This week’s market, investing, and business insights from insiders and experts outside the mainstream media:

A forgotten element just lead the U.S. back to their rival.

The Magnificent 7? Hedge funds just ghosted.

Another new energy mega-trend incoming.

THIS Big tech quietly deleted 220M videos.

And more. Let’s get to it!

Follow us on Instagram | YouTube | Advertise

Top Insights of the Week

1. 🛣️ All Roads Lead Back to Our Rival

A single metal—yttrium—just became more important than you think. Because a new breakthrough in titanium depends on it…

Titanium is strong, light, and doesn’t rust. Great for jets, EVs, offshore rigs, and medical implants.

But it’s hard to make. Oxygen ruins it, so the old process used chlorine and magnesium. It worked—but it was slow, toxic, and expensive. Not anymore.

Researchers found a better way: melt titanium, add yttrium, remove the oxygen—all in one step. No chlorine. No mess. And it even works on scrap.

That means we can recycle titanium. Make it cheaper. Cleaner. Easier to scale. Suddenly, titanium isn’t just for fancy stuff. It’s for everything.

But here’s the catch… 97% of the world’s yttrium comes from China. So if this new process takes off, yttrium becomes a BIG deal. This isn’t just science anymore. It’s strategy…

We’re talking about national security, global power, and who controls the stuff we build the future with. And if we don’t secure the supply chain now, we might hand that future away.

2. 🤫 Retail Trader’s Quiet Coup

Retail’s in charge right now. That’s not how it usually works. The biggest tech names—Apple, Amazon, Nvidia, Meta, Microsoft, Google, Tesla—aren’t being scooped up by hedge funds. Retail investors are the ones buying. That’s a major shift.

Hedge funds’ bets on the Magnificent 7 are at a five-year low—lower than the 2022 crash. Their exposure to those stocks is down 50% in the last year.

Hedge funds are still buying tech. Just not the usual names. For three weeks straight, they’ve been picking up other U.S. tech stocks. Quietly. After dumping the sector for most of the year.

What does it mean?

The pros think the Magnificent 7 might be overcooked.

They’re hunting for smaller, cheaper tech.

Retail is acting faster. Bolder.

Markets move based on who is buying. Right now, it’s regular people leading the charge. That could mean more surprises and bigger swings.

What happens when the hedge funds do come back in?

If retail keeps running and performance forces hedge funds to chase, this could ignite a second leg up—fast. Not because of fundamentals. But because of FOMO.

3. 💸 This Is Your Investing Edge

Join 6,000+ self-directed investors who have already placed themselves on the path to greater wealth by making $500, $1,000, $2,000, $3,000, or more every month with our trade ideas.

Subscribe today for just $299/year.

🚨 What you get when you become a premium subscriber ($13,890.80 value) 🚨

TOP 5 MARKET BEATING STOCK IDEAS ($5,000 value) picked with sniper precision, delivered to your inbox every Monday morning, before the market opens.

HIGH CONVICTION TRADE ALERTS ($1,690.80 value) throughout the week as we spot them.

Access to OUR COMMUNITY ($1,200 value) of fellow traders, where you can ask questions & post comments.

END OF THE MONTH SUMMARY ($600 value) of which ideas performed best.

NO GUESSWORK ($2,400 value). You'll get to see our entry point, stop loss, and profit target.

INSTANT ACCESS, no strings attached. No commitment. Cancel anytime.

UNCONVENTIONAL MARKET & MACRO INSIGHTS ($3,000 value), discover opportunities and risks not highlighted elsewhere.

GET YOUR MONEY BACK GUARANTEE. Subscribe today and if you decide it's not for you, no worries, just let us know within 7-days and we'll refund every penny of your subscription.

Get $13,890.80 worth of value for just $299/year to our premium newsletter. Hands down, Money Machine Newsletter is the most valuable investing service out there.

Just ONE great trade could pay for the premium subscription—MANY times over.

4. 💰 Another New Energy Mega-Trend Incoming

Occidental (OXY) still pumps oil—~1.4M barrels a day. But now, they’re also pulling carbon out of the sky. This is a new kind of oil company. Their pitch is simple…

Vacuum CO₂ from the air

Inject some into old wells to pull more oil

Store the rest underground

Get paid for every ton

The big swing? Their STRATOS plant goes live in Q3 2025. It’ll be the largest carbon capture facility on Earth. Pulling 500,000 tons of CO₂ a year. Phase two doubles that…

They bought Carbon Engineering for $1.1B. Picked up Holocene too. Now they own exclusive rights to cutting-edge direct air capture tech.

The U.S. government is backing them—$500M to build the next DAC plant in Texas.

Amazon, Shopify, Airbus? Already in line to buy credits.

