This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

Apple’s chokehold just slipped—along with billions of dollars.

Building the operating system for public safety.

Solar’s surprise plot twist.

Visa and Mastercard want in on your wishlist.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 😳 Apple Just Lost Its Grip

The gate just cracked open — and ~$20B is walking out. Apple’s been playing toll booth operator for years. Build an app? Pay up. Use their payment system? That’ll be 30% off the top — the infamous Apple Tax. But a U.S. court just said: enough

Developers can now link to outside payment options (like Stripe, which charges ~2.9%). That means more money in their pockets — and potentially lower prices for you.

Apple tried to soften the blow with a “new” fee — 27% for using external links. The court shut that down too… that’s ~$20B annually back in the ecosystem.

This isn’t just about fees… It’s about freedom.

Developers don’t want to be boxed in. And users don’t want to pay more just because Apple says so. For years, the App Store was the only lane. Now There's a side road.

Stripe’s already rolling out tools to make external payments stupid simple to set up. Expect others to follow fast.

The App Store’s chokehold is loosening — just as AI is rewriting how we use software. The more we talk to our apps instead of tapping them, the more the old system feels like legacy infrastructure.

2. 💰 $2B Taser Empire Expands

Axon’s not just building Tasers. They’re building the OS for public safety. And it’s starting to look like a monopoly…

They’ve got the gear—body cams, stun guns, dash cams. They’ve got the cloud—evidence storage, report-writing AI, live crime centers. And they’ve got the customers—cops, cities, countries, even corporations.

In 2024, the stock surged 130%. That’s not hype. That’s $2.1B in revenue, $1B in recurring cloud subscriptions, and their 12th straight quarter of 25%+ growth.

This isn’t just a tools company—it’s infrastructure for modern law enforcement…

Axon’s mission? Cut gun deaths between police and the public by 50% before 2033.

Their TAM? $129B. Axon’s only tapped ~2% of it.

New clients? Canada’s RCMP and a Fortune 500 logistics firm.

New tools? Smart Tasers, auto-reporting AI, real-time drone surveillance.

Their moat? A full-stack platform so sticky, switching is almost impossible.

$2.1B in 2024 revenue (+33%)

$1B ARR from cloud subscriptions (+49%)

~$10B in bookings backlog locked in (5x current revenue)

International revenue? Up 101% last quarter

The risks…

Valuation’s rich—about 23x sales and 150x earnings. Any slowdown? The stock could get zapped.

Also, this is law enforcement tech. Public opinion shifts. Political pressure brews. And if a Taser fails in a high-profile case, Axon gets dragged into it.

3. 💸 Ready to get serious about investing?

Then join our growing list of premium subscribers who have already placed themselves on the path to greater wealth by mirroring our stock ideas.

Subscribe today for just $90/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

MAKE MONEY or GET YOUR MONEY BACK GUARANTEE. If you subscribe today, use it actively for a year, and don't make money, we'll refund your payment and give you an extra year for free.

TRY RISK FREE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

4. ☀️ Solar’s Surprise Plot Twist

For years, solar builders followed one rule: follow the sun. Trackers — big metal arms that tilt panels all day — were the smart move. More sunlight, more power, fewer panels… But the game changed…

Solar panels got cheap. 58% cheaper just in the past ten years. Trackers? Not so much.

So builders started asking: what if we don’t move the panels at all?

Enter, East-West arrays. They don’t move. Half the panels face the morning, half the afternoon. No motors. No moving parts. Just sit, soak up light, and work.

They’re faster to install. Take up less land. Need less labor. And in cloudy places They often outperform trackers… Sure, they use more panels—but who cares when panels are dirt cheap.

The only real downside? Hail. Big storms can crack them. Trackers can tilt away. East-West arrays can’t.

