🪩 Bringing Back an ’80s Plan for the U.S. Economy

Plus: Google's AI Can Now See You, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Trump's 40 year old plan to rewrite the U.S. economy.

Google’s AI just opened its eyes — and it’s locked on your screen.

AI’s boom is fueling a quiet factory comeback in America.

Egg smuggling is booming.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🪩 Bringing Back an ’80s Plan for the U.S. Economy

America wants its factories back. Tariffs are the ticket. The promise? Bring jobs home. Balance trade. Rebuild the middle class. You’ve heard it before. But, this isn’t just about imports and exports… It’s a full-blown economic experiment in rewiring the U.S. economy — without tipping it into chaos.

Tariffs aren't the policy. They're the lever. The real move is rebuilding U.S. industrial power — and restoring control over where the value lives: in jobs, supply chains, and intellectual property.

This is not a fly-by-night plan… It’s been brewing with Trump for over 40 years, and now it’s becoming a reality.

The sequence of levers…

Start with imbalance… we’ve had lopsided trade for decades. U.S. tariffs are low. Other countries tax our goods much higher. Trump’s pushing reciprocity: You charge us 10%, we charge you 10%. Seems fair.

Now pull the tax lever… At the same time, there’s a promise to cut income taxes for 90% of Americans — specifically those earning under $150K. If stuff costs more (because of tariffs), give people more take-home pay to cover it.

Add deregulation to the mix… If you’re going to reshore factories and make it in America again, you’ve got to make that easy. Fast-track permits. Cut red tape. Less friction = more factories.

Bring the real value home… It’s not just about making stuff here. It’s about keeping the intellectual property here too. For decades, companies exported their IP to tax havens. Now the government wants to build incentives to trap that value in the U.S.

Deficit reality check: $1.9T projected shortfall. Tariffs alone won’t fix it… Waste cuts + tax repatriation + deregulation = the real horsepower.

If it works, we get a fresh way to build stuff locally—strong factories backed by smart policy. If it doesn’t, things get pricey, growth stalls, and the next administration is stuck with the mess.

2. 👀 Google's AI Can Now See You

Everyone’s talking about AI agents. Prompt this. Automate that.

But Google just did something different. It didn’t make AI talk more—it made it see…Google’s Gemini can now “see” through your phone’s screen and camera in real-time and talk to you about what it sees, instantly.

It’s another major leap for AI… shifting from chat to being context aware… the ability to see, understand, and respond to the world as we live it—in real time.

Everyone’s chasing multimodal AI. Text, voice, video, images—all in one model. It’s a tech race. And Google’s ahead, again…

Apple’s environmental-aware Siri is still delayed.

Amazon’s upgraded Alexa is in early access.

Samsung switched to Gemini on its phones—ditching Bixby.

Google didn’t add another layer between you and your phone. It removed one…

No more hunting for the right app. No more wondering what to search for. You just look. And ask.

This lays the groundwork for wearables without screens. Voice-first interfaces. Ambient computing. When your assistant knows what you’re looking at, you stop needing to explain so much.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 🇺🇸 Made Rebuilt in America

AI is exploding. Chips, data centers, and compute power are the new oil. Everyone’s talking about the software. But what about the infrastructure behind the boom?… well… it’s quietly leading a factory revival…

Apple is spending a record $500B in the U.S. over 4 years. It’s building a huge AI server factory in Texas and doubling its manufacturing fund to $10 billion.

But this isn’t just about Apple…. this is a full-blown reshoring movement…

Why now?…

Tariff threats from Washington are making overseas manufacturing more expensive.

Geopolitical risks in China and Taiwan have tech CEOs nervous.

Supply chain fragility burned everyone during COVID.

While most are chasing software stocks and flashy AI demos, the real value might be under the radar—in chips, concrete, copper, and cooling…

This isn’t a return to the old “Made in America.” It’s Rebuilt in America. And it might be the biggest tailwind for overlooked industries in decades.

Top 3 Charts of the Week

1. 🥚 Border Agents Are Cracking Down on Egg Imports

People are smuggling eggs from Mexico because they're way cheaper—less than $2 a dozen there vs. $9 in California. U.S. border agents caught 3,254 illegal egg shipments this year, up 116%.

Egg prices in the U.S. shot up due to bird flu, nearly doubling to $5.89 a dozen in February. People are crossing the line—literally—to save money on breakfast.

This shows how inflation pushes people to break rules. When everyday stuff like eggs gets too expensive, folks get desperate—and creative.

