Today we’re featuring G.E.M. News.

Most newsletters talk about the news. This one tells you what it means for your money.

It breaks down global events—from Switzerland to China—to show you where the real opportunities and risks are.

If you want a sharper take on markets and macro trends, it’s worth your inbox.

I’ll let G.E.M News take if from here…

Silver’s role in portfolio diversification & crisis preparedness

In 2024, silver prices had an annual gain of 38% as global demand reached 1.2 billion ounces, largely driven by a 7% increase in industrial consumption. This surge in demand was primarily fueled by the solar panel, electronics, and automotive sectors. Solar panels require silver for connectivity, while the shift to electric vehicles has also boosted demand for silver components.

Over the past four years, silver demand has largely outpaced supply, resulting in an average annual deficit of around 240 million ounces.

Further to the current bullish sentiment surrounding silver is its paper-to-physical ratio. One of the driving factors of gold’s multiple all-time highs this year is fears of a physical gold shortage, exacerbated by the Bank of England’s withdrawal processing time sharply increasing from just a few days to up to eight weeks. The rise in gold ETF purchases this year has led to paper gold contracts outpacing physical gold supply at a ratio of 129:1. While this discrepancy is alarming, the situation is even more pronounced for silver, with the paper-to-physical ratio a staggering 378:1. This suggests that any significant increase in demand for physical silver could send prices soaring, particularly given the already existing deficit.

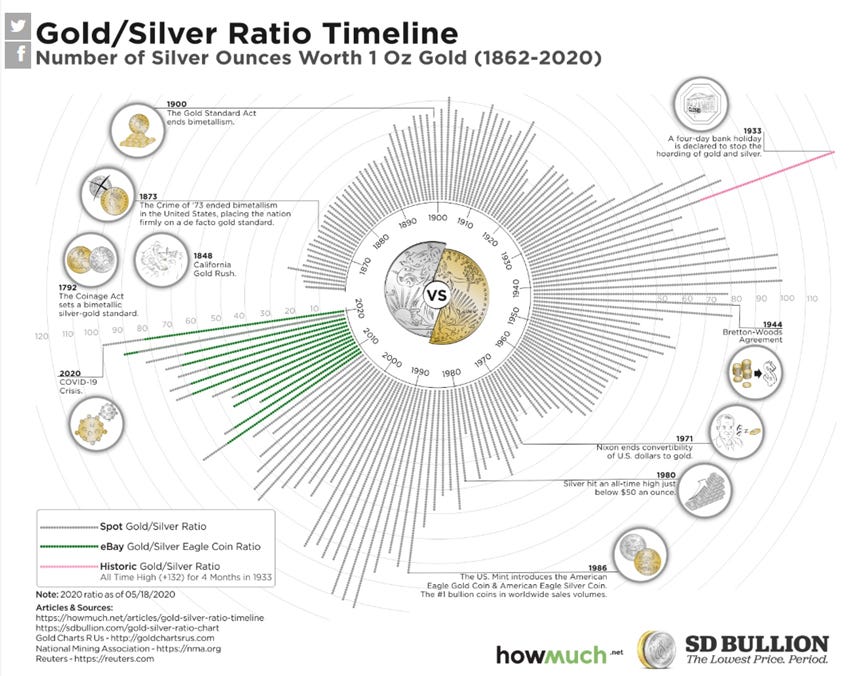

The gold-silver ratio, which measures how many ounces of silver equal one ounce of gold, is another metric closely watched by precious metals investors. Historically, this ratio was set by governments for monetary stability. The Roman Empire fixed it at 12:1, while medieval Europe saw it fluctuate between 9.4:1 and 12:1. In more recent history, following the dollar's decoupling from the gold standard and the subsequent decline in the dollar's value relative to gold, the gold-to-silver ratio has experienced a wider range of fluctuation. The lowest ratio in recent history was 35:1 in 2011, while the highest was 125:1 in 2020.

The ratio has averaged around 65:1 in the 21st century and recently rose to 88:1. A rise often indicates that silver is undervalued and is likely due for an upward price correction. Although gold and silver prices are not strictly correlated and are influenced by different factors, silver has a tendency to follow gold's price increases with its own spikes.

If we look at silver’s bull runs dating back to the ‘70s, we can see distinct periods that share several common economic themes which likely drove silver prices into bull markets. Each period was marked by significant economic and/or geopolitical uncertainty as well as inflationary pressures which were often accompanied by accommodative monetary policies such as low interest rates or quantitative easing.

In 1979-1980, high inflation, the oil crisis, and speculative activities (notably by the Hunt brothers) pushed silver prices up 748%. Similarly, during 2003-2007, robust global growth combined with increasing inflation expectations and a weakening US dollar contributed to rising commodity prices, including silver which rose 395%. The aftermath of the 2008 financial crisis, seen in 2009-2011, brought unprecedented monetary stimulus and uncertainty, fueling investor demand for silver as a hedge, increasing the price by 450%. Most recently, the economic shock of COVID lockdowns followed by massive fiscal and monetary stimulus leading to inflation concerns briefly drove investors to silver once again, with prices rising 114%. On average, silver prices have risen 427%.

Currently, I do not expect silver to rise quite as dramatically as it has historically, given the main driver currently is industrial use, and the sector will likely develop ways to diversify its silver demands if prices hit profit margins too hard. Nevertheless, as gold prices continue to rise some retail investors may choose silver over gold as a more affordable precious metals hedge. On the other hand, I do not believe it is likely that central banks and large institutional investors will be adding significant amounts of silver to their reserves and portfolios, given silver’s tendency to be highly volatile.

In conclusion, considering the above trends, silver may be on the brink of a bullish breakout and may make an interesting investment alternative to temporarily add to one’s investment portfolio.

However, silver’s true worth, in the context of wealth protection and financial security, is in the event of a crisis scenario such as hyperinflation, a monetary system collapse, or a large-scale war. In such crisis scenarios, fiat currency may become unstable or unusable, necessitating direct trade with silver for basic essential goods. While gold is vital for wealth preservation and can be used for larger purchases in crisis times, even ½ a gram of gold would hold too much value to buy, for example, a loaf of bread. On the other hand, a gram of silver (such as can be found in Degussa’s handy Combi bars) or some silver coins would be more appropriate for day-to-day purchases until economic stability returns.

Nothing in this email is intended to serve as financial advice. Do your own research.