Top 3 Charts of the Week

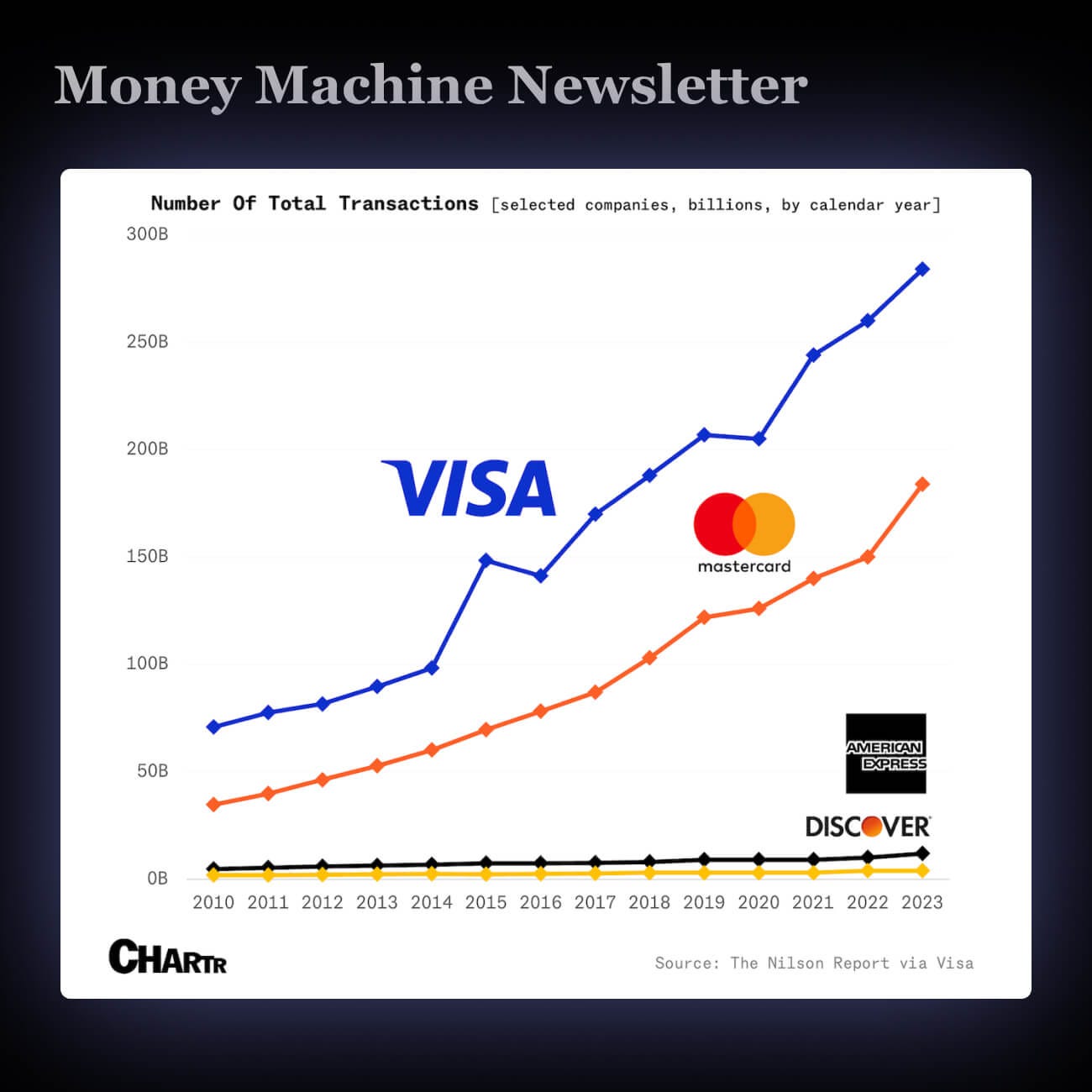

1. 💵 Visa and Mastercard Have Ruled Payments for Years

Visa and Mastercard are adding AI shopping assistants to help you pick outfits and gifts, using tech from OpenAI, Microsoft, and others.

They’re not just processing payments anymore — they want to own the whole shopping journey. From "what to buy" to "how to pay."

These two already handle 80% of U.S. card payments. Now they want your decisions too — not just your swipes.

