Today we’re featuring Earn Out Loud.

If you’re tired of drowning in financial news that leaves you guessing, check out this newsletter.

Provides simple advice on managing your money, investing wisely, and growing your wealth. It’s practical, easy to follow, and genuinely helpful.

I’ll let Earn Out Loud take it from here…

Not sure if it’s the right time to buy? Start with these 3 signs

I remember it like it was yesterday:

Sometime in December 2024, I stood in my garage, door wide open, watching the trees blow in the wind as I listened to my brother on the phone. We were swapping predictions about where the market was headed in 2025.

He believed it would continue climbing well into the new year.

I believed the market was in trouble.

I told him one of my biggest investing fears is being unprepared for a market downturn. Thankfully, I was ready for the one we’re in right now.

But now? I’m more concerned with being unprepared for the rebound.

And I know I’m not alone. The question nearly every investor is asking right now is: “Is this it? Is this the bottom? Should I be buying the dip?”

Here’s the truth: No one can predict the bottom—not me, not the talking heads on TV, not even traders using complex algorithms.

But I can tell you the three data points I’m watching to determine when this rebound is legit—and when it’s time to load up.

Because that’s when the real money is made.

Remember:

A falling market doesn’t always mean a buying opportunity.

And lower prices don’t always mean you’re buying the dip.

If you’ve been told to “buy the dip,” you need to know how to spot the real one.

So let’s talk about it…

1. The Tariff War Must Be Resolved

Tariffs are the #1 reason this market has dropped so far, so fast. They raise prices for businesses and consumers, hurt earnings, and create massive uncertainty around economic policies.

Markets do not like uncertainty. Especially when it directly impacts company profits.

🔎 So, the primary data point I’m watching = tariffs. Here’s what I’m waiting for:

We need a clear resolution or rollback on China tariffs.

A concrete move on trade policy. Something real, in black and white ink, not just headlines.

Market reaction from multinational companies. Especially in the growth sectors like tech and manufacturing.

Until we see progress here, I don’t believe we’ll see a real market reversal. Instead, I expect continued volatility with an overall downward slope.

2. Earnings Projections

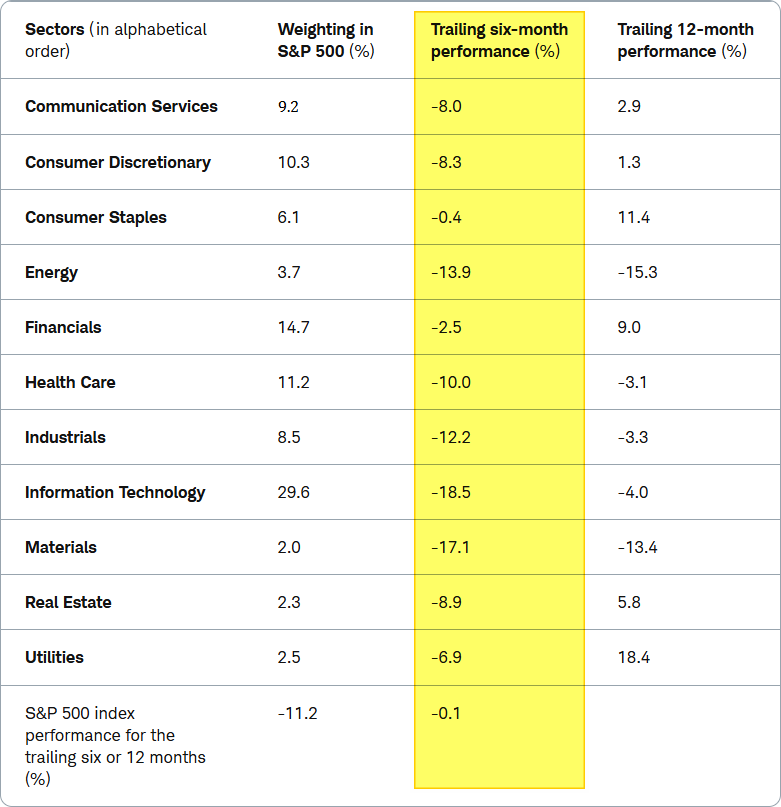

Right now, plenty of companies are revising their forward guidance and giving us weaker earnings projections across sectors—especially in tech, retail, and materials.

Stock prices are sensitive to that data:

Companies aren’t in a good spot right now, and they aren’t optimistic about the future, so investors aren’t either.

What companies are essentially saying is that they expect revenue to continue contracting in the coming months.

And falling prices like that aren’t in dip-buying territory. Those are just red flags.

🔎 Here’s what I’m looking for:

Stabilized or improved earnings forecasts

Sector leaders (like AAPL, AMZN, NVDA) signaling strength

EPS (earnings per share) data that actually move stock prices higher

Until then, I can’t say that stocks are about to rebound.

3. The S&P 500 Needs to Hold Support

While macro- (tariffs) and micro-economics (earnings) are extremely important, there’s another piece to this puzzle—technical analysis support levels.

Once our macro and micro troubles are sorted out, I’ll confirm the market rebound by checking that technical support levels show buying strength.

🔎 The S&P 500 support levels I’m watching:

5,200: Major support zone

5,000: Next level down if 5,200 breaks

4,800: if 5,000 breaks

Pro tip: Plot your support levels now so you’re ready when prices approach them.

A Word of Encouragement

The smartest investors don’t chase every red candle and market decline. They track the data, stay patient, and strike when the odds are in their favor.

Stay sharp, stay disciplined, and stay ready. Because when the real dip shows up, we won’t just be watching—we’ll be buying in huge quantities.

Cheers,

Isaiah from Earn Out Loud

Nothing in this email is intended to serve as financial advice. Do your own research