💰Bitcoin’s Path to $110K: Easing Inflation and Liquidity Driving BTC Higher

MMN Recommend

Today we’re featuring Smart Money Moves.

There’s a lot of noise in the world of crypto and stocks. Hype, headlines, hot takes. Most of it’s junk.

Smart Money Moves cuts through the noise. It’s clear, quick, and sharp. Two free emails a week, five-minute reads, actual insight.

Give it a look. If it clicks, subscribe.

I’ll let Smart Money Moves take over from here…

This is Smart Money Moves - the newsletter that gives the insights you need to make winning decisions and grow your wealth!

Let's see what we’ll discuss today:

🤖 Super Micro (SMCI) Is Heating Up

😮 Trump 2.0: No More ‘Trump Put’

🚨 Bitcoin’s Path to $110K

⚡ Bitcoin Whale Dormant Since 2016 Moves $250,000,000 Worth of BTC

Estimated reading time: 5 minutes

DOW: $41,985 (+0.08%)

S&P: $5,667 (+0.08%)

NASDAQ: $17,784 (+0.52%)

Super Micro (SMCI) Is Heating Up: AI Demand, Bullish Breakout, and a Path to $97?

Super Micro Computer (SMCI) just had a BIG moment.

The stock led the S&P 500 on Friday, surging nearly 8%—and analysts think there’s more room to run.

Why? AI.

JPMorgan just upgraded SMCI, saying its servers (which house Nvidia’s ultra-hot Blackwell chips) are primed to benefit from the AI infrastructure boom.

And despite all the drama—accounting delays, corporate governance concerns, Nasdaq delisting threats—investors are looking past the noise.

Let’s break it down.

The Setup: A Bullish Chart Pattern

SMCI recently broke out of an inverse head and shoulders pattern—a classic bullish signal.

It retested the breakout level, found strong buying support, and pushed the RSI (Relative Strength Index) back above 50.

Translation? Momentum is shifting back in favor of the bulls.

Now, let’s talk levels—because traders are watching them closely.

Key Support Levels

🟢 $35 – Strong support here, aligning with last August’s peak and the neckline of the inverse head and shoulders pattern.

🟢 $26 – If things get ugly, this is the next line of defense. It sits near the 200-week moving average and multiple price bounces from late 2023.

Key Resistance Levels

🔴 $66 – If the rally continues, expect sellers to step in here (it lines up with February’s peak).

🔴 $97 – This is the big one. It’s near SMCI’s all-time high from March 2023. If the stock gets back here, expect fireworks.

Bottom Line

SMCI is riding the AI wave, shaking off past concerns, and flashing bullish technicals.

If AI demand keeps surging—and Nvidia’s Blackwell shipments ramp up—this stock could have much more room to run.

Your move, bulls. 🚀

US 10YEAR: 4.30% (+0.04%)

US 2YEAR: 3.99% (+0.04%)

GOLD: $3,027 (-0.44%)

Trump 2.0: No More ‘Trump Put’—Markets Are on Their Own

Trump is playing a different game this time.

Back in his first term, he was glued to the stock market. If investors got nervous, he’d pivot. Now? He’s doubling down—no matter how hard the market pushes back.

Stocks are sliding. The S&P 500 just took a 10% hit. Confidence is shaking. But Trump isn’t blinking.

He’s pushing massive tariffs, cutting government spending, and laying off federal workers—moves that scream recession warning to investors.

Last time, Wall Street believed in the Trump Put—if markets tanked, he’d step in to save them. Not anymore. This time, it’s pain first, profits later.

The Fed just cut its 2025 growth forecast. Inflation is still sticky. The job market is softening. Investors are uneasy. Nobody knows where this is headed.

And Trump’s team? They’re brushing it off. Treasury Secretary Scott Bessent called the selloff “healthy.” He says once tax cuts and deregulation kick in, the market will come roaring back.

Maybe. But first comes Liberation Day—April 2. That’s when Trump’s tariffs hit, and nobody knows how brutal they’ll be. Markets hate uncertainty, and this is a whole new level of it.

