👀 Big Pharma Piling Into THIS One Sector

Plus: Control Your Home and Health with Just a Thought, AI’s Billion-Dollar Companies in Video Generation, and More

This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Big pharma rushes into THIS rapidly growing, life-saving sector.

Control your home and health with your brain—it’s quietly happening.

Making high quality marketing videos will soon cost next to nothing.

Dealerships overflow with unsold EVs.

And more. Let’s get to it!

Follow us on Instagram | Advertise to our 7K+ subscribers

But first…

Ready to get serious about investing?

Join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Become a premium subscribe today for just $9/month and receive market beating stocks. Picked by elite traders. In your inbox. Every Monday, before the market opens.

Top Insights of the Week

1. 👀 Big Pharma Piling Into THIS One Sector

It’s a sector that is experiencing rapid growth. And expected to save thousands of lives per year. What is this sector?

Antibody-Drug Conjugates (ADCs). They act like "biological missiles" targeting and killing cancer cells while sparing healthy tissues.

Cancer’s impact…

Cost the U.S. ~$209B in 2020.

In 2024, the U.S. will see ~2M new cancer cases and ~600K deaths.

Global cancer mortality rate ~10M deaths in 2020.

Who’s piling in?

Pfizer acquired Seagen for $43B, boosting its ADC portfolio.

AbbVie invested +$10B in ImmunoGen, focusing on ADCs.

Merck invested $4B with Daiichi Sankyo to develop ADCs.

Johnson & Johnson acquired Ambrx Biopharma for $2B to advance next-generation ADCs.

Antibody-Drug Conjugates market: ~$9B in 2023, projected ~$40B by 2029.

2. 🧠 Control Your Home and Health with Just a Thought

It's not science fiction. It’s been quietly happening—Brain-computer interface technology.

Elon Musk’s Neuralink implants lets paralyzed patients control devices with their thoughts.

Johns Hopkins University helped paralyzed patients control lights and select YouTube videos using brain signals.

AAVAA's BCI tech lets users control smart home devices with eye and facial movements.

And now, researchers in South Korea have made a recent breakthrough that could shift momentum in this field…It’s called Nano-MIND, a tech that controls brain circuits with magnetic fields. What does this mean?

Nano-MIND can control emotions, behaviors, and appetite. So far, it's only been tested on animals.

Not far-fetched to imagine Neuralink using this tech to improve implant precision or treat mental health disorders and addiction.

Brain-computer interface market: ~$2B in 2023, projected ~$5B by 2032.

3. 💰 Why add private credit to your portfolio?*

Percent.

In 2023, private credit averaged a 12% return1 and the asset class is poised to grow to $2.3T by 2027.

As an individual investor though, alternative investments like private credit are often out of reach due to deal size and high minimums.

That’s changing with Percent, one of the first platforms to offer private credit to everyday accredited investors and that’s already funded over $1 billion in deals to date.

What can you find with private credit deals on Percent’s marketplace?

Double-digit yield potential: Percent’s Q1 LTM net APY was over 14% after fees.

Shorter term offerings: The average investment term is 9 months.

Diversification: Investors can choose from domestic or international deals in small business loans, trade finance, merchant cash advances, and other forms of direct lending.

Low minimums: Investments can start with as little as $500.

Monthly cash flow: Most deals offer cash flow through monthly interest payments.

Visit Percent to create an account and view all offerings - plus earn a welcome bonus of up to $500 with your first investment.

*Sponsored

4. 😯 AI’s Billion-Dollar Companies in Video Generation

A 2-3 minute high-quality marketing video for social media costs ~$4,000 to ~$50,000+. Soon, it will cost next to nothing. Why?

AI can quickly and cheaply create high-quality videos from text/other inputs.

Hit list of startups leading this shift…

Synthesia lowers video costs by eliminating actors and studios. Valued at ~$1B, +55k businesses use it.

Pictory converts scripts or blog posts into videos quickly.

Replika, AI digital companions that provide emotional support. ~10M users.

ElevenLabs, realistic high-quality voice replicas. Valued at ~$1B, generated over 100+ years of audio since its launch in 2022.

OpenAI’s Sora, creates realistic videos from text instructions.

AI video generator market: ~$554M in 2023, projected ~$2B by 2030.

*Sponsored

Maritime Analytica

Your gateway to the world of container shipping🚢. Join over +11K subscribers in exploring the latest maritime news 📰, sustainability practices 🌱, cutting-edge tech 🌐, financial trends💸, captivating games 🎮, and inspiring maritime arts 🎨. Stay informed, stay ahead. ⚓ Join today for free.

The Tech Bridge

Join over 45,000 readers who use the Tech Bridge to understand a simplified approach to the world of technology. Stay ahead with clear insights and practical strategies curated for aspiring entrepreneurs, founders and product builders. Join today for free.

Little Ends

Book Reviews, Insights For Life! Subscribe for free.