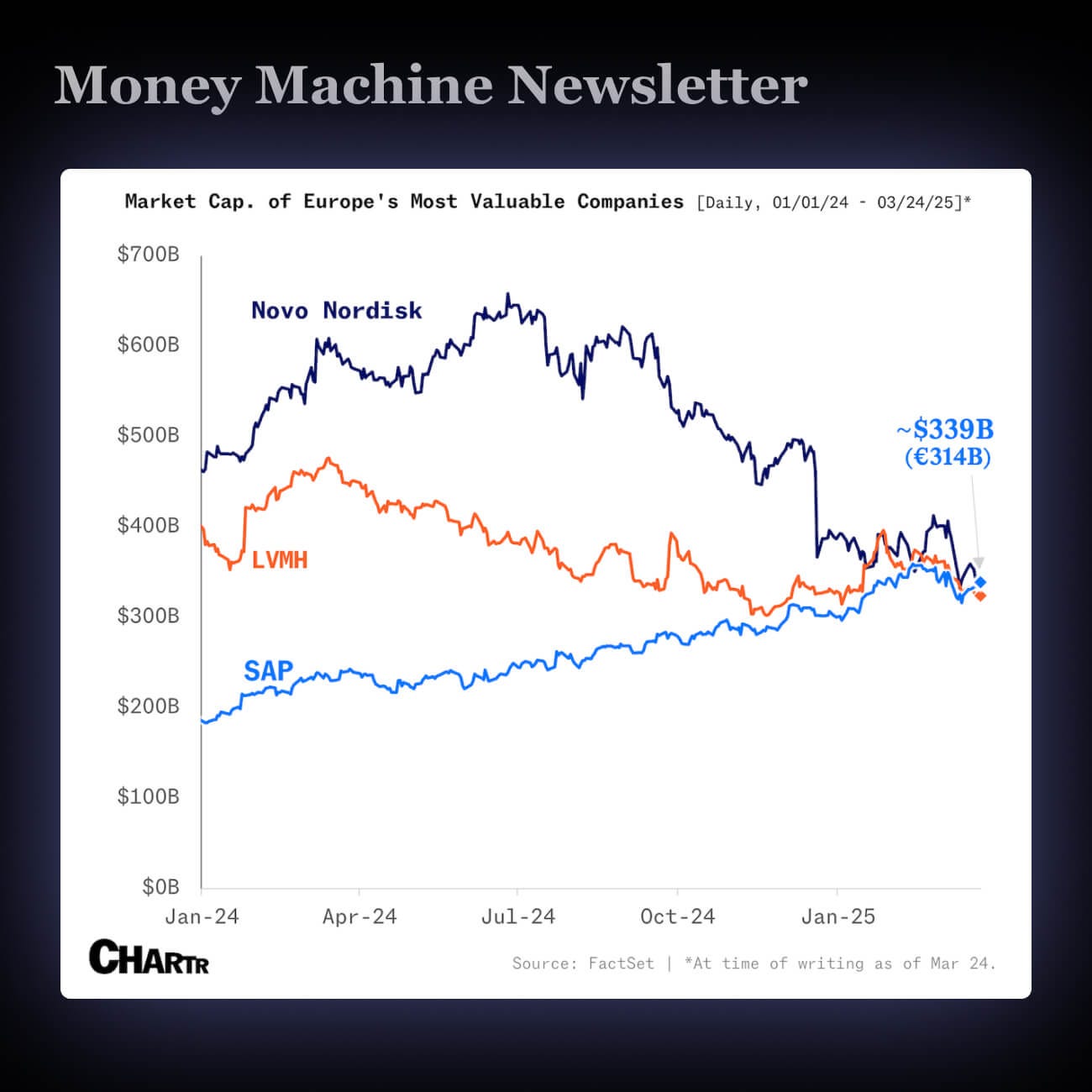

2. 📈 SAP Becomes Europe’s Most Valuable Company, Overtaking Novo and LVMH

Novo Nordisk’s stock dropped after weaker results from its new weight-loss drug and a $2B bet on a Chinese rival. SAP took its spot as Europe’s most valuable company, now worth $340B.

Investors are losing a bit of faith in Novo’s weight-loss pipeline. Meanwhile, SAP is winning big with its AI-powered cloud business, helping push Germany’s DAX index up 19% this year.

3. 🎟️ StubHub Blows Billions on Ads — Skimps on Customer Support

StubHub filed to go public, aiming for a $16.5B value. It made $1.77B in 2024, helped by Taylor Swift’s tour — but spent nearly half its revenue ($828M) on marketing.

StubHub’s growth comes at a high cost. It's spending 14x more on ads than customer support, even with complaints about fake tickets and pricing issues.

Big ad budgets can mask weak service. If you're a customer or investor, know where their priorities are — in hype, not help.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.