Wall Street is screaming for Trump to change course. But if nobody in Washington is listening, the selloff could spiral. And if that happens?

We’re not just talking about a correction—we’re talking about the start of something much bigger.

BTC: $87,345 (+3.10%)

ETH: $2,084 (+3.66%)

SOL: $142.68 (+7.15%)

Bitcoin’s Path to $110K: Easing Inflation and Liquidity Driving BTC Higher

Bitcoin’s heating up.

And some of the smartest people in the game think it could smash through $110K before seeing any real pullback.

Why? Because the perfect storm is brewing: easing inflation, rising liquidity, and a Federal Reserve that’s slowly backing off its tightening stance.

Let’s break it down.

1. The Fed is shifting gears

For two years, the Federal Reserve has been running a tight ship—draining liquidity, keeping rates high, and making money more expensive to borrow.

But that’s changing.

The Fed has started slowing down quantitative tightening (QT)—which is just a fancy way of saying they’re easing up on sucking money out of the system.

And what happens when liquidity starts flowing again? Assets like Bitcoin love it.

Translation? The money printer is slowly warming up. And when liquidity floods back into the system, Bitcoin tends to go vertical.

2. Bitcoin thrives on liquidity

We’ve seen this before.

Last time the Fed turned on the money taps (2020), Bitcoin ripped from $6K to $69K—a 1,000%+ move in just over a year.

This time? The setup looks eerily similar.

Liquidity is rising globally, and discussions around a U.S. Bitcoin strategic reserve are making waves. If institutions start scooping up BTC while supply on exchanges keeps drying up…

You get a supply squeeze.

And a supply squeeze with rising demand? That’s a recipe for fireworks.

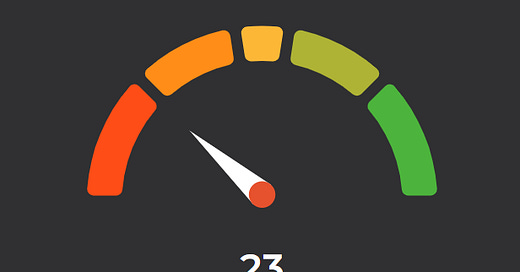

3. The technicals are lining up

Bitcoin just closed above both the 21-day and 200-day moving averages, a key bullish signal.

But here’s the real level to watch: $88K.

If BTC punches through that resistance, we could see a fast move to $100K+.

On the flip side, a pullback to $76.5K isn’t off the table. Bitcoin’s known for its volatility, and profit-taking could trigger a short-term correction.

My bet?

$110K first. Then we’ll talk about retracements.

The Big Picture

This rally isn’t just about hype—it’s about macro forces aligning in Bitcoin’s favor.

The Fed is slowing QT. Inflation concerns are fading. Liquidity is creeping back into the system.

And every time that’s happened before? Bitcoin has exploded higher.

Could we see $110K before any real pullback?

I think so. A lot of smart money does too.

This might just be the beginning.

Flash Market Bites ⚡

New to trading? Start on Binance and enjoy a 20% fee discount! With low fees and a wide range of crypto options, it's the perfect place to begin your trading journey.*

There's a $1 trillion opportunity brewing in the stock market — and it's got nothing to do with AI.

Bitcoin Whale Dormant Since 2016 Moves $250,000,000 Worth of BTC After 83x Gains.

MicroStrategy acquired 6,911 BTC for $584 million during the latest dip, pushing its total Bitcoin holdings beyond 500,000.

Trump keeps insisting markets and the economy are fine. He could be making the same mistake as Biden.

PS: When you're ready, here's how I can help you:

1-on-1 call with Claudiu: Get personalized guidance on navigating the crypto market, making smarter investment decisions, and achieving success with your crypto portfolio.

Smart Money PRO community: Gain exclusive access to premium crypto analysis, weekly market updates, and personalized recommendations that will take your crypto investments to the next level.

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.