Q1 snapshot…

Risks…

Oil prices fall

STRATOS gets delayed

Carbon capture stays expensive

~$26B in debt (but falling)

Big players catch up

Top 3 Charts of the Week

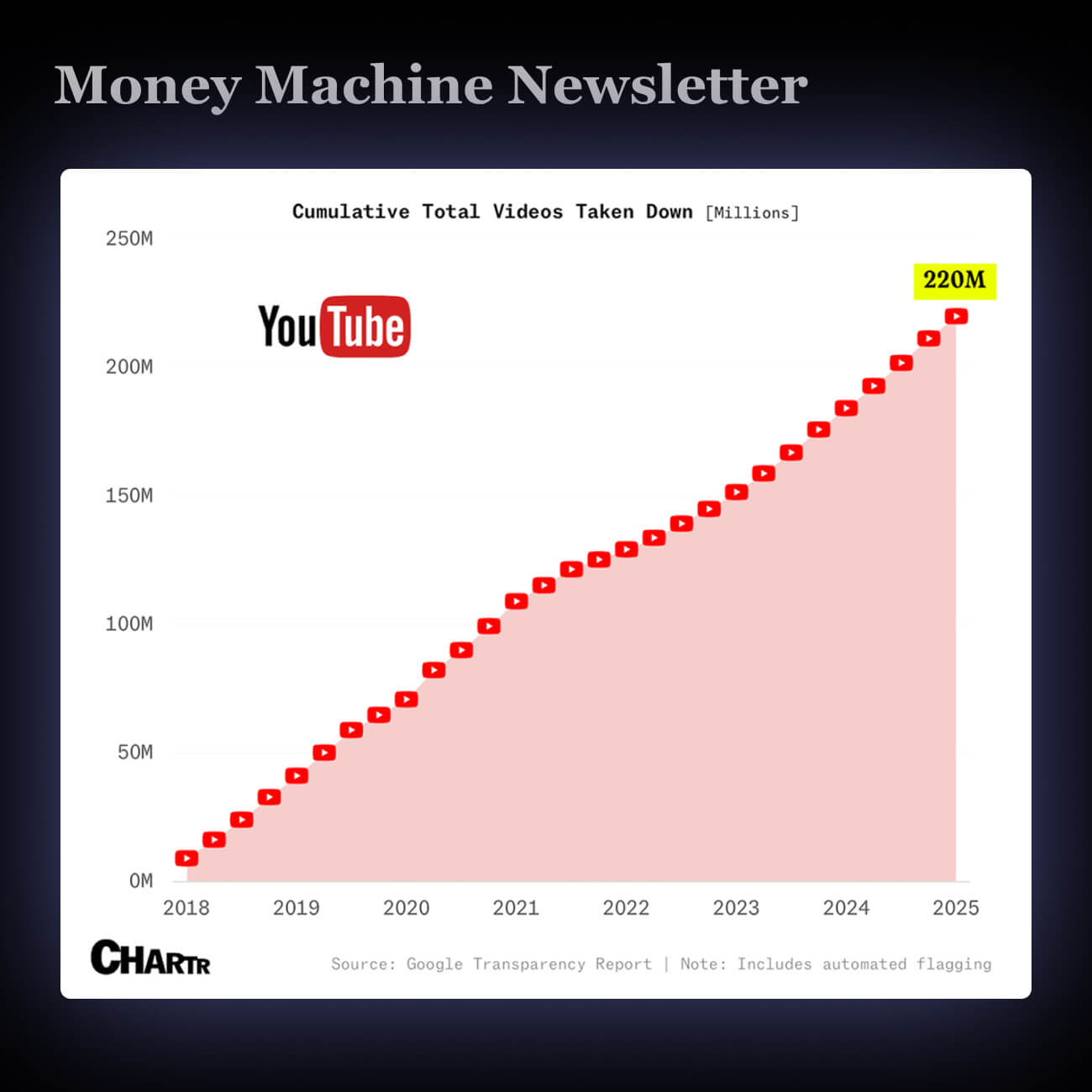

1. 😳 YouTube Deleted 220 Million Videos in 7 Years

YouTube changed the rules—quietly. Since late 2024, certain videos get more leeway. Especially if they cover hot-button topics like elections or gender.

Before, the algorithm took down anything that crossed the line. Now? Videos can break the rules—just a little—if YouTube says they’re “in the public interest.”

Since 2018, they’ve deleted 220M videos. Mostly flagged by AI, not humans. This new policy shifts the balance. More freedom of speech? Maybe. Either way, it affects what shows up in your feed. And what doesn’t.

2. ⚡️ America Produced More Energy Than Ever In 2024

U.S. just hit a record for energy production — over 103 quadrillion BTUs (British thermal units). Solar’s up 25%. Wind, 8%. Biofuels, 6%. Natural gas still leads. Coal? Down 10%, lowest in 60 years.

We’re shifting. Less coal. More clean energy. But gas and oil still run the show. Meanwhile, China’s doubling down on coal — more than the rest of the world combined.

3. 💸 Walmart's Online Sales Just Keep Growing

Last year, Walmart made $79.3B in online sales in the U.S. — that’s 17% of its total U.S. sales. Internationally? Just under $30B. About 24% of the total overseas.

They’re now rolling out drone delivery to 100 more stores in five cities. They’ve already done 150,000 drops since 2021. Now millions more could get groceries in under 20 minutes.

This isn’t just about quicker snacks. It’s where shopping’s going — less waiting, more flying. And Walmart’s not sitting still.

What did you think of today’s newsletter?

Enjoy this content? Subscribe to our Instagram | YouTube

We take the responsibility of emailing you seriously. If you don't want to receive stock market updates and trading education anymore, you can unsubscribe at any time.

Nothing in this email is intended to serve as financial advice. Do your own research. See important disclaimer & terms of service.