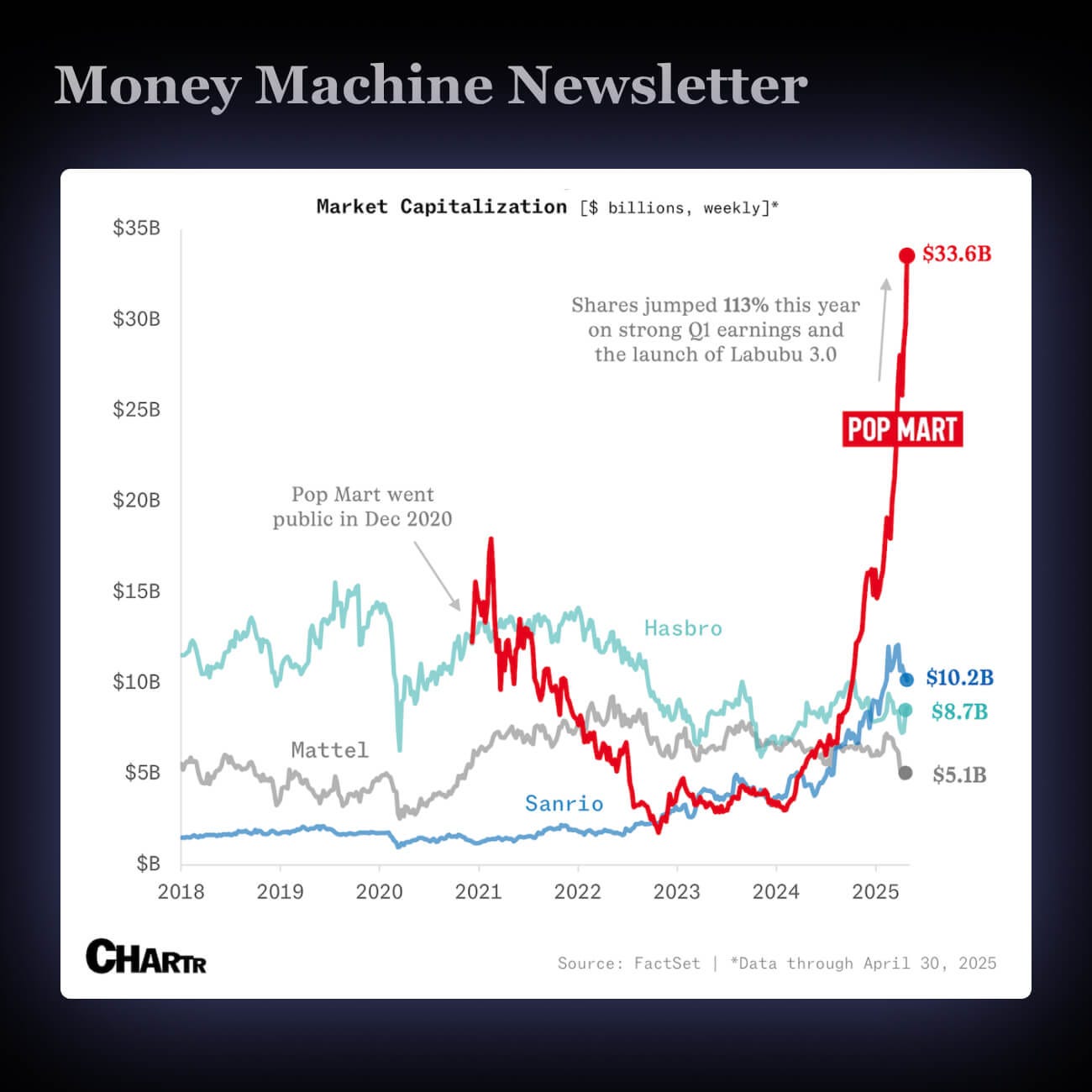

2. 📈 Pop Mart Is Now More Valuable Than The Three Global Toy Giants Combined

A Chinese toy company called Pop Mart is now worth $33.6B — more than Barbie, Hello Kitty, and Transformers combined.

Pop Mart turned designer toys into a cultural obsession. Even with bumpy sales, its stock soared 460% this year, making its founder $1.6B richer in just one day.

This isn’t just toys. It’s proof that new brands — especially from China — can outgrow legacy giants.

