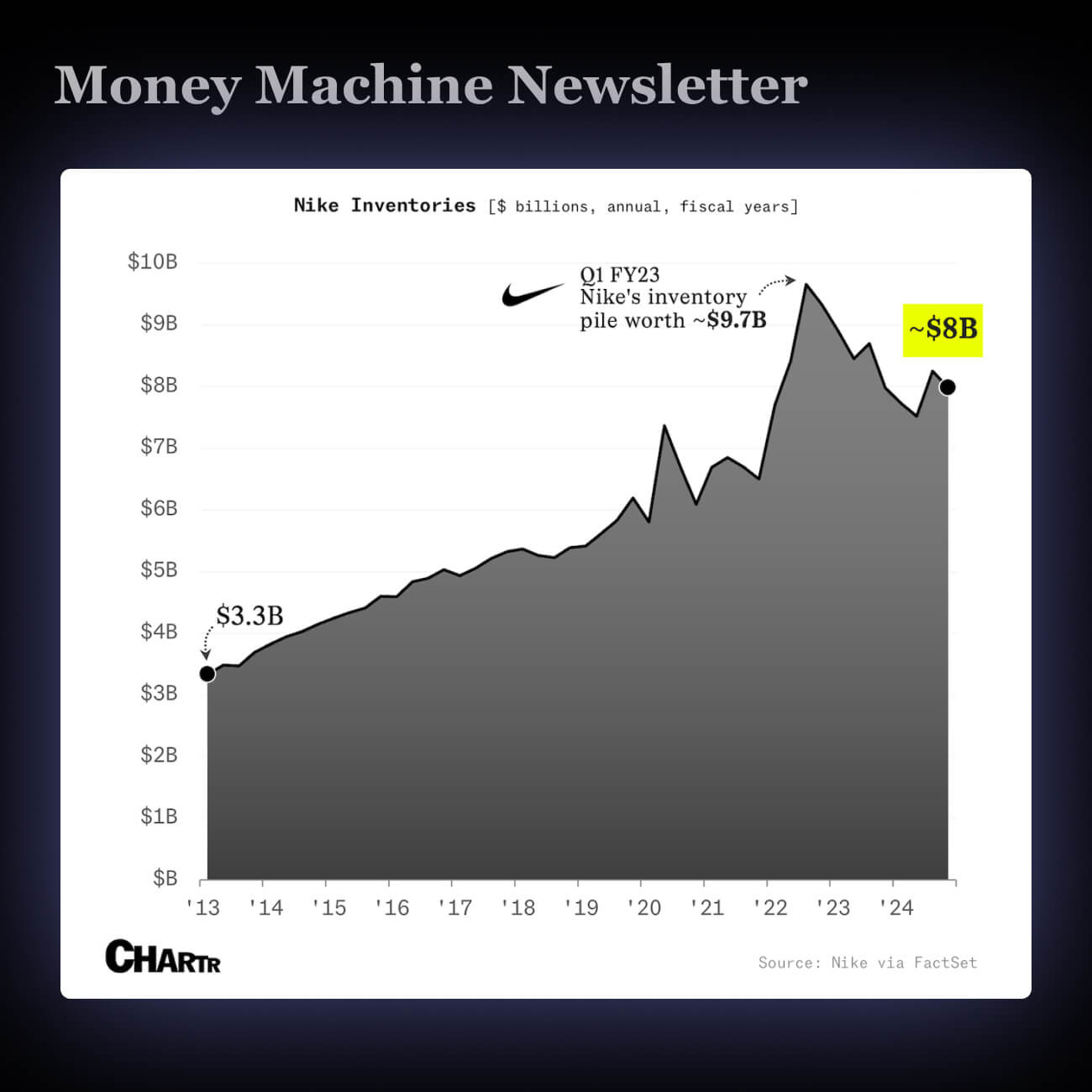

3. 👟 Nike Clears Out Excess Shoe Inventory

Nike’s stock jumped 6% in five days while the S&P 500 fell 3%. After a 50% drop since 2021, analysts now see a comeback as Nike clears old inventory and preps for a restocking cycle.

Nike’s deep discounts helped offload excess shoes. Now, it’s shifting focus back to wholesale partners after years of pushing direct-to-consumer sales, hoping to boost margins and earnings.

If Nike pulls this off, it could mean a strong rebound for the stock. Investors are betting on a fresh supply cycle to drive new sales momentum.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.