Top 3 Charts of the Week

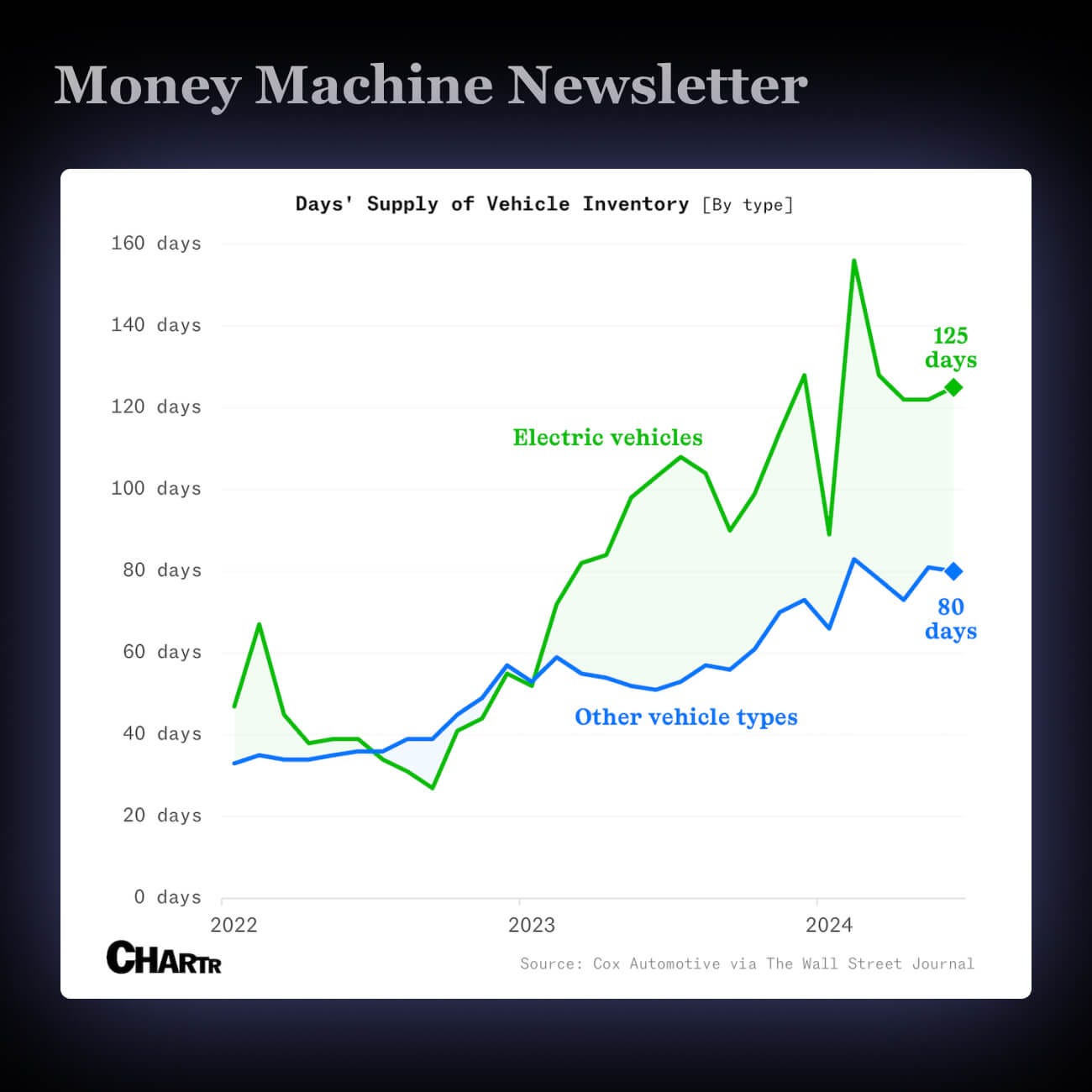

1. 🔌 Dealerships Overflow with Unsold EVs

EV transition slowing. Porsche, GM, and Tesla delay EV plans, face softer demand.

Dealerships have excess EV inventory; average 125-day supply.

Lower EV prices, persistent concerns, and rising hybrid popularity may reshape the auto industry.

2. 🚗 Uber's Long Road To Profitability

Uber turned a profit last year, Lyft is still unprofitable.

Uber still faces scrutiny, with labor disputes and legal challenges over driver classification.

Impacts the gig economy, potentially changing future regulations and employment standards.

3. 🎶 Premium Users Boost Spotify Profits

Spotify shares rose 10% due to record profit, 12% subscriber growth, and positive future outlook.

Higher prices boosted revenue by 21%. Premium users make up 95% of gross profit.

Music fans handle price hikes better than TV streamers–different consumer trends.

Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth.

Subscribe today for just $9/month.

🚨 What you get when you become a premium subscriber 🚨

TOP 5 STOCK IDEAS, picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS throughout the week as we spot them.

Access to OUR COMMUNITY of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY of which ideas performed best.

NO GUESSWORK. You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS, discover opportunities and risks not highlighted elsewhere.

Enjoy this content? Subscribe to our Instagram

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.