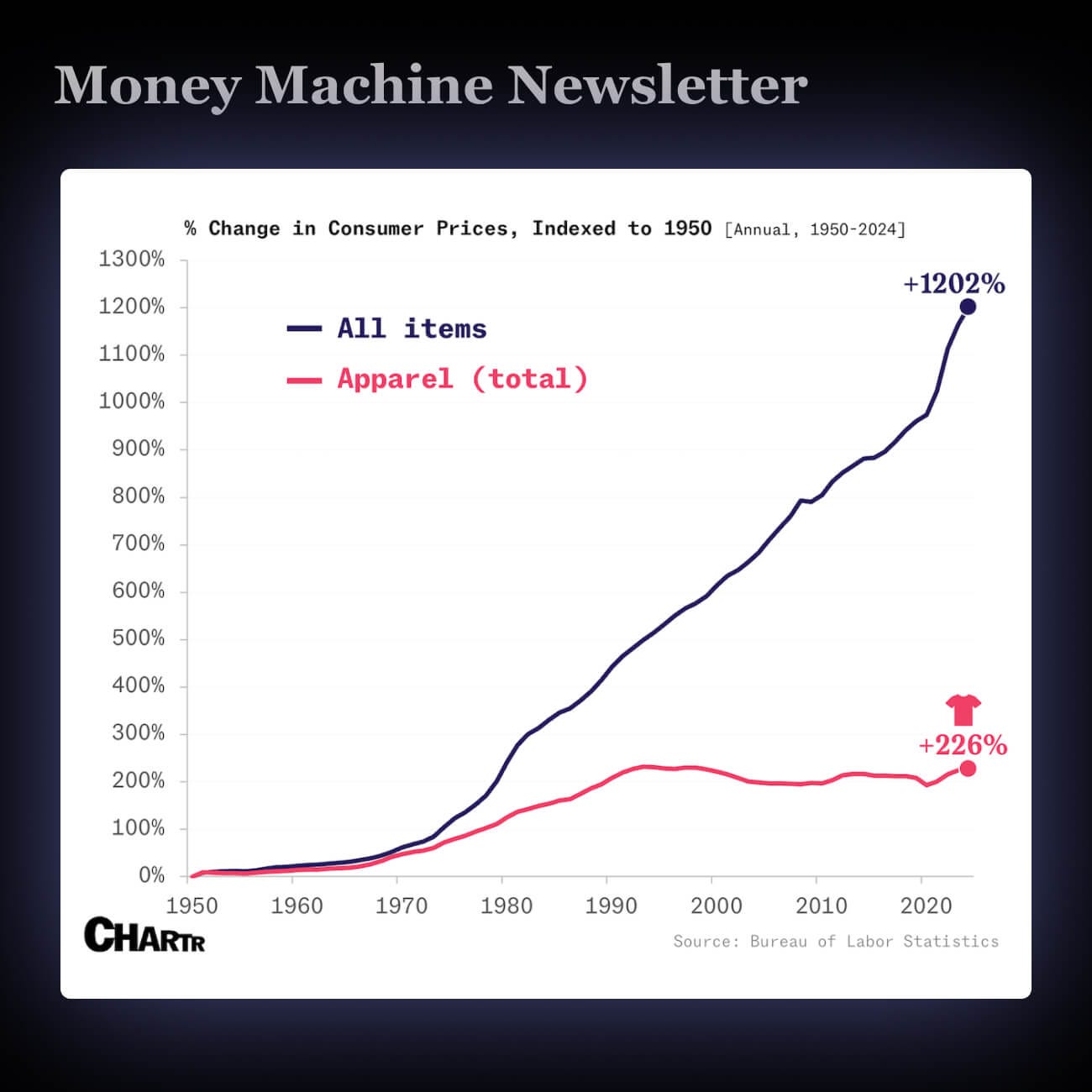

3. 👕 Clothing Prices Stayed Flat While Everything Else Got Expensive

U.S. just ended a rule that let small packages under $800 skip tariffs. Now, even cheap items from China face a 145% import fee.

Over a billion packages used this loophole last year. Without it, prices from sellers like Shein and Temu will likely shoot up — especially for clothes.

Clothes have stayed cheap for decades while everything else got pricey. That streak may be over.

What did you think of today’s newsletter?

Enjoy this content? Follow us on Instagram, YoutTube, Linkedin

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.

Good. Cost average it down.